Nerio Alessandri, Chairman and CEO, commented: “Following a strong 2024, Technogym continued to grow in the first half of 2025. Wellness, health, and the pursuit of healthy longevity have become increasingly central priorities for people, as well as for companies and governments.

Despite ongoing global geopolitical uncertainty, Technogym continues to promote wellness through 360° innovation: leveraging its unique ecosystem of AI-powered products, training content, precision training programs and engaging digital services for both end users and professional operators.

Technogym’s strategy is built around offering dedicated solutions that meet the various needs: from fitness, for those seeking physical shape and social interaction, to sport for people aiming at improving athletic performance, to wellness-minded individuals embracing a balanced lifestyle and to Healthness™ for those looking for scientifically prescribed exercise therapy.

In 2025, we continued to scale our AI-based offerings globally – including Technogym Checkup and Biostrength – while investing for long-term growth. Notably, we launched new products such as Technogym Reform, that allows us to enter pilates, a fast-growing discipline worldwide, and Artis Luxury, designed to bring a new level of differentiation to the premium segment.

Building on these solid results and a robust pipeline of upcoming initiatives – including the Milano Cortina 2026 Olympic Games – we look to the future with confidence. Technogym remains committed to create long-term value for all stakeholders contributing to healthy longevity across the globe”.

***

The Board of Directors of Technogym S.p.A. (Ticker: TGYM) met today and approved the Consolidated Half-Year Financial Report as of June 30, 2025, prepared in accordance with international accounting standards (IAS/IFRS).

In the first half of the year, the Company recorded double-digit growth across both BtoB and BtoC channels, surpassing previous revenue records while maintaining strong financial fundamentals. A significant portion of this growth was reinvested into innovation to further enhance long-term sustainability.

Revenues increased across all global regions, with The Americas posting the highest growth rate. Double-digit growth was achieved in Europe, the Middle East, and Italy as well. APAC registered an improvement compared to the same period in 2024, confirming Technogym’s ability to deliver growth in all its markets, despite ongoing geopolitical tensions and economic uncertainty.

Adjusted EBITDA improved by +27.2% versus the prior year, primarily driven by higher sales volumes, favorable product mix, and cost optimization initiatives. Profitability also improved significantly, with an increase of nearly 200 basis points in the adjusted EBITDA margin.

Adjusted Net Profit rose to € 43.6 million, up 34.4% compared to the first half of 2024.

Net Financial Position stood at a positive € 84.1 million, down from € 160.1 million at the end of the previous fiscal year.

First half 2025 results

The consolidated results have been prepared in accordance with the International Financial Reporting Standards issued by the International Accounting Standards Board. Below is a brief overview of the consolidated revenues categorized by Customer Type, Geographic Area and Distribution Channel, as well as other key economic and financial indicators.

1) Revenue

The first half of the year ended with a revenue growth of +14.1% (+14.4% at constant exchange rates) thanks to the continuous double digit expansion of both BtoB and BtoC, thus confirming a solid and well distributed trend.

Here below we provide a brief revenue analysis for:

- Customer type;

- Geographic area;

- Distribution channel.

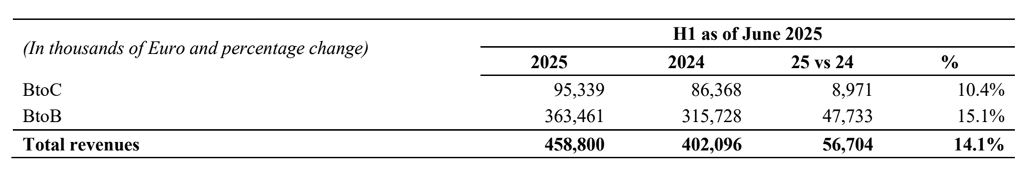

Revenue by Customer type

First half 2025 revenue showed a significant growth both in the consumer business (+10.4%) and the commercial one (+15.1%), with a positive trend in all the segments addressed by the Group.

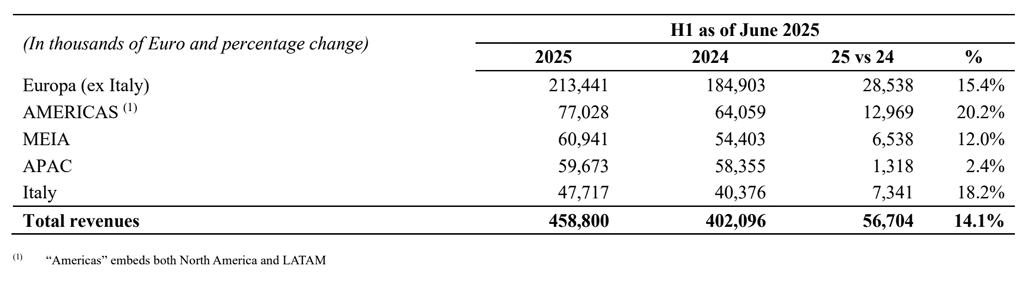

Revenue by Geographic area

From a geographical perspective, it is worth noting the 20% growth of AMERICAS, supported by both North America and LATAM. The positive trend of Europe was confirmed, led by Spain, Portugal and the UK.Italy confirmed the expansion noted in the previous year and registered a +18.2% increase compared to the same period of 2024. APAC supported the performance of the first quarter.

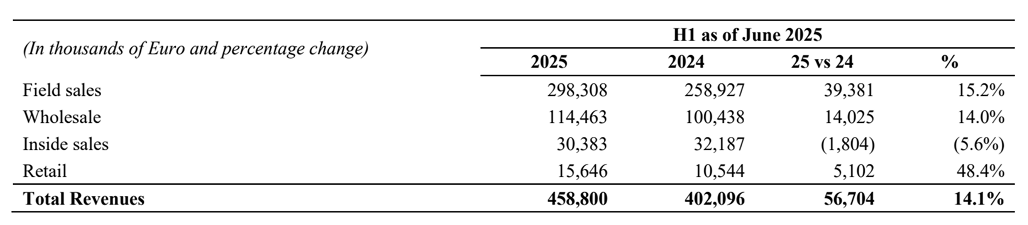

Revenue by Distribution channel

As per distribution channels, the positive performance of BtoC was certainly pushed by the Retail channel, which was boosted by both an increase of geographical coverage and a productivity increase.Channels mainly connected to BtoB, like Field Sales and Wholesale, posted a strong growth in the first half of 2025.

2) Adjusted EBITDA, EBIT and Net Profit

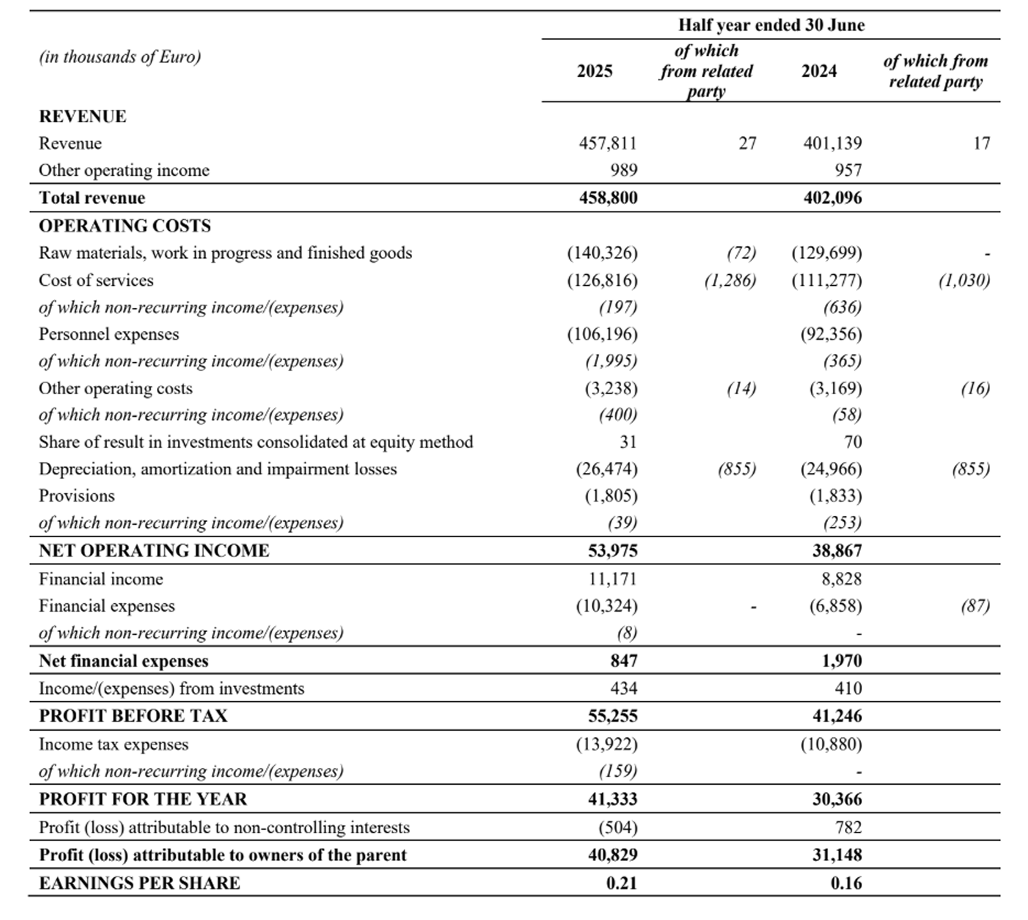

Adjusted EBITDA for the first half of the year amounted to EUR 84.8 million, reflecting an increase of EUR 18.1 million (+27.2%) compared to € 66.7 million in the same period of the previous year.

This result is primarily attributable to the increase in sales volumes, particularly in the BtoB sector, the improvement in product mix, and cost reductions achieved through both the renegotiation of commercial terms with certain suppliers and product reengineering efforts. In this context, the Adjusted EBITDA margin reached 18.5%, improving compared to 16.6% in the first half of 2024.

The Adjusted Operating Income stands at EUR 56.6 million, an increase of EUR 16.4 million (+40.9%) compared to EUR 40.2 million in the first half of 2024, also driven by the dynamics mentioned above. The operating income is further impacted by depreciation during the period, amounting to EUR 26.5 million, up by EUR 1.5 million from the previous year, mainly due to the ongoing investments made by the Group in digital transformation and the renovation of some of its offices and boutique stores in major global cities.

The Adjusted ROS (Return on Sales), at 12.3% for the half-year ended June 30 2025, has improved compared to 10% in the first half of the previous year.

The Adjusted Group Net Profit is EUR 43.6 million, an increase of EUR 11.2 million (+34.4%) compared to EUR 32.5 million in 2024. This trend is consistent with the aforementioned dynamics and is also driven by positive financial management, with a net impact of EUR 0.8 million, and the valuation of minority interests at fair value under IFRS 9 for EUR 0.4 million. The Adjusted Group Net Profit represents 9.5% of revenues, compared to 8.1% in the first half of 2024.

Non-recurring net charges as of June 30, 2025, amount to EUR 2.8 million, mainly related to personnel costs, service expenses, and other costs not related to normal operational activities.

3) Net Financial Position and Pre-Tax Free Cash Flow

Net Financial Position as of June 30 2025 was positive at EUR 84.1 million down from EUR 160.1 million at December 31 2024. This trend is primarily attributable to the payment of dividends, capital expenditures, and higher tax payments, despite positive operating cash generation and a favorable impact from changes in Net Working Capital.

As of December 31 2024, the Group had no outstanding bank debt. However, during the reporting period, the Group utilized a short-term revolving credit facility for a total amount of EUR 30 million.

Additionally, the net financial position benefits from approximately EUR 60 million due to a reassessment carried out by the Group on certain sales contracts, in light of the new interpretative indications issued by the IFRS IC in 2025 regarding financial guarantees granted to customers.

Recurring Pre-Tax Free Cash Flow generated by the Group as of June 30, 2025, amounted to EUR 70.7 million, representing an improvement compared to EUR 59.1 million in the first half of 2024. This increase was driven by higher cash generation from operating activities and more efficient Net Working Capital management, despite recurring capital expenditures of EUR 17.9 million. As part of the previously announced process to insource certain activities and production processes at the Slovak subsidiary—aimed at improving product quality and margins—the Group recorded non-recurring capital expenditures totaling EUR 5.9 million. After accounting for income tax payments during the period totaling EUR 26.5 million, the Group generated Recurring Free Cash Flow of EUR 44.2 million, compared to EUR 43.2 million as of June 30, 2024. The Recurring Cash Conversion Rate (calculated as Recurring Pre-Tax Free Cash Flow divided by EBITDA) stood at 86%, compared to 90% in the same period of the prior year.

Significant events occurred in the period

Launch of the new Healthness™ Concept

On February 15, 2025, during the 25th Wellness Congress—attended by 2,000 employees and 200 top clients from over 100 countries—Founder and President Nerio Alessandri unveiled Healthness™, Technogym’s new strategic vision. Building on 40 years of innovation in wellness, Healthness™ brings a scientific, data-driven approach to preventive health.

Launch of the new Technogym Reform (Pilates)

Technogym Reform is the latest innovation reshaping the Pilates category, seamlessly combining advanced technology and iconic design. Drawing on four decades of expertise in wellness design and a portfolio of over 60 international design awards, this product was developed in collaboration with leading global instructors to deliver a highly intuitive and versatile user experience.

Launch of the new Pure Strength

Technogym’s new platform for strength training, a rapidly growing phenomenon, includes equipment with advanced biomechanics, new rigs, and functional training solutions.

Launch of the new Artis Luxury

The new identity of the Artis line in the new elegant Sandstone color, that also includes the new Personal Tools, offers premium operators—fitness clubs, luxury hotels, spas, and real estate—the opportunity to create an exclusive offering that stands out.

New pop-up stores

According to the “prestige” Technogym brand positioning, the Company activated two summer pop-up stores in top global locations like Porto Cervo and Ibiza.

Outlook

In the first half of the year, all sales channels—both commercial and consumer—reported growth, confirming the increasing preference of both business partners and end-users for Technogym. The market is evolving toward increasingly diverse needs, which require tailored responses. The Technogym ecosystem, with its comprehensive portfolio of solutions enhanced by artificial intelligence, is capable of capturing and addressing millions data to deliver highly personalized experiences. This unique capability supports the Group’s outlook for growth significantly outpacing that of the reference market. For the current year, Technogym expects to meet its stated objectives of sustainable growth, with revenue expansion, improved profitability, and solid cash generation, while continuing to invest in innovation to further strengthen the brand’s distinctive global positioning and drive long-term value creation.

Consolidated Income Statement

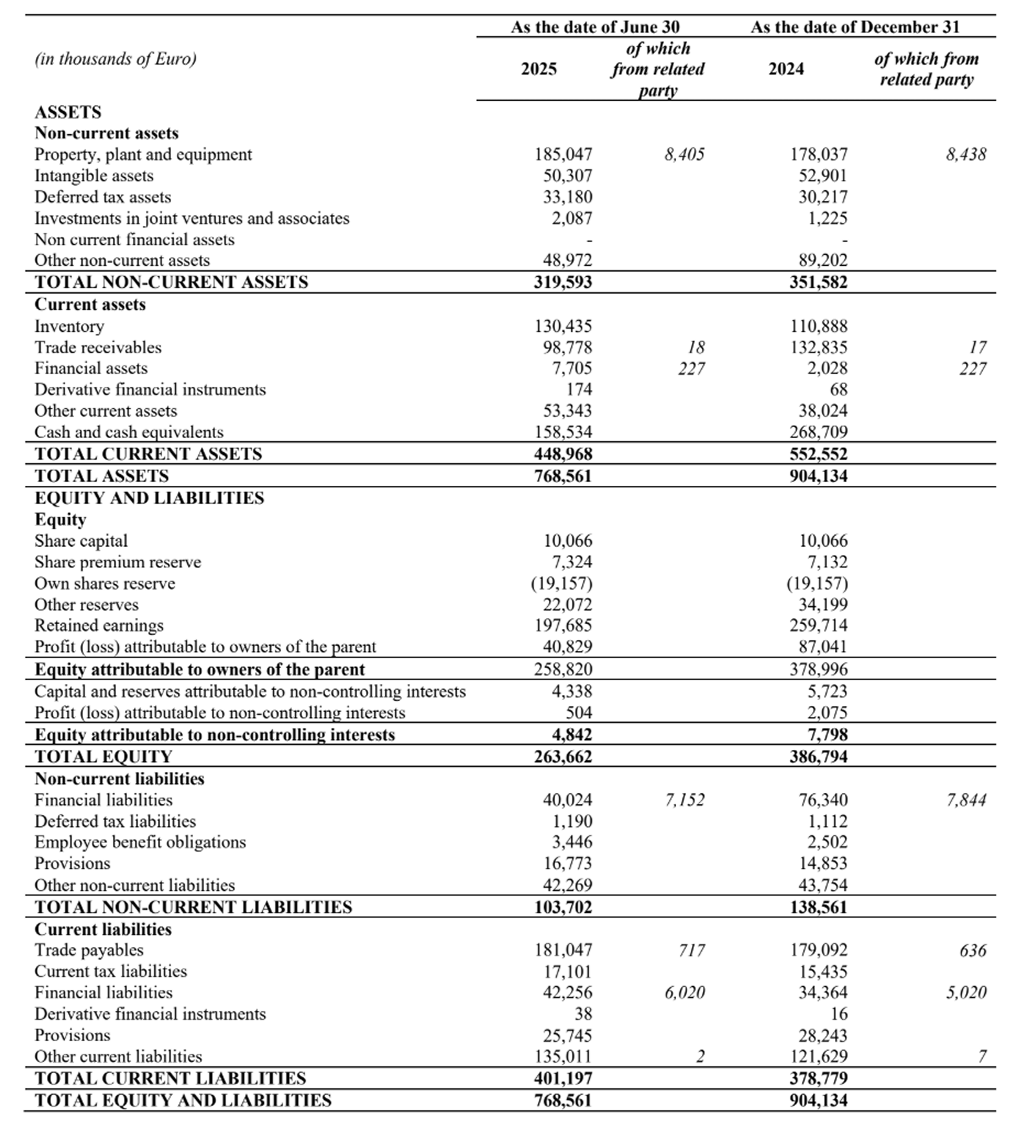

Consolidated Balance Sheet

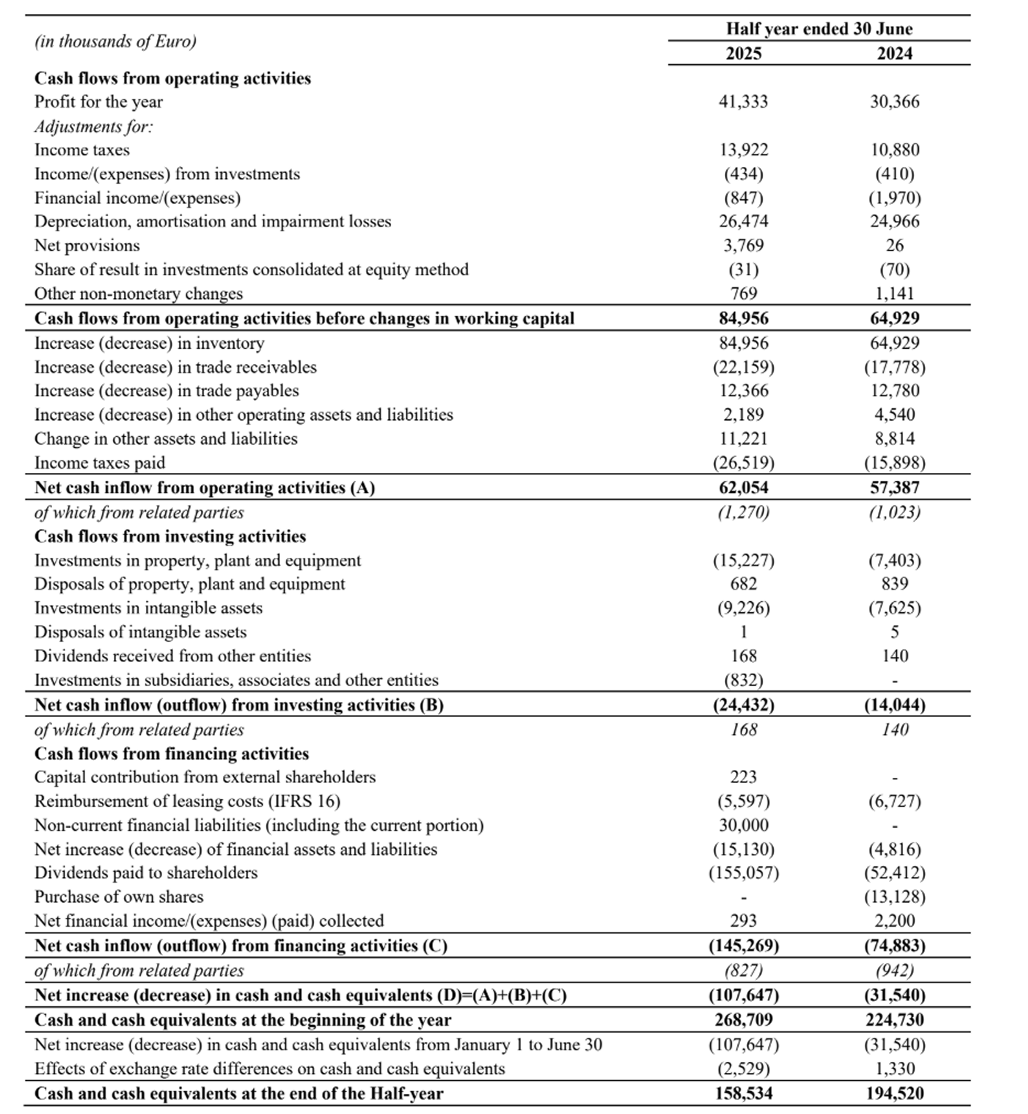

Consolidated Cash flow Statement

Pursuant to art. 154-bis, paragraph 2 of the Consolidated Finance Act, the executive in charge of the preparation of financial reports, William Marabini, declares that the accounting data contained in this press release is consistent with entries in the accounting books and records.

Technogym is a world leading brand in smart equipment and digital technologies for fitness, sport and health for wellness. Technogym offers a complete ecosystem of connected smart equipment, digital services, on-demand training experiences and apps that allow every single end-user to access a completely personalized training experience anytime and anywhere: at home, at the gym, on-the-go. Over 70 million people train with Technogym in 100,000 wellness centers and 500,000 private homes world-wide. Technogym has been Official Supplier to the last nine Olympic Games and it’s the brand of reference for sport champions and celebrities all over the world.

Forward looking statements

Certain statements in this press release could constitute forward-looking statements, including references that do not exclusively relate to historical data or current events, and as such, uncertain. These statements are based on a number of assumptions, expectations and other factors that could lead to actual results which differ, even substantially, from those forecasts. There are numerous factors that could generate results and trends that are notably different from the forward-looking information in this press release. These elements include but are not limited to the ability to manage the effects of the current uncertain international economic scenario, ability to acquire new assets and integrate them effectively, ability to forecast future economic conditions and changes in consumer preferences, ability to successfully introduce and market new products, ability to maintain an efficient distribution system, ability to achieve and manage growth, ability to negotiate and maintain favorable license agreements, currency fluctuations, changes in local conditions, ability to protect intellectual property, problems with information systems, risks associated with inventory, credit and insurance risks, changes in tax regulations, and likewise other political, economic, legal and technological factors and other risks and uncertainties. These forward-looking statements were issued as of today and we shall not be under any obligation to provide any updates and they are not a reliable indication of future performance.

Alternative performance indicators

This press release provides a number of alternative performance indicators used by management to allow an improved assessment of the business performance and the financial performance and position of the Group. These indicators are not recognized as accounting measures in the context of IFRS and should therefore not be considered as an alternative way to assess the financial performance of the Group and its financial position. Since the calculation of these measures is not governed by the applicable accounting standards, the calculation methods applied by the Company may not be the same as those used by others and therefore these indicators may not be comparable. Therefore, investors should not place undue reliance on this data or information. This press release also contains certain financial, operating and other indicators that have been adjusted to reflect non-recurring extraordinary events and transactions, known as special items. This ‘adjusted’ information was included to allow better comparison of the financial information for all periods; however this information is not recognized as economic or financial data within the scope of the IFRS and/or does not constitute an indication of the historical performance of the Company or Group. Therefore, investors should not place undue reliance on this data or information.

Investor Relations Director

investor_relations@technogym.com

Press and Media Relations Director

emanaresi@technogym.com