Mental health tech’s bubble might be bursting.

- Falling from pandemic highs, mental health apps have seen first-time downloads drop over 30%, as MAUs fell 23% for top apps.

- Dissatisfied users are ditching apps en masse, driving 30-day retention rates down to 3.3%.

- After raising $5.5B globally in 2021, mental health tech funding took a 60% YoY nosedive in Q1 2022.

As our collective mental health suffered, many hailed digital platforms as a potential solution. While some companies sought clinical validation, others blurred the line between wellness and healthcare.

Still, despite a wave of online options, we’re more anxious and depressed than ever.

Mental Turmoil

The ease of launching a mental health app prompted a rush of entrants — experts estimate that up to 20K may exist today. But, as the barriers to entry lowered, so did the oversight and outcomes.

Sounding the alarm, in Issue No. 182, we warned of mental health startups like Cerebral playing fast and loose with digital prescriptions. Taking notice, Congress and the DOJ are probing industry practices.

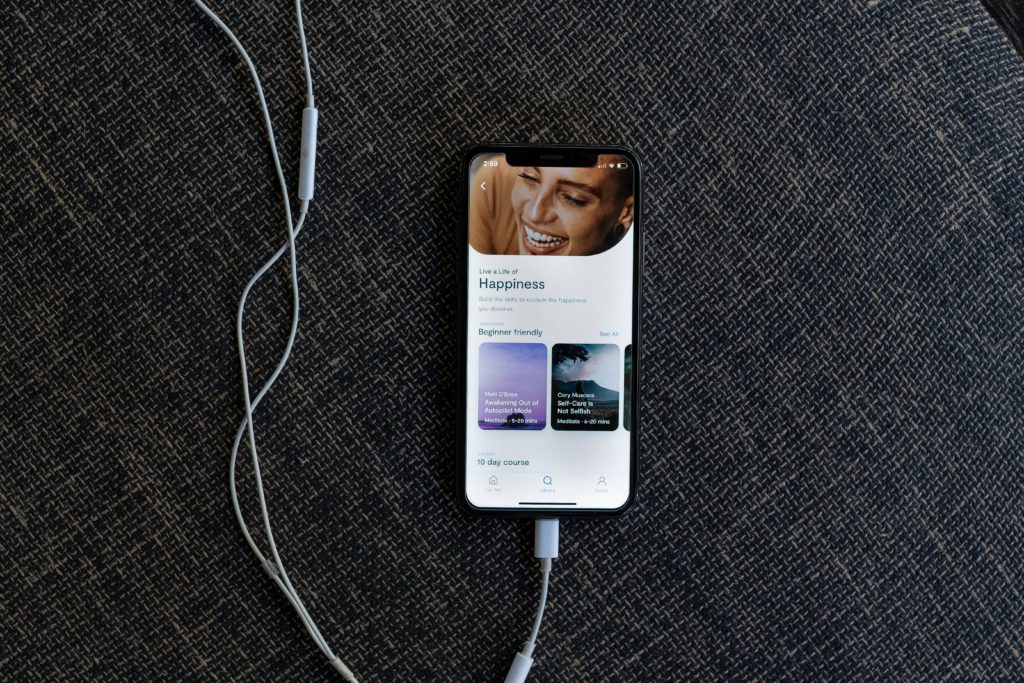

Changing their mind, mindfulness apps want medical sign-off. Hoping to combat churn while enticing insurers, Calm and Headspace used M&A to enter healthcare. Doubling down, clinically validated solutions are cashing in on corporate wellness.

Punchline: Digital health is cooling, but the dropoff doesn’t spell doom. After years of rapid growth, the downturn can be seen as a correction, weeding out underperforming apps. For now, tech’s solution for the growing mental health crisis is still loading.