After topping $6B in revenue for 2021, lululemon plans to double sales in the next five years, reaching $12.5B by 2026.

Growth Mindset

In 2019, the activewear maker called its shot, promising to grow its men’s business and digital sales while expanding internationally.

Having delivered on all fronts, lululemon upped the ante, with its new Power of Three ×2 growth strategy:

- Product innovation: double men’s revenue and pursue new categories like tennis, golf, and hiking, in addition to its recent footwear launch.

- Guest experience: introduce a membership program to strengthen its physical and digital community.

- Market expansion: quadruple international sales, scaling its presence in China, APAC, and Europe.

Members Only

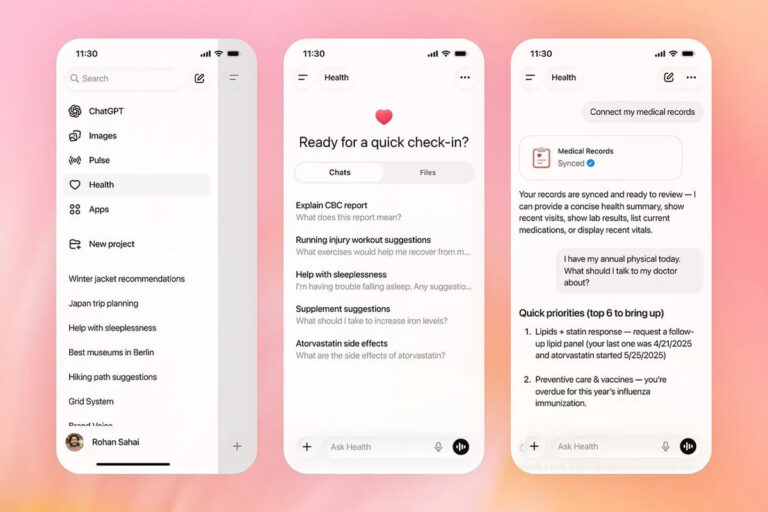

A key component of the plan, lulu is rolling out a two-tiered membership program aimed at enhancing the current MIRROR offering.

- Free: product drops, exclusive gear, and in-person events.

- Paid: in addition to freemium perks, for $39/month, MIRROR users receive exclusive fitness content and in-person classes. A digital-only offering is expected this fall.

All-access. After acquiring MIRROR for $500M in 2020, lululemon struggled to scale the fitness offering, slashing sales figures for the device in half last year.

In early 2022, Amazon vet Michael Aragon replaced MIRROR founder Brynn Putnam as chief executive.

Now, the company envisions a “new path for connected fitness,” creating:

“the most immersive fitness marketplace in the industry.”

Step one: bundle digital fitness with its membership. Step two: launch lululemon Studio, partnering with boutique studios like Pure Barre, Rumble, and DOGPOUND for workout content and in-person classes.

Sweat x spend. By integrating MIRROR and lulu, the company thinks 80% of its customers will eventually become members. A powerful combination, delivering value while promoting an active lifestyle pays dividends — as lululemon CEO Calvin McDonald put it:

“The more they sweat, the more they spend.”

TBD. Bundling fitness content, clothing, and community, lulu is making MIRROR a central element of its omnichannel guest experience. But the question remains: is MIRROR’s hardware necessary to achieve that goal?

For instance, other retailers have found success sans equipment, see: Nike’s app arsenal, Alo Yoga’s Moves platform, and Athleta x obé.

Takeaway: Membership programs are nothing new. But, lululemon hopes the addition of fitness content will entice consumers to sweat and spend.