As in-person exercise rebounds, wellness booking platform Mindbody is plotting its return to the public market.

Need to know: After its 2015 IPO, Mindbody was taken private by Vista Equity Partners in 2019, valuing the company at $1.9B. Last fall, Mindbody acquired fitness marketplace ClassPass while also adding a $500M investment from Sixth Street.

Why now: Early in the pandemic, when gyms shuttered, Mindbody and ClassPass laid off employees as revenue dried up. Even in pivoting to digital, however, both companies remained bullish on the eventual return to gyms.

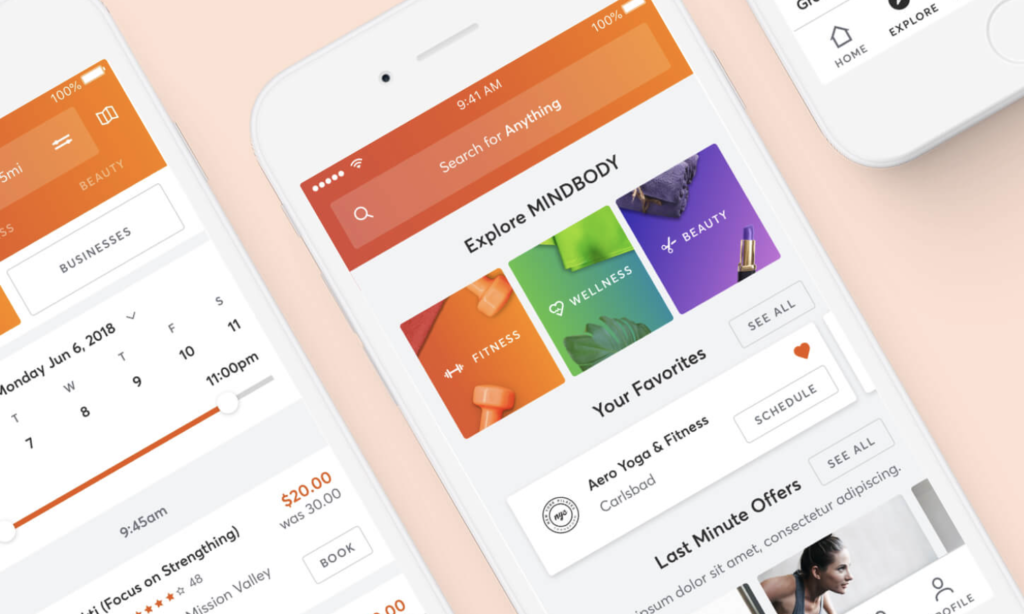

As the brick-and-mortar industry gets back on its feet, the Mindbody x ClassPass tag team hopes to create a new operating system for fitness and wellness.

What they’re saying. According to Mindbody CEO Josh McCarter, the company’s IPO bid isn’t about liquidity. Speaking to the FT, he said, “We want to have a public currency we can use for M&A,” adding:

“Our belief and our investors’ belief is that Mindbody is the most logical consolidator in the market to bring . . . wellness platforms together.”

Looking ahead: While virus surges remain a risk, McCarter believes we’re in an “endemic state,” citing no major gym closures in their network. If market conditions hold, the company is targeting a 2023 listing — giving rise to a wellness super app of sorts.