August 2019 Recap: What’s Trending in Fitness and Wellness

If you subscribe to our weekly newsletter, then you already know we’re constantly tracking the investment, acquisitions, and transactions impacting fitness and wellness.

Taking a step back from the week-by-week rundown, here’s a recap of the trends and developments we saw this month.

The Bar Boom

August was headlined by Simply Good Foods’ acquisition of Quest Nutrition for $1B. This deal shows us that the nutrition bar business is booming, while also reinforcing the notion that big brands are willing to shell out big bucks in order to reach health-minded consumers.

- Of note: this month also saw Hershey scoop up low-sugar protein bar producer ONE Brands for $397M.

- In June: Oreo-owner Mondelez acquired the maker of Perfect Bar, a refrigerated protein bar with $70M in sales.

- For perspective: General Mills bought EPIC for $100M in 2016. Kellogg’s paid $600M for RXBAR in 2017. PepsiCo picked up Health Warrior in 2018.

Takeaway: Considering that the global nutrition bar market was valued at $5.1B in 2017, expect this category only to expand.

IPO: Initial Peloton Offering

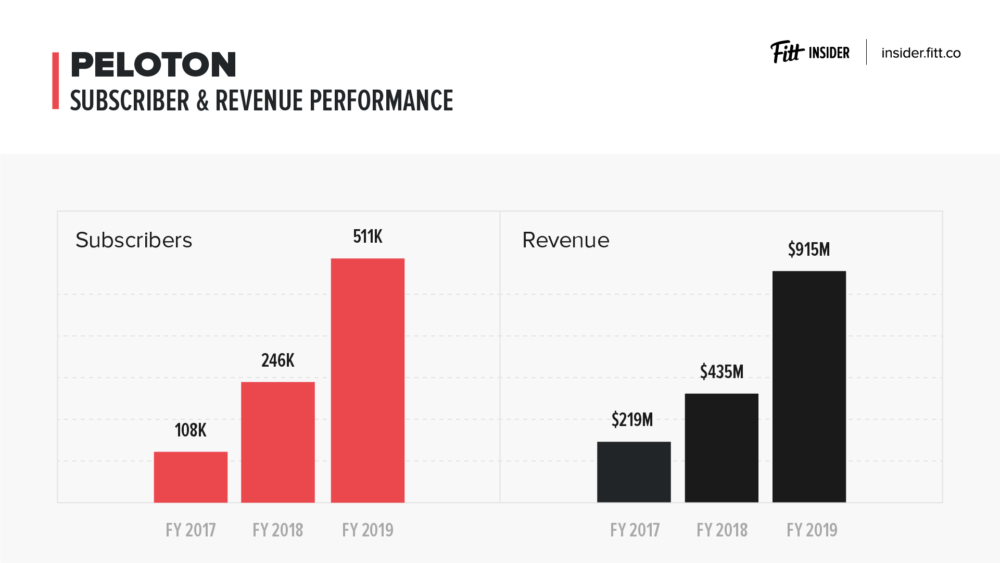

Peloton’s S-1 filing revealed that, despite substantial losses and sharply increasing marketing costs, the connected fitness company’s sales, margins, and cult following make it an attractive investment opportunity.

- Bull position: Peloton’s hardware margins are better than Apple’s iPhone. Their content subscription generates SaaS-style recurring revenue. And the company’s obsessive userbase will propel the brand forward.

- Bear position: Peloton, like most fitness regimens, is a fad. The bike/brand has become a status symbol for affluent consumers who are already inclined to exercise. Over time, the competition will increase, people will quit, and sales will stall.

For more: read our full breakdown of Peloton’s IPO filing here.

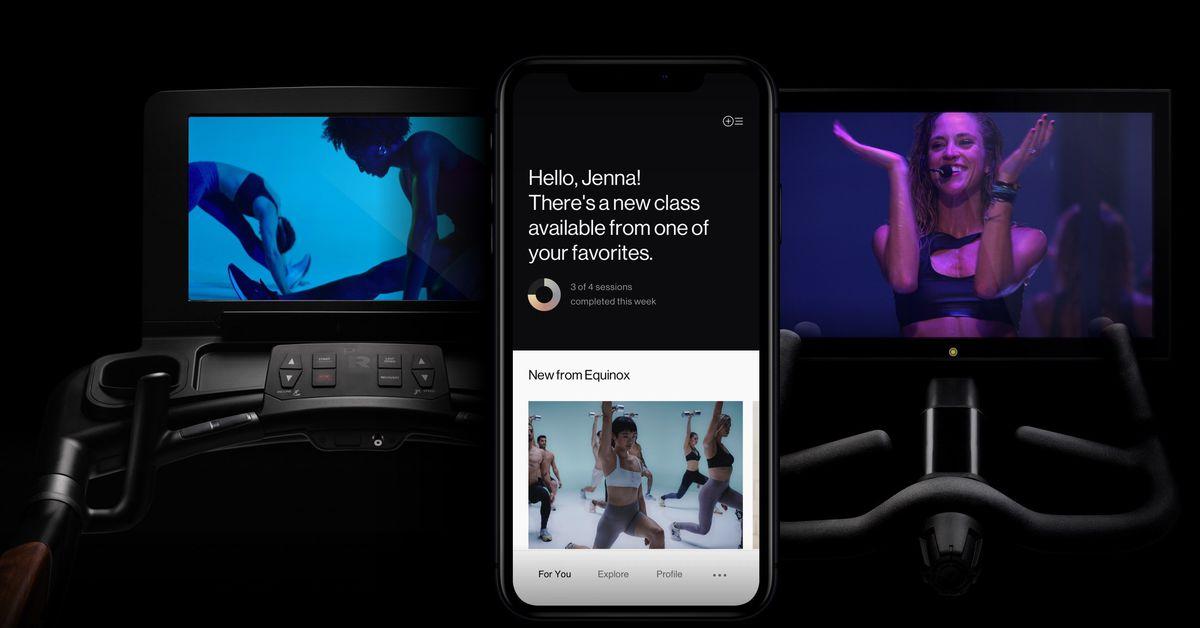

Equinox unveiled its Peloton competitor

Launching later this year, Equinox will offer connected equipment and streaming content for the at-home market that encompasses its portfolio of fitness brands, including Equinox, SoulCycle, and Precision Run.

- The SoulCycle stationary bike, identical to those found in its studios, is getting a screen and will be available for purchase. (FWIW: Both the SoulCycle and Peloton bikes were designed by Eric Villency)

- Proprietary Woodway treadmills, also equipped with a screen, will bring the Precision Run studio experience into the home.

- A yet-to-be-named digital platform and app will feature live and recorded classes led by top instructors from Equinox’s portfolio of fitness concepts.

- Prices were not announced, but across the connected fitness landscape, costs range from $1,000 to $4,000 — plus a $40–$50 monthly subscription fee for content.

For more >> The Connected Equipment Report

News & Notes

Tech-enabled health and fitness startups raked in funding:

- Fiture, a Chinese connected fitness startup, raised $6M in an initial round of funding led by Sequoia Capital China.

- Zero, an app used to track intermittent fasting, raised $2.8M from True Ventures and Trinity Ventures.

- WellSet, an upstart tech booking platform, raised pre-seed funding from a group of private equity and angel investors. The specifics of the funding were not disclosed.

Vitamin companies were in the headlines:

- Nestlé Health Science acquired Persona, makers of personalized vitamins. Terms were not disclosed.

- The Vitamin Shoppe is being acquired by Liberty Tax for $208M.

- Baze, an at-home nutritional testing kit, landed $6M in Series A funding led by Nature’s Way.

- Snapdragon Capital Partners and The Maze Group acquired a minority stake in Nutraceutical, a manufacturer and distributor of nutritional supplements and personal care products. Snapdragon is the private equity firm behind Xponential Fitness — the owner of Club Pilates, CycleBar, Pure Barre, StretchLab, Row House, AKT, YogaSix, and Stride. The implications for private label Xponential products or a vitamin subscription for members is worth watching.

More From Fitt >> DTC Vitamins Are Up-ending Retail Supplement Shops

Gyms and fitness studios continue to expand their footprint:

- NBA star Joakim Noah has joined Mayweather Boxing + Fitness as an investor and partner. Noah previously invested in Laird Hamilton’s health food company, Laird Superfood. For his part, Floyd Mayweather plans to open 500 boxing gyms within five years.

- MADabolic, an interval-based fitness concept, secured growth capital from ZGrowth Partners, who acquired a controlling interest in the company. MADabolic plans to build on the success of its 10 existing gyms, reaching 30–35 locations by 2020 and 200 locations in the next five years.

In related news: New York-based flexible workspace provider and WeWork competitor Industrious secured $80M in Series D funding. Of note, Equinox invested in the round.

Why it matters >> Equinox, Life Time, & Wellness Real Estate

Circling Back

As we pointed out in our article The Women’s Health Revolution, this billion-dollar industry is attracting the attention of top-tier VCs.

- Nurx, a birth control delivery startup, raised $32M in Series C funding co-led by Kleiner Perkins and Union Square Ventures. It also secured $20M in debt funding for a total of $52M.

Finally, this month, as we’ve noted several times, the plant-based protein craze continues.

- Shiru, a protein-synthesis startup backed and incubated by Y Combinator, is raising a round of funding to explore sustainable protein production.

- Senai, Malaysia-based insect protein company Nutrition Technologies has raised an $8.5M Series A round led by Openspace Ventures and SEEDS Capital.

For a comprehensive look at newsworthy headlines and noteworthy deals, subscribe to or read past issues of the Fitt Insider weekly newsletter.