After months of speculation, Peloton—makers of connected fitness equipment and on-demand classes—filed its S-1, setting the stage for its highly-anticipated public offering.

Let’s dig in.

Contents

- TL;DR

- Peloton: By The Numbers

- Beyond the Bike

- Risk Factors

- Company Ownership

- Looking Ahead

TL;DR

Peloton’s S-1 pulls back the curtain on the company’s fast-growing hardware + subscription business. The punchline: Despite soaring losses and skyrocketing marketing costs, Peloton’s sales, margins, and cult status make a compelling argument for the company’s potential.

Bull position: Peloton’s hardware margins are better than Apple’s iPhone. Their content subscription generates SaaS-style recurring revenue. And the company’s obsessive user-base will propel the brand forward.

Bear position: Peloton, like most fitness regimens, is a fad. The bike/brand has become a status symbol for affluent consumers who are already inclined to exercise. Over time, competitors will gain ground, people will quit, and sales will stall.

PELOTON BY-THE-NUMBERS

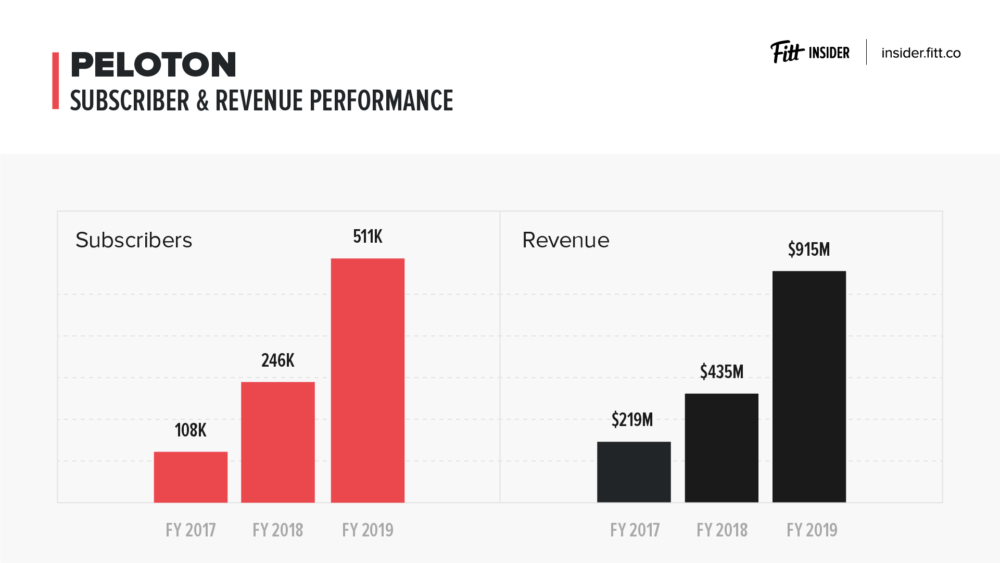

Revenue: The company brought in $915M for 2019, up 110% from $435M in 2018.

Members: Peloton counts 1.4M total community members — defined as any individual who has a Peloton account.

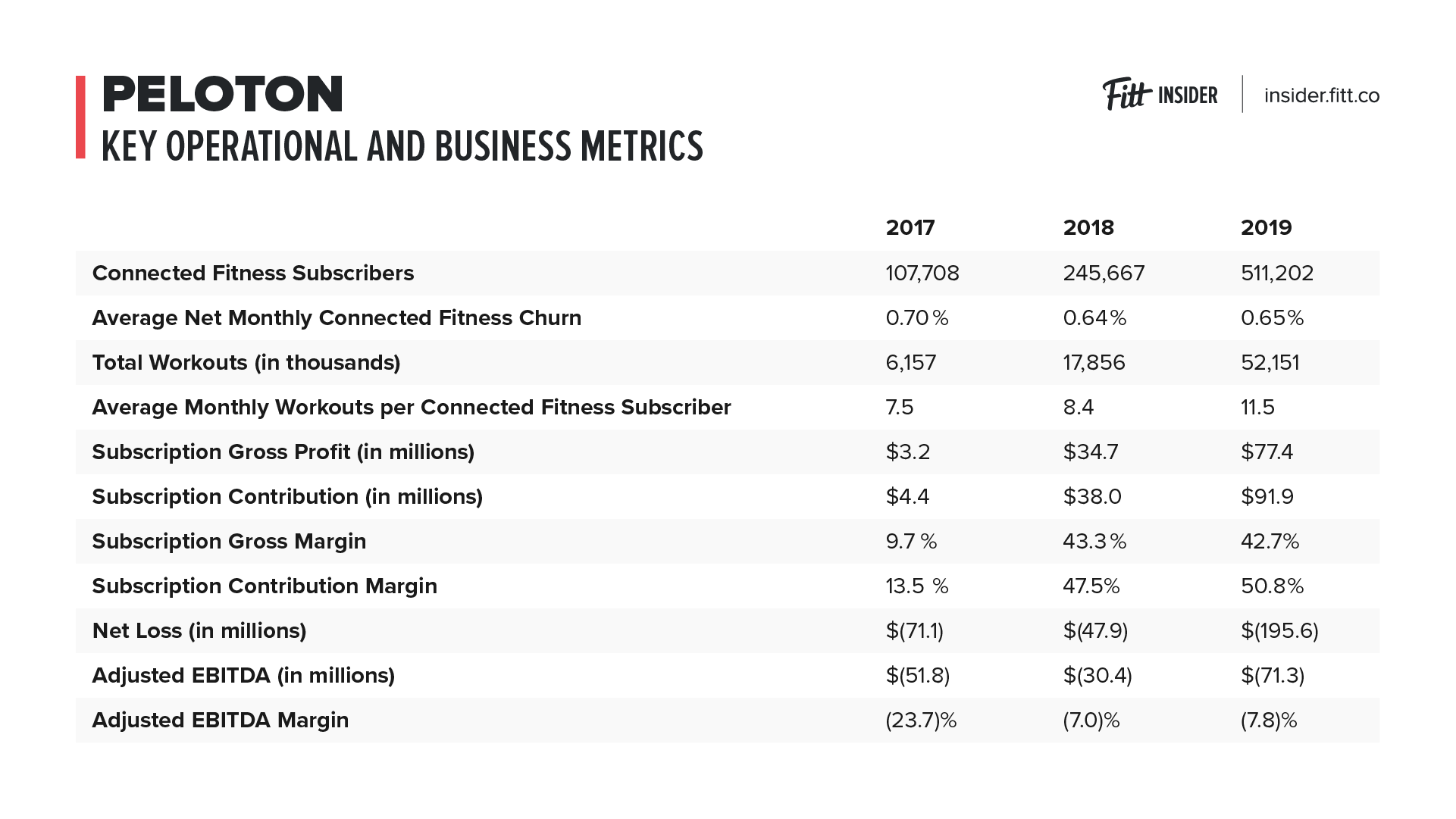

Subscribers: There are 511K “Connected Fitness Subscribers.” Between 2016 and 2019, subscribers rose from 35,135 to 511,202 representing a 144% annualized growth rate.

Hardware: Combined, the company sold 577K bikes + treadmill.

Participation: Users completed 58M workouts in 2019, with subscribers averaging 11.5 rides each month and a 95% retention rate over the first 12 months.

Churn: reported at .7% “Average Net Monthly Connected Fitness Churn” — a self-created metric that might not capture pre-paid subscriptions, promotions, and classes vs digital-only users.

BEYOND THE BIKE

In the opening of its S-1, Peloton doesn’t confine itself to being a hardware or content producer. Instead, the company defines itself with 10 different words, emphasizing “We are a” and listing: technology, media, software, product, experience, fitness, design, retail, apparel, and logistics.

“Above all else,” the prospectus reads, “we are an innovation company transforming the lives of people around the world through our ever-evolving fitness programming.”

Later, in a letter to prospective investors, Peloton’s co-founder and CEO John Foley doubles-down on this expansive vision, writing: “On the most basic level, Peloton sells happiness.” Foley continues:

“Peloton is so much more than a Bike — we believe we have the opportunity to create one of the most innovative global technology platforms of our time. It is an opportunity to create one of the most important and influential interactive media companies in the world; a media company that changes lives, inspires greatness, and unites people.”

Also of note, Peloton puts its content front and center in the filing, referring to its streaming workouts as “Engaging-to-the-Point-of-Addictive.” Comparatively, the word “content” appears 172 times, while bike, Tread or treadmill, and equipment show up 49, 44, and 34 times respectively.

On the topic of content, we see that producing fitness content isn’t cheap. Peloton’s gross margins on hardware and software each sit around 43%. The company has been praised for better hardware margins than Apple, 43% versus 30%. However, Apple rakes in 64% of its internet services business.

Among the many production costs, Peloton lists leasing studio space, hiring instructors, and music royalties. The expectation is that the content margin will improve with time and scale.

RISKS

Like any public offering, a variety of risks await the company and potential investors. Here are a few notable takeaways:

The Market

In Peloton’s case, many of those risks are largely dependant on a relatively young connected fitness category and fickle fitness consumers.

“The market for our products and services is still in the early stages of growth and if it does not continue to grow, grows more slowly than we expect, or fails to grow as large as we expect, our business, financial condition, and operating results may be adversely affected.”

Music

Additionally, as evidenced by the company’s legal troubles, music is central to Peloton’s business. For context, the word music appears some 170+ times in the filing. According to the company, changes to or loss of third-party music licenses could adversely impact the business.

“Given the high level of content concentration in the music industry, the market power of a few licensors, and the lack of transparent ownership information for compositions, we may be unable to license a large amount of music or the music of certain popular artists, and our business, financial condition, and operating results could be materially harmed.”

Talent

As we touched on in our Peloton IPO preview, attracting and retaining high-quality instructors will present its challenges.

The company credits trainers like Robin Arzon as being essential to its success. And for the trainers, working for Peloton is a dream job — they’re paid well and are achieving celebrity status. But this asset could prove to be a liability.

As more competitors enter the space and the instructor marketplace heats up, Peloton is at risk of having their talent poached. Sure, they can defend against it with contracts and compensation, and users will find new favorites, but losing a top instructor is inevitable.

“…if we are unable to attract and retain high-quality fitness instructors, we may not be able to generate interesting and attractive content for our classes.”

COMPANY OWNERSHIP

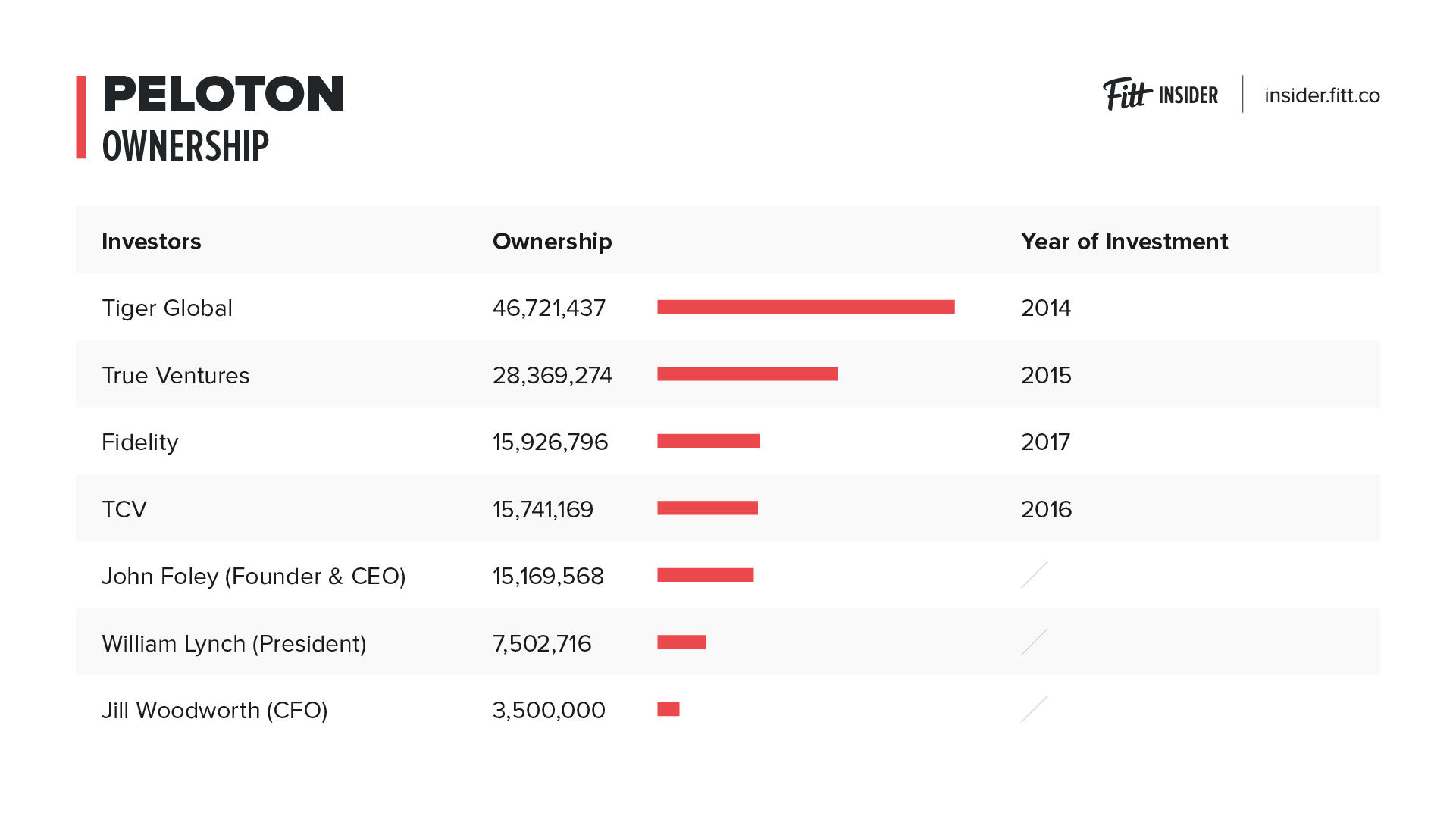

According to page 132 of Peloton’s S-1, investors (with more than 1% equity) break out as illustrated by the chart above.

Beyond the ownership breakdown, IPO paperwork revealed executive compensation for two of Peloton’s top corporate officers.

CEO John Foley earned a $500K salary, a $750K bonus, and a stock option package worth $20.1M, for a total compensation package worth nearly $21.4M. Last year, Foley was paid $5.5M in cash and stock.

William Lynch, Peloton’s President, also earned a $500K salary, a $750K bonus and stock options valued at $20.1M. Lynch’s 2018 compensation was just under $9M.

Worth mentioning: both Foley and Lynch have already cashed out some of their shares. In 2018, Foley sold about 1.8M shares in a secondary offering, netting $24.5M while Lynch sold a portion of his shares amounting to $3.3M.

LOOKING AHEAD

As Peloton prepares for its pre-IPO roadshow, the company looks ahead to a future where all 67M households in their total addressable market (TAM) have become converts to their fitness content and equipment.

The company is quick to point out that their fastest-growing demographic segments are “consumers under 35 years old and those with household incomes under $75,000.” Additionally, Peloton is expanding beyond the US into Canada, the UK, and Germany.

The Takeaway: Having amassed 500K subscribers and nearly $1B in revenue, Peloton has validated the connected fitness market and established a cult-like brand that’s well-positioned for a debut on the public market.

In the meantime, expect a growing list of competitors to give chase as onlookers wait to see 1.) how Peloton is received by the markets and 2.) if connected fitness proves to be a fad or the future.