Fitt Insider Outlook 2020: What’s Next In Fitness & Wellness

As we close out 2019 and move into a new decade, we’ve taken stock of emerging fitness and wellness trends to create the 2020 Fitt Insider Outlook.

From fitness to food and wellness to wearables, we’ve surveyed the landscape to gauge consumer behavior, investment activity, and whitespace across the industry. Then, we drilled down into the business implications of what’s happening and why.

Following the blueprint we used for the 2019 Outlook, this report will cover macro trends, mainstream developments, and areas of interest worth following for the year ahead.

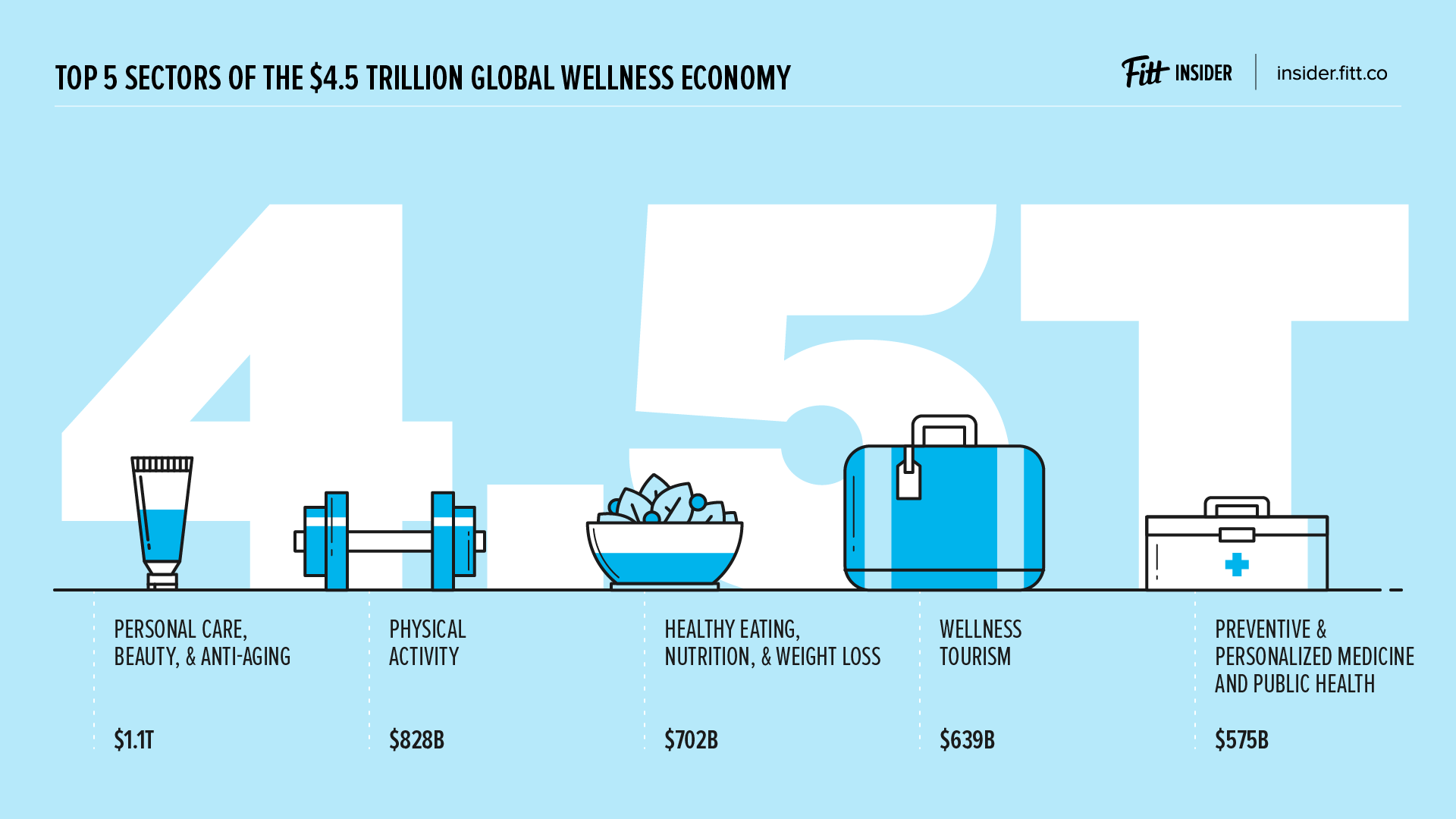

This new year also marks a new decade. Looking back at the last ten years, as the industry ballooned into a $4.5T behemoth, the word “wellness” became increasingly nebulous. Seemingly anything can be wellness. And if that’s the case, the word wellness could become devoid of any real meaning at all, which begs the question: what does the post-wellness era look like?

In 2010, Gwyneth Paltrow’s lifestyle brand Goop was just getting started. Flash-forward ten years and celebrity-endorsed pseudoscience has become inseparable from modern-day wellness. Seizing on this opportunity, everyone from Beyonce and Kourtney Kardashian to Kevin Hart, Mark Wahlberg, and Tom Brady are slinging some kind of supplement, wellness advice,

This period also saw the rise of healing crystals, sounds baths, and astrology-as-wellness. At the same time, new-age brands co-opted ingredients rooted in Eastern medicine or homeopathic remedies, repackaging them as the antidote to modern ailments. In a trend we detailed in The New Wellness Lexicon, functional ingredients used for centuries have now become the foundation for pills, shakes, powders, elixirs, and tonics that make us “glow”, “chill”, or “focus.”

But, in a decade when we spent more (time and money) on wellness than ever before, we’ve become increasingly unwell. From obesity to diabetes and burnout to depression, the word “wellness” may be well-intentioned, but far from a solution, it has proven to be part of the problem.

This fact led us to predict the unbundling of wellness — where top-tier brands begin to distance themselves from the W-word. Instead of playing up the empty definition of wellness, more companies will define and own siloed verticals of the broader industry. Looking in on leading brands, this trend is already proving true.

- Calm has built a billion-dollar company on the back of meditation and sleep.

- Outdoor Voices has built a cult-like following around its “Doing Things” motto.

- WHOOP isn’t a wearables company; they’re unlocking human performance.

As this trend persists, expect the industry to splinter into specialty or luxury brands and commodities. And if that’s the case, our hope is that a few new tracks emerge. The first track would see a movement away from woo-woo wellness and toward common sense. As author Brad Stulberg routinely points out, “the more you have to pay for wellness, the less likely it is to make you well.” Getting back to the basics, sleeping more, not smoking, exercising consistently, and eating nutritious foods is the secret we’re searching for.

Going a step further, a longer shot would see a mega-brand like Google, Apple, or Amazon make a play to vertically integrate healthcare, rolling up components of both health and fitness (see India’s Cure.Fit). By combining insurance and incentives with activity tracking and health data, this move would prioritize well-being while rendering “wellness” obsolete.

There’s no denying the wave of disruption washing over the fitness industry. Not too long ago, boutiques upended big box gyms. Now, at-home and on-demand options are threatening to remake the space once again. But don’t expect 2020 to be the year of the gympocalyspe.

HVLP Gyms. While connected fitness companies garner all the headlines, “high-volume, low-price” (HVLP) gyms like Planet Fitness continue to see steady growth.

In fact, Planet Fitness has amassed 12M members across 1,800 locations. Moreover, in keeping with the company’s goal of opening 4,000 total units, Planet Fitness added 225 new gyms in 2019 alone.

How can that be? Dollar General and other discount chains are the retail equivalents of HVLP gyms like Planet Fitness. In 2019, Dollar General was the number one retailer for new store openings. And that’s not an anomaly. After Dollar General, the top retailers for planned store openings this year are Dollar Tree, Family Dollar, Aldi, and Five Below. Similarly, across the fitness space, many of the fastest-growing and top-earning gyms fall under the HVLP banner.

Boutique Fitness 2.0. Between 2013 and 2017, membership at traditional gyms grew by 15%, while membership to boutique studios grew by 121%. But if boutiques crushed traditional gyms, studios could be supplanted by a new era of fitness concepts taking the experience and amenities to new heights.

In New York City, NEOU is a fitness studio, production house, and streaming workout platform in one. NYC is also home to private, invitation-only concepts like GHOST and Performix House (hint: exclusivity sells). BYNDfit is bringing a fitness hall to Washington DC. Seattle’s Sanctuary is a private, bookable studio complete with streaming fitness classes. Then there’s a growing number of climbing-gym-meets-fitness-center concepts popping up, best exemplified by Brooklyn Boulders and their adventure-themed studio BKBX.

Connected Fitness. Peloton did the hard work of popularizing connected fitness. Now, everyone wants to cash in. And competition is flooding the space.

- Mirror, Hydrow, and Echelon Fitness each added new funding in 2019.

- Equinox is planning a Precision Run treadmill, SoulCycle bike, and digital platform.

- Technogym unveiled its LIVE platform and accompanying equipment.

- Life Fitness rolled out on-demand classes across all of its cardio equipment.

- iFit secured $200M in funding to accelerate its interactive streaming platform.

The influx of options is proving that mounting a display screen to a piece of fitness equipment isn’t all that innovative, or defensible. In reality, connected fitness just might be a pit stop on the road to augmented and/or virtual reality.

Speaking of which, although Zwift doesn’t make hardware, they have created a virtual fitness world for their thriving user base. And Hydrow CEO Bruce Smith told us that the company could release rock climbing and cross-country skiing products that utilize Live Outdoor Reality or augmented reality to create an immersive environment.

Social Wellness Communities. It’s a foregone conclusion that the fitness landscape is shifting toward a tech-enabled future. But that doesn’t signify the end of sweating in real life. Instead, like brick-and-mortar retailers in the age of Amazon, fitness providers will be forced to innovate on their offerings, experience, and value proposition.

In San Francisco, you’ll find The Assembly — co-working space that revolves around health and wellness, placing an emphasis on “sweat, work, and play.” Catering to the “modern outdoor enthusiast”, Gravity Haus is a social house and hotel located in the mountains of Breckenridge, Colorado. And in NYC, THE WELL, a “complete ecosystem for wellness” recently opened its 18,000-square-foot private, membership-based club.

An Emerging Ecosystem. Technology isn’t disrupting fitness, it’s redefining it. Instead of choosing between gyms and studios or on-demand content and connected equipment, the future of fitness will bring about a more complete ecosystem that provides users with options spanning the home, office, gym, studio, and hotel. This trend is already taking shape among the connected fitness competitors mentioned above — the majority of which already have footholds in the commercial fitness space.

Similarly, as the distribution of fitness content becomes ubiquitous across every device, the competition for talented instructors, distribution, and production value will usher in an era of “picks and shovels”, where service providers build the infrastructure, logistics, fulfillment, and software that supports the evolution of fitness.

As we detailed in last year’s Direct-to-Consumer Healthcare report, a new generation of startups is attempting to reinvent the trillion-dollar healthcare industry. From new-age clinics to mobile apps and at-home medical testing, the impact is already starting to be felt.

In 2019, women’s health and fertility treatments, erectile dysfunction and hair loss, and subscription-based vitamins gained traction in the form of funding and users. Looking ahead, 2020 will see us double-down on alternative healthcare, further blurring the lines between healthcare, self-care, and wellness.

Mental Health. Depression, loneliness, and anxiety are on the rise. Worse, stigmas related to mental health and a lack of access to care force many to suffer in silence. But now, driven in part by the wellness boom and technology startups, mental health is breaking into the mainstream.

- Over 40M Americans suffer from mental illness, including depression and anxiety.

- One in five people dealing with mental illness say their needs are going unmet.

- Left unchecked, the mental health crisis could cost the global economy $16T between 2010 and 2030.

In the US, there’s a shocking gap between demand (those in need of care) and supply (access to affordable care). More than 46M people report experiencing mental illness each year. Yet, there are only 28K psychiatrists in the US — a number that’s declining.

Individuals who are able to access care will wait an average of 25 days for an appointment. Even then, treatment is often expensive, with in-room therapy costing $150–$400 per session, plus the added cost of medication if necessary. Unsurprisingly, 45% of untreated individuals cite cost as a barrier.

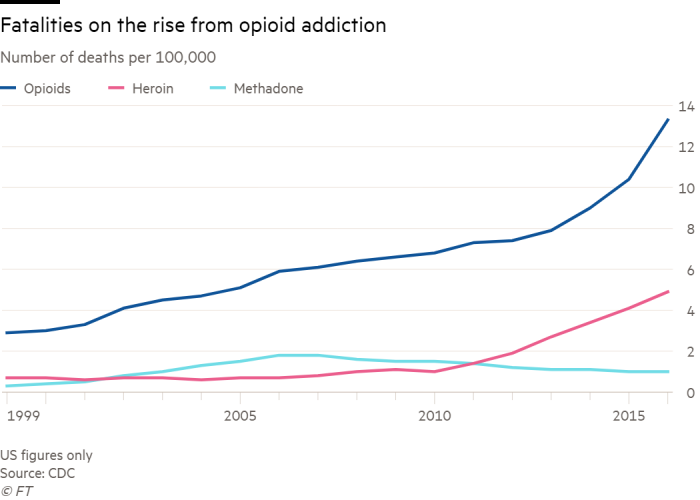

At a time when suicide rates are at an all-time high, 130 individuals die each day from opioid abuse, and one in eight Americans over the age of 12 are taking an antidepressant every day — it’s painfully clear that the current system is ill-equipped to address mental health.

But now, from meditation to artificial intelligence and hardware to telemedicine, mental health is getting a makeover.

- In 2018, 230+ mental health startups were funded, with $800M invested in the space.

- The behavioral and mental health software market is expected to reach $4.77B by 2026.

Across the sector, tech startups break out across six categories, including computerized cognitive behavioral therapy, telepsychiatry, consumer tools, applied artificial intelligence, provider tools, and hardware.

Among the more prominent players, Calm and Headspace have built billion-dollar businesses around cognitive behavior therapy. Two Chairs ($21M in funding) uses technology to match patients with therapists at on-site clinics. Meanwhile, Alma ($8M) is creating coworking for therapists. Still others, like Talkspace ($106M) and Lyra Health ($103M), are connecting patients and therapists digitally.

Addiction. Like mental health, individuals seeking treatment for addiction have been underserved and overlooked. As we’ve seen with other sectors of the healthcare industry, dissatisfaction with the traditional institution has given rise to tech startups and wellness-adjacent alternatives seeking to offer a solution. And in 2020, more attention will be paid to affecting change among individuals suffering from addiction.

- Between 1999 to 2017, more than 700,000 people died from drug overdoses, with 68% of deaths involving prescription or illicit opioids.

- The total economic burden of the opioid crisis in the US from 2015 to 2018 was at least $631B.

- The existing, flawed addiction treatment industry brings in $35B a year.

Zooming out: Two approaches for addressing addiction have begun to emerge. First, a wave of tech startups hopes to develop innovative solutions in the form of therapeutic apps, niche social networks, and smart devices that could assist with the administration of medication. At the same time, wellness-centric approaches like the therapeutic use of cannabis and psychedelics are gaining traction in the treatment of depression and addiction.

Tech Startups. According to a Rock Health report, digital solutions for addiction are relatively nascent, but a few approaches have started to take shape. In some cases, pharmaceutical drugs are used to alter neural pathways. Psychological methods like Cognitive Behavioral Therapy (CBT) and Acceptance and Commitment Therapy (ACT) are used to identify and change troubling thoughts and behaviors. Contingency management deploys tangible rewards to reinforce positive behaviors, like attending doctor appointments. And in-person or in-app social support is used to provide accountability during recovery.

Startups to watch: Marigold Health ($2.4M), Pear Therapeutics ($134M), DynamiCare Health ($5.1M), Chrono Therapeutics ($82.5M), Workit Health ($8M), WEconnect ($8.1M).

A Treatment Trip. With applications for mental health and the treatment of addiction, psychedelics are gaining traction. Although psychedelic drugs remain illegal, a number of recent developments have spurred a renaissance of sorts.

- With backing from Tim Ferriss, John Hopkins University recently launched a center for psychedelic drug research

- Clinical trials exploring psilocybin as a therapy for treatment-resistant depression, drug addiction, and other anxiety disorders are underway.

- The FDA granted “breakthrough therapy” designation to psilocybin to expedite the development and review process.

- Oakland, CA and Denver, CO have decriminalized hallucinogenic mushrooms.

Looking ahead, psychedelic drugs are being viewed as a means of healing, not a purely recreational pursuit. And therein lies the link to wellness culture. Once, yoga and meditation were seen as fringe spiritual pursuits. Then, over time, these practices were westernized and co-opted by the mainstream.

More recently, cannabis underwent a similar transformation. Initially seen as a harmful gateway drug, weed has become a pillar of the wellness movement. Now, psychedelic ceremonies are taking on spiritual significance as opportunities for growth and healing. And, as psychedelic-assisted therapy gains acceptance, trained “guides” are becoming wellness practitioners of sorts — helping people navigate a trip.

For context: For years, the Multidisciplinary Association for Psychedelic Studies (MAPS) has served as the leading nonprofit research and educational organization promoting the safe use of psychedelics. More recently, companies like Compass Pathways and Mindmed have undertaken an effort to turn psilocybin into a pharmaceutical product.

Despite some skepticism, more companies in the space have started to attract investment dollars. Able Partners, an early-stage investment firm focusing on positive living startups, backed Synthesis Retreat, a legal, medically supervised psilocybin retreat. And 2019 saw the launch of Field Trip Ventures, a Canadian venture capital fund planning to bankroll psychedelics research.

On-the-Radar. Senior care is an emerging wellness market that needs to be disrupted. According to an AARP report, in 2017, about 41M family caregivers in the United States provided an estimated 34B hours of care to an adult. The estimated economic value of their unpaid contributions was approximately $470B.

“People will spend more time and resources caring for their aging parents than they did raising their children.” — Jo Ann Jenkins, AARP CEO

As lifespans continue to increase, it’s imperative we begin to rethink aging. In doing so, a proactive focus on health and wellness, as well as a technology-enabled approach to care—including biosensing, wearables, and telemedicine—will begin to remake the senior care landscape.

In 2019, countless headlines hit on a common theme: society’s collective anxiety and burnout. Writing for The New York Times, Erin Griffith took on hustle culture. A few weeks prior, Buzzfeed ran a piece painting millennials as “the burnout generation”. Incredibly, the Internet’s response was almost unanimous — millennials don’t have a monopoly on burnout; we’re all exhausted.

Of course, our collective exhaustion coupled with anxiety, depression, and loneliness helps explain the rise of wellness. More specifically, yoga paved the way for meditation and other Eastern influences. Now, our quest to cure burnout will prop up new verticals.

Disconnected Fitness. If connected fitness is characterized by tech-enabled equipment and streaming content, disconnected fitness will create new self-care, beauty, and recovery-focused concepts to compete with traditional fitness formats.

Stretching, recovery, and meditation studios like StretchLab or MNDFL are only the beginning. The future of disconnected fitness looks a lot more like Remedy Place, a holistic health club, WTHN, a fresh take on acupuncture, and Chillhouse, a modern self-care studio. The infrared sauna at HigherDOSE, sensory deprivation tanks at Float Lab, and Fig.’s high-tech facial treatments aren’t anomalies, they’re indicative of what’s to come. With that in mind, we expect more places like Bathhouse to pop up, taking a cue from Scandinavian saunas, Russian banyas, and Turkish hammams.

Perfecting Performance. As a counterpoint to disconnecting, an alternative approach to confronting burnout focuses on optimizing performance. Part biohacking, part quantified self, and part longevity science, this trend is being exemplified by companies like WHOOP, Oura Ring, Eight Sleep, and Elysium Health.

According to WHOOP CEO Will Ahmed, human performance goes well beyond how strong or fast an athlete is. In fact, WHOOP’s mission to unlock human performance encompasses the interconnectivity of health, well-being, cognition, personal relationships, and sleep. Expanding on the point, Ahmed believes activity trackers miss the point. In his estimation, 2020 will prove that “sleep is the new steps.”

Instead of simply tracking activity, WHOOP measures Recovery, Strain, and Sleep metrics to determine “personal readiness to perform each day.” More specifically, by analyzing heart rate variability, resting heart rate, and quality of sleep, WHOOP provides users with a green, yellow, or red recovery score each day. And here’s where things get interesting.

Whether it’s professional athletes, venture capitalists, or weekend warriors, WHOOP users are posting screenshots of their personalized recovery score across social media. This humblebrag now ranks alongside sharing your Peloton leaderboard status or Headspace meditation streak among a demographic confronting burnout by asserting their willpower.

There’s no denying that plant-based meat alternatives are remaking our food system. But the plant-based food revolution is just getting started.

In 2019, the effort to replace animal protein reached a tipping point. As evidence, consider the two most prominent names in replacement meat — Beyond Meat and Impossible Foods. While the former went public and is valued at more than $5B, the latter is reported to be raising $300M to $400M in new funding at a $3B valuation. Now, countless food-tech startups have emerged and Big Food brands like Tyson, Nestlé, Unilever, and Kellogg have introduced plant-based meat options.

Peering into the future, A.T. Kearney estimates that by 2040, the conventional meat supply will drop by more than 33%. Look for a combination of plant-based, cultured (or lab-grown), and blended protein options to replace animal protein as we know it.

Beyond Beef. With the race to replace the all-beef burger underway, no animal product is safe from disruption. From fish and shrimp to chicken nuggets, milk, and ice cream, practically every product will get a plant-based makeover.

Carbon Neutral. Health concerns associated with eating meat and the environmental impact of animal agriculture have been a driving factor behind the alt-protein movement. But, there’s not unanimous buy-in. Instead of ditching animal protein completely, there’s growing support for more responsible farming techniques. As a result, in 2020, you can expect to hear a lot more about regenerative agriculture.

In short, regenerative agriculture is a farming technique that claims to sequester carbon and rehabilitate the ecosystem. This approach is foundational to Force of Nature, the new company from the founders of EPIC Provisions — the company known for its meat bars that was acquired by General Mills in 2016. Now, with Force of Nature, the husband-and-wife team of Taylor and Katie Collins hopes to “reclaim the legacy of meat.”

Waste Not. Around the world, 1.3B tons of edible food is thrown away each year. By 2025, this number is expected to increase to 2.2B. In the US, we waste 70% more food than we did in the 1970s. Heading into a new decade, government policies and food startups are turning their attention to addressing this problem.

While literal tons of food are thrown away each year, people around the world confront starvation and food security issues. Viewed through the lens of health and wellness, achieving optimal well-being is impossible if access to nutritious food is in question. With that in mind, the “wellness” industry should be far more concerned with access than adaptogens — and reducing food waste seems like a logical place to start.

Fortunately, in 2018, food waste startups raised more than $125M in funding to combat this growing issue. As this trend continues, “ugly” produce and upcycled ingredients will gain traction.

- Consolidation has been a topic of conversation across digital options and physical locations. But, Peerfit CEO Ed Buckley told us that 2020 will bring more of the same for fitness providers. By Buckley’s estimation, connected fitness isn’t cutting into the physical space just yet. And an unexpected consolidation could see someone like Google or Apple step in to steer fitness and healthcare going forward.

- Lisa Blau and Amanda Eilian of Able Partners shared their focus for 2020 with us, pointing to areas of stigma, like Addiction, Aging Women’s Health, Mental Health, and Sexual Wellness, as ripe for disruption.

- In 2019, Xponential Fitness concluded its roll-up and teased the idea of a multi-studio membership. Next, we’re predicting that 2020 will bring a public offering from this fitness conglomerate. And, in doing so, it will be interesting to see if the franchisor will be scrutinized like Peloton, where onlookers demand utilization numbers, not simply the total number of locations?

- In chatting with Jim Crowell, CEO of OPEX Fitness, the topic of corporate wellness prompted an interesting question: could Planet Fitness introduce its own insurance reimbursement in partnership with a healthcare provider?

- From rice to pizza crust and fried buffalo bites, cauliflower was the ingredient of 2019. This year, the three Cs will dominate: collagen, CBD, and chickpeas. These ingredients will become so ubiquitous that we’ll start to ask questions when they’re not in a product.

- Google’s acquisition of Fitbit and the secretive “Project Nightingale” raised new questions about the security of personal health data. In 2019, social media experienced significant techlash. But, as more mega-brands enter the healthcare space, health data could be next.

Finally, whether it’s connected fitness, plant-based foods, self-care Sunday, or boutique studios, the wellness economy is thriving. But, there’s a massive disconnect because well-being is waning. In the US, life expectancy has decreased for three consecutive years. By 2030, almost half of US adults will be considered obese. And 50% of Americans are likely to be diagnosed with a mental illness or disease in their lifetime. When will the time, money, and attention we pay to fitness and wellness result in any type of real change?