In less than two years, Hims—a men’s wellness and personal care company—has earned tens of millions in sales while raising $197M at a valuation north of $1B. Given its minimalist packaging and suggestive subway ads, Hims tends to get lumped in with a growing list of DTC companies aiming to become the next Warby Parker. But under the hood, there’s more happening here than meets the eye. As Hims CEO Andrew Dudum told Digiday, the company is actually building the consumer healthcare platform of the future.

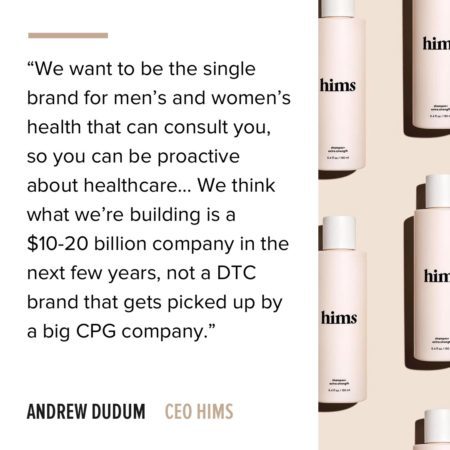

“We want to be the single brand for men’s and women’s health that can consult you, so you can be proactive about healthcare… We think what we’re building is a $10-20 billion company in the next few years, not a DTC brand that gets picked up by a big CPG company.” — Andrew Dudum, CEO Hims

The part where Hims wants to “consult you” is key to understanding how a company whose core business is selling cheap, generic versions of drugs like Rogaine and Viagra could disrupt healthcare.

Ultimately, it comes down to telemedicine — the remote diagnosis and treatment of patients. By requiring a prescription for many of its products and routing people to a network of doctors to obtain one virtually, Hims is turning customers into patients. In doing so, their entire value proposition shifts from helping guys keep it up or keep their hair to helping them access healthcare on their own terms.

The way Dudum sees it, if Hims is able to maintain consumer trust, they’ll be able to introduce any number of new products across health and wellness. Exhibit A? Hers, the company’s women’s wellness brand that launched in November 2018.

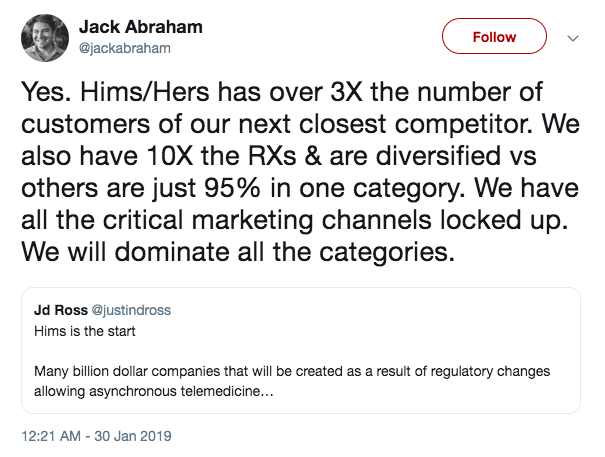

Of course, Hims isn’t alone in using telemedicine and exceptional branding to target a long-stigmatized market. As the patents on drugs like Viagra have lapsed and telemedicine laws have relaxed, startups like Keeps, Roman, Lemonaid Health, Nurx, and The Pill Club have hit the scene, tackling everything from hair loss and erectile dysfunction to birth control and at-home HPV screenings. And these competitors are aligned on where the value lies.

Saman Rahmanian, co-founder of Hims competitor Roman, sees the opportunity much the same as Dudum. “We never wanted to build an ED company or a men’s-health company,” Rahmanian told Men’s Health. “We wanted to build a health-care technology company.”

Despite early success and a lofty vision for the future, DTC healthcare companies in the vein of Hims still have to prove they have staying power. Like Bill Evans, managing director of Rock Health warned, “These [market] dynamics are great for consumers, who have access to best-in-breed solutions when and if they want them. But consumer behavior in most digital-health categories does not support high-growth, large-scale businesses.”

Special Delivery

If generic Viagra and hair loss pills are just the beginning, and DTC companies like Hims believe they represent the future of healthcare, Truepill wants to be the infrastructure for that future.

“The plan for Truepill’s API and fulfillment service is to be as indispensable as Amazon Web Services is to companies.” — Business Insider

Sticking with the Hims example, they’ve built the brand and a website. They handle customer acquisition and have assembled a team of contracted doctors who write prescriptions. But when the patient gets prescribed a medication on the Hims platform, it gets sent to Truepill, who fulfills it and ships it out the same day.

Not to be confused with an online pharmacy like PillPack, Truepill is focused on “pharmacy API and fulfillment service,” as they call it. As telemedicine grows and more companies go the DTC route, Truepill is positioning itself as the behind-the-scenes player powering this movement.

Regulatory Woes

But these healthcare startups may have made getting a prescription for hair loss treatments, ED pills, and beta blockers a little too cool — and possibly too easy. Recently, DTC healthcare companies have been the subject of reports from Bloomberg, The New York Times, and other outlets questioning the ethics and legal implications of pushing prescription medication with very little (or no) oversight.

“Some of these companies operate in a regulatory vacuum that could increase public health risks, according to interviews with physicians, former federal health regulators and legal experts. And federal and state health laws, written to ensure competent medical care and drug safety, have not kept pace with online services…” — New York Times

While the pros (convenience) and cons (health risks) are fairly evident, and with telemedicine the inevitable future, the elephant in the room remains: will Hims have to fight an Uber- or Airbnb-like regulatory battle or will they be able to skirt the rules?

Funding Update

In early 2018, direct-to-consumer pharmacy and telehealth startup Ro—best-know for its men’s brand Roman—raised $85M in Series B financing at a $500M valuation. This funding comes seven months after Ro closed an $88M Series A.