CrossFit is in crisis mode. The result of a dereliction of leadership and ensuing fire sale, the $4B brand is on the ropes. But there’s a chance this much-maligned fitness enterprise emerges stronger than before. Beyond the drama, and tired CrossFit jokes, here’s why this story is worth following.

ICYMI: In a whirlwind of events, starting with a tone-deaf tweet from founder and CEO Greg Glassman, CrossFit saw its sponsors flee and its community revolt as affiliated gyms disavowed the brand. In the end, Glassman had little choice but to resign and sell off his fitness empire.

[Get up to speed: Read our recap of CrossFit’s collapse here.]

For context: To outsiders, an inept leader fostered a toxic culture that, when exposed, toppled CrossFit overnight. In reality, insiders have been tracking the brand’s backslide for years.

The big picture: In many ways, CrossFit succeeded despite Glassman. Now, with Eric Roza—seasoned executive, Oracle veteran, and bonafide CrossFitter (athlete, coach, and affiliate owner)—set to take the reins, the company could be poised for a turnaround.

It’s an uphill battle, to be sure. Still, the prospect of a cleaned-up CrossFit could legitimize one of the largest, fastest-growing, and most impassioned communities in fitness.

The Good

At its core, CrossFit is a trademark and methodology. Its methodology favors functional fitness over bodybuilding, cardio machines, or Nautilus-style equipment.

More specifically, CrossFit defines its approach as “constantly varied, functional movements, performed at high intensity.” Even so, the program is designed to be scalable — meaning it could and should be modified to meet the needs of all comers.

In the early days, as Glassman tinkered with the protocol, the unconventional routine and the extraordinary results it produced gained traction. In 2000, Glassman opened the original CrossFit gym in Santa Cruz, California.

Fueled by word-of-mouth, one gym grew to 500 CrossFit affiliates within four years. By 2014, the brand crossed 10,000 locations. Today, there are more than 15,000 affiliates.

By comparison, there are just over 2,000 Planet Fitness locations. Including all of its brands, from Blink and SoulCycle to Equinox clubs, Equinox Group only totals 300 locations. And, across eight concepts, Xponential Fitness counts 1,600 locations. The numbers don’t lie; CrossFit is quite the phenomenon.

By the numbers

- CrossFit affiliates: 15,000 locations in 150 countries

- Members: some 4M members participate in CF

- Certified CrossFit trainers: 175,000+

- 2019 CrossFit Open participants: nearly 359,000 athletes

- Revenue: the brand generates some $4B in annual revenue, and CrossFit, Inc. rakes in as much as $100M, according to Forbes.

The bulk of its business comes from certifying trainers ($1,000 for a two-day seminar) and a $3,000 annual fee for affiliated gyms (early affiliates pay as little as $500/year). CrossFit has also generated revenue from licensing, sponsorships, and ticketing at events like The Games.

Then there’s the billion-dollar WOD economy built atop CrossFit. From personalities like Kelly Starrett (Ready State) and Melissa Hartwig Urban (of Whole30 fame) to brands like Rogue Fitness, NOBULL, Siete Foods, and RXBAR, countless businesses started within or cater to CrossFit.

The Bad

If the story stopped there, CrossFit would be heralded as a fitness juggernaut, transforming lives one workout at a time. Instead, the embattled brand is defined by countless controversies. And that’s because, under Glassman, conflict was CrossFit’s modus operandi.

From the jump, CrossFit earned a reputation for inducing rhabdomyolysis, a potentially fatal condition where muscle tissue breaks down and is released into the bloodstream. Similarly, CrossFit was believed to be dangerous, intimidating, and downright grueling.

Instead of apologizing, examining its potential shortcomings, or enacting safety protocols, in 2005 Glassman told the New York Times: “[CrossFit] can kill you. I’ve always been completely honest about that.”

At every turn, Glassman doubled down on this sentiment. Early on, the company proudly displayed two bloody, vomiting clown mascots, a tongue-in-cheek nod to rhabdomyolysis.

Ruling with an iron fist, and in an effort to protect his trademark, Glassman was incredibly litigious. And on many occasions, legal battles and PR dust-ups turned personal. Like its workouts, CrossFit held nothing back, seeking to smash the opposition.

The Ugly

Straight to the point, the actions that led to Glassman’s demise are inexcusable. Racism, sexual harassment, and misogyny have no place in this world, let alone the workplace.

It’s been said that absolute power corrupts absolutely, and Glassman’s dictatorial reign bears this out. As the company’s sole owner, and with nobody to keep him in check, CrossFit became an extension of the man. Inextricably linked, the fate of the company, athletes, affiliates, and the broader community has long been at risk.

This time, they were collateral damage.

The Upshot

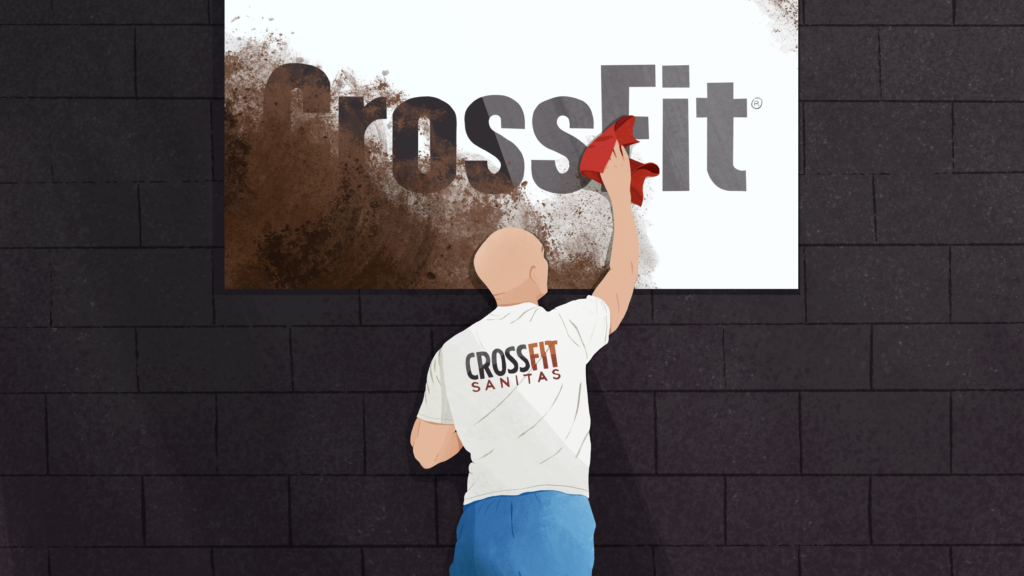

Now comes the hard part: restoring faith and transforming the culture such that CrossFit takes on a new image.

For his part, Eric Roza, CrossFit’s new owner and chief executive, appears up to the task. Roza previously served as the CEO of Datalogix, an online analytics company that sold to Oracle for $1.2B. More recently, he was Executive in Residence at General Catalyst, in addition to advising and sitting on the board of multiple startups.

Of note, Roza is a CrossFit devotee who “gets it”. But getting the various stakeholders back on board will be a tall order.

- Members: The CrossFit brand has become toxic. Reviving the company’s social media and content production efforts (disbanded under Glassman) will aid in reshaping CrossFit’s image.

- Affiliates: Gym owners are CrossFit’s true customer; prioritizing their success is paramount. Glassman left affiliates to fend for themselves, believing the cream would rise to the top. Roza is likely to take the rising tides approach, lifting all affiliates through concerted effort.

- Athletes: CrossFit’s stars have taken a back seat to Glassman’s whims, like downplaying The Games in favor of CrossFit Health. Propping up its athletes will help to propel the brand forward while strengthening its community.

The list goes on… Ultimately, these suggestions are low-hanging fruit. And it will be interesting to see how Roza navigates his new role. But the fact remains that, if he gets it right, CrossFit could see a resurgence — and that’s the real story to follow.

🏡 Never going back

According to Time, the pandemic is turning people against the gym. The article goes on to cite surveys in support of its claim:

- As of July 13, only 20% of Americans said they’d feel comfortable going to a gym, according to a Morning Consult poll.

- Another survey, conducted by market research firm OnePoll and commissioned by LIFEAID Beverage Co., found that 25% of Americans never plan to go back.

Piling on: This sentiment is nothing new. For months, exercising in-person has been off-limits. As the debate over whether or not to reopen rages on, the post-pandemic outlook for gyms continues to worsen.

As Time points out, “Many people, even in non-pandemic times, could not care less about the gym… The COVID-19 pandemic has shown there are other options.”

Activity > Fitness: With gyms closed, physical activity is replacing fitness, and working out has taken on a new meaning. As we pointed out in Issue No. 80, walking, biking, running, and simply stepping outside has been a respite during the pandemic, writing:

“Ultimately, fitness is exercise you pay for. And, in many ways, COVID is serving as a reminder that the best things in life are free.”

Punchline: Given the rising rates of obesity and other chronic ailments, anything that gets people moving is a step in the right direction. But the eventual outcome could leave gym operators in a precarious position as would-be members start or continue their workout habit from anywhere.

👀 Be on the lookout

According to consultancy Interbrand, Oatly, Dosist, and Seedlip are poised to become breakthrough brands.

Zooming out: More than the brands themself, the categories in which they play represent a significant portion of their upside.

- Oatly: The Swedish-born milk alternative recently raised $200M in growth capital from Blackstone Group in an effort to disrupt the dairy industry.

- Dosist: By positioning itself as a wellness company, this weed pen purveyor hopes to capture an outsized share of the billion-dollar cannabis boom.

- Seedlip: As more and more people opt out of consuming alcohol, not drinking has become the new cool. For its part, Seedlip is fast becoming the zero-proof spirit of sober culture.

Takeaway: Of note, Mirror and Impossible Foods also made the list. All told, the five standout brands represent the strength of and interest in the broader wellness movement. Tracking the industry’s trends and launching a product well-timed with the zeitgeist is proving to be a powerful advantage for health and wellness operators.

📰 News & Notes

- We blew it.

- Calm lands an HBO Max show.

- “Strength training is the assassin of self-doubt.”

- Breaking down Gymshark’s cash conversion cycle.

- Baze enters personalized nutrition. [Reread: What’s Next in Nutrition]

- Rogue Fitness hits 1,000 employees, processing 500K pounds of steel a day. [Reread: Rogue’s Under-the-Radar Dominance]

💰 Money Moves

- Ergatta, a connected rower, raised $5M in a seed round led by Greycroft. More from Fitt Insider: The Connected Fitness Wars

- Digital-first therapy startup Real closed a $6M round led by Forerunner Ventures and including Gwyneth Paltrow. More from Fitt Insider: Confronting The Mental Health Crisis

- Movano, a healthtech startup innovating glucose monitoring, secured $10M in additional funding as part of a $27M round.

- Joywell Foods (formerly Miraculex), a food technology company developing a sweet protein portfolio, closed $6.9M in funding. More from Fitt Insider: American’s Obsession With Protein

- Health-focused holding company HumanCo acquired a majority stake in plant-based ice cream producer Coconut Bliss. Terms of the deal were not disclosed.

- Berlin-based RSG Group, owners of Germany’s largest fitness chain, will buy Gold’s Gym for $100 million.

- Chilean insurtech startup Burn to Give raised a $8.5M Series A, with participation from Albatross Capital.

- LA-based Ready, Set, Food!, creators of food allergy prevention supplements, secured $3M in second-round funding from Danone Manifesto Ventures, Mark Cuban, and AF Ventures.

- The Cusp, a telemedicine service for women in menopause, has launched an at-home hormone test after raising $4M in funding.

- Noops, a New York-based oat milk pudding maker, closed a $2 million pre-seed round led by 25madison.

- UK-based gut-friendly snack maker Boundless raised £1 million in funding.

- CityBlock Health, a subsidiary of Alphabet providing healthcare services for low-income patients, raised $53.5 million in a Series B extension.

- Caption Health, creators of AI-guided ultrasound technology, closed a $53M Series B round led by DCVC.