In recent years, the fitness industry has experienced significant growth — expanding its member base and raking in record profits.

At the same time, innovative upstarts have descended on the space, disrupting the status quo. From boutique studios to wearable technology and streaming content to connected fitness, there’s no denying the transformation taking place.

Meanwhile, as consumer habits shift and new fitness unicorns are minted, the role of the fitness professional has been noticeably absent from larger conversations about the industry’s future. Given the implications of COVID-19, paired with the preexisting trend toward digital options, the topic is more relevant than ever.

The big picture: Developed in collaboration with Courtside Ventures, an early-stage venture fund focused on fitness, sports, and gaming, this report explores the future of personal training. In addition to discussing the role of in-person training, online offerings, and digital tools, we examine fitness education, compensation, new business models, and much more.

The Business of Fitness

The US fitness industry is the most lucrative in the world, bringing in $32.3B in 2019. More than 60M members, or a quarter of adult Americans, now belong to gyms. And the number of gyms has increased by 200%, reaching nearly 40,000 locations, in the last three decades.

Starting in the mid-2000s, the industry entered a boutique fitness boom. Between 2013 and 2017, growth in boutique studios specializing in a particular kind of exercise rose 121%. Of note, growth in traditional gyms only increased by 15% during the same period.

The result has seen fast-growing concepts like SoulCycle, Orangetheory Fitness, and F45 Training transform the fitness landscape. Further altering the space, this era gave rise to ClassPass, a multi-studio membership now valued at more than $1B.

More recently, starting in earnest with the emergence of Peloton, new digital offerings have begun to disrupt the gym and boutique studio ecosystem. In a few short years, the Peloton of “X” idiom came to define the connected fitness category — an offering that pairs fitness equipment (or hardware) with a subscription-based content membership.

As 2020 got underway, connected and on-demand fitness were already applying pressure to brick-and-mortar incumbents. Beyond Peloton’s public offering, countless other digital offerings, from Aaptiv and Freeletics to Future, were gaining traction. Solidifying this shift, lululemon’s acquisition of Mirror for $500M speaks to the far-reaching implications of digital fitness offerings. Complicating matters, COVID-19 shuttered businesses everywhere, forcing the entire fitness industry online.

Where Do Fitness Professionals Fit In?

As fitness formats and modalities evolved amid an era of record growth and innovation, the role of fitness professionals remained relatively unchanged. Going a step further, there’s an argument to be made that the profession stagnated.

From earning potential and career advancement to basic necessities like consistent hours and healthcare, the field had already been rife with challenges. Now, as COVID-19 threatens to alter the landscape indefinitely, rethinking the role of fitness professionals is paramount.

By the numbers:

- There are an estimated 400K fitness instructors and trainers in the US.

- The US personal training industry is valued at $10B and is growing 2.8% annually.

- The median income for a fitness professional is $40,390 annually, or $19.42/hour.

Across the industry, fitness professionals are often employed as independent contractors. In the group setting, instructors are paid per class. Depending on the employer and arrangement, instructors might also earn a bonus per attendee or for sold-out classes.

Personal trainers typically split the revenue from each session with the gym — where the club’s take ranges from 50–70%. IHRSA puts the average cost of a 60-minute, one-on-one session at $65, meaning trainers could be left with less than $20.

Contractor or full-time, trainers don’t typically receive benefits like healthcare or paid vacation. According to the American Council on Exercise, only 43% of full-time trainers have full health coverage. Among part-timers, that number is only 4%.

Despite the shortcomings, from high-end clubs like Equinox and Life Time to budget operators like Anytime Fitness, personal trainers are in high demand. But, because the balance of power is often misaligned, trainers can find themselves holding the short end of the stick.

In 2019, for instance, Equinox, CorePower Yoga, and YogaWorks all landed in hot water related to labor disputes. Of note, personal trainers at Equinox likened the environment to the Hunger Games while alleging they were underpaid and overworked. More telling, the company has a 50% annual turnover rate among trainers.

Far from isolated incidents, fitness professionals are often stretched thin. In the end, trainers are forced to work long hours or hack together multiple side hustles to make ends meet. Inevitably, the flaws in the system reveal themself to the effect of 80–90% annual turnover across the industry.

The Underlying Problem

The phrase “certified fitness professional” is losing its meaning. If left unchecked, this trend will impact consumers, gyms, universities, certifying agencies, and the trainers themselves.

A red flag, the fitness certification business is characterized by an alphabet soup of acronyms like ACE, NASM, AFAA, ACSM, NSCA, NESTA, and many others that are seemingly indistinguishable from one another.

The same can be said of the accreditation organizations like NCCA or DEAC. If any certification can become accredited by meeting a relatively low bar and paying a small fee, the certification and accreditation run the risk of losing their value.

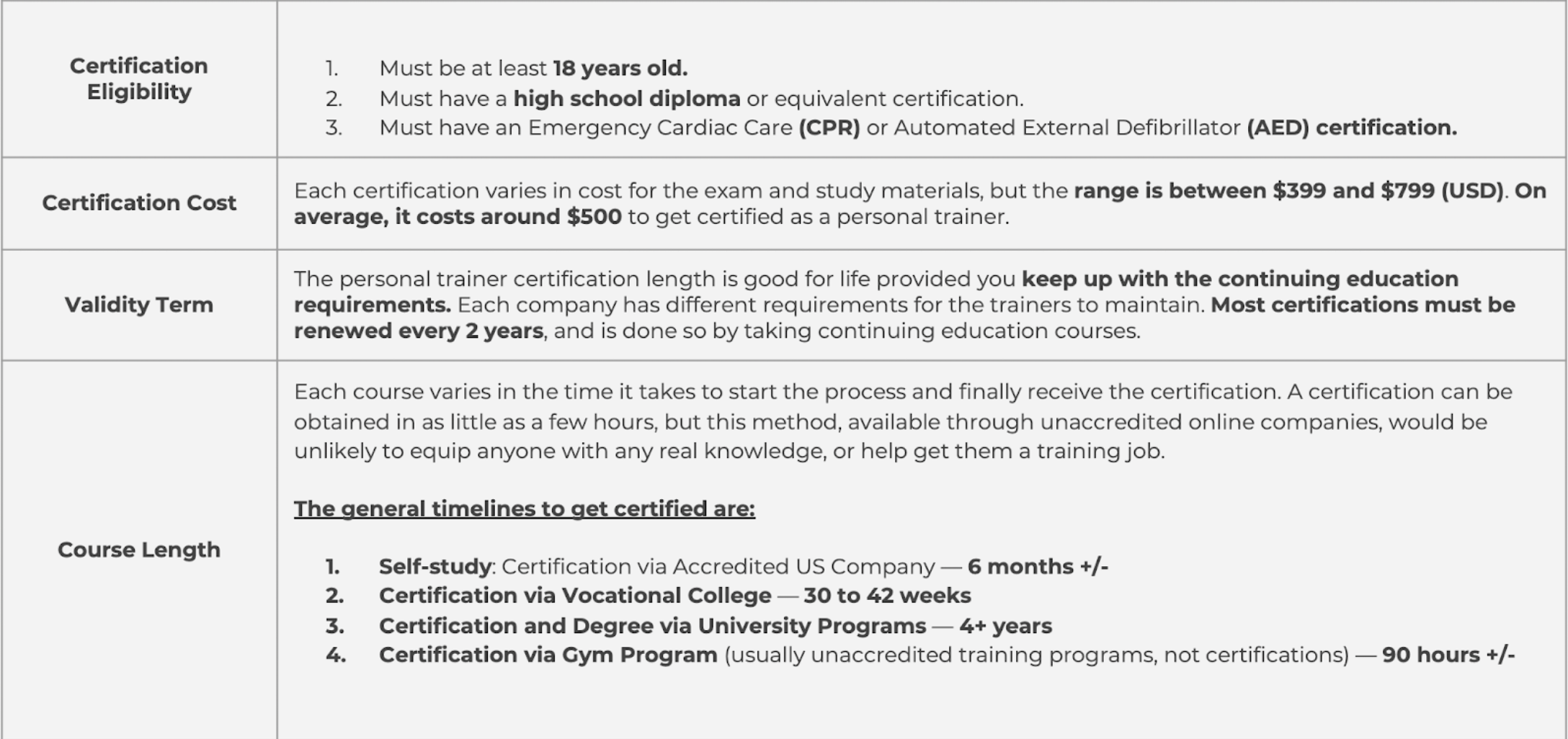

Among the many issues, would-be trainers can simply purchase a course, complete a self-study, and take a test with little to no oversight. While it’s true that some certifications are more stringent than others, the growing number of subpar certifications combined with the lack of clarity between best and worst ultimately devalues the resulting credential.

Making matters worse, aspiring trainers have no way of mapping the cost of a credential to future earnings. While standard certifications vary in cost from a few hundred to a few thousand dollars, some require a bachelor’s degree, as well as annual continuing education credits. Alternatively, students shell out hundreds of thousands of dollars for a degree in kinesiology, or a related field, in order to pursue personal training.

In either case, whether it’s a four-year degree or an online certification, fitness professionals enter the field woefully unprepared to compete in an industry undergoing rapid change.

Digital Disruption

As we pointed out, digital options including connected fitness, streaming video, on-demand content, and remote coaching are reimagining the sector. Caught in a tidal wave of disruption, personal trainers are being forced to innovate or risk being swept away. Unfortunately, much like the education component, the digital tools and new business models geared toward trainers aren’t evolving at the same pace.

Formerly, landing a job at a premium club like Equinox or in a star instructor role at Barry’s was highly sought-after. While that’s still true, ambitious trainers have set their sights on two alternative paths.

The rise of platforms like Peloton, Tonal, and Future has christened a new class of celebrity trainers. Once, that title was reserved for fitness professionals who trained high-profile clients. But now, the trainer is the celebrity. As the digital fitness category becomes more competitive, the demand for A-list instructors will create a talent arms race while paving a new career path. A word of caution: this route amounts to becoming a professional athlete — the chances are slim.

Opting for a more accessible path, trainers are taking matters into their own hands by taking their talents online. A development we’ve dubbed The Rise of the Fitness Creator, trainers are cutting out the middleman by building digital, direct-to-consumer offerings.

Like filmmakers on YouTube, writers on Substack, and independent podcasters everywhere, fitness professionals are waking up to the fact that they hold a disproportionate share of the value. Now, as consumer habits shift, and new digital tools emerge, the rise of the fitness creator could be more disruptive to the industry than Peloton.

Innovate or Die

Taking stock of the multi-billion-dollar fitness industry in the wake of COVID-19, as it evolves in an era of substantial upheaval, the sector is fertile ground for founders and investors who tailor new offerings to ambitious fitness professionals. Slowly but surely, this trend is starting to take shape.

Silofit, for one, is rethinking in-person exercise. This Montreal-based startup is building a network of private, on-demand fitness spaces. While individual users are able to rent the studio for a workout, the real innovation is twofold.

[Editor’s note: Courtside is an investor in Silofit.]

First, Silofit rents small spaces in high-traffic areas, shirking the overhead relative to a big-box gym. Second, the platform is aimed at personal trainers who use the space to train clients. Unlike traditional gyms, Silofit trainers keep a large share of the revenue, paying a small hourly fee to access the space. From physical space and software to certifications, Silofit is enabling fitness and wellness professionals to run their own business.

Playbook, a platform for fitness creators, is empowering online trainers. Instead of prioritizing end-users alone, Playbook focuses on building digital tools that help fitness creators. Like Patreon or Substack, Playbook wants creators to do more creating while they build the infrastructure for content production, distribution, and transactions.

Two key insights inform Playbook’s model. First, the growth of fitness content on platforms like Instagram and YouTube led by hugely popular trainers. And second, the fact that consumers are often very loyal to their trainer helps retention. If Playbook helps creators produce better content, and improves the delivery of said content, users will likely stick around.

Around the Industry

There’s still room for significant business model and technological innovation in the fitness industry.

For years, the industry has played hot potato with the phrase omnichannel fitness. In a post-COVID world, this buzzword will come to be a pillar of business-as-usual. On the Fitt Insider podcast, we’ve spoken to Paul Bowman, CEO of Wexer and Lauren Foundos, CEO of FORTË about their efforts to help gyms and studios go beyond the four walls of their physical location.

In a hurry, MINDBODY and ClassPass spun up digital fitness offerings to help studios connect with members stuck at home. The idea of omnichannel fitness was echoed by both company’s CEOs on the Fitt Insider podcast.

ClassPass CEO Fritz Lanman said he thinks the future of fitness is “heterogeneous”, meaning digital and in-person options will exist in concert with one another. He went on to say that the company is considering the role of online workouts and digital content in a post-COVID world.

Similarly, MINDBODY CEO Rick Stollmeyer said the company is committed to offering systems that allow studio owners to: “more easily upload compelling content, sell access to that content, use that content to activate people, and hopefully bring them into the studio.”

Looking Ahead

More than ever, the conversation has evolved beyond a debate between in-person or at-home workouts; instead, the focus is still being placed on connecting members with gyms. In this moment, there’s significant white space for new business models and digital tools that help connect individual fitness professionals to would-be clients, online and in-person.

While other industries have seen their fair share of innovation, like Adobe’s creative suite, podcasting platforms, or community management tools, fitness creators have made do by hacking together solutions that weren’t meant for them. Meanwhile, many of the platforms focused on fitness don’t go far enough to empower trainers, coaches, and instructors to seize new opportunities.

In the years to come, founders and investors will be well-served by putting fitness professionals at the center of the conversation about the industry’s future.

This report was a collaboration between Fitt Insider and Courtside Ventures.

Courtside Ventures is an early-stage VC fund focused on fitness, sports, and gaming. They’ve invested in 40+ companies, including 100 Thieves, Beam (acq by Microsoft), Religion of Sports, StockX, The Athletic, and The Drone Racing League. Their fitness investments include Every Mother, Freeletics, Future, Gainful, Hammerhead, Journey, RecoverX, Silofit, TF Living, and Zenrez, among several others.