Digital Health Funding Reached $14B In 2018

In the world of VC-backed startups, 2018 was a record-breaking year. All told, the venture industry deployed $130.9B in US-based startups, surpassing the dot-com-era high set in 2000. This news becomes increasingly relevant to readers of Fitt Insider when we drill down on transactions taking place across digital health and fitness.

In line with the venture industry as a whole, 2018 saw digital health investments surge to new heights. According to StartUp Health, global digital health funding totaled $14.6B, with approximately $8.6B (up 21%) going to US companies. Worth defining, the term ‘digital health’ applies broadly to a range of companies—from fitness to electronic medical records to genomics—taking aim at the $3.5T US healthcare industry.

Distilling these deals down further, we see that the largest and fastest-growing segments include patient empowerment ($3.3B raised) and mental health ($602M raised). Given the sad state of our healthcare system and potential for cost- and life-saving innovation, the most surprising nugget of all is that Peloton’s massive $550M Series F was the largest digital health deal of 2018. The at-home bike and treadmill maker also topped all investments into fitness startups.

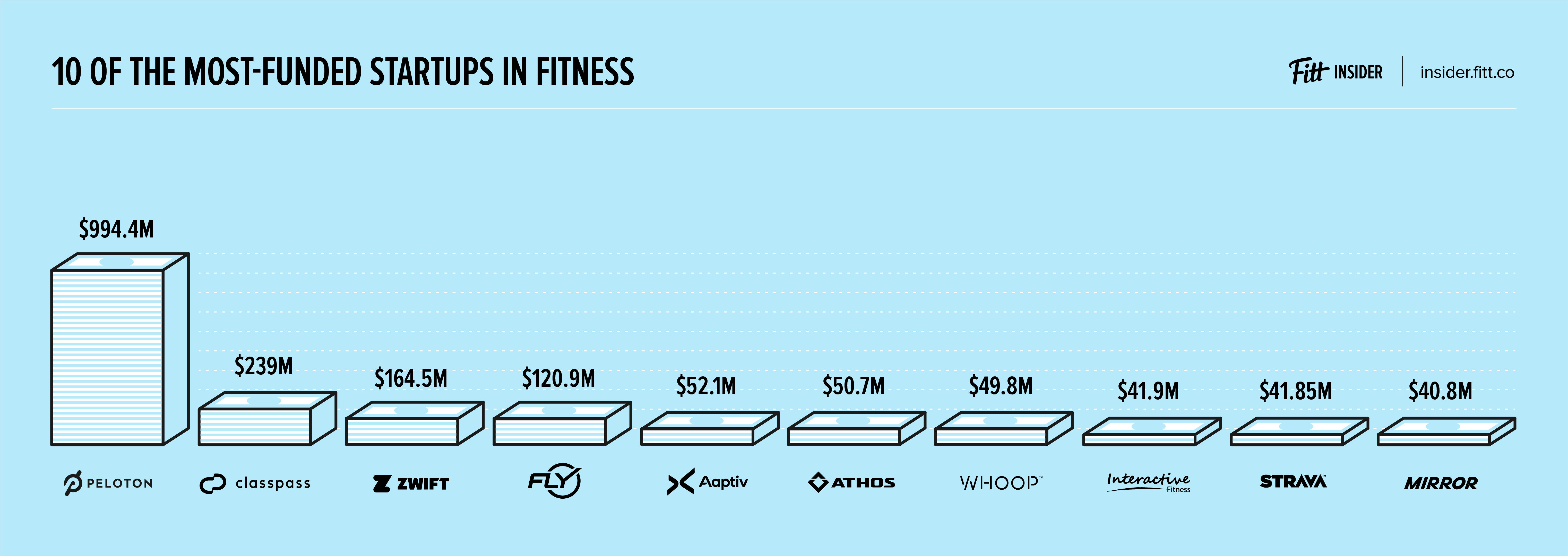

Speaking of fitness, the 10 most-funded US-based fitness startups have raised some $1.6B amongst themselves. Overall, funding to fitness-focused startups experienced significant growth between 2013 and 2017, with CB Insights noting 696 deals and $2.4B in equity funding flowing into the space. When all the data is compiled, 2018 will have proven to be a banner year on the account of Peloton ($550M), Zwift ($120M), ClassPass ($85M), Mirror ($38M), WHOOP ($25M), and Aaptiv ($22M) alone.

With capital flowing like crazy, it may seem as though digital health is, well… healthy. But all is not well. Onlookers are beginning to voice criticism over the fact that, despite billions in funding, Americans aren’t getting any healthier. Worse, we’re fatter than ever and dying younger. It’s a buzzkill, we know. But facts are facts, and in this case, they’re a stark reminder that we’ve yet to crack the code for things like behavior change, noncompliance, and adherence.

As Rock Health points out, as markets soften and capital becomes hard to come by, digital health companies will have to prove that they can deliver on their fundamentals. At which point, you can expect the conversation to shift from “show me the money” to “show us the results”.