Erasing Stigmas: The New Wellness Playbook

A new playbook for health and wellness startups has taken hold. v1. As we previously outlined in The Wellness Lexicon, an entire category of wellness brands employed a similar playbook:

- Use functional ingredients to sell an aspirational outcome.

- Organize products into shoppable categories like Immunity, Sleep, or Beauty.

- Use a questionnaire to recommend personalized supplement protocols.

v2. Now, wellness upstarts have identified a new playbook: erasing cultural stigmas by normalizing highly personal or taboo topics like mental health and sexual wellness.

- Identify an underserved consumer, shift in culture, or niche audience.

- Develop a time-saving, private, vertically integrated distribution channel.

- Evangelize consumers, creating a flywheel and community of people “like me”.

How it works: Making consumers feel safe has become the first step in building a disruptive wellness brand. After solving for stigmas, brands follow up by doubling down on content and community centered on a shared experience. From there, it’s all about increasing access — achieved through building trust, personalization, affordability, and convenience.

The big picture: By erasing stigmas and increasing access, the new wellness playbook is empowering people to take care of themselves on their own terms. Looking closer, we identified seven categories being disrupted—Mental Health, Addiction & Recovery, Aging, Sexual Wellness, Women’s Health, Cannabis & Psychedelics, and Men’s Wellness—as well as the leading concepts tackling challenges and seizing opportunities associated with erasing stigmas.

Burnout, depression, and anxiety are on the rise. Worse, stigmas related to mental health and a lack of access to care forces many to suffer in silence.

- Over 40M Americans suffer from mental illness, including depression and anxiety.

- One in five people dealing with mental illness says their needs are going unmet.

- Left unchecked, the mental health crisis could cost the global economy $16T between 2010 and 2030.

But now, driven in part by the wellness boom and technology startups, mental health is breaking into the mainstream — thanks, in part, to tech startups.

- In 2019, funding for mental health startups reached $750M.

- Q1 2020 saw $462M invested in mental health through 30 transactions.

Across the sector, tech startups break out into six categories, including computerized cognitive behavioral therapy, telepsychiatry, consumer tools, applied artificial intelligence, provider tools, and hardware. Among the more prominent players, Calm and Headspace have built billion-dollar businesses around cognitive behavior therapy. Two Chairs ($21M in funding) uses technology to match patients with therapists at on-site clinics. Meanwhile, Alma ($12.5M) is creating coworking for therapists. Still others, like Talkspace ($106M) and Lyra Health ($178M), are connecting patients and therapists digitally. Read the full report: Confronting the Mental Health Crisis Listen to the podcast: Two Chairs CEO Alex Katz

A new generation of femtech startups is prioritizing women’s health and seizing a multi-billion-dollar market in the process.

“Women’s health has been under-researched, underdeveloped, and underfunded. But that’s starting to change.” – Elina Berglund, CEO of Natural Cycles

The sector is centered on fertility solutions, pregnancy and nursing care, menstrual care, and reproductive healthcare.

- The femtech market saw nearly $1B invested in 2019.

- The menopause market will reach $5.28B by 2023.

- The global fertility services market is expected to exceed $50B by 2025.

Women have become increasingly disappointed with and distrustful of a healthcare system that fails to address their needs. Now, instead of relying on the male-dominated healthcare industry, a new era of female entrepreneurs have taken it upon themselves to create the products and services they demand. Going forward, aging women’s health—including menopausal care—is garnering attention. The rationale is simple, by 2030, there will be more women between the ages of 40 and 64 than women under 18. Considering the fact that women make 70–80% of all consumer purchases and control 80% of all healthcare decisions, it’s no wonder that the menopause market, and women’s health in general, is gaining traction. Read the full report: The Women’s Health Revolution

Whether it’s self-care or healthcare, guys tend to be stubborn about seeking help. But as the definition of wellness broadens, men’s health is booming.

- Men’s personal care market is expected to hit $166B in 2022.

- 40% of men experience some degree of erectile dysfunction by age 40.

- Globally, the male infertility market is expected to reach $5B by 2027.

From ED to fertility treatment and hair loss to skincare, the list of brands tackling sensitive topics related to men’s well-being is growing. Chief among them, hims (with $197M in funding, valued north of $1B) and Roman ($176M raised) started with specific, highly stigmatized ailments before expanding into telemedicine and, in Roman’s case, a cloud pharmacy. Elsewhere, Dadi and Legacy are innovating on men’s fertility and sperm storage. Vault, a men’s health company offering in-home visits, recently raised $30M. And on Fitt Insider, we pointed out the potential in direct-to-consumer testosterone replacement therapy. Looking ahead, the category is wide open for further expansion. And the emerging opportunity centers on refining masculinity and dismantling gender boundaries.

We’re living longer than ever, but societal norms and institutions have not adapted to accommodate this shift. To date, the desire to stay young and the lack of attention paid to aging populations has created two diverging categories. On one hand, anti-aging startups are attempting to “cure” mortality.

- Investors sunk more than $850M into aging and longevity startups in 2018.

- The global anti-aging market is expected to exceed more than $271B by 2024.

On the other hand, senior care is a crisis in the making.

- The fastest-growing segment of the US population is between the ages of 85 and 94.

- By 2029, 54% of middle-income seniors will not have sufficient resources to pay for senior housing, plus the much-needed care provided.

As we grapple with our fears of growing old—and the resulting agism, lack of care, and loneliness—it’s imperative that we rethink aging beyond staying young or living forever. Because, as Andrew Carle, founding director of George Mason University’s program in senior housing administration, sees it, failing to do so isn’t an option:

“The rapidly aging worldwide population will affect us more than global warming, I think. It’s the seminal event of the 21st century.”

Read the full report: The Senior Care Crisis and The End of Aging

Until recently, sexual wellness was just plain awkward. Now, it’s gaining traction as part of the broader self-care movement.

- The global sexual wellness marketing is expected to reach $122B by 2026.

- Startups in the space include Sprout ($20M in funding), Unbound ($2.7M), Dipsea ($5.5M), Lover ($5M), Maude ($2.1M), and Dame (<$1M).

Cindy Gallop, the founder of Make Love Not Porn (MLNP), is aiming to raise $200M for a sextech fund called All The Sky. Gallop plans to invest in female-founded sextech ventures. Meanwhile, Intimate Capital touts itself as the “world’s only private equity fund dedicated to sexual wellness.” And Vice Ventures is targeting sextech companies within its broader thesis of conquering stigmas.

“The market never goes away. We’re all having sex. It’s recession-proof.” – Cindy Gallop, founder of MLNP

In the future, if sexual wellness companies are successful, Gallop thinks the industry can help normalize sex, promote good sexual values, combat rape culture, and potentially end sexual harassment and sexual violence. At the same time, Gallop is confident she can help build a “multi-trillion-dollar market” in the process.

For years, marijuana was considered to be a harmful gateway drug. Users were characterized as deviants. Worst case, they were at risk of being arrested, prosecuted, and jailed. But now, in the era of expanding legalization, cannabis has gained mainstream acceptance. The resulting “green boom” has spawned a billion-dollar industry.

- The global market for cannabis could reach $194B by 2025.

- In 2019, VCs invested $2.62B into 277 cannabis-related companies.

At the same time, weed has become a lucrative pillar of the wellness economy. Instead of catering to potheads, cannabis brands are targeting the self-care-seeking, anxiety-ridden, creative-minded wellness consumer.

“It’s not about recreation and intoxication anymore; it’s about wellness and natural solutions.” – Gunner Winston, CEO of dosist

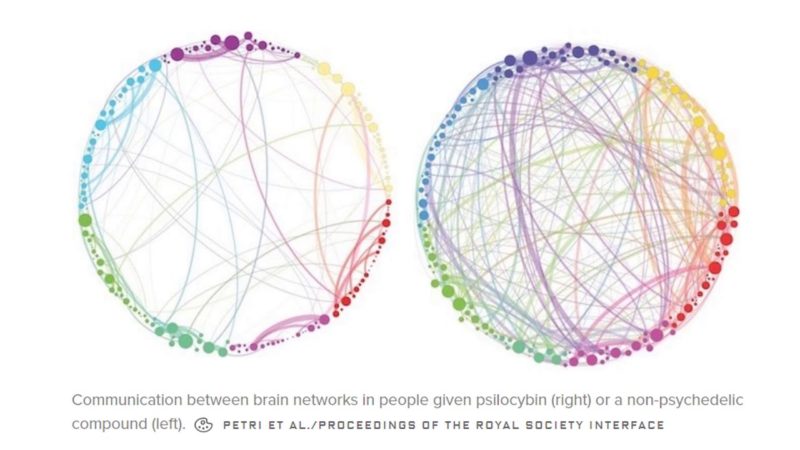

Similarly, with tie-ins to wellness culture and hopes of shedding its stigma, psychedelics are moving into the mainstream. With applications for mental health and the treatment of addiction, psychedelic drugs remain illegal, but a number of recent developments are forming a new narrative:

- With backing from Tim Ferriss, John Hopkins University recently launched a center for psychedelic drug research.

- Clinical trials exploring psilocybin, the psychoactive compound in “magic mushrooms”, as a therapy for treatment-resistant depression, drug addiction, and other anxiety disorders are underway.

- The FDA granted “breakthrough therapy” designation to psilocybin to expedite the development and review process.

- Oakland, CA and Denver, CO have decriminalized hallucinogenic mushrooms.

Now, psychedelic ceremonies are taking on spiritual significance as opportunities for growth and healing. And, as psychedelic-assisted therapy gains acceptance, trained “guides” are becoming wellness practitioners of sorts, tasked with helping people navigate their trip. For context: For years, the Multidisciplinary Association for Psychedelic Studies (MAPS) has served as the leading nonprofit research and educational organization promoting the safe use of psychedelics. More recently, companies like COMPASS Pathways and MindMed have undertaken an effort to turn psilocybin into a pharmaceutical product. Despite some skepticism, more companies in the space have started to attract investment dollars. Able Partners, an early-stage investment firm focusing on positive living startups, backed Synthesis, a legal, medically supervised psilocybin retreat. And 2019 saw the launch of Field Trip Ventures, a Canadian venture capital fund planning to bankroll psychedelics research. Read the full report: Weed is Wellness Listen to the podcast: Amanda Eilian and Lisa Blau of _able Partners

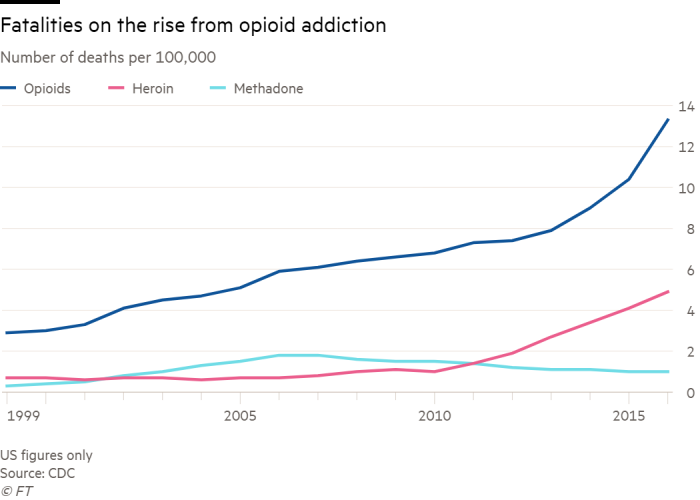

Like the other highly stigmatized categories we’ve covered, individuals seeking treatment for addiction have been underserved and overlooked. The fallout is similar as well — dissatisfaction with traditional healthcare institutions has given rise to tech startups and wellness-adjacent alternatives offering a solution. More than ever, attention must be paid to supporting individuals suffering from addiction.

- Between 1999 to 2017, more than 700,000 people died from drug overdoses, with 68% of deaths involving prescription or illicit opioids.

- The total economic burden of the opioid crisis in the US from 2015 to 2018 was at least $631B.

- The existing, flawed addiction treatment industry brings in $35B a year.

Two approaches to addressing addiction have begun to emerge. First, a wave of tech startups hopes to develop innovative solutions in the form of therapeutic apps, niche social networks, and smart devices that could assist with the administration of medication. At the same time, wellness-centric approaches like the therapeutic use of cannabis and psychedelics are gaining traction in the treatment of depression and addiction. According to Rock Health, digital solutions for addiction are relatively nascent, but a few approaches have started to take shape. In some cases, pharmaceutical drugs are used to alter neural pathways. Psychological methods like Cognitive Behavioral Therapy (CBT) and Acceptance and Commitment Therapy (ACT) are used to identify and change troubling thoughts and behaviors. Contingency management deploys tangible rewards to reinforce positive behaviors, like attending doctor appointments. And in-person or in-app social support is used to provide accountability during recovery. Startups to watch: Marigold Health ($2.4M in funding), Pear Therapeutics ($134M), DynamiCare Health ($5.1M), Chrono Therapeutics ($82.5M), Workit Health ($8M), WEConnect ($8.1M). On the wellness front, the effort to address addiction and recovery is most evident in the rise of sober culture. Health-conscious consumers are opting out of alcohol consumption. Instead, they’re touting their teetotalism on Instagram with hashtags like #mindfuldrinking and #dryjanuary.

- 66% of US millennials are trying to reduce their alcohol consumption.

- Gen Z is drinking at lower rates than previous generations.

In response to these developments, social media, apps, and in-person communities are forming around shared sobriety. Startups like Tempest and Loosid are creating new tools to help people get sober. Unlike Alcoholics Anonymous, a non-profit free to anyone willing to admit they have a drinking problem, new age apps aren’t altruistic detox programs. Tempest has raised $14M in venture funding for its tech-infused approach to recovery, one that’s not limited to addiction. Seeking to make “sober the new black”, Tempest also welcomes users who might just want to drink less. Similarly, Loosid is a sober community for individuals in recovery and health enthusiasts seeking to socialize without alcohol. Read the full report: Sober is the New Cool

With consumers embracing an expansive view of wellness—including good health, self-care, and pleasure—the perception of what’s off-limits has started to shift. Going a step further, and stemming from the shortcomings of the traditional healthcare system, individuals suffering from depression, addiction, or sensitive health issues are taking an any-means-necessary approach to cure what ails them. The result has seen highly stigmatized topics shed gain acceptance as founders, brands, and investors champion alternative paths to personal well-being.