8 Charts That Explain COVID-19’s Impact on the Fitness Industry

While tracking the effect of COVID-19 on the fitness industry, we began compiling key data points to better understand the fallout.

From gyms and studios to at-home and on-demand options, consumer behavior—and an entire industry—has shifted almost overnight.

The following charts help to explain that shift, providing context on the broader impact.

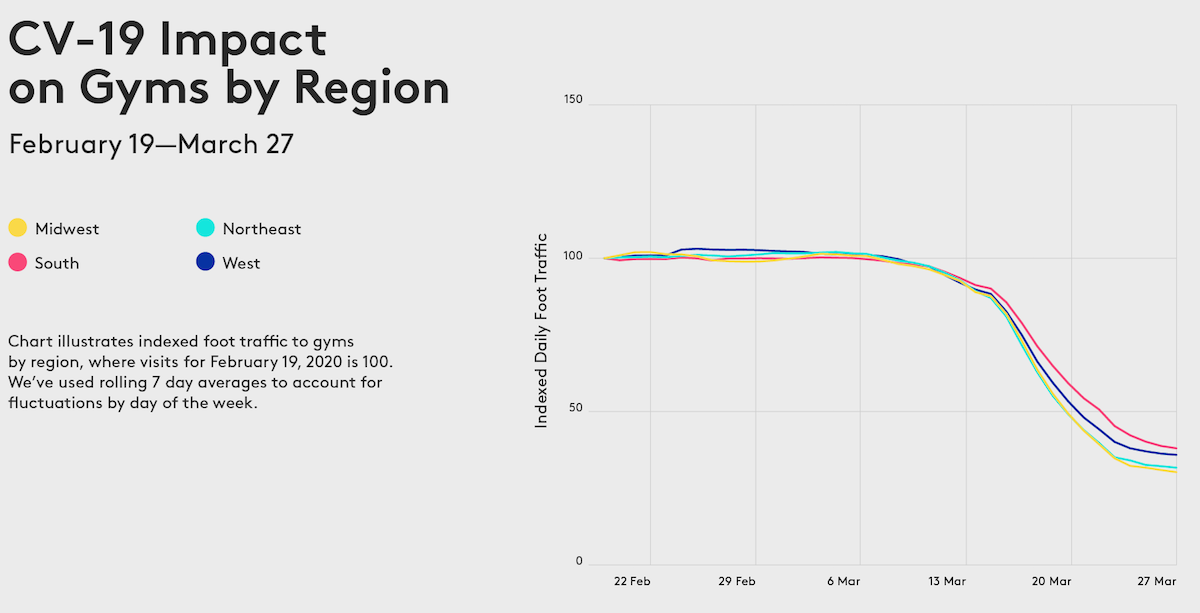

According to Foursquare, visits to gyms nationally are down 64% from the week ending February 19 to the week ending March 27. As people find alternative ways to stay moving, visits to trails were up 34% nationally and visits to parks were up 10% nationally, over the same time period.

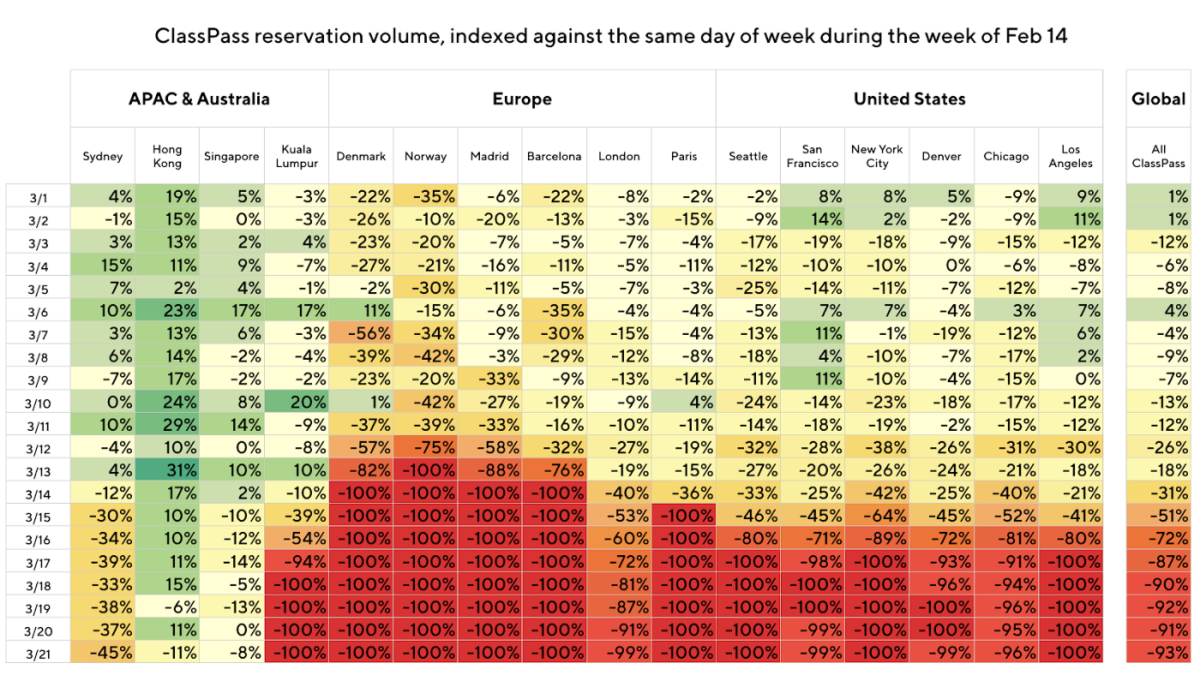

Starting in mid-March, ClassPass’s global revenue fell by 96%. With 90% of the company’s 30,000 studio partners closed, bookings declined by 100% month-over-month. The result saw the company cut 53% of its staff, with 22% laid off and 31% furloughed.

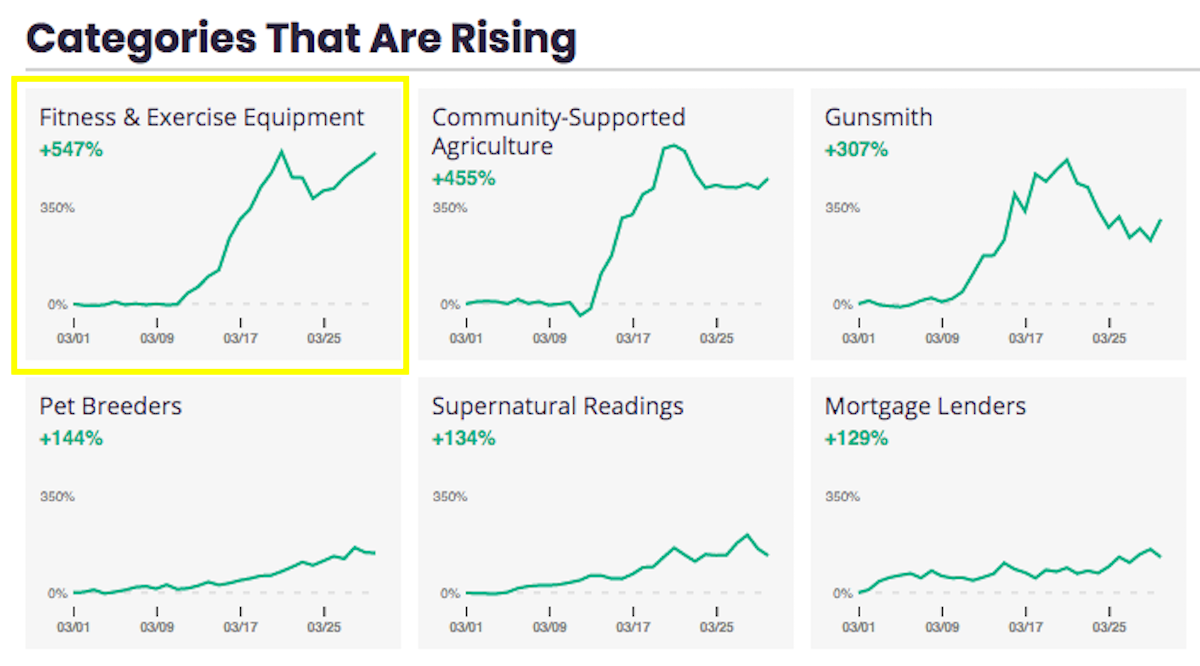

Gym closures have led to a 500% increase in interest in home fitness equipment, according to Yelp’s data. From connected hardware to free weights, at-home equipment is as popular as guns, ammunition, hand sanitizer, and toilet paper.

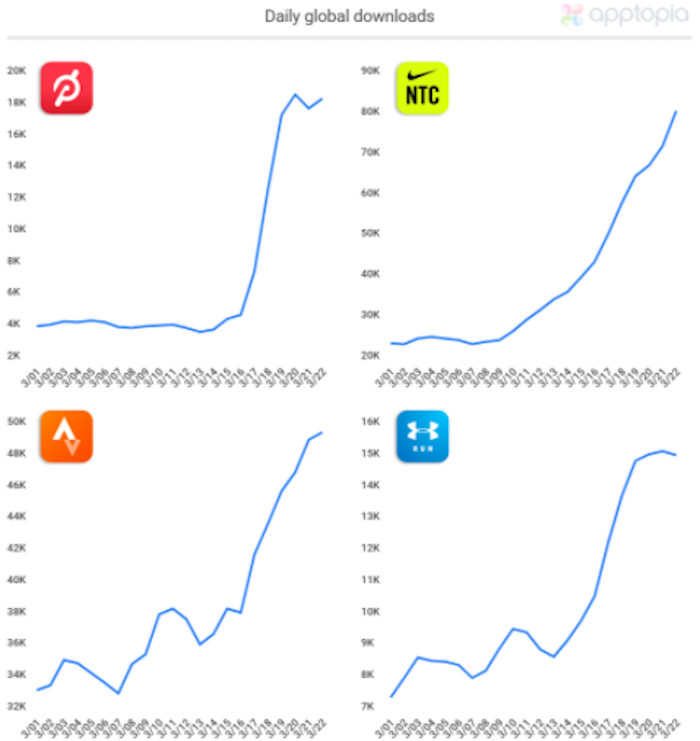

As we hunkered down, app downloads began to slow. But, as appfigures pointed out, Health & Fitness was an outlier in its continued growth.

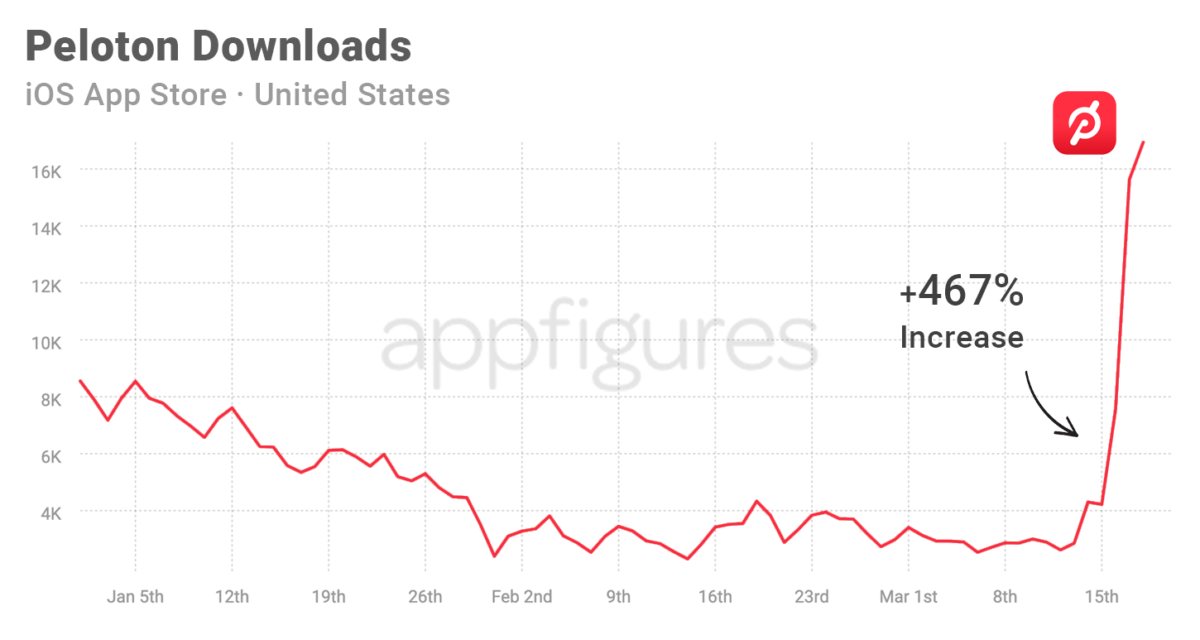

Looking closer, big-name workout apps like Nike Training Club, Map My Run, and Strava, saw an uptick in new users. According to apptopia, Peloton responded by making their app free for 90-days. The hope is that these free users convert to paid app subscribers, or they go on to purchase a piece of connected equipment.

While downloads have surged, Peloton’s corona-boom could backfire. Will people continue using their app or bike, and continue paying for a subscription, once they can leave the house again? If not, the company could be forced to answer tough questions about the stickiness of its product.

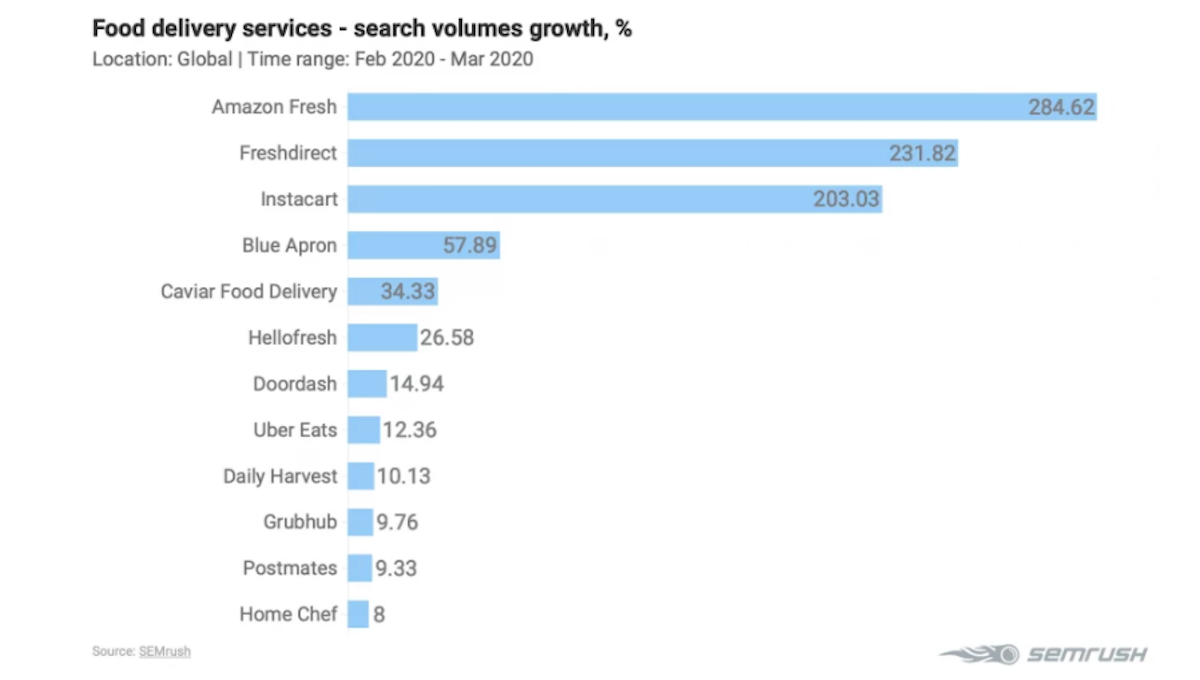

Under quarantine, people are searching for convenient and healthy food options. According to SEMrush, a data trends provider, the food and grocery delivery services with the greatest increase over the past two weeks include:

Daily Harvest – 68.52% increase

Uber Eats – 53.97% increase

Green Chef – 50% increase

HelloFresh – 43.75% increase

Beyond fitness equipment, consumers are also seeking out multi-vitamins, health trackers, nutrition bars, and other wellness-related products in increased numbers.