About a decade ago, big-box gym chains dominated the fitness scene. For about $50 a month, you got everything you needed to break a sweat. Flash-forward to the present day, and boutique studios—like indoor cycling, barre, boxing, or yoga—have taken the industry by storm.

Despite the hefty price tag (up to $40 per class), growth at boutique studios is booming. According to the International Health, Racquet, and Sportsclub Association, between 2013 and 2017, membership at traditional gyms grew by 15%, while membership to boutique studios grew by 121%.

Vying for an even larger share of $25.8B fitness market, studios are ramping up expansion. While there have been rumblings about a boutique fitness bubble, there doesn’t seem to be a slow-down in sight. In fact, many of the brand names in boutique fitness are making moves.

The Boutique Boom

Equinox Holdings, Inc. Combing luxury health clubs with a collection of boutique fitness studios, Equinox Holdings is a force in the fitness industry. With an estimated $1.3B in revenue in 2017 across its collection of brands—including Equinox, SoulCycle, Blink Fitness, and Pure Yoga—Equinox has become synonymous with a bespoke fitness experience defined by brand, luxury, and status.

Most recently, in an effort to capitalize on the popularity of boxing-inspired workouts, Equinox invested in Rumble Boxing, purchasing a significant minority stake. With backing from fitness powerhouse Equinox, Rumble has plans to expand its reach in New York and bring its power-packed, 45-minute group classes to West Hollywood in LA, the Financial District in San Francisco, Washington, DC, and Philadelphia.

Blink Fitness is another Equinox brand undergoing rapid expansion with plans to enter six new US markets in 2018, going from 64 locations to 90 by year’s end. This expansion is part of a larger plan to open 300 company- and franchisee-owned studios by 2021. And that’s to say nothing of the forthcoming Equinox Hotels, a luxury hospitality brand, the first of which will open at New York City’s Hudson Yards.

Xponential Fitness. Relatively unknown to folks outside the industry, Xponential Fitness is a private equity-backed holding company scooping up the best concepts across boutique fitness.

Initially, a collaboration between Anthony Geisler and Mark Grabowski of Snapdragon Capital, Xponential Fitness was conceived as a curator of brands that would identify, purchase, and scale emerging fitness concepts. In 2018, Mark Grabowski left TPG to launch Snapdragon Capital. Along with Geisler, Grabowski and Snapdragon bought out TPG’s stake in the company to become the majority owners.

Starting with Geisler’s purchase of Club Pilates in 2015, Xponential has grown to include seven additional brands — CycleBar, StretchLab, Row House, AKT, Yoga Six, Stride, and Pure Barre. To date, the plan has played out masterfully. In 2017, Xponential Fitness hit $148M in revenue across all brands, with Club Pilates accounting for $47.5M of that total. 2018 is sure to be a banner year, as Club Pilates adds 500 clubs to its roster of 300 existing franchised locations.

At the same time, StrechLab—thought to be the next big boutique concept—has sold 100 franchise territories. On a similar trajectory is dance concept AKT with plans to add 500 new studios by 2021. And Row House—a fast-growing fitness rowing concept—has sold 100 franchise territories in an effort to propel rapid expansion across the US while keeping the brand on track to reach their goal of opening 100 studios each year through 2022.

Building on this momentum, Xponential Fitness is teeing up for global expansion. Phase one: CycleBar. Adding to the 180 US locations slated to be in operation by the end of 2018, CycleBar is set to open 30 studios in the UK over the next five years.

Sweat Equity

Led by millennials and Gen Z who view health and fitness as a way of life (and status symbol), consumer spending in the fitness space has been fast-growing and relatively recession-proof. As revenue numbers tick into the billions, the conversation is naturally advancing toward private equity and IPOs.

On the private equity side, these firms aren’t buying out boutique studios, they’re using them as growth vehicles. The initial TPG/Xponential relationship is a prime example. Then there’s Atlanta-based Roark Capital, a fitness and wellness conglomerate in waiting. With a portfolio of investments that includes Anytime Fitness, Orangetheory, Drybar, and Massage Envy, Roark could do some finagling and roll up these investments into an IPO-capable holding company.

If we were to look at public companies, one would see that Planet Fitness is the only publicly-traded player of note in the fitness space. To date, none of the boutique concepts have been able to make the leap. But Xponential Fitness is well-positioned to make a run at going public in the not-so-distant future. The same can be said of Peloton, though, they’re more tech company than boutique studio. And, although SoulCycle filed for an IPO only to later withdraw their bid, Equinox Holdings, Inc. could make a compelling bid by combining their brands under one umbrella.

Other notable firms with fitness-centered investments include L Catterton and North Castle Partners. The former touts CorePower Yoga and Pure Barre among its portfolio, while the latter boasts Barry’s Bootcamp, SLT, and Brooklyn Boulders. As Bloomberg points out, while private equity firms may be best served by keeping their various companies separate, those willing to get creative could be rewarded by Wall Street.

Movers & Shakers

According to Marketwatch, Americans spent $19B on gym memberships last year. That same study revealed that 36% of millennials pay for a gym membership — twice the percentage of older demographics. And while there have been rumors of a boutique fitness bubble that’s certain to burst, all signs point toward a continued boom. Here are some of the notable concepts taking advantage of the surge:

Mayweather Boxing + Fitness. From Rumble to Shadowbox and TITLE to EverybodyFights, boxing appears to be the next big thing in boutique fitness. And since Floyd “Money” Mayweather Jr. isn’t one to miss out on an opportunity to cash in, he plans to open 200 boxing-based functional training studios within two years with a goal reaching 500 studios in five years.

Orangetheory Fitness. This heart-rate monitored, high-intensity workout studio has been setting up locations at an incredible clip for years. And in July, Orangetheory reached the 1,000-studio milestone. The company now has 1,000 studios in 49 states and 18 countries—including the United States, Canada, the United Kingdom, Australia, Mexico, Dominican Republic, Colombia, Japan, Israel, Peru, and Chile—with 500 studios in the development pipeline.

F45. This Aussie-born fitness phenomenon is making moves. To date, they’ve sold more than 1,150 studio franchises in 36 countries. Growth is going so well that they’ve even floated the idea of forming a fitness conglomerate and going public.

Shred415. Seeking to expand on the success of nine locations across the Midwest, Shred415 is bringing its high-intensity, interval-based fitness concept to locations across the US, aiming to have more than 100 studios by the end of 2019.

D1 Training. Founded by former NFL player Will Bartholomew and with roots in athletic-based training to achieve sport and fitness goals, D1 Training has more than 30 locations currently open across 24 states and anticipates more than 75 locations operating by 2019. Most recently, the company announced that it will be targeting the state of Texas, opening at least 25 locations over the next five years.

Legends Boxing. From TITLE to 9Round and Rumble to Everybody Fights, boxing studios are big right now. Next up, Utah-based Legends Boxing. Led by co-founder and two-time Golden Gloves boxing champ Andrew Scott, Legends has three successful gyms in Utah, 11 gyms in various stages of development, and plans to have as many as 20 new gyms over the next two years.

Tough Mudder. Building on the success of their internationally-acclaimed obstacle race, Tough Mudder has launched a boutique fitness concept offering team-based, high-intensity bootcamp classes. The first Tough Mudder Bootcamp opened in Boston, followed by a second location in Las Vegas, and Houston is slated to come online this fall. The franchise is busy signing up new partners, projecting 100 agreements inked by the end of 2018.

UFC Gym. For years, UFC Gym has been quietly expanding, growing to 139 franchised locations and 17 corporate clubs in 2017. All told, this extension of the Ultimate Fighting Championship raked in $148M in 2017 revenue. Most recently, UFC Gym announced plans to capitalize on the boutique boom by expanding its CLASS by UFC Gym concept—built around boxing, kickboxing, and HIIT training—to Singapore, the UK, and Ireland.

For a closer look at the movers and shakers in the studio space, check out our Guide to Boutique Fitness Studios in the US.

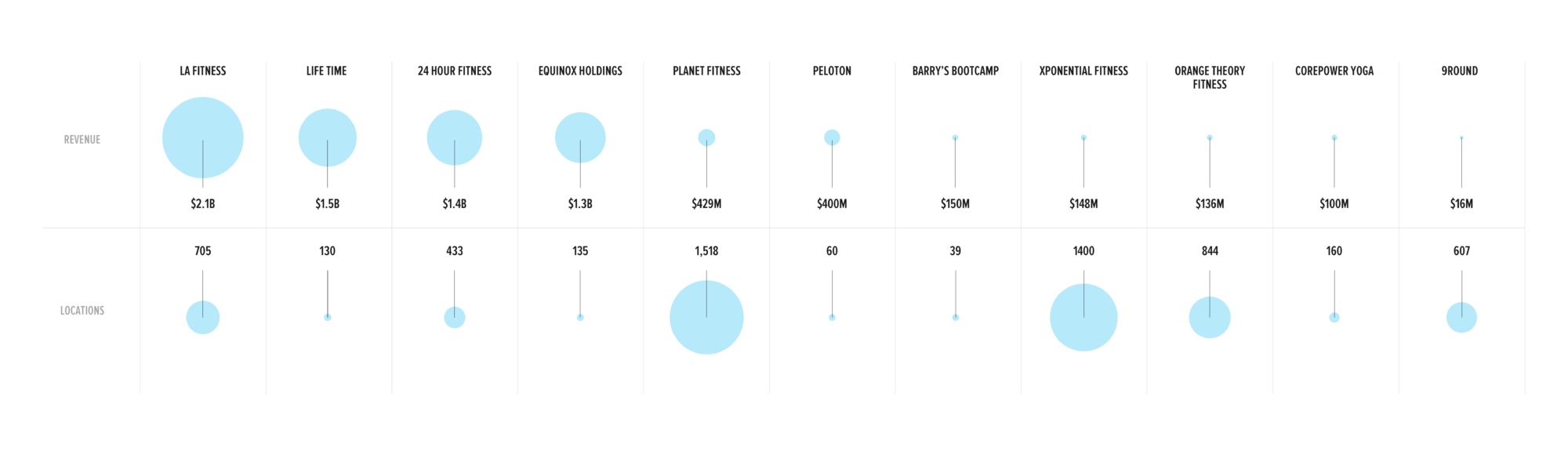

*data used to complete the location and revenue chart are from publicly available and previously reported statistics via Club Industry, Forbes, and Inc.

Want to get in touch? Email anthony@fitt.co with tips, questions, or to continue the conversation.