September 15, 2019

A new generation of startups is disrupting healthcare, seizing a trillion-dollar market in the process.

From new-age clinics and mobile apps to wearables and DTC medical testing, there’s a growing number of companies working to alleviate the numerous pain points associated with healthcare.

As a result, the category is transforming so quickly that it’s a challenge just to stay informed. With that in mind, we’ve compiled the “DTC Healthcare Report” to keep tabs on the ever-evolving industry.

Though, like other reports in the series, this isn’t intended to be a conclusive piece. Instead, this report will be a fluid work-in-progress that’s updated as the market continues to take shape.

Contents

- Why Now?

- Blurred Lines: Health or Wellness

- The Patient/Consumer

- Promises & Pitfalls

- DTC Healthcare Landscape

WHY NOW

The desire for a top-to-bottom revamp of health services has been building for years.

As costs skyrocketed, the overall customer experience has suffered, lacking personalization and transparency while becoming increasingly inconvenient. Now, a convergence of factors makes this the perfect moment to reimagine healthcare.

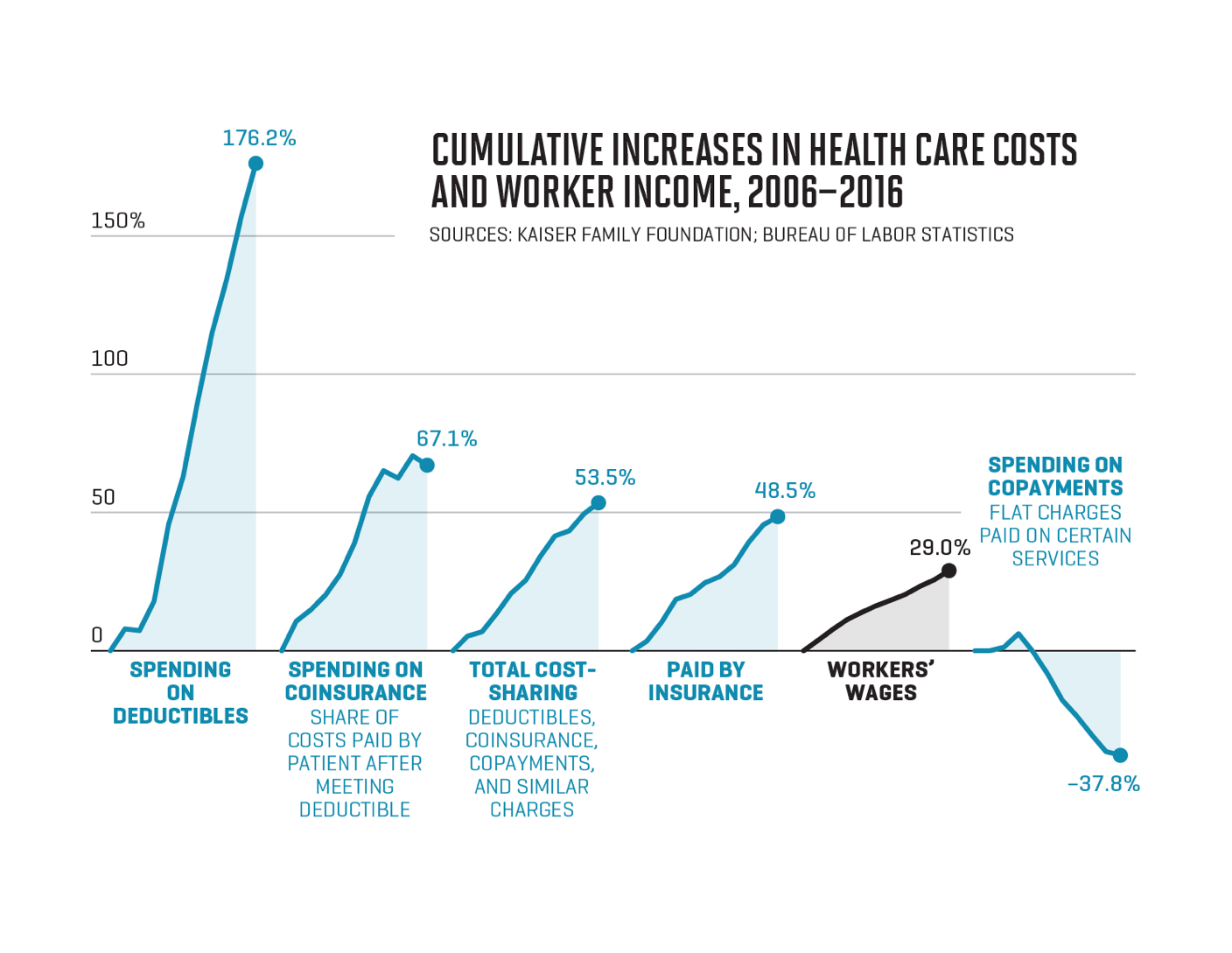

Rising Costs

- US expenditure on healthcare has surpassed $3.5T and accounted for more than 17% of GDP.

- A Kaiser Family Foundation study showed mean employer deductibles increased from $303 to $1,505 between 2006–2017, forcing patients to pay more and a greater portion out of pocket.

- Between 2001–2014, while general inflation increased 33.4% and physician practice expense increased by 60.6%, Medicare payment rates only increased 2.9%.

Telemedicine

- Improvements in technology and changes to state laws now allow patients to be treated over the internet.

- The patient-physician relationship has evolved to include virtual, real-time visits and asynchronous communication.

- The ability to evaluate, diagnose, prescribe, and treat patients remotely has given rise to the current era of direct-to-consumer healthcare startups.

Patent Cliffs

- Starting in 2008, patents on some of the most powerful drugs capable of treating many chronic conditions have begun to expire.

- Over $198B in global prescription drug sales are up for grabs between 2019–2024 from patent expirations.

- As a result, drug prices for common ailments are decreasing while access is increasing.

Additional Factors

- Companies can target specific audiences on social media to scale acquisition.

- Margins and lifetime value (LTV) for healthcare products are strong.

- Many healthcare products have built-in retention that’s well-suited for a subscription model.

Zooming out: ambitious startups and investors are motivated to enter the healthcare space. From technology to deregulation and consumer preference to investor interest, now is proving to be the right time to take on this large, broken market.

BLURRED LINES: HEALTH OR WELLNESS

Wellness as healthcare

As attitudes toward health shift, millennials and baby boomers alike are taking more responsibility for and placing a higher value on their well-being. At the same time, and maybe as a direct result of this trend, we’re seeing wellness infiltrate healthcare.

Traditionally, the concept of wellness and, more specifically, its practitioners have been kept outside the gate of the healthcare establishment. But as wellness ballooned into a $4.2T industry while assuming nuanced and varied forms—beauty, self-care, healing, meditation, and more—the term is becoming synonymous with a new version of healthcare.

As evidence, consider the growing number of startups blurring the line between wellness and healthcare.

New-age and holistic treatments come complete with easy-to-book appointments and 24/7 access to an app, medical advice, or a doctor. Whether they’re taking inspiration from Eastern medicine or employing proprietary technology to make a diagnosis, these companies look nothing like doctor’s offices of old.

With a focus on elevating the aesthetic, the drab, sterile environment has been replaced by hardwood floors, natural sunlight, velvet sofas, and, in some cases, kombucha bars. Like boutique fitness studios and direct-to-consumer companies, building brand appeal and a sense of belonging is a focus for healthcare’s newcomers.

Parsley Health is a boutique medical practice that is, in their words, “bringing nutrition and wellness to cutting-edge medicine.”

- For $150/month, Parsley members receive holistic treatment from a team of doctors and health coaches.

- Think offerings like blood work, genetic testing, a fitness regimen, food plan, and supplement suggestions.

- From the lighting to the architecture to the furniture, the space is built to make you feel happy and healthy.

Tia is bringing “convenience, compassion, and personalization” to women’s care.

- This women’s health clinic offers a suite of services, including gynecological exams, primary care, and general wellness.

- Tia combines data from its app with in-person visits to provide doctors with a holistic view of their patients’ health.

- Tia features an “Instagrammable” design and fridge stocked with CBD-infused sparkling water Recess in a space meant to remove the anxiety from what is often a stressful experience.

And the list goes on. From Forward Health’s high-tech approach to the healers at NYC wellness center The Well, the race to remake healthcare is on. As more companies enter the space, expect the concept of wellness to become more present and less defined in the future of healthcare.

Health or Wellness

From direct-to-consumer startups to high-tech health trackers, and even connected fitness equipment, health and well-being are in the headlines. But beyond the hype and billion-dollar valuations, it’s possible that many of these companies are missing the mark.

- More than 1 in 3 Americans are considered obese, costing $147B a year.

- Type 2 diabetes is on the rise, and about 610,000 people in the US die from heart disease every year.

Solutions like wearables, high-end stationary bikes, and DTC Viagra don’t come close to moving the needle for the majority of people who need intervention the most.

This fact has led to growing dissent at Apple, where the health team’s top brass disagrees about the direction of the group.

Employees say they want to tackle bigger, healthcare-related challenges, such as medical devices, telemedicine, and health payments. Apple, however, has emphasized wellness by focusing on exercise, meditation, and sleep.

Similarly, Peloton has been criticized for selling a pricey bike to affluent people who are already exercising anyway. And hims has been called into question for being more of a personal care brand than a healthcare company.

Takeaway: The shortcomings of the US healthcare system have made it ripe for disruption. From the Big Four to DTC healthcare companies, the opportunity has become obvious to contenders intent on offering a better way to receive care. But, as many digital health startups have discovered, reinventing healthcare has proved futile. Even Apple, one of the most valuable companies the world has ever known, is running up against the wall.

Wellness, on the other hand, is low-hanging fruit. The lack of risk and regulation helps explain Apple’s decision-making and speaks to the explosion of the $4.2T wellness industry. While startups like hims are using wellness and personal care as a stepping stone to healthcare, the blurred lines between healthcare and wellness make it difficult for consumers to differentiate between trends and treatment.

THE PATIENT/CONSUMER

The push toward a direct-to-consumer model fundamentally changes the healthcare industry. For some, that’s the goal. For others, that change—one that would transform the patient into the consumer—should be avoided at all costs.

According to renowned bioethicist Art Caplan, patients aren’t consumers and physicians should not be viewed as providers.

While startups are hoping to compete on cost and choice, Caplan doesn’t think market-based financial considerations or choice have a place in healthcare. In his words: “If you’re beset by a sudden health problem… you’re not going to act like a consumer.”

Similarly, Caplan believes doctors should be referred to as physicians instead of business-related terms like providers. The rationale, as he describes it, is quite simple: “I don’t want to replace medical ethics and medical professionalism with business jargon and business ethics.”

On the other hand, some would argue that the lack of transparency and market forces got us into this healthcare mess in the first place. Obviously something has to change.

Follow the money

As we’ve pointed out, the change is well underway. And one indicator (and outcome) of the shift toward consumer-centric healthcare is the growth in advertising. Whether it’s television commercials, Instagram ads, or podcast reads, we’re bombarded with ads for healthcare-related products and services.

In the US, more than $30B is spent on healthcare advertising each year.

- DTC advertising accounts for more than $10B in spending

- Pharmaceutical marketing to health professionals makes up the remaining $20B

The downside: DTC health ads might encourage consumers to buy products they don’t need — like tests or supplements that could have negative consequences.

The upside: DTC advertisements can help de-stigmatize conditions associated with depression or sexual wellness, encouraging people to seek care.

PROMISES & PITFALLS

The quest to disrupt healthcare has proven to be exceedingly difficult. Beyond proving their value to consumers, healthcare startups have a number of medical, ethical, and financial hurdles to clear. Factors like venture funding and advertising standards further complicate matters for companies straddling medical science and Silicon Valley’s growth-at-all-costs mentality.

While funding, valuations, and hype are at an all-time high, the promise of direct-to-consumer healthcare is marred by high-profile pitfalls.

Of course, the most noteworthy nosedive was that of Theranos, the once-lauded blood-testing company founded by Elizabeth Holmes and backed by $700M in funding. After it was revealed that the underlying technology was invalid, the company ceased operations and Holmes has been indicted on wire fraud and conspiracy charges.

But Theranos is hardly alone in its collapse. More recently, uBiome, a health-tech startup, filed for Chapter 11 bankruptcy. The company had previously raised more than $100M from investors, including YCombinator, 8VC, and Andreessen Horowitz, before an FBI raid and investigation revealed predatory practices.

Even companies that have achieved mass appeal aren’t free from controversy. Take 23andMe, for example. In 2013, the FDA issued a warning letter to the company while a regulatory review was undertaken. The company has since received FDA clearance, but there’s a catch: the accuracy of at-home genetic tests—for ancestry or health—are largely overstated. In fact, the health kits the company sells state they’re, “not intended to tell you anything about your current state of health, or to be used to make medical decisions.”

Turning our attention to the new category of telemedicine upstarts, a new list of concerns appear.

hims and Roman have experienced tremendous growth by making hair loss treatments, ED pills, and beta blockers cool and accessible. But they may have made getting a prescription a little too cool — and possibly too easy.

Hubble, a direct-to-consumer contact lens startup, has also had its tactics called into question. A recent NYT article raised a number of red flags, citing criticism from optometrists and ophthalmologists who claim the company bypasses eye care professionals and does not properly vet prescriptions. Hubble, of course, disputed these claims.

Still, a number of DTC healthcare companies have been the subject of reports from Bloomberg, The New York Times, and other outlets questioning the ethics and legal implications of pushing prescription medication with very little (or no) oversight.

“Some of these companies operate in a regulatory vacuum that could increase public health risks, according to interviews with physicians, former federal health regulators and legal experts. And federal and state health laws, written to ensure competent medical care and drug safety, have not kept pace with online services…” — New York Times

While the pros (convenience) and cons (health risks) are fairly evident, and with telemedicine the inevitable future, the elephant in the room remains: will hims and other healthcare startups have to fight an Uber- or Airbnb-like regulatory battle or will they be able to skirt the rules?

Either way, DTC healthcare startups will continue to find success by capitalizing on the inefficiencies that have come to define the current state of the US healthcare system. In doing so, medicine will undergo the kind of commodification that’s already hit other industries. Meanwhile, from primary care to Big Pharma, traditional providers will feel the pressure to become more effective and less bureaucratic.