Consumers aren’t sold on connected fitness mirrors.

The latest: After filing paperwork in January, fitness mirror maker FORME quietly went public last week, grossing $12M on the sale.

Pricing its 1.5M shares at the top of the $6–8 marketed range, its stock price slumped 17% on its first day of trading, closing at $6.61/share.

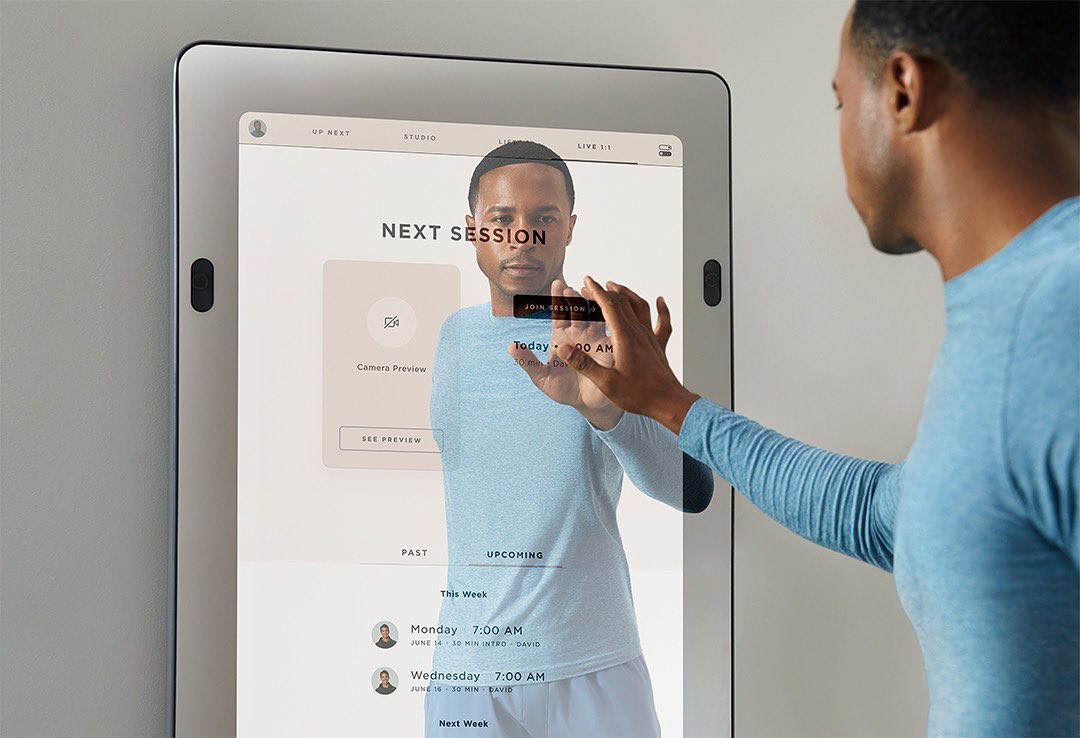

Ups and downs. Rising during the pandemic, FORME opened pre-orders for its Studio smart screen in May 2020.

With $128M in funding raised to date, the company invested in its product, launching a live 1:1 personal training service, a smart strength extension called Lift, and an Apple Watch integration.

Yet, with consumer interest in connected fitness equipment falling across the board, FORME was initially rumored to be seeking $50M via IPO.

According to its S-1 filing, the combined revenue of hardware and subscription services from 2020 to Q3’22 was below $750K while accumulating losses of ~$91M.

Moment of Reflection

After high hopes for the product, makers of interactive fitness screens are taking stock.

- After buying MIRROR for $500M, lululemon said it’s “pivoting away” from the hardware, reportedly approaching Tonal about a sale.

- Tempo has distanced itself from its debut screen-affixed weight locker, prioritizing its Move motion-tracking device and bundled subscription.

- After exploring a potential sale, smart strength brand Tonal raised $130M in a down round, cutting its valuation to a third of its one-time $1.9B high.

- NordicTrack’s fitness screen Vault is listed on closeout, with its premium version Complete selling for a third of its original price.

Internationally, it has been much of the same. Germany’s VAHA sold its business to UK-based nutrition startup bioniq. Meanwhile, Chinese smart screen maker Fiture has already exited the US, less than a year after its Stateside debut.

Looking ahead: Glued to existing screens, mirror makers misjudged the willingness of consumers to spend big on yet another portal to fitness content. As hardware-agnostic platforms strike deals with smart TVs—and computer vision-enabled tech becomes smaller and cheaper—FORME will need to convince everyone to take another look.

FORME

FORME