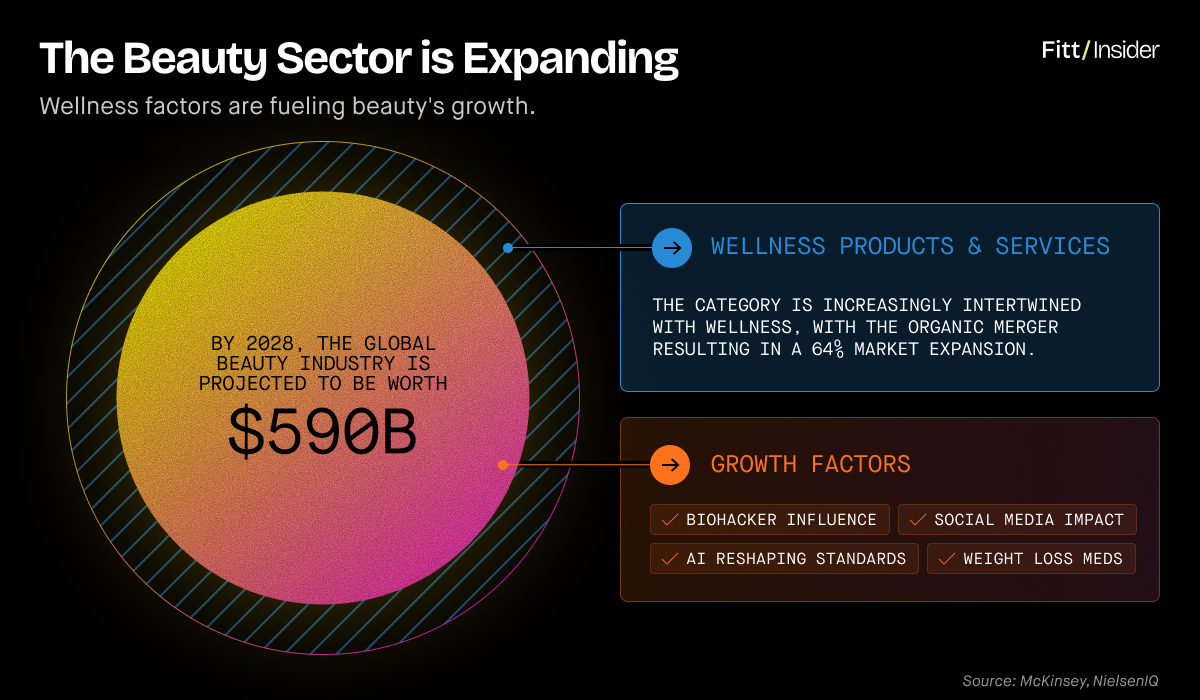

The global beauty industry is projected to reach $590B by 2028.

Bigger than makeup, the category is increasingly intertwined with wellness — an organic merger driving 64% market expansion. Like mental and sexual wellness, aesthetics are no longer seen as frivolous but an extension of health optimization.

Longevity-focused biohackers are fueling the $21B medspa boom, TikTok shoppers sent beauty CPG sales up 22% last year, and skin supplements are a $3.1B business, led by collagen.

The sector shows no signs of slowing. Per Vogue, 68% of under-35s believe AI will reshape beauty standards, and the majority think weight loss meds will do the same. Social media is a multiplier, with 74% saying filtered “Instagram face” is normalizing cosmetic procedures.

Altogether, the concurrent rise of regenerative medicine, social media commerce, and GLP-1s are altering consumers’ aesthetic expectations, often to the detriment of self-esteem.

Still, the shift toward holistic beauty can be a net positive if science surmounts hype.

Pt. I: The Good, The Bad, and The Ugly

In its infancy, the medicalization of beauty is legit but complicated, confusing, and often predatory — with the overlap of psychological and physiological factors bloodying the waters.

Primer

In this report, we dive into three pillars of the beauty industry: CPG products, IRL medspas, and DTC platforms.

We’ll explore why aesthetics became a tenet of wellness, what trends consumers are buying, and how builders can capitalize on longevity-focused beauty.

Foundation

A delicate matter, studies do show links between perceived attractiveness and well-being. Biologically, good health correlates to improved appearance and confidence, which typically welcomes better social treatment — aka “pretty privilege.”

But history reveals how misleading culturally normative beauty standards can be. Consider ancient Mayan skull shaping, 10th-century Chinese foot binding, or 1980s US tanning beds.

An unfortunate catch-22, toxic and arbitrary standards can spiral into prejudiced “lookism,” triggering a “plainness penalty.” Not unique to America, South Korea’s narrow ideals created a culture where plastic surgery is commonly gifted to high school grads to support success in life.

Contour

Resisting appearance-based discrimination will be key to avoiding propaganda and backlash while ensuring real wellness remains centered.

When messaging goes awry, mental health issues and eating disorders result, with the compound effects of negative body image already costing the US ~$300B annually.

Interestingly, while older adults are more likely to appreciate new tools like GLP-1s for their practical health benefits, younger people are feeling negative pressure to fit a shrinking mold. Admittedly vulnerable, Gen Z cares more about image than any other age group.

As elders rethink aging and seek preventative care for midlife transitions like menopause, more are opting for cosmetic enhancements to match — making 50 the new 30. But at the same time, younger generations fear their natural faces aren’t enough.

Feeding homogeneity, a 2023 survey revealed 40% of respondents earning >$150K have had at least one cosmetic procedure. Globally, aesthetic surgeries jumped 41% from 2019–2023, while noninvasive treatments like Botox and fillers gained 58%.

Key insight: People have always peacocked, but today’s boom is driven by a different ethos: Looking good isn’t superficial; it’s a byproduct of taking care of one’s mind and body.

Pt. II: Scratching the Surface

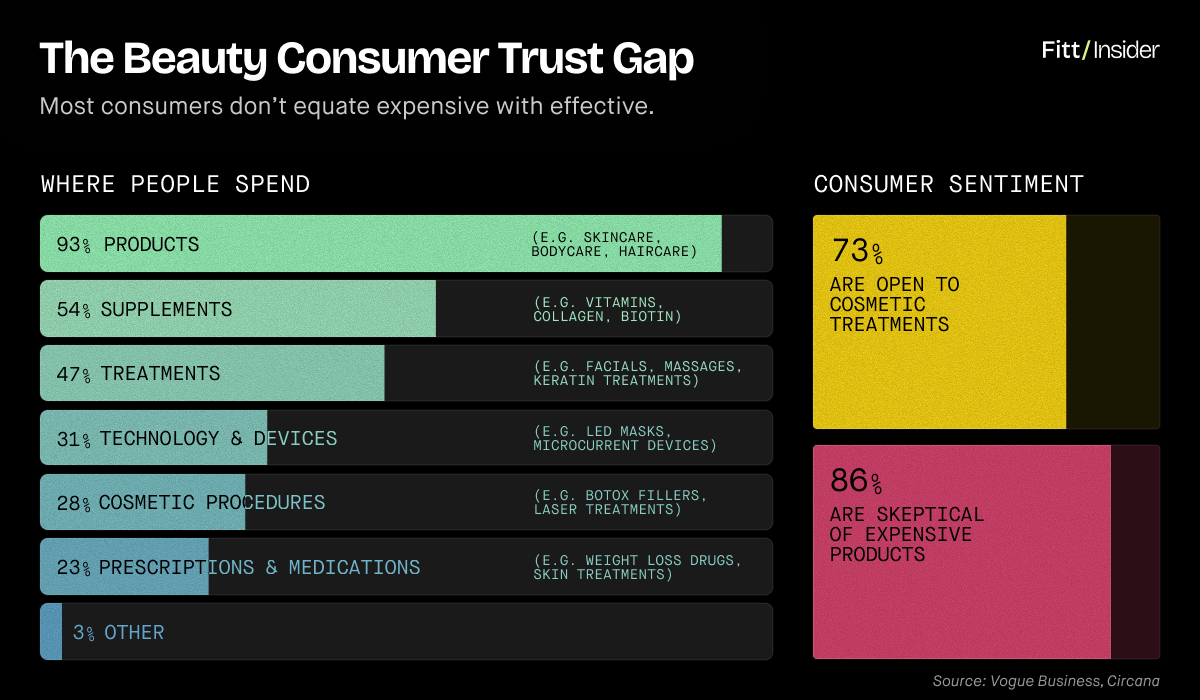

Despite plastic surgery’s growth, almost half of consumers still worry about risks, side effects, and looking unnatural. A preferred alternative, 93% will invest in effective products.

Skin

The body’s largest organ is the sector’s biggest moneymaker, with skincare accounting for 44% of beauty sales. As longevity eats wellness, brands are embracing a new narrative, emphasizing science-backed ingredients for cellular renewal over surface-level anti-aging.

The shift is clear in the evolution of makeup away from cakey cover-ups à la ’90s M·A·C toward modern leaders like rhode, MERIT, and Summer Fridays — which toe the line between personal care and primping. Rather than masking blemishes, wellness-focused cosmetics promise “barely there” coverage, selling clear skin as an unspoken and aspirational prerequisite for use.

As skincare takes precedence, clean marketing is giving way to clinical clout, making cult favorites like The Ordinary and SkinCeuticals household names. Up and coming, Noble Panacea was founded by a Nobel Laureate-awarded chemist, OneSkin is the brainchild of four PhDs, and NakedBeauty MD is helmed by a Harvard-trained reconstructive surgeon.

Crossing $130M in sales last year, Augustinus Bader sells $300 creams rooted in its founder’s breakthrough regenerative medicine research. An old guard, Estée Lauder tapped sleep expert Dr. Matt Walker as an advisor while patenting a peptide for overnight skin recovery. The company is also teaming with Stanford to shape cultural perception of longevity aesthetics.

L’Oréal-owned Vichy Laboratoires enlisted biochemist and author Jessie Inchauspé, aka “Glucose Goddess,” to educate on the role of lifestyle, plus launched an AI-powered skin analysis tool to predict user’s responsiveness to active ingredients. All-in, L’Oréal’s investment arm also backed longevity brand Timeline, which sells skincare to restore the mitochondria.

Monopolizing manufacturing, Magic Molecule is cornering the market on hypochlorous acid-based skin healing products. Pushing R&D, Croda Beauty sells innovative chemicals B2B, while Debut just raised $20M for its AI-based ingredient discovery platform.

Selling pills to preserve a youthful glow, aging research company Elysium kickstarted the NAD+ craze. Developing lifestyle systems, goop and Sakara Life highlight nutrition — pairing meal delivery subscriptions with skincare and supps to support the skin-gut axis.

Reframing beauty as a biohack, “high-performance” brands like Caldera + Lab and Dividends are pioneering a premium men’s niche. Moving forward, guys represent a continued growth opportunity, with 52% now purchasing face products — up from 31% in 2022.

Hair

The second-largest market sliver, hair products are also getting a high-grade makeover, and scalp care specifically grew 19% in H1.

Mainstreaming scalp science, Act+Acre’s serums address factors like hormone imbalance and hard water, scoring 60% of sales DTC while maintaining a 50% subscription rate.

Trademarking “hair wellness,” VEGAMOUR projected $160M in sales last year, using plant-based exosomes to improve follicle function without chemical hormone disruptors.

Riding TikTok virality, MaryRuth Organics bootstrapped its way to $100M selling liquid liposomal hair vitamins, a form offering improved bioavailability and absorption. Unilever-owned Nutrafol remedies hair loss with ingredients like ashwagandha, omega-3s, and peptides — publishing double-blind, randomized, placebo-controlled studies plus securing an NSF-certified stamp.

A potential breakthrough, regenerative medicine biotech company Pelage Pharmaceuticals closed a $16.75M Series A led by GV in February; it’s trialing topical hair loss treatments that leverage a novel peptide developed at UCLA.

Maxxed out

A step further, consumers are crafting home spa routines to structurally rejuvenate faces. Originating in dark corners of the web, “looksmaxxing” grew legs on TikTok — tapping posturing techniques from controversial orthodontist Dr. Mike Mew to chisel jawlines.

The belief that soft diets, poor dental work, and mouth-breathing have caused poor craniofacial development are gaining, with similar concepts explored in James Nestor’s bestseller Breath. Hijacked by wellness brands, mouth tape is commonly sold as a solution, but new tech is taking things up a notch.

Strategically contentious, LooksMax AI, Umax, and QOVES analyze users’ faces and provide step-by-step, nonsurgical glow-up protocols. As links between anatomy, appearance, and function are explored, Wildling is popularizing ancient reflexology, gua sha, and face cupping.

Coining “skin fitness,” Skin Gym sells a complete routine featuring kinesiology-style face tape. Sparking uproar, SKIMS debuted face shapewear. Building muscle memory, studio franchise FACEGYM pairs in-person “face workouts” with at-home lymphatic massage and tech tools.

Home devices from Solawave, Therabody, and HigherDOSE sell consumers on the benefits of red light, while medicube combines LED, microcurrent, electric needles, and sonic vibration. Running a cool $6K, LYMA’s handheld cold laser claims to work on a genetic level.

Key insight: Science and funding are aligned, but marketing and costs are missing the mark. Suspicious of snake oil, just 14% of beauty consumers equate expensive with effective — a sign that slick branding only goes so far, and education on mechanisms is needed.

Pt. III: Glowing Up

Platforms and clinics are combining diagnostics, dermatology, and body sculpting to establish concierge looksmaxxing as a consumer service.

Looks labs

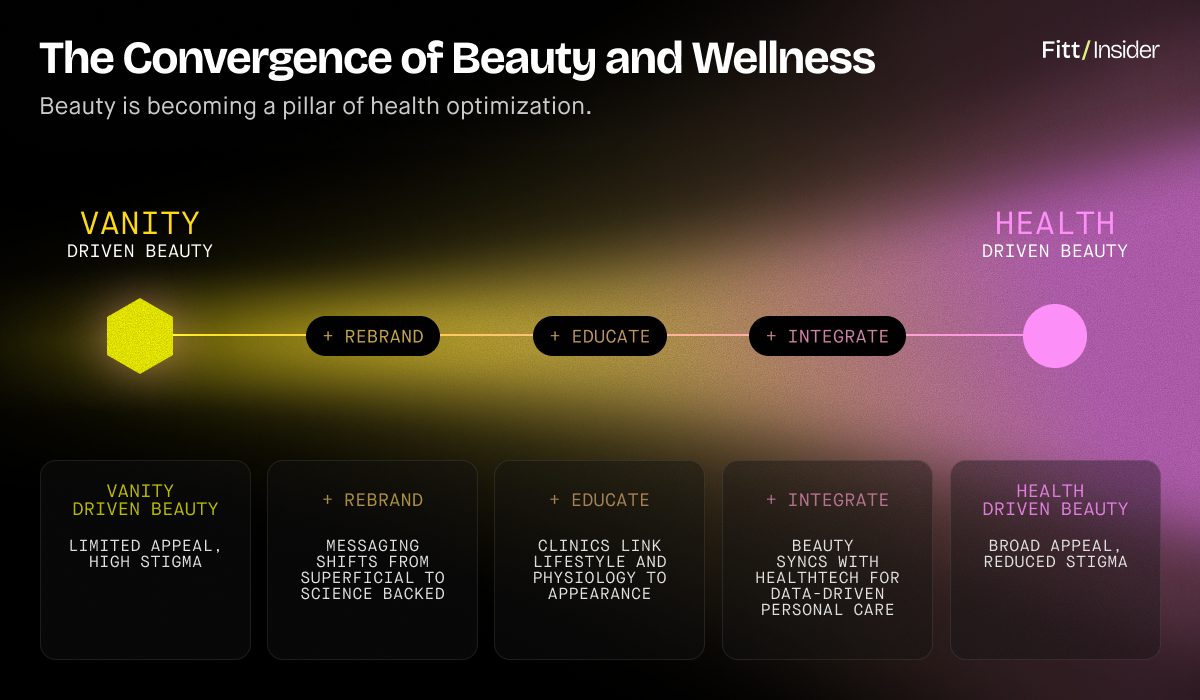

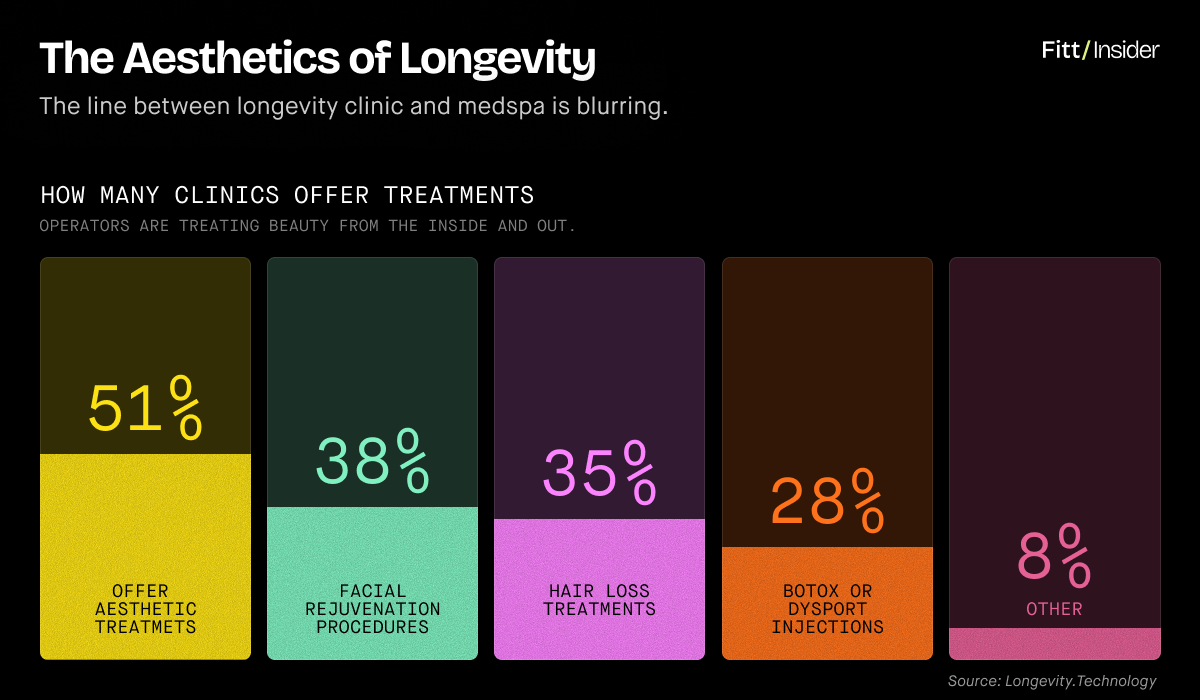

As noninvasive aesthetic procedures advance, the line between medspa and longevity clinic is blurring. Early proof, an April survey of 82 longevity clinics revealed 28% offer Botox, 35% tackle hair loss, and 38% perform “facial rejuvenation” procedures.

The move toward longevity marketing extends appeal beyond those chasing vanity, capturing people who preach personal health responsibility. Buying the rebrand, the number of men receiving minimally invasive cosmetic procedures spiked 29% from 2000–2020.

Reduced stigma means 73% of consumers are now open to cosmetic treatments, with injectables, microneedling, laser resurfacing, and chemical peels sparking the most curiosity. Predicting patients will want to look better once they feel better, clinics like Fountain Life and Next Health offer aesthetic care add-ons.

From Skin Laundry’s signature laser facials to Great Many’s plasma-powered hero service for hair loss, tech is transforming beauty treatments. At Four Seasons Maui, options include cryofacials and i-lipo, a laser-based alternative to traditional liposuction. Recreating Seoul in SF, Saelo’s Korean-inspired clinic nanoneedles exosomes.

Nesting beauty within holistic retreats, SHA precedes services with diagnostics and facial scans for personalized skin, hair, and smile fixes. Data-driven, Aesthetica Skin Lab’s membership program includes advanced skin age analysis, custom facials, and 1:1 dermatologist consults.

Looking ahead, 25% of GLP-1 users are interested in post-weight-loss procedures, meaning nonsurgical lifting treatments like Emsculpt Neo, Ultherapy, and Sofwave—which employ radiofrequency and ultrasound—could see spikes.

Tox talk

As #no-tox spreads, clinics are wrapping the old neurotoxin in new narratives.

Insisting injections empower, Merz Aesthetics counts Joe Jonas, Demi Lovato, and Gwyneth Paltrow as ambassadors for its Botox competitor, Xeomin. Being mindful, Skin Pharm preaches subtlety, Peachy uses AI to avoid overtreating, and Self London offers psych evals on site.

While Botox is widely accepted as safe, research shows it alters amygdala activity, affecting emotional processing. With pushback brewing and “Mar-a-Lago face” making news, cosmetic acupuncture is rising as a natural alternative, sending Google searches up 248% in two years.

Boasting whole-body benefits, an acu-approach stimulates rather than paralyzes muscles — strengthening mind-body connection instead of numbing it. Beyond smoothing wrinkles, studies show it reduces asymmetries and adds contour while boosting blood flow and moisture.

AI-estheticians

Full-stack and tech-forward, brands are designing digital journeys to guide purchase decisions.

Democratizing dermatology, GetHarley’s online office advises on everything from hormonal acne to healthy aging. An employee benefit program, JOYA emphasizes skin cancer prevention. Targeting psoriasis and eczema, Zest Health caters care to the modern workforce.

Personalizing subscriptions, Curology provides access to prescription-strength products. Even more precise, Parallel onboards customers with at-home tests for microbiome-specific serums, while Happy Head follows a similar process for scalp struggles. Keeping transformations in house, Hims and Ro stack skin and hair loss solutions alongside weight loss drugs.

If the Personal Health OS becomes reality, platforms could one day sync data from wearables and invisible diagnostics to inform custom AI-driven care plans — incorporating metrics like metabolic health, hormones, hydration, and microbiome to adjust skincare regimens as needed.

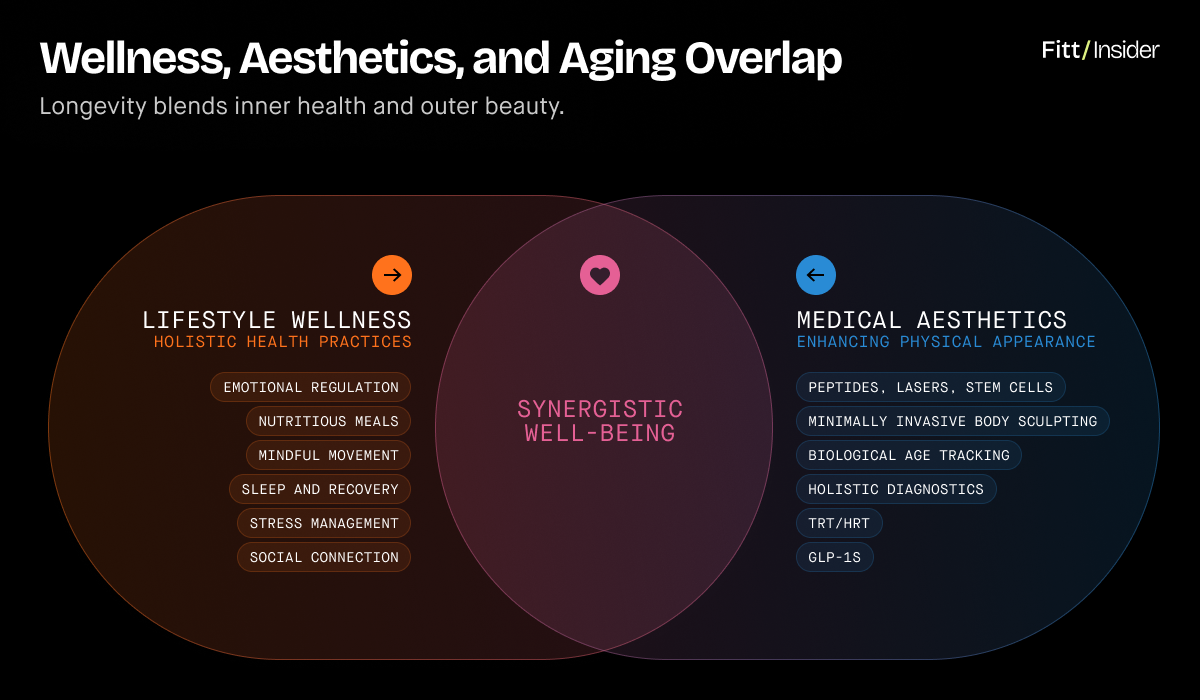

Key insight: There’s a new stack emerging at the edge of wellness, aesthetics, and aging. Diagnostics like biological age, hormone panels, and DEXA scans are meeting treatments like injectables, lasers, and sculpting — with home devices, peptides, and supps rounding out routines.

Pt. IV: Vanity Metrics

No longer anti-intellectual, aesthetic medicine is becoming core to the quantified lifestyle.

Model behavior

Just as Equinox is more than a gym and Erewhon more than a grocer, next-gen medspas will be status symbols — acting as command centers for aging and looking better.

Influencers are already sharing high-tech spa sessions like SoulCycle classes and posting reversed biological ages like sleep scores, making aesthetics the new performance. But like the broader longevity sector, beauty may want to rethink its hyper-aspirational approach, as survival-of-the-hottest undertones could create a ceiling.

Alternatively, the sector may splinter via differentiation — with the unapologetically altered flocking toward super-glam suites and graceful agers opting for human-centered clinics. In either case, brands that fuse science and experience for seamless personalization will win.

As the space heats up, consumers may also need help knowing who to trust. An MD isn’t required to open a medspa, meaning just 37% are doctor-operated. Being cash-pay, they face little regulation while reaping high margins, making careful vetting crucial.

Laws of attraction

Nothing to be ashamed of, 97% of beauty consumers are concerned about aging, but the predominant mindset is wanting to align mind and body, inside and out.

More than complete makeovers, people want their best possible body at every age, and science is starting to support that goal. Yet, skeptical of exaggerated claims and/or unable to shell out on luxury goods, consumers are still choosing “masstige” products over premium.

Following the Wellness 2.0 Playbook, brands must be better at articulating how aesthetic medicine can be more than skin deep, and when/why splurging could be worth it.

With issues like underdeveloped jaws and deviated septums affecting respiration, wanting to remedy faces shouldn’t feel superficial. Consumers should know these traits are treatable and addressing them can actually improve vitality.

The more companies can normalize caring for skin, hair, and body without making people feel shallow, the more consumers they’ll reach. But when marketing speaks to insecurities over science, solutions feel like cash grabs.

Key insight: Helping consumers navigate the new aging landscape is part biology, part psychology. With a subject as sensitive as beauty, nuanced marketing and communication is needed.

Last Looks

The rise of cosmetic procedures means it has never been easier to meet conventional beauty standards while remaining mentally, physically, and/or spiritually ill. That said, while looking, feeling, and being good are not the same, valid bidirectional links shouldn’t be ignored.

And if investing in appearance genuinely keeps people well, judgement is hardly progressive.