If the drinks section at your local grocery store wasn’t a dead giveaway, consumers are turning their backs on sugary sodas, confusing retailers, creating an opportunity for beverage startups, and causing headaches for the likes of Pepsi and Coke.

Water, soda, coffee, and alcohol aren’t what they used to be. Now, sparkling water, ready-to-drink coffee, and “functional” beverages are taking over. As PepsiCo’s incoming CEO Ramon Laguarta put it in a recent video to staff, “The consumer is moving to this triangle of taste, nutrition, and convenience…”

The result is a top-to-bottom reinvention of the beverage category.

So long soda

In the US, sales of soda drinks have been falling for the last 12 years in a row. With obesity and diabetes on the rise and new sugar taxes coming into effect, consumers are opting for healthier, lower-calorie options with lots of flavor. To offset the sales slump, the biggest makers of soft drinks are pulling out all the stops.

In recent years, PepsiCo has been on a mission to become more health-conscious by revamping their beverage and snack businesses. Some of the more headline-worthy moves include their acquisitions of Bare Snacks (~ $200M) and SodaStream ($3.2B). Don’t forget they also purchased KeVita—a leader in fermented probiotic and kombucha beverages—back in 2016. And earlier this year, PepsiCo launched Bubly, a fruit-flavored sparkling water.

Hello sparkling water

Consider this: according to data from Beverage Marketing Corp., as reported by The Wall Street Journal, Americans will buy approximately 821 million gallons of sparkling water this year, bringing total sales of non-alcoholic sparkling water to $2.7 billion in the US in the year that ended June 30. No wonder everyone from upstarts to established players in the beverage space are trying to chase down LaCroix, the market leader in sparkling water and seltzer sales.

Coca-Cola has tried some sleight of hand to target millennials consumers — there’s Diet Coke, Coca-Cola Zero, Coca-Cola Zero Sugar, and Coca-Cola Life. As if that wasn’t confusing enough, the company also rolled out fruit-flavored Diet Coke, hoping sleeker cans and cooler names can win over consumers. Still, not willing to chance the company on diet everything, last year, Coca-Cola paid $200M+ for Topo Chico, a sparkling water bottled in northern Mexico with a massive cult following in Texas.

Bolstering their existing sparkling offerings, which include S.Pellegrino and Perrier, Nestlé recently introduced sparkling water line extensions for Poland Spring, Deer Park, Ice Mountain, Arrowhead, and other regional brands.

Not to be outdone, beer giant Anheuser-Busch got in on the action with their purchase of Hiball/Alta Palla, makers of a line of sparkling waters, as well as energy drinks and sodas.

But don’t expect the sparkling surge to slow down any time soon. Data from Pitchbookshows that some $152 million has been invested in sparkling water companies in 2018 alone — see Spindrift and Waterloo. As Quartz put it, “The only people more obsessed with sparkling water than millennials are venture capitalists.” And if this sparkling water subscription says anything, it’s that sparkling is just getting started.

Cool Brew

Cold brew is the new cool. Whether it’s iced coffee, actual cold brew, nitro, or some other ready-to-drink (RTD) coffee concoction, consumers are going crazy for cold coffee.

Why? Convenience, for one thing. The grab and go aspect of many RTD products has contributed to growing popularity in the US. As a result, RTD coffee has become the fastest growing segment of the $13.6 billion retail coffee market. In all, US retail sales of refrigerated cold brew coffee grew 460% from 2015-17 to reach an estimated $38.1 million. Looking ahead, Mintel forecasts the RTD coffee segment will see 67% growth from 2017–22.

Coffee giants like Starbucks, Peet’s, and Blue Bottle (owned by Nestlé, who also owns Chameleon Cold Brew) have RTD versions of their coffeehouse beverages. Same goes for Stumptown and La Colombe, the latter of which has managed to capture 1% market sharewithin one year of announcing their RTD coffee. But VC-backed upstarts are hot on their heels.

At the head of the pack is CAVU Venture Partners. In the food and beverage category, they’re killing it. And they’ve set their sights on cold brew coffee, backing High Brew, Bulletproof, and REBBL. But they’re not confining themselves to coffee. CAVU’s entire portfolio, including Health-Ade, WRTMLN WTR, and Mighty Swell reflects the broader trends within beverage industry — the rise of enhanced and functional drinks.

Let’s get functional, functional

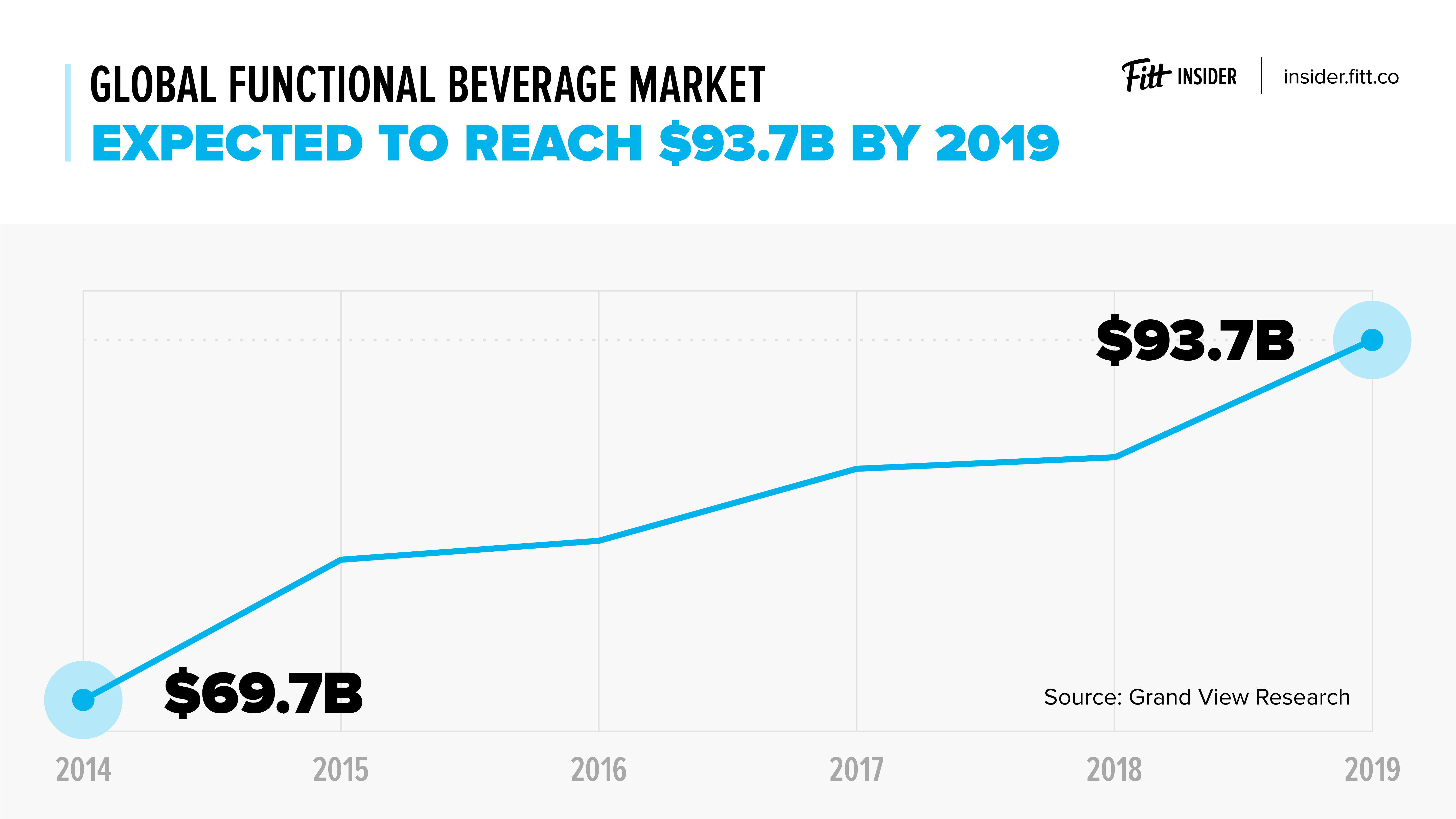

With ingredients like vitamins, minerals, nootropics, amino acids, or fruit and vegetables, consumers are drinking up beverages that have benefits beyond just quenching their thirst. And, seizing on this opportunity, venture capital firms have invested more than $170 million in functional beverage companies so far this year, up $111 million from 2017 according to PitchBook. The result has been a seemingly endless stream of products flooding the market.

What has been referred to as ‘premium’ hydration has hit an all-time high. Essentia, the pioneer of ionized alkaline bottled water in the US, recently reported 52-week sales of $153 million. Hint water is expanding their product line as they close in on $100M in sales. And Beyoncé-backed WTRMLN WTR recently launched four new SKUs and a sports-focused line.

Fermented drinks have gone mainstream, too. In 2017, the global kombucha marketgenerated $1.5 billion in sales and is projected to grow at a compound annual growth rate of 23% over the next five years. In that space, the OG of kombucha, GT’s Living Foods is family-owned, independent, and leading the industry with 55% of the US market. The aforementioned PepsiCo-owned KeVita is in the number two spot, followed by Health-Ade — who has received investment from Coca-Cola’s venture group.

After that, things really start to get interesting. Backed by Castanea Partners, Brew Dr. kombucha is eyeing $50M in revenue by 2019. Humm Kombucha—who raised $8M Series B from VMG Partners last summer—is vying for the podium. And Revive Kombucha is benefiting from an investment by and distribution in Peet’s Coffee, who led Revive’s $7.5M Series B. Finally, and most recently, Coors purchased Clearly Kombucha and plans to roll it out across its distribution network.

What’s next?

Clean energy is out to clip Red Bull’s wings. With another $8M in the bank, and celebrities like Drake, Von Miller, and Diplo behind them, MatchaBar hopes to reinvent energy drinks with the release of Hustle — a first-of-its-kind, sparkling matcha energy drink. It’s part of a movement by brands hoping to create a healthier, natural Red Bull replacement for the next generation of consumers. Keep an eye on Runa, Hiball, EBOOST, and Guayakí Yerba Mate.

We’re now entering the “healthy alcohol” phase. Sales of hard seltzers and canned cocktails are up while beer sales are slipping. It’s true! Sales of alcoholic fizzy water totaled $295 million in the year ended July 14, up from $106 million the previous year and $11 million two years ago, according to Nielsen. Hard seltzer now represents about 10% of all flavored malt beverage sales in the US.

If you’re watching the market or minding your waistline, check out Truly Spiked & Sparkling (owned by Boston Beer, brewers of Sam Adams), White Claw (made by Mike’s Hard), and Mighty Swell (backed by CAVU Venture Partners).

Like I’ve mentioned before, CBD is in everything. And sparkling water, energy drinks, and beer are all seeing green with the emergence of weed water. Dirty Lemon, a functional beverage with a cult-like following recently launched a new elixir called +cbd. But CBD is just the start. Lagunitas Brewing Company now offers Hi-Fi Hops, an “IPA-inspired” sparkling water infused with THC. And Sprig is the LaCroix of THC-infused sparkling water.

Want to get in touch? Email anthony@fitt.co with tips, questions, or to continue the conversation.