As losses mount, Peloton’s app takes center stage.

Taking Stock

Following a tumultuous 2022, the connected equipment maker announced wider-than-expected losses and mixed membership growth but higher revenue in the first quarter (Peloton’s Q3).

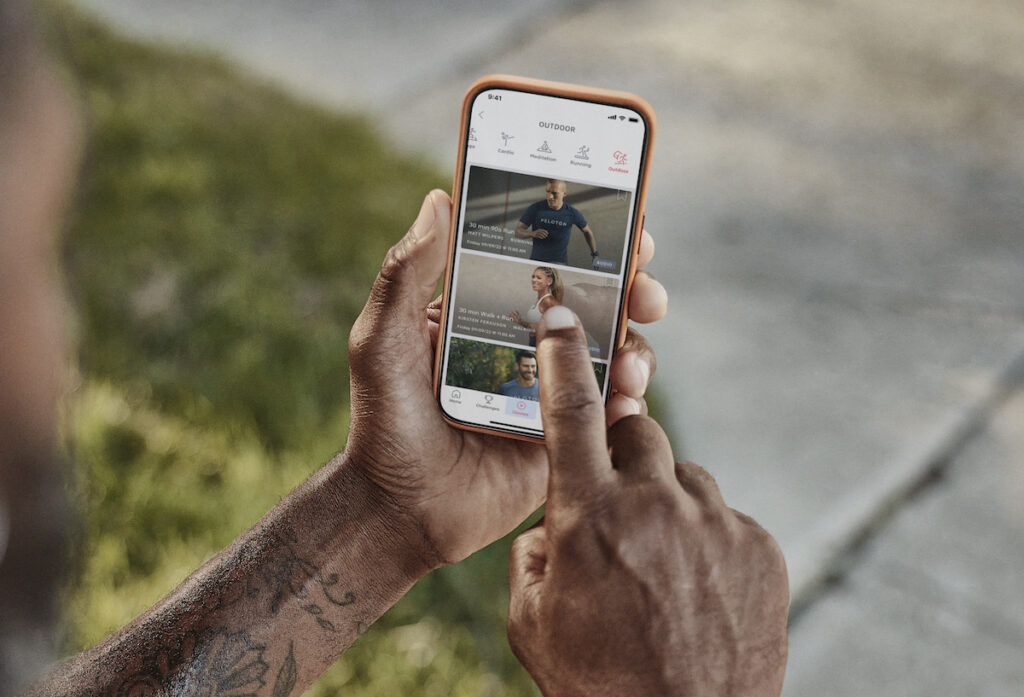

The bigger news: Expected at the end of May, Peloton will unveil a new brand identity, deemphasizing hardware while relaunching its app with a tiered subscription model.

This move aligns with CEO Barry McCarthy’s stated goal of implementing a “good, better, best” strategy for reaching a broader audience at different price points.

Hard Times

Peloton’s dream of putting a Bike in every living room may very well be dead.

On a positive note, Peloton grew connected fitness subscribers—aka those that own a hardware component—by 5% this quarter.

In particular, its Fitness as a Service (rental bike) and Peloton Certified Refurbished (used bike) programs accounted for 24% of the company’s Q3 hardware sales. Peloton plans to expand both programs through 2024.

Unfortunately, the coming quarter is historically Peloton’s worst for hardware sales.

Complicating matters, Peloton signaled it’ll be strapped for cash next quarter, as the company headed off a potential FTC important ban by settling a patent suit with DISH Technologies for $75M.

And its new tech launches—Row and Guide—underdelivered, with only 4% and 1% of polled consumers, respectively, knowing they even exist.

Even after tapping third-party retailers and inking a global partnership with Hilton, the company expects its first-ever decline in connected fitness subscribers next quarter.

Content is king. There’s justification behind the rebrand.

- Subscriptions made up 60% of its revenue for the quarter.

- 57% of all workouts were not cycling-related in Q3.

- 38% of all workouts involved no Peloton hardware.

In a shareholder letter, McCarthy posited that the company legacy was never the bike, instead calling content the “golden goose”:

“Is the bike a great experience from a hardware perspective and better than things that came before? Absolutely, but the magic and the glue that binds the community with almost religious fervor amongst our members is the content and the instructors.”

But… it appears the draw of content isn’t such a sure thing. Peloton’s overall subscriptions (connected + digital-only) were flat from last quarter, sticking at 6.7M — a glaring 300K decrease from this time last year.

As the company rolls out a paywalled content model, it anticipates “near-term pressure” on the app subscriber base as well.

Looking ahead: Few challenge that Peloton’s star instructors and production quality are of the highest caliber. But it appears Peloton is betting the business on its content’s ability to drive premium subscribers.