Issue No. 99: The Athlete VC

Courtney Powell

Courtney Powell

Nothing new, pro athletes use their stardom to profit off the field. But now, a growing number of superstars see startup investing as a path to outsized gains.

A more interesting development, companies like Hyperice, Tonal, and WHOOP are running the athlete-as-investor playbook to perfection.

More than the check size, having an athlete on the cap table is proving to be invaluable.

Cashing In

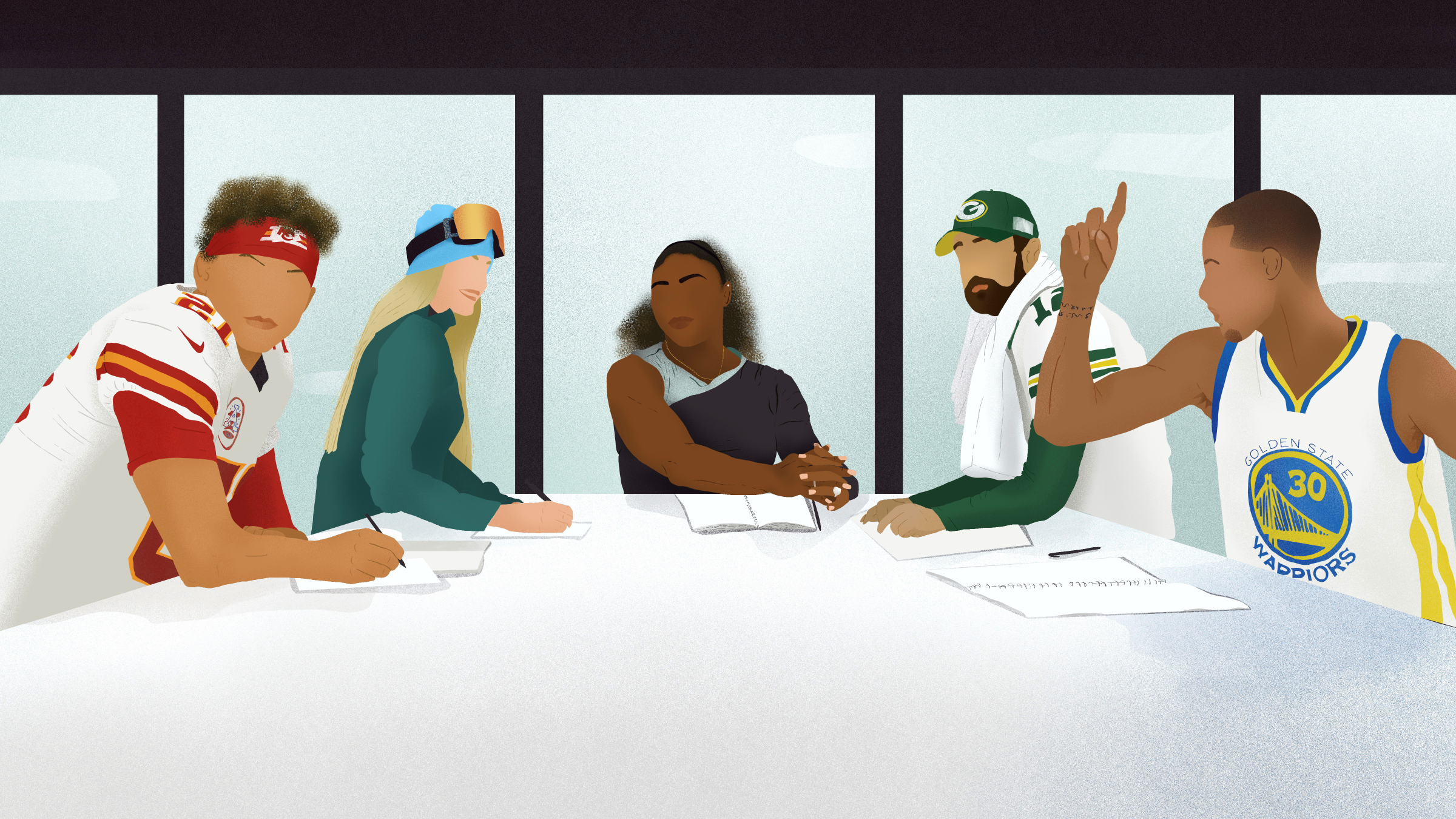

Armed with capital, clout, and expertise, athletes are increasingly backing early-stage companies. As technology and sports converge with fitness and wellness, some pros have found themselves sitting at the intersection of multiple billion-dollar industries.

Serena Williams. Tennis star Serena Williams is a world-renowned athlete. With a net worth in excess of $200M, she’s also one of the highest paid. Through her venture capital firm, Serena Ventures, Williams has written checks into more than 30 companies since 2014.

While it’s not the sole focus, Williams has made numerous investments in the fitness and wellness space, including Daily Harvest, Tonal, Impossible Foods, Every Mother, and Noom.

Lance Armstrong. Embroiled in a PED controversy, Lance Armstrong’s earnings evaporated. By his telling, an investment in Uber by way of his role as an LP in Chris Sacca’s Lowercase Capital returned $20M, saving him from financial ruin.

After dabbling in venture capital, Armstrong teamed up with Lionel Conacher, an investment banking and private equity executive, to start NEXT VENTŪRES. Leveraging Armstrong’s expertise, NEXT invests in companies optimizing human performance, backing Oura Ring, PowerDot, and Amp Human, among other upstarts.

Alex Rodriguez. During his 22-year baseball career, Rodriguez made a fortune. But, according to him, he works harder at business than he did on baseball.

A-Rod’s empire is vast, but his focus on health and fitness is worth noting. Rodriguez has invested in telehealth unicorn hims, MCT-infused Super Coffee, Dirty Lemon parent company Iris Nova, and workout app Fitplan, where A-Rod is also a trainer.

Speaking of workouts, Rodriguez also has the rights to open UFC-branded gyms in Miami-Dade County. He also joined forces with Seattle Seahawks QB Russell Wilson with an investment in the TruFusion studio chain.

Aaron Rodgers. Super Bowl Champion Aaron Rodgers co-founded Rx3 Growth Partners, a venture capital firm where he serves as general partner. Joining forces with Nate Raabe and Byron Roth of ROTH Capital Partners, the firm raised $50M to invest in consumer brands.

A differentiating factor, Rx3 has a number of athlete-LPs beyond Rodgers. The roster of influencer investors includes former Heisman Trophy winner Desmond Howard, racecar driver Danica Patrick, skateboarder Ryan Sheckler, and New York Jets QB Sam Darnold.

With a focus on lifestyle brands, food & beverage, and sports, Rx3 has backed health and fitness companies like hims, Hydrow, Super Coffee, Hydrant, and Orgain.

Far from an exhaustive list, we’ve intentionally focused on athlete-investors putting their name and money behind fitness and wellness companies. Elsewhere, countless other athletes are making a name for themselves by investing.

Athlete-backed

If you’re a fast-growing brand or promising upstart, capital isn’t all that hard to come by. But the cosign of a world-class athlete is worth its weight in gold.

Brand alignment is the key to the athlete-as-investor formula. With long-term upside and passion for a product, sports stars have a vested interest in promoting a brand to their massive, engaged fanbase.

For their part, companies tap athletes for awareness, distribution, and relevance in culture.

Simply put, direct access to an athlete’s audience lowers customer acquisition costs, helping brands avoid the tolls levied by platforms like Google, Amazon, and Facebook. A step further, companies like Hyperice, Tonal, and WHOOP have used athlete-investors to shift culture and stand out from the crowd.

Hyperice. Working with athletes has been central to Hyperice’s strategy from the start. Makers of high-tech recovery products, Hyperice was purpose-built with input from Kobe Bryant. In fact, the company is named after Bryant’s custom Nike shoe, the Hyperdunk.

According to Hyperice CEO Jim Huether, well over 20 pro athletes—including Patrick Mahomes, Lindsey Vonn, Blake Griffin, and Naomi Osaka—have invested in the company. More than money alone, Huether told us, these athlete investors have also contributed to product development and marketing while helping to mainstream the recovery category.

A win-win for both parties, Huether believes the athlete-investor arrangement is more effective than traditional endorsement deals, with athletes reaping “significant returns” as the company grows. With Hyperice eyeing $200M in revenue for 2020, the strategy appears to be working.

Tonal. This connected strength training company is winning over sports superstars. Like Hyperice, Tonal touts more than 20 pro athletes; Serena Williams, Stephen Curry, and Michelle Wie have invested, among others.

Interestingly, Tonal’s strategy developed organically. Take Curry, for instance. After initially purchasing his Tonal system under a pseudonym and experiencing the product firsthand, he reached out to the company about investing.

That kind of buy-in speaks dividends. Essentially, if this smart home gym is good enough for an elite athlete, it’s good enough for anyone. With $110M in new funding, a valuation over $500M, and a run rate in excess of $100M, Tonal is bearing that out.

WHOOP. Health trackers are nothing new. But WHOOP’s wearable is a favorite among athletes and high-performers. Thanks to its focus on strain, recovery, and sleep, optimal performance is demystified.

From Tiger Woods to LeBron James, WHOOP decorates the wrist of world-class pros. According to WHOOP CEO Will Ahmed, that’s by design. Not unlike Apple or Tesla, Ahmed said the company catered to the high end of the market, thinking the technology would trickle down.

In addition to athletes like Kevin Durant and Russell Okung, the NFL Players Association is a WHOOP investor. Better still, WHOOP is the official recovery wearable of the NFLPA, with every active footballer receiving a device. More interesting, athletes can sell their data, with WHOOP earning a cut.

The list goes on. Plant-based burger makers Impossible Foods and Beyond Meat have enlisted athlete VCs to hack culture. And athlete investors like Kobe Bryant, Rob Gronkowski, and James Harden help sports drink maker BODYARMOR compete with Gatorade.

Athlete-owned

Now, more than ever, athletes are aspiring to build business empires beyond their on-field accomplishments. Armed with piles of cash, a passionate community, and a premier personal brand, investing is just the beginning.

As Jay-Z put it, “I’m not a businessman, I’m a business, man.”

Realizing this fact, the athlete-as-founder or co-founder is becoming more common. From Tom Brady’s TB12 to Mayweather Boxing to Laird Hamiliton’s XPT Life and publicly traded superfood company, athletes aren’t just backing companies, they’re starting them.

Looking ahead, there’s an opening for an athlete-owned empire to be built at the intersection of sports and fitness. It won’t be long until we see an athlete founder score an exit on par with Beats by Dre or Ryan Reynolds’ Aviation Gin.

💣 Boom and Bust

Each new day brings word of another enormous digital fitness investment. Meanwhile, the brick-and-mortar industry is collapsing.

Booming: ICON Health & Fitness is the latest beneficiary of the digital fitness gold rush. The parent company of NordicTrack, iFit, ProForm and Freemotion, ICON landed $200M in funding from L Catterton and Pamplona Capital Management.

A bust: California-based In-Shape Health Clubs is searching for options to restructure $70M in debt, as bankruptcies and closures cascade across the fitness industry. To date, 24 Hour Fitness, Town Sports International, Gold’s Gym, Flywheel Sports, and countless have entered bankruptcy due to COVID.

In ICON’s case, this old-school equipment manufacturer turned connected fitness company is giving chase in a category they could have owned.

Enter COVID. With gyms closed, dumbbells sold out, and Pelotons on backorder, ICON pounced.

• 700K paid iFit content subscribers

• Valued at $7B+

Of note: L Catterton is all-in on at-home fitness, backing Peloton, Tonal, Hydrow, and now, ICON. Looming over the ICON deal, Peloton is suing ICON, alleging patent infringement. Remember, Peloton previously sued Flywheel’s at-home division of business.

The big picture: In recent months, digital fitness companies have raised $1B+. While the category shows no signs of slowing down, we can’t help but wonder if it’s all for not.

👀 Funding Watch

Strava is on the fundraising trail, hoping to secure an investment between $150M to $400M. According to Bloomberg, the company is seeking a valuation north of $1B, a sizable increase over its $350M value.

Earlier this year, Strava doubled down on its subscription product, putting what were free features behind a paywall. Initially met with pushback from users, the strategy has resulted in significant revenue growth.

In his appearance on the Fitt Insider podcast, Strava co-founder Mark Gainey discussed the various iterations of the company’s business model, saying:

“We’ve learned over time that we’re at our best when we’re focused on the athlete experience and really thought about how we can improve and create this subscription upgrade that’s so valuable it becomes indispensable.”

At $5/month, the subscription is affordable and impactful for millions of members — a number that has seen tremendous growth during COVID.

• 68M members, up 35% from February

• 3.4M downloads in May, up 179% from January

• $6.4M revenue in May, up 166% from January

Zooming out: This increase reflects the rise in outdoor activities during the pandemic and a surge in downloads among fitness apps.

Looking ahead: Strava puts its total addressable market at 700M users. With unicorn status in sight, and momentum at its back, this fitness app is on its way to that goal.

📰 News & Notes

- The race to redesign sugar.

- This Headspace x Madhappy collab.

- Coca-Cola to discontinue Zico coconut water.

- Lux Capital announces a Health + Tech initiative.

- DTC healthcare startup Ro unveiled Plenity for weight management.

- Meet the Apple Fitness+ instructors. [Reread: What to make of Fitness+]

💰 Money Moves

- ICON Health & Fitness, owners of fitness brands NordicTrack, ProForm, and Freemotion, received $200M in a funding round led by L Catterton. More from Fitt Insider: The Connected Fitness Wars

- UK-based VR fitness startup QUELL raised over £500K ($648K) on Kickstarter.

- Tend, a tech-enabled dental startup focusing on hospitality, raised a $37M Series B led by GV (formerly Google Ventures).

- Spanish women’s health startup Emjoy, creators of a subscription-based audio app for sexual empowerment, secured $3M in seed funding. More from Fitt Insider: Women’s Health Revolution

- Flow Alkaline Spring Water, a Canadian mineral water producer, raised an additional “seven-figure investment” after its initial $45M Series D earlier this year.

- French tech startup RunMotion Coach closed a $300K seed round to expand its run tracking app to the US and Europe.

- 4.5.6 Skin, a French beauty startup dedicated to melanin-rich skin complexions, received €700K ($825K) in seed funding.

- Paired, a couples therapy app developed in tandem with relationship academics and therapists, launched with $1M in funding.