Direct-To-Consumer Vitamins: Instagram, Amazon, & The End Of GNC

Fueled by Instagram’s growing popularity and a surge in wellness-related spending, a new breed of companies has emerged. Say hello to personalized, direct-to-consumer vitamins.

Using clean lines and bright colors paired with targeted social advertising and Instagram influencers, direct-to-consumer (DTC) vitamin startups are perfectly positioned within the millennial zeitgeist. Offering a convenient form of self-care that’s amplified by social sharing, the rise of the DTC vitamin startup is causing headaches for brick-and-mortar retailers like GNC and Vitamin Shoppe who are already struggling to stay in business.

With the writing seemingly on the wall, inquiring minds have to wonder: Will the DTC trend continue its hockey stick growth? Can the likes of GNC survive? And could there be a Dollar Shave Club-like acquisition in the future? Let’s take a look.

The Market

According to Statista, the global size of the vitamins, minerals, and supplements market was expected to reach $106.2B in 2017, up from $68B in 2014. In the US, the sale of vitamins (excluding dietary supplements) totaled $13.5B in 2017, with online sales of vitamins accounting for $2.4B.

However, as the global and US vitamin markets grow at a rate of 3% and 6%, respectively, there has been a significant shift from brick-and-mortar sales to online sales. Yet, somehow, vitamin retailers like GNC have failed to cash in on the wellness boom.

Going back years, Vitamin Shoppe and GNC have struggled with lawsuits alleging the sale of potentially dangerous supplements. But slinging shady supplements is just the tip of the iceberg and really just par for the course for an industry that’s entirely unregulated. It’s a combination of factors that have landed these legacy supplement sellers a spot on nearly every bankruptcy watchlist.

The broader retail apocalypse paired with the commoditization of vitamins—everyone from Walmart to Costco and Whole Foods has a “vitamins” section—and steep competition from online retailers like Amazon and Bodybuilding.com have traditional stores on life support.

The Old Guard

Up until 2014, GNC was on solid footing. But that year, the company’s revenue growth was flat and earnings declined by 4%. Although revenue was up 1% in 2015, earnings declined overall. The trend continued in 2016 as revenues declined 5.5% from 2015. Also in 2016, as foot traffic fell across more than 4,400 US stores, the company’s shares tanked by more than 64%. All told, GNC’s market value has dropped by about $5B since their peak in 2013.

During this tumultuous period, GNC has tried nearly everything to weather the storm. Unfortunately, things have only gone from bad to worse.

There have been shakeups at the top — the company has had four CEOs since 2014. Questionable tactics ensued. In attempts to move away from gimmicky promotions, the company lowered pricing, overhauled their loyalty program, and began selling on Amazon. When nothing stuck, the idea of a GNC and Vitamin Shoppe merger resurfaced, but GNC couldn’t afford to take on the debt. They even considered an outright sale of the company in 2016, but the Chinese suitors backed out.

Of course, GNC isn’t alone in their struggles. Vitamin World filed for Chapter 11 bankruptcy in 2017. At the time of filing, the retailer operated 345 stores and employed nearly 1,500 people. Initially, the chain had planned to close underperforming stores and reorganize, however it now appears as though they’ll sell off their assets and wind down operations.

Meanwhile, over at Vitamin Shoppe, there’s a hint of optimism. After seeing net sales drop 8.6% between 2016 and 2017, Vitamin Shoppe CEO Colin Watts stepped down in May. However, a revamped digital strategy, e-commerce experience, and their SPARK Auto Delivery Platform are providing a shred of hope for the future. Still, they have to do something about the fact that Q2 2018 sales were still down.

Underlying issues

Although vitamin retailers have taken steps to sure up business from a tactical and financial standpoint, they’re seemingly unwilling—or unable—to confront some fundamental issues. Mainly, their business model is broken and the brands they’ve created aren’t relevant in 2018.

In recent years, both GNC and Vitamin Shoppe have tried to refresh their brands. In December 2016, GNC went as far as closing all 4,400 company-owned stores for a day to relaunch as “One New GNC”. Unfortunately, it feels more like the same old GNC. As one article put it, “GNC is using a cosmetic fix to address fundamental issues”. And it appears as though Vitamin Shoppe is undertaking “cosmetic” efforts as well. The company is launching a new store format complete with a kombucha bar while rolling out 800 Instagram accounts in an attempt to localize their marketing efforts.

As Seema Shah, an analyst at Bloomberg Intelligence, put it when speaking on GNC, vitamin retailers who are selling a commodity product must “be the lowest price or you have to have some amazing experience.” Neither Vitamin Shoppe or GNC are succeeding there.

A whole new world

Wellness has become an important part of the luxury lifestyle. And the old guard is out of touch with what today’s wellness consumer wants.

When speaking to Racked about GNC, Neil Saunders of GlobalData said, “The stores themselves do not fit in with the wellness trend. They don’t feel calm or relaxing but rather are a bit overwhelming and, for those not familiar with the category, can be stressful. Crowding in loads of product puts off occasional shoppers, and it means it is hard for GNC to easily showcase new innovations or ideas in health.”

Racked goes on to point out that GNC’s retail experience is sterile and overly masculine, putting them at odds with the broader wellness movement characterized by physical, spiritual, and emotional self-care. Wellness is a new game and the next generation of DTC vitamin companies are simply outplaying the incumbents.

Magic Pills

Taking a page out of Warby Parker’s playbook, direct-to-consumer vitamin companies are disrupting the retail landscape. Using bright colors and tongue-in-cheek messaging to break through the clutter of the vitamin space, DTC companies like Ritual, Care/of, Hum, and Goop Wellness have created brands that millennials simply can’t—and won’t—part from.

With an obsessive approach to brand identity, customer experience, and digital storytelling, these companies are taking advantage of social media and Instagram influencers to reach a targeted audience. And, unlike retail competitors who’ve proven incapable of fostering meaningful or authentic relationships with their customers, startups like Ritual are building brands that go beyond vitamins.

When the playbook is implemented properly, the results are plain to see — customers identify with and are inspired by these brands and products. Social sharing leads to word-of-mouth growth. Then, the brands who are already reliant on visual content make user-generated a central part of their marketing efforts. This is important because, as a study by Deloitte Digital points out, user-generated content increases conversion two times while retailer-generated content—like the kind of stock imagery used by GNC and Vitamin Shoppe—deters buyers.

Cashing in

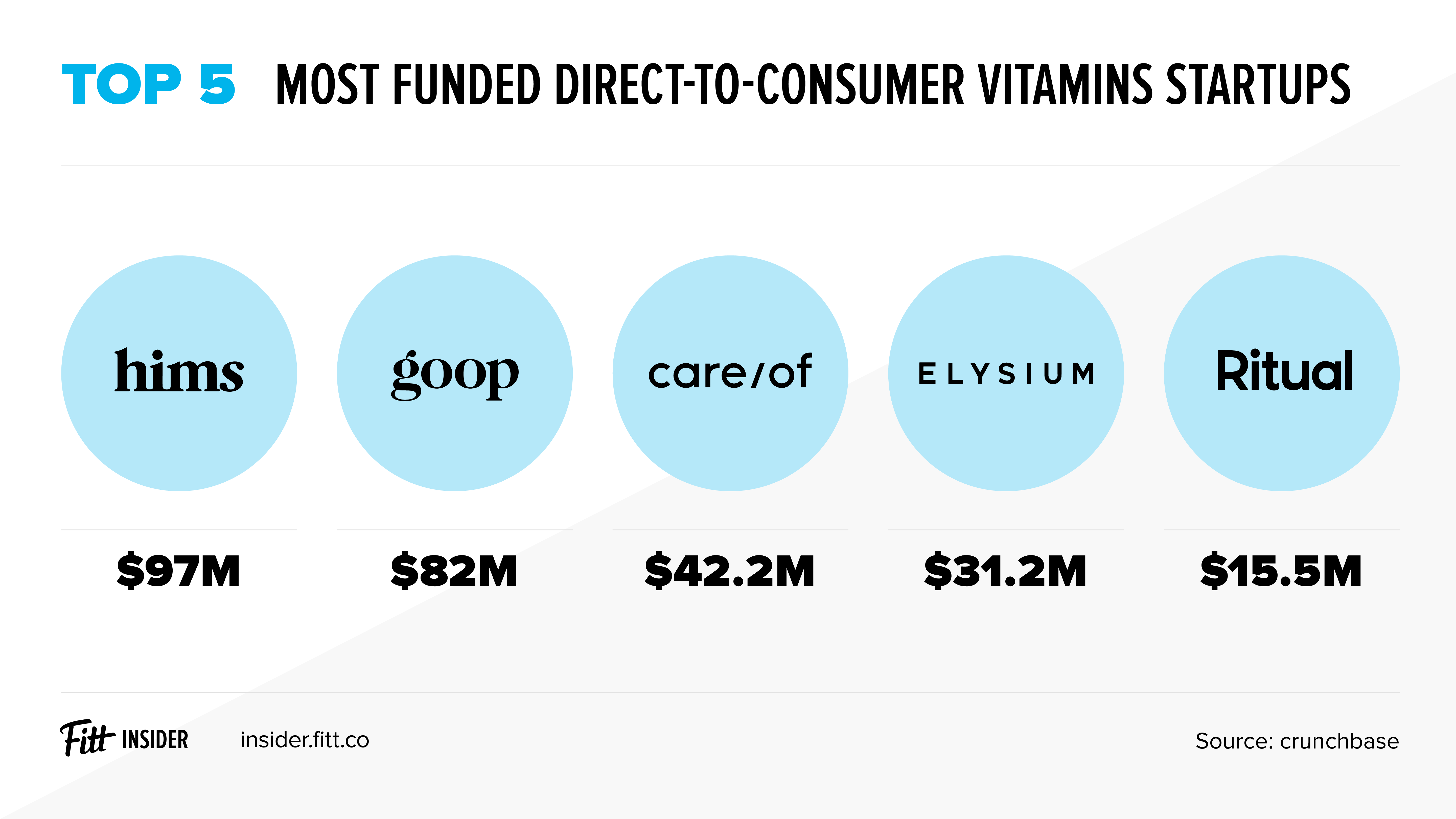

Although brand is essential for winning over customers, product personalization, subscription models, and unit economics have captured the attention of venture capitalists, who poured more than $200M in funding into vitamin and supplement startups in 2017. Topping the chart of blockbuster investments, Care/of, hims, and Elysium Health have collectively raised hundreds of millions in funding over the past few years.

Falling squarely into the category of personalized, subscription-based DTC vitamins, Care/of recently announced a funding round of $29M from Goldman Sachs’ venture arm and RRE Ventures. The two-year-old company is now valued at $156M. Compare that to Vitamin Shoppe and GNC who have a market value of $203.5M and $254M, respectively, and it’s obvious that a massive shift is underway. Add to that the fact that Vitamin Shoppe has 3,860 employees and nearly 800 stores and GNC has about 6,400 employees and 9,000 stores compared to Care/of, which has about 100 workers — it’s easy to see how vitamin retails can fall hard.

Playing perfectly into the personal wellness trend, hims is basically Glossier for guys. Instead of jade eggs and moon dust, hims offers expertly branded, subscription-based penis pills and hair loss treatments. After launching with backing from Thrive Capital and Forerunner Ventures—who also backed Dollar Shave Club, Warby Parker, Outdoor Voices, and Glossier—hims is outpacing their DTC peers. In early 2018, the company raised an additional $40M in funding, earning a $200M valuation. Now, the company is reportedly in talks with investors to raise $100M at an $800M valuation to launch a women-focused vertical aptly named “hers”.

Last but certainly not least, Elysium Health has hit the scene claiming their subscription-based supplement can help you live longer. Although their formula—a combination of nicotinamide riboside (NR) and pterostilbene—isn’t proprietary and the supplement is unproven in humans, they’ve still managed to attract more than $30M in venture funding. Because the supplement industry is unregulated, Elysium doesn’t have to seek FDA approval either. Instead, they’re able to rely on sleek branding and a scientific advisory to win consumers over.

The Elephant(s) in the Room

There’s are a couple painful truths that the entire vitamin and supplement world—DTC and retail alike—are forced to grapple with.

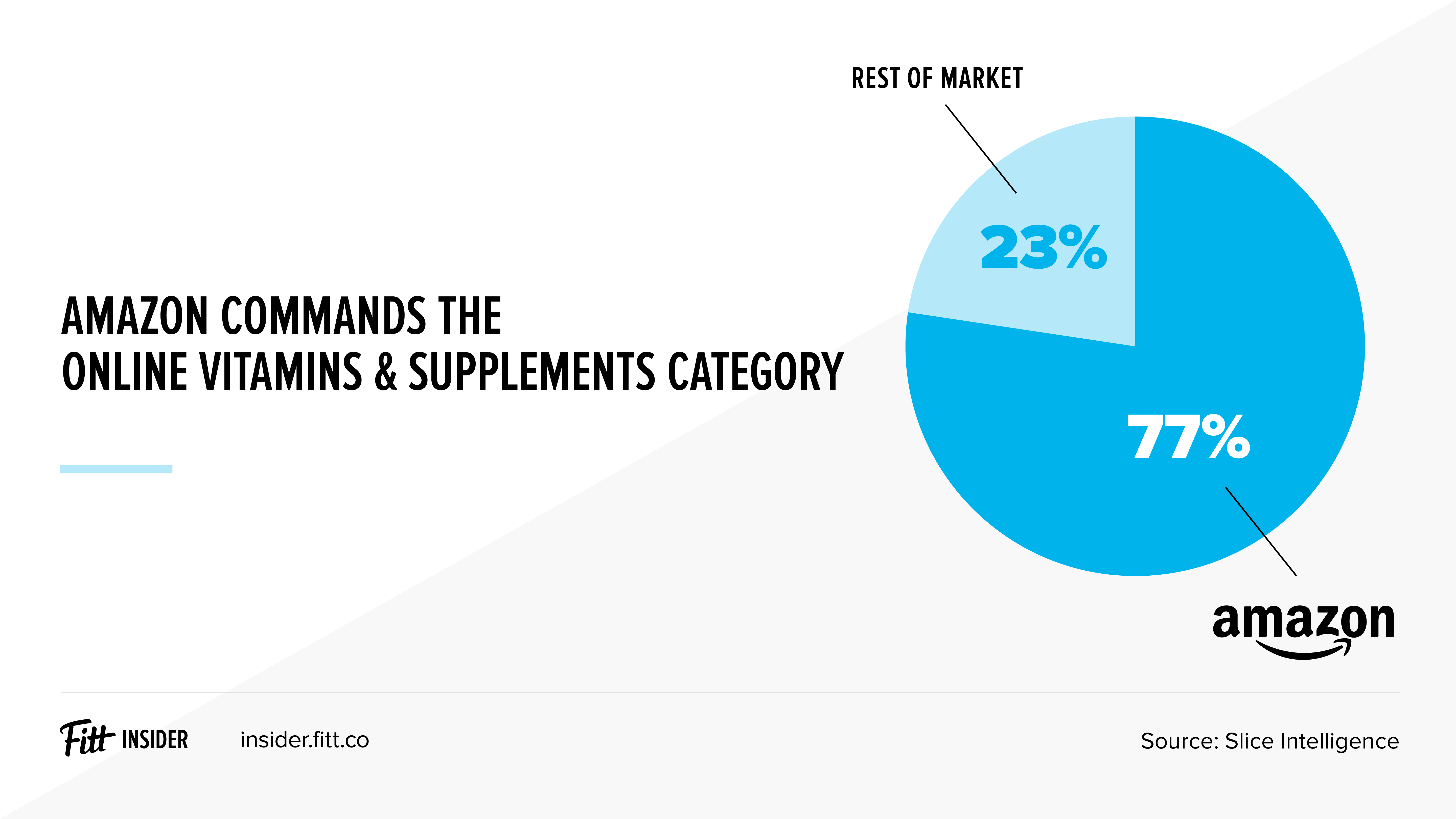

First and foremost, Amazon is an absolute monster. GNC and Vitamin Shoppe aren’t going out of business because of companies like Care/of — they simply can’t compete with Amazon. In a recent price comparison, GNC’s prices were 11% greater than Amazon across 30 identical brands. Pricing and convenience are factors that have earned Amazon 77% of the market for online vitamin and supplement sales.

Couple that with Amazon’s acquisition of PillPack, the online pharmacy that’s essentially a DTC pharmaceuticals company. While prescription medicines are the primary business, they also offer vitamins, supplements, and over-the-counter medications that just might render the new wave of DTC vitamin companies irrelevant.

Finally, in what might be the hardest pill to swallow, there’s a growing body of evidence that many popular vitamins and mineral supplements provide no health benefit. Worse, they can be downright dangerous. But as long as we continue to buy what wellness lifestyle companies are selling, expertly crafted brands will provide us with the products we think we need. And, in turn, venture capital will continue to fund the vitamin and supplement space in hopes of cashing in on the next unicorn.

Want to get in touch? Email anthony@fitt.co with tips, questions, or to continue the conversation.