Fitt Insider Outlook 2019: What’s Next In Wellness

Flipping the calendar to a new year is as tempting a time as any to pontificate about what’s to come. But instead of making sweeping predictions about what the future might hold, we took a slightly different approach in examining the year ahead.

From fitness to food and wellness to wearables, we surveyed the landscape to get a sense for where consumer behavior is tracking. Then, we drilled down into the business implications of what’s happening and why.

The result is something we’re calling the Fitt Insider Outlook for 2019 and it’s an in-depth breakdown of macro trends, mainstream developments, and areas of interest worth following.

Macro Trends

- Wellness has become omnipresent. It’s such a force that the concept has overtaken health as our ideal state of being. If health is the absence of disease, wellness is the presence or pursuit of physical, emotional, social, environmental, and spiritual well-being. Now, when we discuss health, we’re actually talking about wellness.

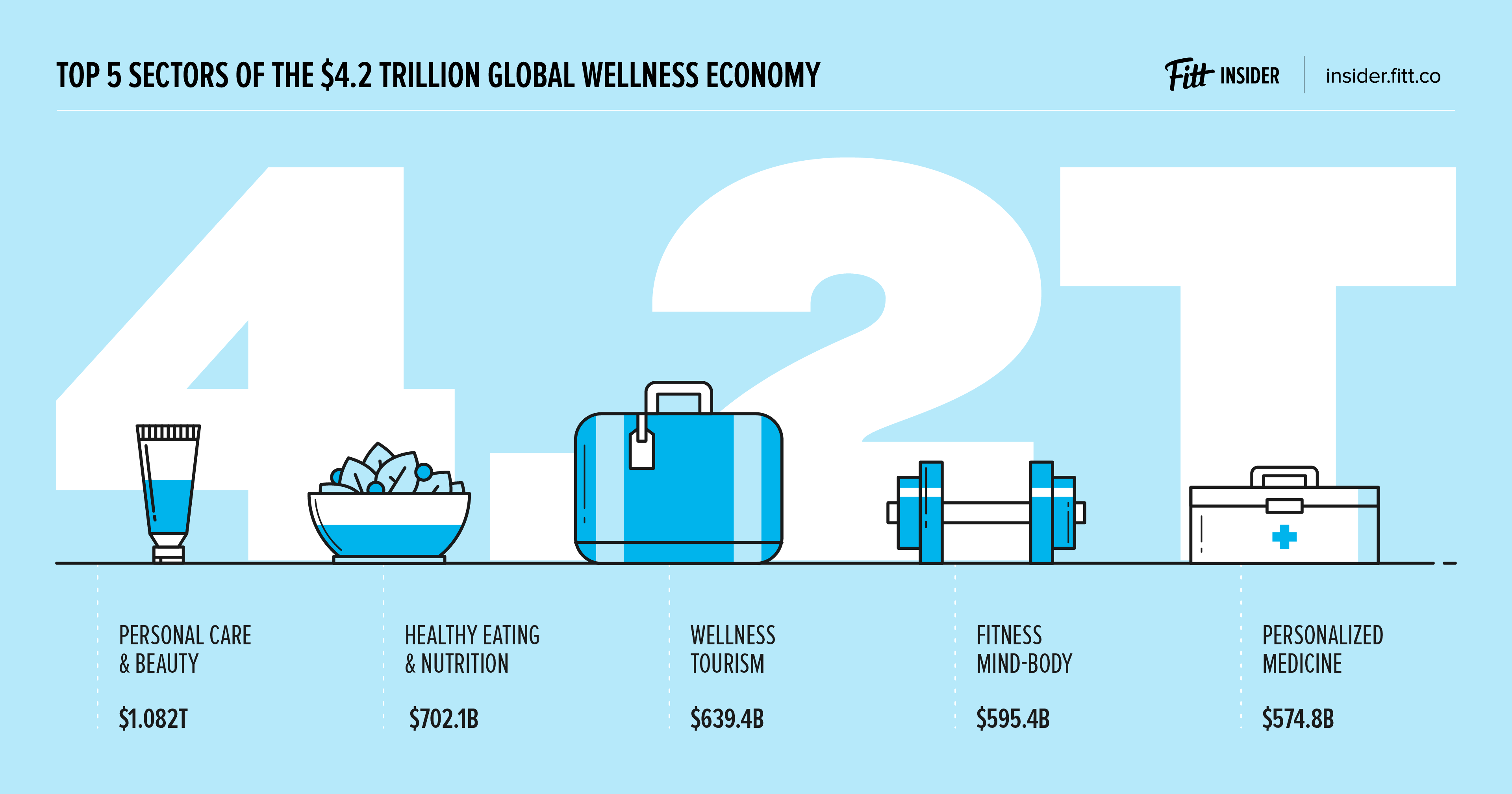

- $4.2 trillion reasons. The proliferation of wellness has created a massive industry that has become known as the wellness economy. According to the Global Wellness Institute, the global wellness market is now valued at $4.2T, up 12.8% from $3.7T in 2015. As a result, and in an attempt to capitalize on consumer demand, just about every brand—from CVS to Nestle to Weight Watchers—is repositioning itself as a wellness company. It’s a trend that we’re referring to as “the pivot to wellness.”

- On your mark. It might be hard to believe, but wellness—in all its forms—is still a young category. While we’re starting to see the industry break out of the tried-and-true verticals of food, fitness, and beauty, we’re only toeing the starting line of what wellness will become. Going forward, expect to see the tendrils of this burgeoning industry impact and define culture, society, and economics.

- It’s personal. From DTC vitamins (Care/of, Ritual) to custom-formulated shampoo (Function of Beauty, Prose) and made-for-you beauty products (Curology) to gene-guided nutrition (Habit), personalization is taking over. Whether it’s a simple online quiz or a full-on DNA test, more and more brands are putting the individual consumer front and center in an effort to deliver an elevated experience and strengthen consumers’ relationship with their brand — enabling the company to collect more data in the process.

- Convenience is key. If it isn’t accessible, easy to navigate, or time-saving, consumers aren’t interested. Taking convenience a step further, consumers expect almost everything to be on-demand. First, there was fast food and now, those expectations have extended to grocery delivery. But for today’s wellness consumer, there’s more to be gained. Expect to see more services like Sweetgreen’s Outpost—a catering/delivery hybrid—Farmer’s Fridge vending machines stocked with salads, or bougie corner stores à la The Goods Mart. Even things that are inherently inconvenient like making time for exercise, meditation, or a spa day will be stripped down, repackaged, and served to us in a more convenient form: i.e., Freeletics, Calm, and Heyday.

- Content is king. Along with a pivot to wellness, bet on more brands becoming media companies. While Peloton spawned a growing number of connected-equipment lookalikes, content is central to the experience and business model of many brands across the wellness space. Different still, SoulCycle’s newly launched media and events division is creating serialized content for social and concert-like cycling classes. Then, there’s Goop. While their pseudoscience is highly questionable, it’s hard to argue with their content x (commerce + events) formula. Medium and delivery system aside—whether it’s editorial, audio, or video, accessed online, via an app, or connected equipment—content will continue to fuel the wellness economy.

Mainstream Developments

PLANT-BASED

According to a report from GlobalData, 70% of the world population is either reducing meat consumption or forgoing meat altogether. That could help explain the 600% increase in people identifying as vegans in the US in the last three years. Whether it’s health concerns associated with eating meat or the environmental impact of animal agriculture, the rise of the plant-based diet is setting off a chain reaction across the food industry and the economy.

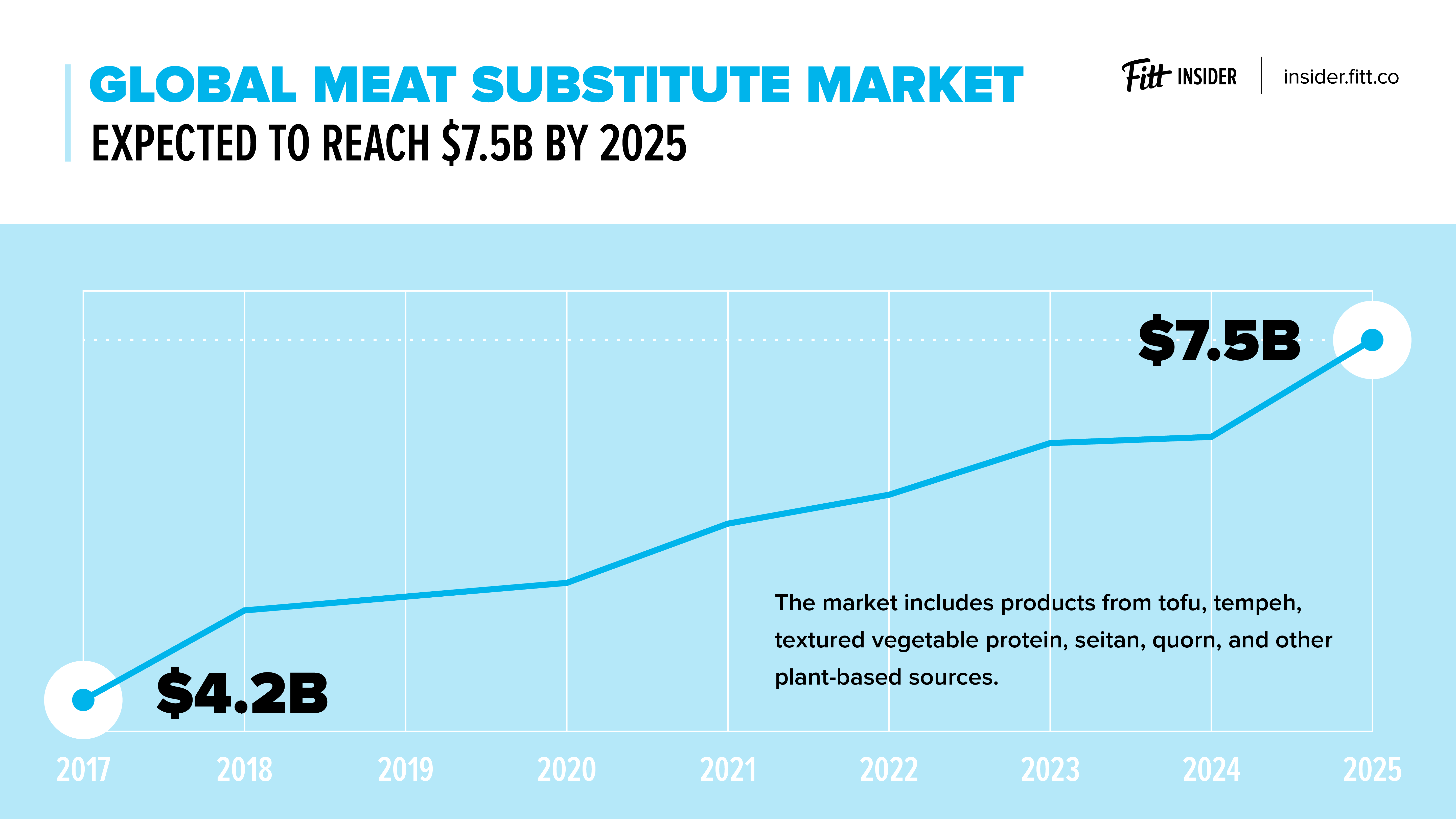

- Meat and dairy alternatives. The plant-based meat alternative market is expected to reach $7.5B by 2025. That’s divergent of the lab-grown, cultured meat alternatives that are set to disrupt the $200B market for animal meat. Similarly, plant-based milk and yogurt alternatives are expected to reach $16.3B in 2018. With Beyond Meat filing for an IPO and companies like Impossible Foods and JUST scaling up production of their meat alternatives, expect to hear more about “protein”—from a variety of sources—and less about animal meat. Likewise, with the decline of dairy, milk will become “milk” as companies like Kite Hill, Forager, and Ripple come up with new, cow-free concoctions.

FUNCTIONAL

In the wellness realm, it’s not enough that a product is good for you, it has to be “functional”. With that in mind, companies across food, beverage, and beauty aren’t just marketing ingredients, they’re selling outcomes. A collagen protein that makes your skin appear younger or a drink that helps you focus is becoming the status quo.

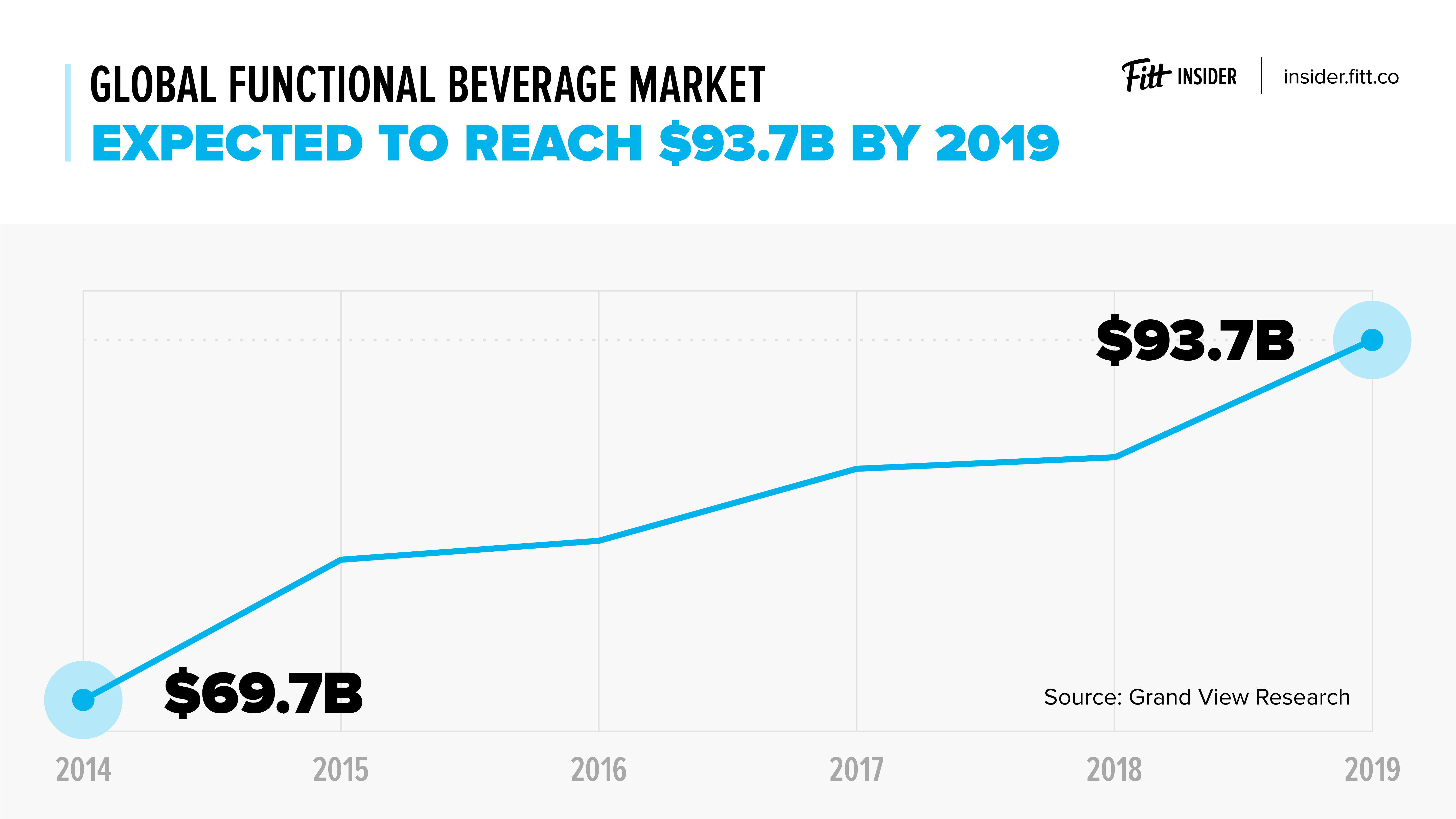

- Drink it in. The functional beverage sector is expected to become the fastest-growing product in the overall beverage category while the global market for functional drinks is projected to reach $93.68B in 2019. As innovation in the space continues, expect to see more and more drinks using adaptogens, nootropics, cannabis, and the like to deliver clean energy, cognitive benefits, stress relief, and the oh-so-ambiguous sense of well-being.

- Good for your gut. Kombucha was just the tip of the digestive health iceberg. Between 2012 and 2017, there was a 350% increase in Google searches for “best foods for gut health”. Looking ahead, expect to encounter probiotic and fermented products everywhere. The impact will push the probiotic market forward, increasing its value from $40B in 2017 to an estimated $65.9B by 2024.

MINDFUL

In 2017, the US meditation market generated $1.2B in revenue and is forecasted to reach $2.08B in revenue by 2022. That’s on top of the $260M invested into mindfulness since 2012. Now, meditation has tipped into the mainstream. The Centers for Disease Control and Prevention found that the number of Americans who meditate tripled between 2012 and 2015. More telling, self-care apps topped Apple’s 2018 trends list, with consumers spending $32M on mindfulness apps like Calm, Headspace, and 10% Happier. In 2019, mindfulness will escape your phone and enter your everyday life. From the office to the airport, there will be more opportunities (and paradoxically, pressure) to disconnect, breathe, and recharge.

- Recovery becomes a workout. Closely related to recharging and being mindful, post-workout recovery has become an industry unto itself. In a move that’s essentially rebranding physical therapy, stretching studios are cropping up across the country. With Xponential Fitness’s acquisition of StretchLab, and their plans to open 17 locations in San Francisco, five in Houston, three in Denver, one in Tampa, and three in Westchester County, this trend has officially taken off. Next, count on nap studios, cryotherapy, saunas, flotation tanks, and corrective exercises like foam rolling and myofascial release getting the boutique studio treatment as our definition of self-care expands to include optimizing downtime.

STAYING FIT

Remember fitness? Tried-and-true workouts like picking up heavy things or going for a run have been overshadowed by boutique studios, connected equipment, streaming content, and multi-studio memberships. From the consumer perspective, expect to see more of the same.

- Boutique studios. These class-based communities will increasingly trend toward luxury, exceptional experiences (SoulCycle) or convenient, high-intensity workouts (Orangetheory). In terms of what’s next, boxing studios (Rumble), treadmill classes (Mile High Running Club), and rowing gyms (Row House) are poised to become the newest fitness concepts to receive the same sort of hype we saw barre studios garner when they first came onto the scene a few years back.

- On demand, on trend. Smart and streaming workouts are fundamentally changing how we work out and reshaping the industry. As a result, the global digital fitness market is set to reach new heights, climbing to an estimated $27.4B by 2022, growing 33% from 2017 to 2022. Going forward, it will be almost impossible to talk about the fitness industry without mentioning the Peloton of “X” or the Netflix of fitness. Across the various categories—connected equipment, voice, and an AI-powered “personal trainer”—Peloton, Aaptiv, and Freeletics have established themselves as the front runners. While that’s true, Mirror already has a war chest and Studio is gaining traction. Meanwhile, Beachbody and Les Mills both have on demand offerings that are flying under the radar.

- Choice. ClassPass was ahead of its time when it pioneered the multi-studio membership. In the future, choice, not contracts, will be the new standard of fitness. Given the growing number of on-demand offerings, gyms and studios have a limited number of options. They could: 1) use a ClassPass-like middleman, 2) offer a streaming component, or 3) create a brand and experience that members can’t live without. Of course, those options aren’t ideal for gym and studio owners. A reliance on ClassPass has begun to commoditize boutique fitness, tarnishing the experience. On the other hand, launching streaming options or maintaining the luxury standard are expensive. The result? In a world where choice—across digital or real life workouts—is unrestricted, a middle-of-the-road experience will struggle to survive.

WELLNESS LIVING

According to the Global Wellness Institute, wellness tourism is one of the fastest-growing tourism markets. Consider this: between 2013 and 2015, the wellness tourism industry experienced 14% growth, totaling $563B. Meanwhile, during that same time, the entire tourism industry only grew by 6.9%. And this is just the start — wellness tourism is expected to reach $808B by 2020. Beyond the dollars and cents, this development signals a major shift in consumer behavior. Previously, vacations were seen as an escape from our healthy lifestyle. Now, consumers are seeking out experiences that enable or are an extension of their wellness routine.

- Wellness is life. Equinox, a well-established brand at the crossroads of luxury and fitness, is adding a health-conscious hotel line and multi-day luxury tours to create offerings across sweat, stay, and explore. Not to be outdone, Life Time is prioritizing co-working and residential living while tapping shopping malls as prime real estate for growth. It’s part of a plan that could become Life Time Village — a place where their Fitness, Work, Living, and Resort concepts combine to create a modern-day town square. That sounds a lot like what WeWork is up to with their co-working, co-living, MRKT, and Rise by We combo.

- These examples aren’t the exception. They’re becoming the rule. More than just a part of our lives, wellness is increasingly defining how we live. Perhaps the most telling trend is the rising tide of wellness real estate. As a pioneer in the category, Delos defines wellness real estate as “the merging medicine and science with design and construction to reinvent the role of the built environment on our health”. With developers investing in communities purpose-built for holistic health and wellness, the global industry is expected to grow from $134B in 2017 to an estimated $180B in 2022.

INFUSED

Claiming to relieve inflammation, anxiety, and pain, CBD-infused everything has become a trendy cure-all almost overnight. Whether or not it works, the wellness industry was quick to capitalize on the trend. According to Forbes, the cannabidiol (CBD) market is expected to undergo a 700% spike in sales by 2020. Similarly, the Hemp Business Journal projects that the CBD market will grow to $2.1B by 2020, which is a huge jump from 2017’s value of $202M.

- Big Food’s cannabis question. Without the burden of proof, upstart brands and wellness warriors have peddled CBD with few inhibitions. So far, functional beverages like Recess—a CBD- and adaptogen-infused sparkling water—has been a hit among millennials who thought LaCroix couldn’t get any better. Recognizing the upside, big-time food and beverage brands want in, but regulatory roadblocks have given them pause. Although Coca-Cola recently invested $15M into Dirty Lemon, makers of the +cbd elixir, the startup has discontinued sales of its spiked drink until the FDA gives it the go-ahead. It’s true that the Farm Bill, which recently cleared Congress, will make it easier for farmers to grow hemp, helping the CBD cause. But for the time being, cannabis is proving to be more of a risk than a miracle for established packaged food companies.

BLURRED LINES

Health is now synonymous with wellness. And because wellness includes beauty, and as self-care is a tenet of beauty, it’s almost impossible to tell where one category starts and the other begins. Taking note, neighborhood drugstores and big-box retailers are undergoing a makeover — in turn, they’d like to give you a makeover, a free health screening, or both. It’s all part of a growing trend set to turn the likes of CVS and Walgreens into health hubs or wellness destinations.

- Whether it’s medical services or beauty consultations, brick-and-mortar retailers see “wellness” as a way to drive foot traffic and increase revenue. And, with the US retail clinic market expected to grow to $7.3B by 2025 as the US beauty market balloons to $56.4B, their efforts are more than justified.

- Health hubs aren’t simply a new name for drug stores. The next generation of wellness centers and primary care offices are gaining steam. Taking aim at the $3.3T Americans spend on healthcare annually, Parsley Health and Forward Health use a membership model and proactive intervention to tackle chronic and lifestyle-driven diseases. On the other end of the spectrum, wellness-focused communities and clubs are taking shape. Whether it’s The Well, The Assemblage, or Yinova, there’s no shortage of all-in-one options for mind, body, and spirit.

AREAS OF INTEREST

- Fat. In 2018, keto took the diet world by storm. Although MCT oil isn’t going away just yet, expect to hear more about the paleo/vegan hybrid diet, known as “pegan”.

- Wearables. The wearables revolution has been years in the making, and 2019 could provide a breakthrough. The wearables market is expected to see $42B in sales in 2019, including $16.2B on smartwatches alone. Apple’s smartwatch is proving to be more of a healthcare tool than a health accessory. Meanwhile, WHOOP’s performance strap and Oura’s smart ring are trending as a cooler, more actionable Fitbit.

- Big Food. Whether it’s through investment, incubation, or both, Big Food is buying its way into the healthier hearts of consumers. Just this year, Pepsi scooped up Health Warrior and Bare Snacks. Coca-Cola took a stake in BODYARMOR and Dirty Lemon. And Danone said they could invest in 20–25 food startups by 2020.

- Insect protein. Plant-based and lab-grown meat is just the beginning. As our appetite for animal meat continues to diminish, prepare your palate for insect-based protein. According to Global Market Insights, the global edible insects market could exceed $522M by 2023, with beetles, grasshoppers, locusts, and crickets making up the greatest potential growth areas.

- Sex care. Sexual wellness is set to become the next frontier in an amorphous wellness industry. In fact, this sector of the wellness market is expected to grow from its 2014 value of $23B to a projected $57B by 2020. From vitamin C and CBD to ED and K-Y, wellness is officially TBD.

- VR. To date, virtual reality has over-delivered on hype and under-delivered on everything else. Will 2019 be a breakout year? Probably not. Despite the fact that there was a record high of $3B invested into VR in 2017, and that the VR market is expected to reach $215B by 2021, mainstream adoption is anything but certain. Still, VR- and AR-enabled workouts are a foregone conclusion. It’s only a matter of time.

Want to get in touch? Email anthony@fitt.co with tips, questions, or to continue the conversation. Also, if you find value in what we put together, consider forwarding this article to a colleague or peer.