Last week, new research from the Global Wellness Institute (GWI) valued the worldwide wellness industry at a record high of $4.5 trillion-with-a-“T”. From physical activity to anti-aging and personalized medicine to tourism, the report makes it clear: wellness is infiltrating every aspect of our lives. But what exactly does that mean and is it actually a good thing? Let’s take a look.

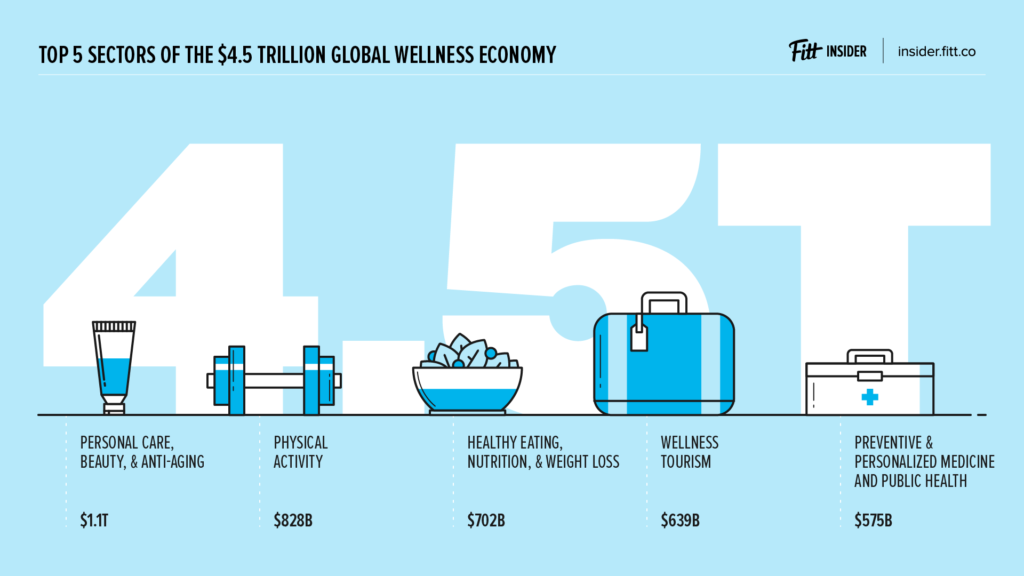

According to the GWI report, the top five sectors of the expansive wellness industry include:

- Personal Care, Beauty, & Anti-Aging: $1.1T

- Physical Activity: $828B

- Healthy Eating, Nutrition, & Weight Loss: $702B

- Wellness Tourism: $639B

- Preventive & Personalized Medicine and Public Health: $575B

The “physical activity economy” was identified as being a driving force behind the industry’s growth. In all, this sector of the wellness industry accounts for consumer spending on sports and recreation ($230B), fitness ($109B), mindful movement ($29B), equipment and supplies ($109B), apparel and footwear ($333B), and technology ($26B).

By 2023, the physical activity sector is expected to exceed $1.1T in value, further contributing to the proliferation of wellness. Of note, during that same period, the Asia-Pacific region is expected to overtake North America as the largest region by expenditures.

The good. For operators and brands in the space, wellness has proven to be a gold mine. The altruistic hope is that the world becomes a healthier, happier place thanks to flourishing wellness brands, connected fitness equipment, and meditation studios on every corner.

The bad. We’re spending more on wellness than ever before, but (in the US, anyway) we’re increasingly unwell. From obesity to diabetes and burnout to depression, the word “wellness” is well-intentioned, but it’s certainly not an antidote. Worse, long-term, overuse (and misuse) of “wellness” runs the risk of becoming devoid of meaning.

Zooming out. Whether it’s the pursuit of physical fitness, longevity, or vanity, a number of factors have contributed to the rise of “wellness”. But over time, the Wellness Industrial Complex turned the rewarding journey toward well-being into a status-signaling luxury good. As a result, wellness is poised for an unbundling of sorts.

The unbundling of wellness: When every brand is a wellness brand, being a wellness brand doesn’t mean anything. As a result, we’ll see top-tier brands distance themselves from the word. Instead of playing up the nebulous and ultimately empty definition of wellness, the standout companies will:

- Own a siloed vertical within the broader industry.

- Redefine this vertical to suit an underserved, passionate community.

- Build out a results-oriented and/or values-driven ecosystem for their core customers.

This approach is already taking shape across the industry.

Recess. Everyone is jumping on the CBD bandwagon, but Recess, a leader in the category, doesn’t rely on those three letters to move product — the letters CBD don’t appear on the can or website. Founder Ben Witte knew that CBD would be a commoditized ingredient, much like caffeine. From the onset, Witte has focused on creating an “antidote for modern times” perfectly tailored to the “Burnout Generation”.

Sufferfest. The drinkable counterpart to OV’s #DoingThings, Sufferfest is a functional beer created with the “sweaty consumer” in mind. Sufferfest founder and CEO Caitlin Landesberg, who’s set to appear on the Fitt Insider Podcast, told us that her beer was “a happy accident” created for the tribe of trail running, fire-sitting adventure-seekers that she herself is a part of.

WHOOP. Speaking with WHOOP founder and CEO Will Ahmed for an upcoming episode of the Fitt Insider Podcast, Ahmed said he doesn’t think of his company within the wellness landscape. Instead, WHOOP and Ahmed encourage people to live a “Performance Lifestyle”, quantifying lifestyle choices and guiding them to better decisions, and thus better performance, through WHOOP data.

At the opposite end of the spectrum, there’s a massive opportunity for companies seeking to remove barriers and increase access to physical activity, nutritious foods, social connectivity, the outdoors, and more.

On this front, we’ve recently spoken to startups like Public Recreation and BallBox, who are increasing access to fitness and recreational activities. Similarly, the November Project and Camp Gladiator are breaking down barriers and building community around physical activity.

Everytable, a healthy-fast casual restaurant concept, changes its prices based on the average income in the neighborhood where it’s located. And Thrive Market, an online grocery that bills itself as “Costco meets Whole Foods”, is increasing access to healthy products, regardless of income. The company also has a robust giving program, donating meals, money, and memberships for low-income families, students, teachers, veterans, or first responders.

The takeaway. Even though the market is worth $4.5T, when everything is wellness, nothing is wellness. As this fact becomes more clear, the unbundling of wellness will see top-tier brands disassociate with the broader industry. Instead, they’ll evangelize their customers around a specific lifestyle, not a catch-all definition.

The discrepancy between spending and access (or outcomes) will remain, representing the contradiction between what the industry preaches and what it provides. At the same time, solving for access, adherence, and results represent a massive opportunity.

Lastly, companies that remain in the wellness arena without recognizing the inevitable shift will find themselves in a race to the bottom.