Apocalypse Now: Is Streaming To Studios What E-Commerce Is To Retail?

Reports of a retail apocalypse have garnered so much attention that every store closure is attributed to hostile e-commerce and cast as another sign of the all-out collapse of brick-and-mortar retail.

But there’s a catch: retail isn’t dying, it’s actually growing. Less of an apocalypse and more of a recalibration, what we’re really seeing is the reinvention of the retail experience. And the root cause goes far beyond the rise of Amazon.

Drawing on this example as we turn our attention to the fitness industry, there’s a similar showdown said to be taking shape. Every new innovation in at-home or on-demand exercise is referred to as the Netflix of fitness, threatening traditional gyms and studios everywhere.

Whether it’s streaming services, voice-led workouts, or tech-enabled exercise equipment, there’s no denying the shift taking place in the fitness space. But it’s reductive to position every advancement in fitness technology as a Netflix-like disruptor set to decimate big box gyms and boutique studios. It makes for a catchy title, but it lacks perspective.

As the battle between e-commerce and brick-and-mortar retail has shown us, it’s not an either-or debate, the future is likely to include some combination of physical and digital experiences. Approaching the streaming-versus-studio conversation with that context in mind, what we should be asking is: how will studios reinvent the exerciser’s experience, what new technologies will emerge, and will any of these developments improve access or adherence to physical fitness?

The Studio Surge

Boosted by the growing popularity of boutique fitness studios, membership in US health clubs reached an all-time high in 2016. According to a report for that year, the International Health, Racquet & Sportsclub Association counted 57.3M people who belonged to a health club or studio, with studios accounting for 42% of those memberships. When comparing studios versus traditional gyms, the lopsided growth is undeniable: between 2012 and 2015, membership at traditional gyms grew by 5% while membership to boutique studios grew by 70%.

As the shift to studios played out, new concepts scaled up fast. Franchised concepts like Orangetheory Fitness have expanded to more than 1,000 studios, while private equity-backed holding companies like Xponential Fitness have assembled an impressive portfolio of boutique brands.

Like most things, the shift in consumer preferences can be seen across demographics, from Baby Boomers to Gen Z. As data from Piper Jaffray points out, studio members are 10 years younger than members at traditional health clubs. While Boomers prefer aquatic exercise, stationary cycling, Tai Chi, and weight machines, Millennials and Gen Z prefer studios that offer kickboxing, indoor cycling, yoga, functional training, and other specialty/group classes.

Connected Equipment

With health clubs, boutique studios, and fitness-focused startups hoping to claim a piece of the $80B global fitness market, CB Insights identified $2.4B in disclosed equity funding into fitness-related technology across 696 deals between 2013 and 2017. Fueled by this influx of capital, a tech-enabled landscape has emerged and at-home, on-demand, and streaming fitness services are at the center. Now, everyone from celebrity trainers and fitness influencers to traditional gyms and boutique studios are competing with a growing number of tech companies who are all hoping to be the Netflix- or Amazon-like disruptor.

As the best-funded of the bunch, having raised nearly $1B, Peloton is redefining how we exercise beyond the four walls of a gym. As the makers of an at-home, tech-enabled bike and treadmill, as well as the Peloton Digital on-demand workout app, the company is creating a truly scalable platform.

What’s more, their success has spawned a host of lookalike competitors — including FLY Anywhere and a bike claiming to be a better Peloton. And these copycats aren’t limited to at-home bikes and cycling classes. There are at least five companies, from all areas of fitness, hoping to become the Peloton of “X”. From Mirror—a “nearly invisible, interactive home gym that brings live and on-demand fitness classes right to your living room” that has raised $30M to date—to FightCamp, each aims to turn your living room into a boutique experience.

Fitness on demand

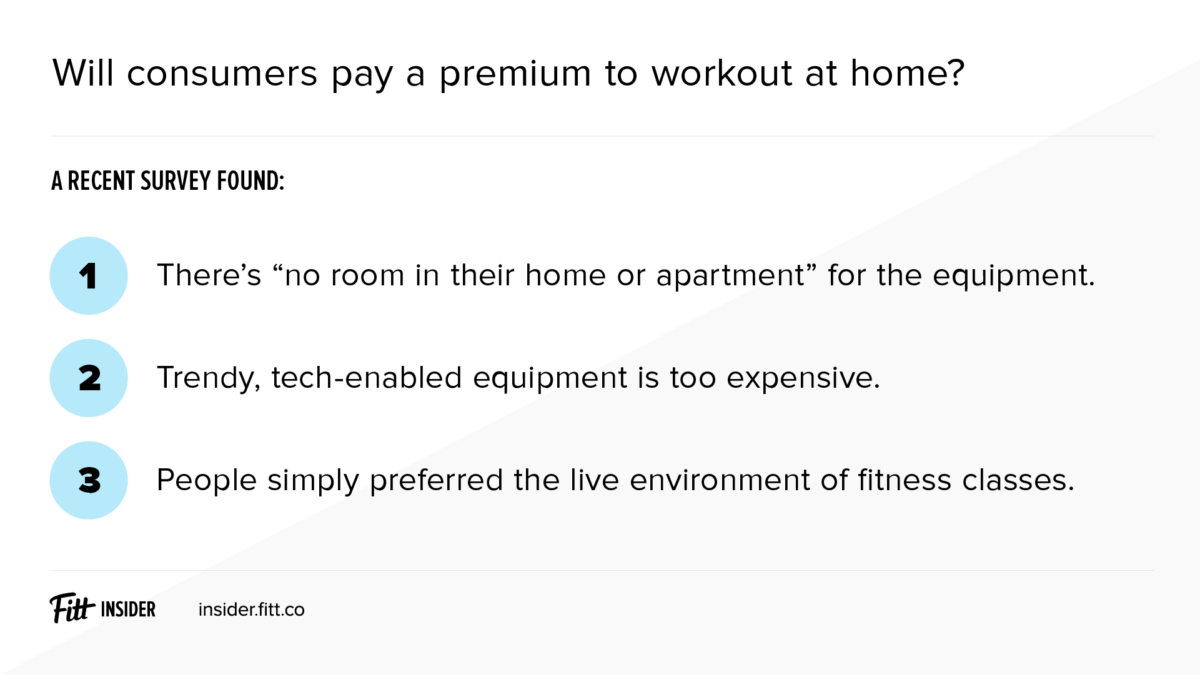

As cool as connected equipment may be, there are a few chinks in the armor. A recent survey of consumers interested in buying an at-home fitness system found them hesitant to make a purchase. Three factors stood out: they don’t have enough room, the equipment is too expensive, or they flat out prefer live classes to exercising at-home.

Given these consumer insights, streaming services that remove equipment from the equation—thus saving space and money—might be the holy grail of getting in shape.

Leading the charge, Daily Burn has been in the streaming game since 2017. Now, the company boasts some 150,000 monthly subscribers who access a library of over 750 streaming workouts. And recently, the company announced plans for a whole series of fitness apps, each dedicated to specific training verticals, starting with HIIT Workouts. The basic Daily Burn subscription runs $14.95/month and the HIIT app is $9.99/month.

Following the Daily Burn model, FORTË offers on-demand and live streaming boutique fitness classes for $99/year or $39/month.

As tech-focused streaming startups garner all the attention (and funding), Beachbody is flying under the radar. Interestingly enough, they’re probably the closest thing to Netflix there is. The company popularized at-home VHS and DVD workouts with P90X (and a modern-day multilevel marketing machine with some 450,000 “coaches”) before transitioning to a streaming platform called Beachbody On Demand. A 2017 press release spoke to their success, claiming to be fitness’s first streaming service to reach one million subscribers (at $99/year). Combined with their supplement and DVD sales, the company pulled in some $1.3B in revenue last year.

Streaming with a twist

Because the streaming, on-demand space became crowded just as quickly as it emerged, a new batch of innovative companies are putting a twist on digital fitness content in an effort to compete.

First up, there’s Aaptiv. If you’re not familiar, Aaptiv is the category leader in audio-guided fitness classes with around 200,000 paying members. And with the announcement of their $22M Series C from strategic investors like Amazon Alexa Fund, Bose Ventures, and Warner Music Group, Aaptiv has raised a total of $52M in funding and is well-positioned to continue their dominance.

Then there’s NEO U. They’ve created a 20,000-square-foot exercise complex in Midtown Manhattan that doubles as a multimedia production studio and influencer hangout. In addition to hosting regularly-scheduled classes, celebrity trainers and fitness influencers can use the space to host workouts and produce original content. Then, all of the classes are available to be streamed or downloaded.

Under this model, NEO U has a real-life community, high-quality content, and digital distribution. In comparison, the Pelotons of ‘X’ miss out on the in-person element that’s essential to long-term success. Although Peloton has a studio and is in the midst of a plan to open showrooms across North America, NEO U has created a dual-purpose space that could be replicated across multiple cities.

The dual-purpose model isn’t anything new, though. In fact, there’s already a whole host of studios taking a NEO U-like approach by streaming or filming their daily classes for on-demand consumption. Name-brand studios including AKT, CorePower Yoga,Tracy Anderson, Physique57, and Pure Barre offer streaming subscriptions. Even big box gyms like Gold’s Gym and Crunch have seen the writing on the wall, causing them to launch digital offerings — Gold’s AMP and Crunch Live, respectively.

Innovate or die

While it’s easy to pit these new technologies against traditional gyms and boutique studios in a winner-take-all deathmatch, the future of fitness is much more nuanced. Simply put, what we’re seeing is the development of an exercise ecosystem that offers more options, personalization, and greater accessibility for health-seekers.

In that way, the fitness industry has a lot to learn from the supposed retail apocalypse. While many brick-and-mortar retailers ignored massive shifts in consumer behavior, emerging technologies, and online retail, others took advantage of the changing tide.

Consider this: Blockbuster had the opportunity to acquire Netflix in the early 2000s for $50M (the company is now worth about $4B). And in 2015, when Casper was going viral as customers posted unboxing videos online, Mattress Firm spent $780M to buy another retail chain. In both cases, and in other similar examples, a lack of vision and failure to adapt led to an inevitable outcome.

And if retail is the warning shot, big box gyms and boutique studios have begun to take notice. There has never been more upside for fitness-focused businesses to create new revenue streams or reinvent themselves altogether.

Take Orangetheory Fitness, for example. Technology already plays a huge role in classes here — performance stats are projected onto big screens in the studio throughout the workout. But OTF wants to go with you when you leave the studio, too. That’s where The Burn comes in — it’s their wear-all-day armband that connects with the OTF app, tracking your steps, distance, caloric burn, and more.

And tech-based advancements aren’t isolated to boutique studios, traditional health clubs and equipment manufacturers are also embracing innovation. Planet Fitness sees an opportunity in AI to improve the member experience. The budget gym chain plans to introduce an AI-powered virtual coach that plays the part of personal trainer, but at a significant cost savings for members. And thanks to Apple’s GymKit, health clubs everywhere are getting a tech boost. The Apple Watch OS connects to most major cardio-equipment brands to track and relay your workout stats back to your watch.

Streaming versus Studios

In closing, it’s probably best to revisit the question that initially brought us here: is streaming to studios what e-commerce is to retail?

Well, kind of. In both cases, advancements in technology don’t signify the end of shopping or sweating in person. Like retail, on the fitness front, there’s room for the digital and physical to co-exist. Even John Foley, Peloton’s CEO, had to admit as much when he said, “My wife and I like to leave the house every once in a while and go to a studio class.”

But burying your head in the sand as an entire industry shifts beneath your feet is a surefire way to become the fitness equivalent of Blockbuster. In the end, what streaming really represents is the reinvention of the exercise experience, creating opportunity for those willing to innovate and self-inflicted apocalypse for those who resist change.