Historically seen as lowbrow, sexual wellness is shedding its stigma.

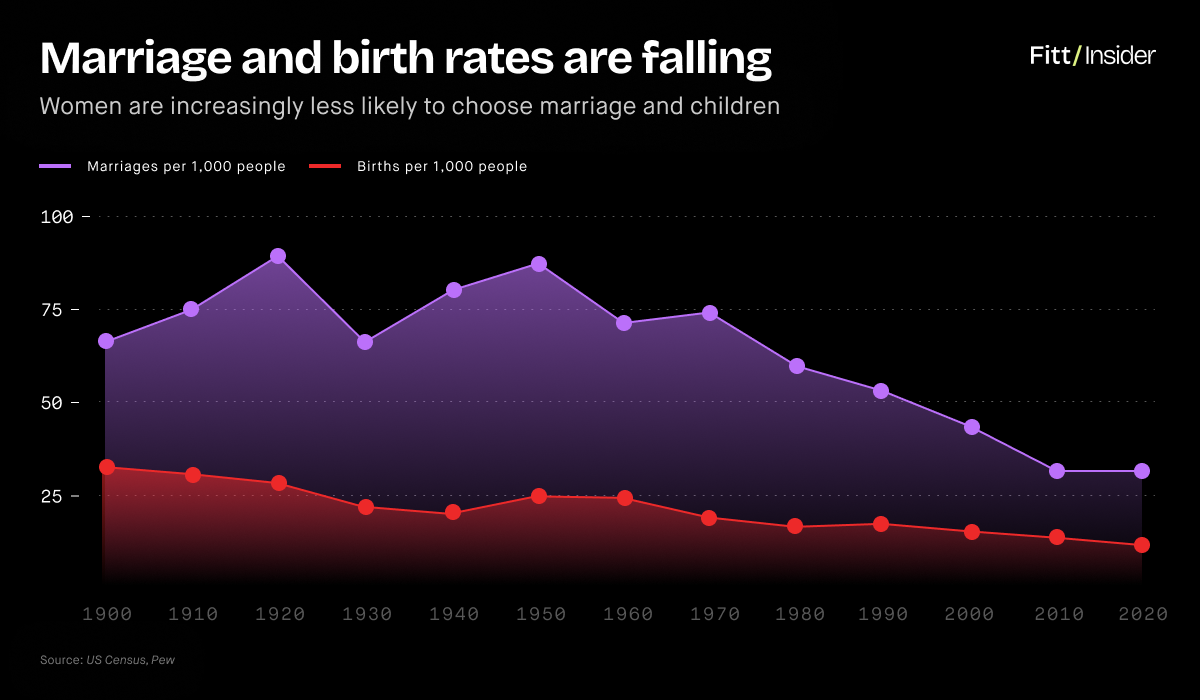

A convergence of trends, young people are calling out taboos as senior cohorts confront hormones’ impact on healthspan. Adding drama, declining birth rates are skewing the population older, prompting warnings of an economic slowdown and “mass extinction.”

Mired by ideological debate, the sector faces unique challenges but is projected to reach $115B by 2030. From hormone therapies and fertility treatments to supplements, specialized care platforms, clean hygiene products, relationship apps, and more, companies are cashing in.

This report explores the current sexual wellness wave, why it’s happening, and where it could go from here — with implications for longevity, social cohesion, and family-wide health outcomes.

Pt I: Heating Up

Sexual wellness could be the missing link in longevity.

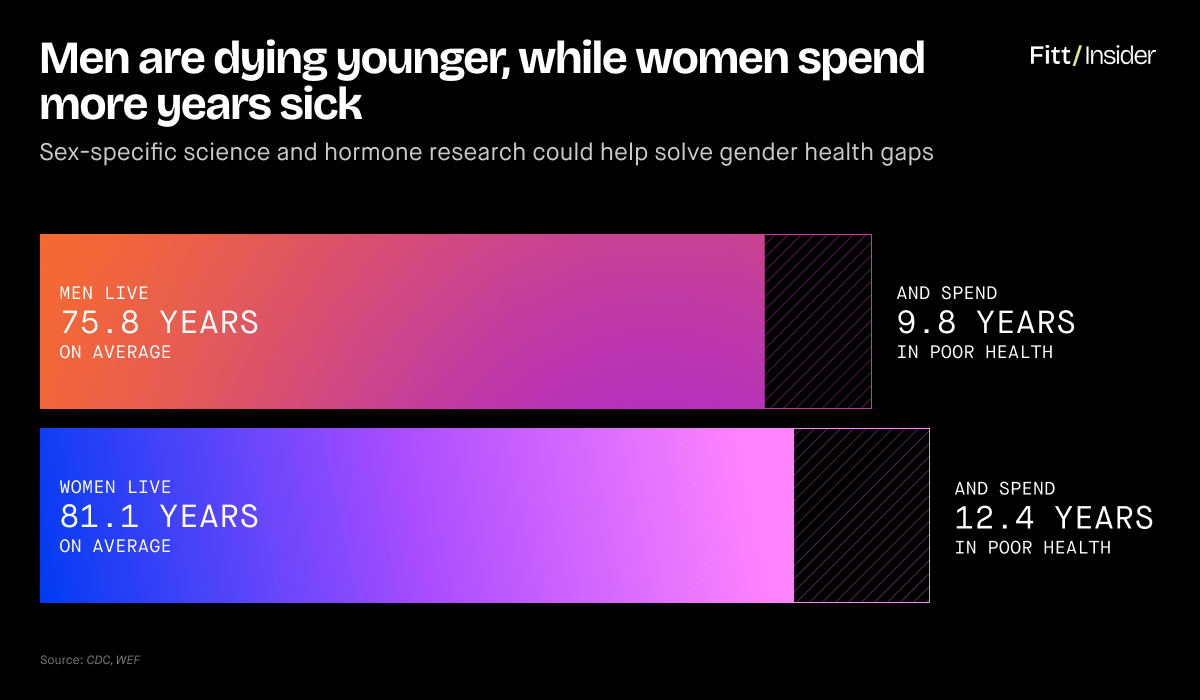

From puberty on, sex hormones have outsized effects on well-being, with estrogen boosting longevity in women and low testosterone tied to shorter lifespans in men.

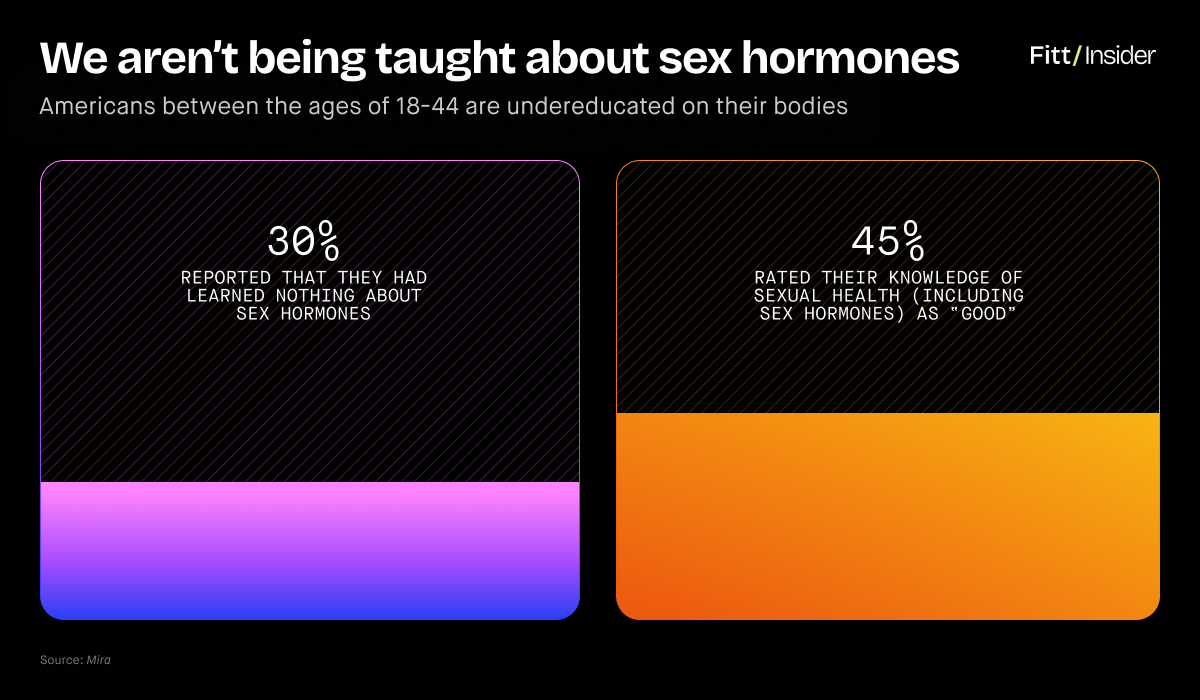

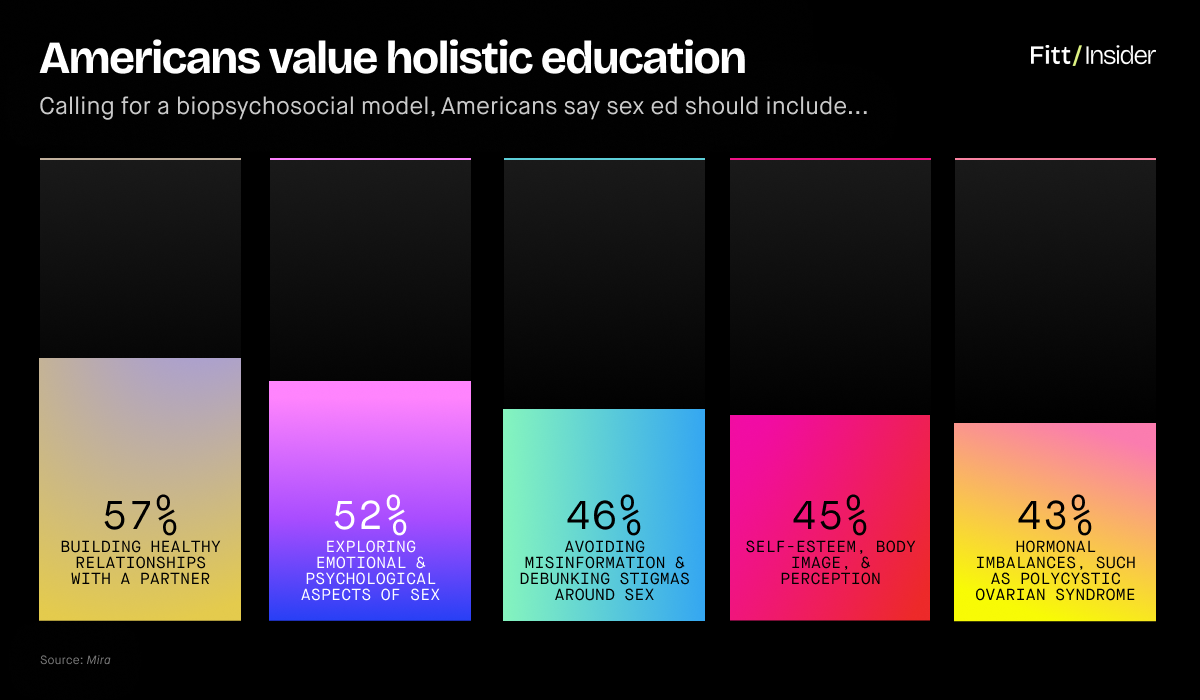

Because sex ed is geared toward pregnancy prevention, many adults remain unaware of their significance until symptoms of imbalance show.

Unprepared, 80% of women know little about postmenopause before turning 40, despite it taking up 40% of their lives. Men’s experience is no better, with 40% reporting ED by age 40.

As voices like Attia and Huberman separate science from creed, consumers are connecting hormonal and reproductive factors to weight, aging, and more — sparking a sexual wellness revolution.

More than the absence of STDs or ability to reproduce, sexual wellness widens the scope, examining the physical, social, emotional, and mental layers of healthy sexual function.

XX Factor

Hormones have entered the chat.

Hormones modulate nearly every bodily function, but differing levels of estrogen, progesterone, and testosterone mean male and female metabolisms don’t operate the same.

For women, fluctuations alter caloric needs. Fighting chemistry in the name of willpower, many ignore natural ebbs and flows and fall prey to disordered eating. Skimping on meals while overtraining, they worsen imbalances, wrecking the thyroid, adrenals, and reproductive system.

For men, low T, weight gain, diabetes, ED, and sleep apnea are common bedfellows, all tied to metabolic dysfunction and blood flow restriction. Robbing them of more than pleasure, sexual dysfunction can be an early sign of heart disease, cancer, and organ failure.

To date, day-to-day hormone changes have been hard to track, leaving practitioners with little choice but to dish generic dieting advice, birth control, and little blue pills.

But if companies like Eli Health, Level Zero, Persperity Health, and Mira can make real-time hormone monitoring a reality, sexual wellness could soon be part of holistic treatment plans.

Opening the floodgates, more data will feed a research and innovation flywheel, and one day novel therapeutics may extend the healthspan of both sexes.

Zero to One

Startups are capitalizing on traditional care’s shortcomings.

A massive TAM, 43% of women and 31% of men report some form of sexual dysfunction.

Considered low on their list of concerns, only 15% of GPs discuss SD with patients, and just 7% of OB-GYN residents feel comfortable treating menopause.

Stepping up, Midi Health closed a $60M Series B last year, serving 100K patients. Providing personalized virtual menopause care, Midi listens to women as they navigate hormonal shifts, helping decide their ideal mix of meds vs. lifestyle and wellness therapies.

A case study for the ages, Hims & Hers hit $1.48B in revenue with 2.2M subscribers in 2024. Critics argue it’s too lax in prescribing, but Hims was among the first to explicitly make sexual health a front door to whole-person care, validating underserved consumers. Following a similar playbook, Ro has raised >$1B by offering sexual, metabolic, hair, and skin health in one place.

Backing its way into sexual wellness, Noom added HRT to support menopausal women on their weight loss journeys. Emphasizing longevity, Hone Health and Lifeforce incorporate comprehensive hormone panels and optional TRT to keep men ahead of the curve.

Becoming ubiquitous, medspas like VIO and men’s clinics like Gameday are bypassing red tape, further mainstreaming peptide therapy, TRT, ED treatment, and more.

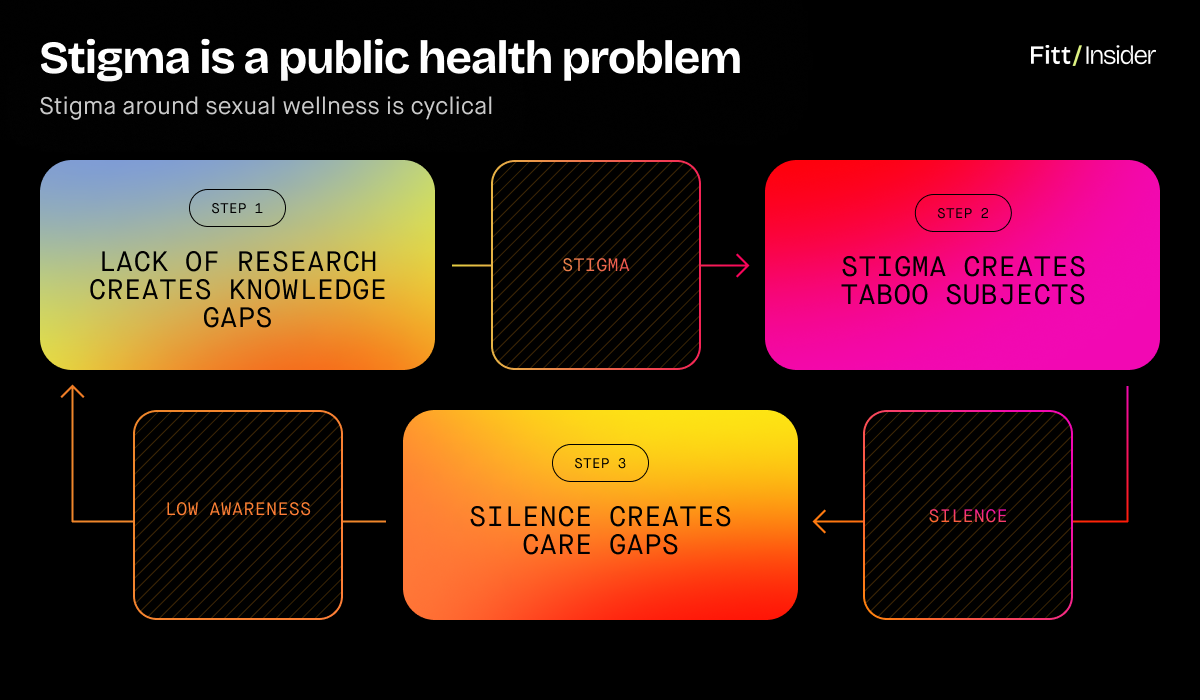

What it means: Good health and good sex are correlated, but the connection is underexplored, with embarrassment over symptoms like low libido and incontinence slowing scientific progress. The more companies can articulate links between sexual and general wellness, the less stigmatized the space becomes.

Pt II: Coming of Age

Operating outside of healthcare, wellness brands want to make sex comfortable for all.

The Talk

Forums for productive communication are missing.

Sticky territory, sexual behavior is as cultural as biological. Case in point, while 39 states teach sex ed, only 26 require it be medically accurate. 40% of millennials say it wasn’t helpful anyway.

Looking elsewhere for answers, over half of 13–17-year-old boys consume porn, with 45% of watchers saying it offers helpful info about sex. Learning the hard way, 85% of teen girls experience street harassment, sexualized whether they like it or not.

A lose-lose, the message instilled is people are bound by urges, without top-down processing. Ignoring the brain’s role, men reach for TRT or Viagra as a quick fix, never addressing psychogenic causes of ED — performance anxiety, relationship conflict, etc.

Reducing each other to tropes, over a third of women believe men will take sexual advantage of them, while about a third of men fear being accused of abuse. As polarized politics eclipse mindful communication, marriage rates are sinking, leaving nearly half of adults single.

Feeling ostracized, 47% of men don’t think feminism was good for America. Feeling exploited, women are increasingly less likely to want kids. All things considered, if sexual wellness can get women and men on the same page, positive social effects will ripple.

Offering fresh vernacular, Esther Perel’s no-nonsense relational intelligence courses confront the messiness of romance and desire on the road to life-enriching eroticism. Built for men, Mojo’s AI-powered dating, sex, and relationship coaching reforms outdated masculine ideals.

Supporting established couples, apps from Arya and Coral guide healthy intimacy. Providing a pause, luxury resort operator SHA designs retreat programs to help people find their spark.

No Shame

The menstrual care category is freshening up.

While 92% of teens agree periods should be considered a sign of good health, 75% feel they’re seen as gross and unsanitary instead. Internalizing shame, girls are more prone to body image issues and low desire later in life.

Changing the narrative, next-gen period care brands are coming for Kotex, pushing the feminine hygiene products market past $44B by 2029. Dealing more than tampons, disruptors like Cora, Lola, The Honey Pot, Rael, and Nixit act as big sis with wraparound sexual wellness support.

Better menstrual care also translates to more active youth. An overlooked roadblock, 78% of girls avoid exercise on their period, with almost half dropping sports altogether during puberty. Understanding the struggle, Sequel engineered a leak-proof tampon for athletes while Thinx, Saalt, and Aisle are popularizing period underwear.

Building an innovation ecosystem, Comma raised a $2M seed round for its period health platform. In the works, it will sell sustainable tampons girls can use and send back to the lab for blood biomarker analysis, receiving menstrual health insights within its secure app. On the same page, Daye’s tampon-shaped diagnostics screen for STIs, HPV, and bad bacteria.

Addressing other issues down there, Evvy combines vaginal microbiome tests with products to fix pH imbalance or irritation, while Seed debuted a tailored suppository to protect against UTIs. After a breakthrough study showed bacterial vaginosis—a commonly recurring condition for one in three women—is actually an STI, Wisp launched the first-ever male partner treatment.

Going all-in on women’s health, Oura adapted its algorithm to factor female hormones while syncing with Natural Cycles for temperature-led birth control. Diversifying research, the company’s STIGMA study aims to uncover the influence of variables like socioeconomic status, athletic performance, and contraceptive use on cycle abnormalities.

Wildcards

All’s fair in love and sexual wellness.

Normalizing adult products, brands aim to make pleasure mature, mutual, and measurable.

Maude and Dame have proven prestige vibrators can scale, paving the way for Sporty & Rich’s Sensual Sport launch. Medically endorsed, PT clinic Origin teaches patients to use toys as tools for better blood flow by palpating pelvic floor muscles and softening post-baby scar tissue. Developed by an OB-GYN, Joylux’s vFit adds red light to improve hydration and sensation.

Cleaning up personal care, Fur and Oyo make nontoxic products for intimate upkeep, while Nécessaire sells natural lube. Pushing boundaries, Alo launched a sexual embodiment course, Alice sold out “Happy Ending” chocolates, and ASYSTEM stocks libido gummies.

Reminding penile problems precede heart disease, biohacker Bryan Johnson suggests men monitor nighttime erections with the wearable Adam Sensor. For the ladies, Lioness’s device measures orgasm quality while connecting factors like sleep, caffeine, and stress.

What it means: The majority of Americans feel sex ed failed them. Seeing brands normalize sex talk may cause some to recoil, but problems don’t disappear without positive discourse.

Pt III: Fertile Debate

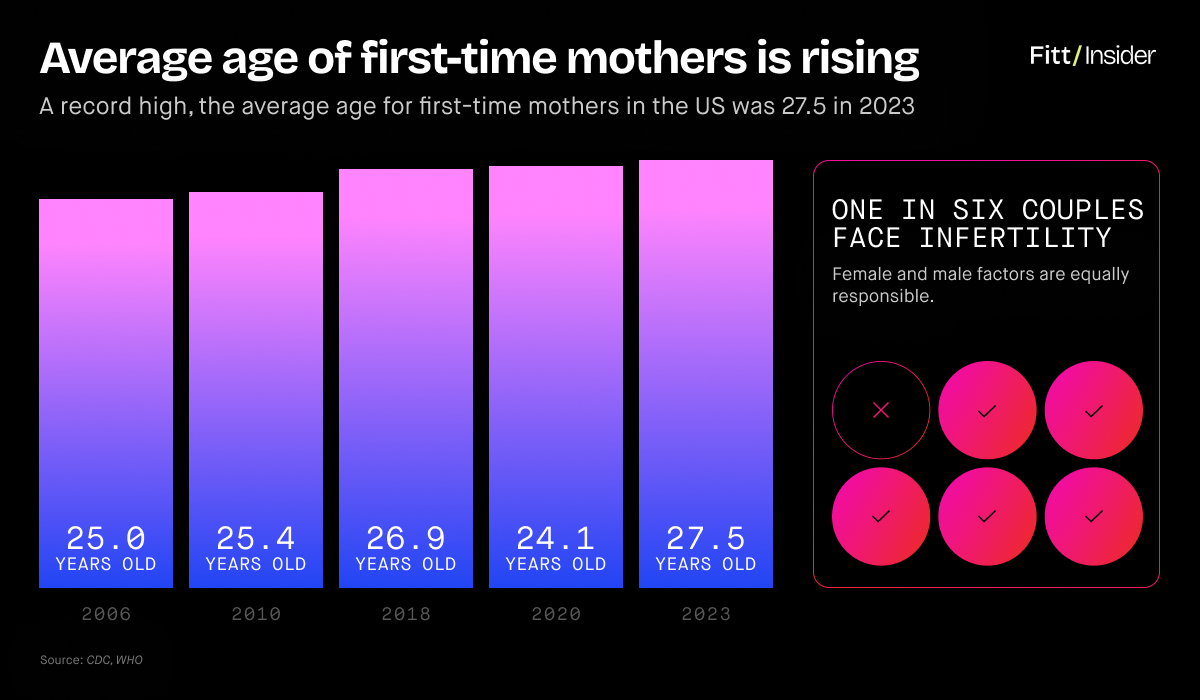

A record high, the average age for first-time mothers in the US was 27.5 in 2023. Pushing back timelines, one in six couples faces infertility, with female and male factors equally responsible.

On the Clock

Fertility solutions must adapt to modern families.

Asking women to choose between work or kids is a cop-out, given our capacity for innovation. Backfiring for birth rates, more women than men now see kids and marriage as inessential.

Women are well aware having children young means significant sacrifice to lifetime earnings, and with one in four facing domestic violence, financial independence is a necessary safety net.

Instead, the focus should be making IVF and egg freezing accessible plus treating common conditions like PCOS, endometriosis, and autoimmune diseases — which up pregnancy risks.

Red hot, fertility startups raised $1.5B from 2019–2023. Since being greenlit by the American Society for Reproductive Medicine in 2012, annual egg freezing procedures have jumped 400%. But with cycles costing upwards of 10K (and no guarantees of success), it’s cost-prohibitive.

Becoming table stakes for employers, 42% of US orgs now offer fertility benefits, with leaders like Progyny, Maven Clinic, and Carrot serving enterprises. Alternate approaches, Cofertility lets women freeze eggs for free if they donate half, while Future Family offers nationwide IVF insurance and financing plans. The unicorn in the room, Kindbody was valued at $1.8B in 2023.

Tackling PCOS—the leading cause of female infertility—May Health is trialing use of radiofrequency to restore ovulation. With $38.5M raised, Allara Health is scaling in-network virtual care for chronic hormonal and gynecologic conditions.

Disrupting surrogacy, Nodal’s Bumble-inspired platform matches parents with vetted surrogates under a transparent pricing model. Making IVF less distressing, Gameto’s in-vitro approach matures eggs outside of the mother’s body — cutting required hormonal self-injections by 80%.

Reconceiving

The burden of infertility can’t fall on women alone.

Less discussed, men also face a fertility cliff, with sperm quality declining from age 40. Raising concern, poor lifestyle habits and toxin exposure may be eliciting an earlier dropoff, with a meta-analysis showing global sperm counts fell >50% in the past 40 years.

Studies show sperm from older males is more likely to result in miscarriage, IVF failure, premature births, and autism, no matter how young and healthy their female partners are.

Overdue, male reproductive care is gaining attention, with Posterity Health closing a $13M Series A in February. Offering at-home tests, semen analysis, and cryopreservation, Legacy and Fellow aim to make sperm freezing as common as egg freezing. Meanwhile, prenatal supplement makers Bird&Be, Perelel, and Needed all added male-focused products.

Splitting birth control responsibility, Contraline and NEXT Life Sciences are developing long-lasting nonhormonal options for men — an intriguing alternative as more women worry about side effects of staying on the pill and pain from IUDs.

What it means: Increased capital and innovation can widen family planning options. The idyllic vision, AI-powered care and preventative MSK health simultaneously extend vitality, keeping couples healthy enough to have kids later, and freeing both sexes to pursue their full potential.

Real Talk

Sexual wellness is a heated topic, but not talking about it means turning a blind eye to some of the biggest health and social challenges of this century.

Reproductive health has real ramifications on well-being, irrespective of personal politics or family plans — with hormone-related issues like sexual dysfunction, infertility, PCOS, endometriosis, menopause, irregular menstruation, and hypothyroidism affecting millions.

Not to mention, hormonal struggles feed into bigger epidemics, from obesity to mental health.

Continued sex-specific research is crucial to decoding imbalances, and allocating just 2% of funding to women won’t suffice. Outside the lab, it’s time for honest discussion of societal factors perpetuating these problems, leading with curiosity over condemnation.

In the past, VCs steered clear due to vice clauses blocking funding of “bad” industries like gambling, cannabis, and psychedelics. But blanket vilification of categories is changing.

Sports betting is now legal in most states. Psychedelics are considered medicine. Cannabis is a functional ingredient. Nicotine is a biohack. And sexual wellness is healthcare.

Not shying away, firms like Vice Ventures, Access Ventures, and Amboy Street Ventures are actively invested — with the latter valuing the “ghost market” at $360B.

Still largely untapped, companies in the space have a chance to reshape the world.