15 Trends Redefining Fitness & Wellness

As 2019 comes to a close, we pored over a year’s worth of insights to identify the most impactful trends redefining fitness and wellness.

The result was a year-end review that serves as the perfect bookend to the 2019 Fitt Insider Outlook we shared at the start of the year.

With a new year on the horizon, we’re already a few weeks into working on the 2020 Outlook. But in the meantime, comparing and contrasting the 2019 Outlook with this recap sheds a spotlight on the most prominent developments while laying a foundation for what’s to come.

From mindfulness to sober culture and Peloton’s IPO to plant-based everything, here’s what’s trending.

Reinventing At-Home Fitness

For years, the at-home fitness space was devoid of innovation — a treadmill was a treadmill. The problem, of course, was that your cardio machine quickly turned into a drying rack.

Then in 2012, Peloton turned the direct-to-consumer fitness market upside-down. In the time since, as Peloton pulled ahead, a growing number of competitors have joined the race to reinvent the home gym.

Flash-forward to the present day and an entirely new category has emerged: say hello to connected fitness equipment.

>> Read the Connected Fitness report

The Future is Plant-Based

Meatless burgers may have put protein alternatives on the map, but beef is just the beginning. From fish to chicken and even pork, there’s a growing list of startups racing to replace meat as we know it.

- A recent Nielsen Homescan survey found that 39% of Americans are actively trying to eat more plant-based foods.

- A shift in consumer preferences is bolstering plant-based meat sales, which could increase by 1,000% in the next decade to reach $140B, according to investment firm Barclays.

Meanwhile, this plant-based coup isn’t isolated to just animal protein — the dairy industry is also under siege. Milk, yogurt, cheese, ice cream… You name it, and there’s an incredibly well-funded startup seeking to make dairy obsolete.

>> Read the Plant-based Everything report

The End of Aging

Backed by billions in funding, anti-aging startups are seeking to stave off mortality.

- According to CB Insights, investors sunk more than $850M into aging and longevity startups in 2018.

- The global anti-aging market is expected to exceed more than $271B by 2024

As one paper concluded, healthspan extension companies are “risky and most likely to fail.” Still, the lure of living forever is too strong to subdue the ambitions of entrepreneurs, scientists, and billionaires committed to finding the proverbial fountain of youth.

>> Read the Anti-aging report

The Big Business of Sleep

If the headlines are true, we’re living in the age of anxiety. Beset by burnout, wellness has emerged as the antidote to modern times. And now, more than ever, a good night’s sleep is critical to any self-care routine.

- Humans spend about one-third of their lives sleeping.

- Sleep deprivation costs the US $411B of lost productivity each year.

- The global market for sleep aids is expected to reach $101.9B by 2023.

Bragging about pulling an all-nighter has been replaced by tracking your sleep with wearables like an Oura ring, Apple Watch, or WHOOP band. As a result, selling sleep has become a billion-dollar business.

>> Read the Business of Sleep report

Weed is Wellness

Instead of catering to potheads, there’s a contingent of cannabis brands targeting the self-care-seeking, anxiety-ridden, creative-minded wellness consumer.

“There is an evolution of looking at marijuana… from being about getting stoned to actually thinking of it as a wellness product.” — Linda Gilbert, BDS Analytics

If early indications hold, “weed as wellness” will help cannabis achieve mainstream acceptance while forming a lucrative pillar of the billion-dollar cannabis industry.

>> Read the Cannabis report

Wellness Industrial Complex

Wellness, they say, is a journey. Unlike health, which is the state of being free from illness, wellness is more abstract. It’s a process, a pursuit, and, increasingly, an ideal.

“The future of the wellness industrial complex will be defined by celebrity influence perpetuated on social platforms.”

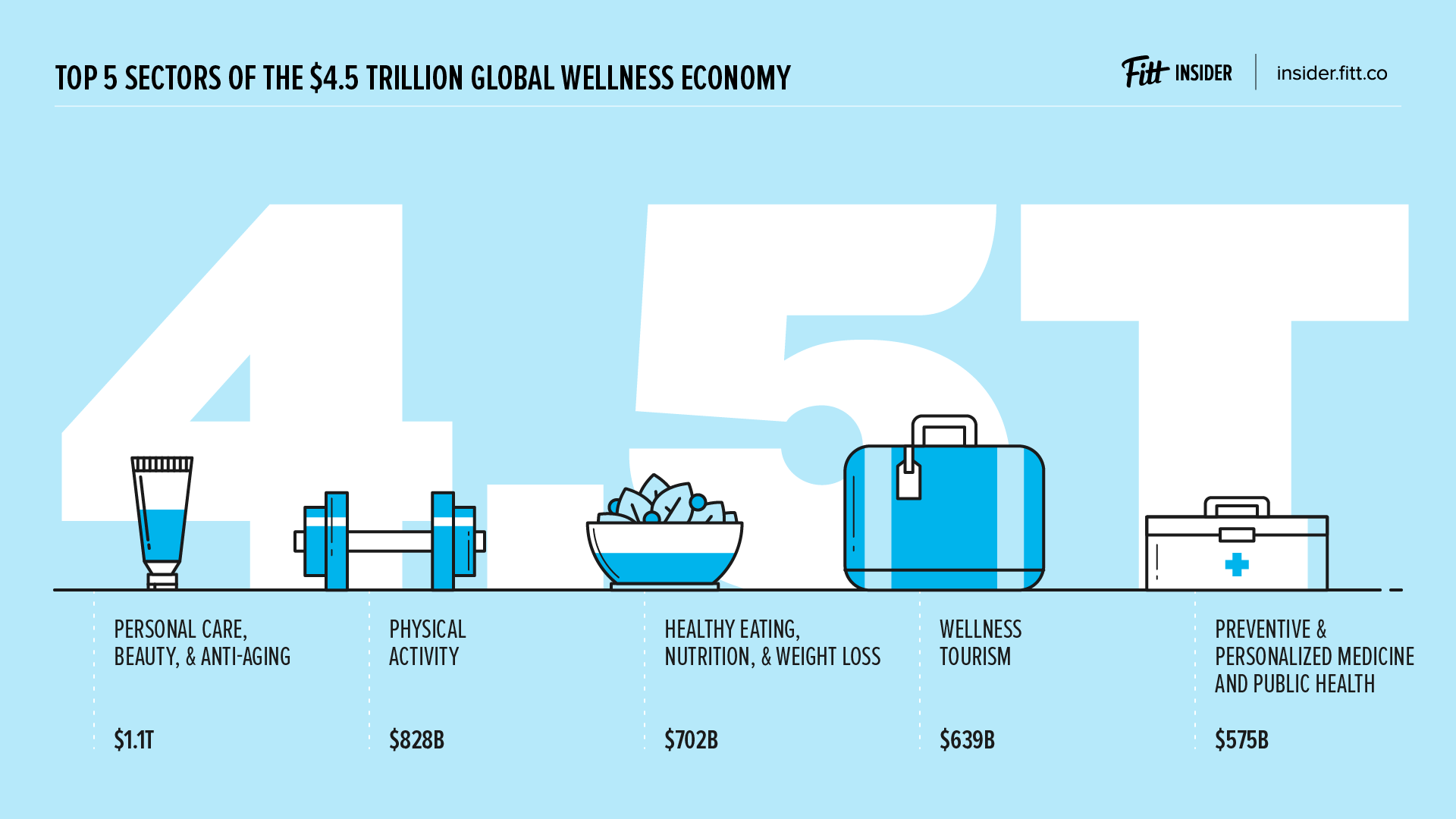

Nowadays, that belief is a byproduct of the wellness industrial complex — a mesmerizing combination of medicine, magic, and marketing that has turned wellness, in all its forms, into a $4.5T behemoth.

>> Explore the Wellness Industrial Complex

Fitness Real Estate

With big-box stores struggling to stay relevant during a time when iconic brands like Sears declare bankruptcy, the fallout from a retail apocalypse is creating a world of opportunity for fitness providers.

- Since 2013, the amount of square footage leased by gyms and fitness centers in malls has grown 70%, according to CoStar Group.

- In 2017, Planet Fitness leased more new square footage in US malls than anyone else.

- Planet Fitness sees vacant malls and empty big-box stores as being central to their growth. The same goes for Life Time, Gold’s Gym, and Equinox’s Blink Fitness.

From budget gyms and boutique studios to high-end health clubs, fitness is filling the void left by brick-and-mortar retailers.

>> Read the Fitness Real Estate report

The End of Food?

Fueled by busy and health-conscious consumers seeking convenience and nutrition, the meal replacement market is forecast to reach $20.6B by 2021. In an attempt to appeal to the modern, on-the-go consumer, powdered or ready-to-drink shakes are popping up everywhere.

- Soylent has raised $74.5M from prominent investors like GV, Lerer Hippeau, and Andreessen Horowitz.

- Huel has sold 50M meals globally, with an annual growth rate of 150%.

- Ample raised over $4M from investors and another $774K in equity crowdfunding, boasting a 150% monthly growth rate for Amazon-based revenue.

While each brand is ultimately focused on convenience, their products vary to include keto-friendly, vegan, protein-packed, or soy-based formulas. But these brands aren’t all that dissimilar — they all seem to embrace clean-label ingredients and online DTC sales.

>> Read the End of Food report

DTC Healthcare

A new generation of startups is disrupting healthcare, seizing a trillion-dollar market in the process.

From new-age clinics and mobile apps to wearables and DTC medical testing, there’s a growing number of companies working to alleviate the numerous pain points associated with healthcare.

As costs skyrocketed, the overall customer experience has suffered, lacking personalization and transparency while becoming increasingly inconvenient. Now, a convergence of factors makes this the perfect moment to reimagine healthcare.

>> Read the DTC Healthcare report

The Netflix of Fitness

Every new innovation in at-home or on-demand exercise is referred to as the “Netflix of fitness”, threatening traditional gyms and studios everywhere.

Whether it’s streaming services, voice-led workouts, or tech-enabled exercise equipment, there’s no denying the shift taking place in the fitness space. But it’s reductive to position every advancement in fitness technology as a Netflix-like disruptor set to decimate big-box gyms and boutique studios.

How will studios reinvent the exerciser’s experience, what new technologies will emerge, and will any of these developments improve access or adherence to physical fitness?

>> Read the Netflix of Fitness report

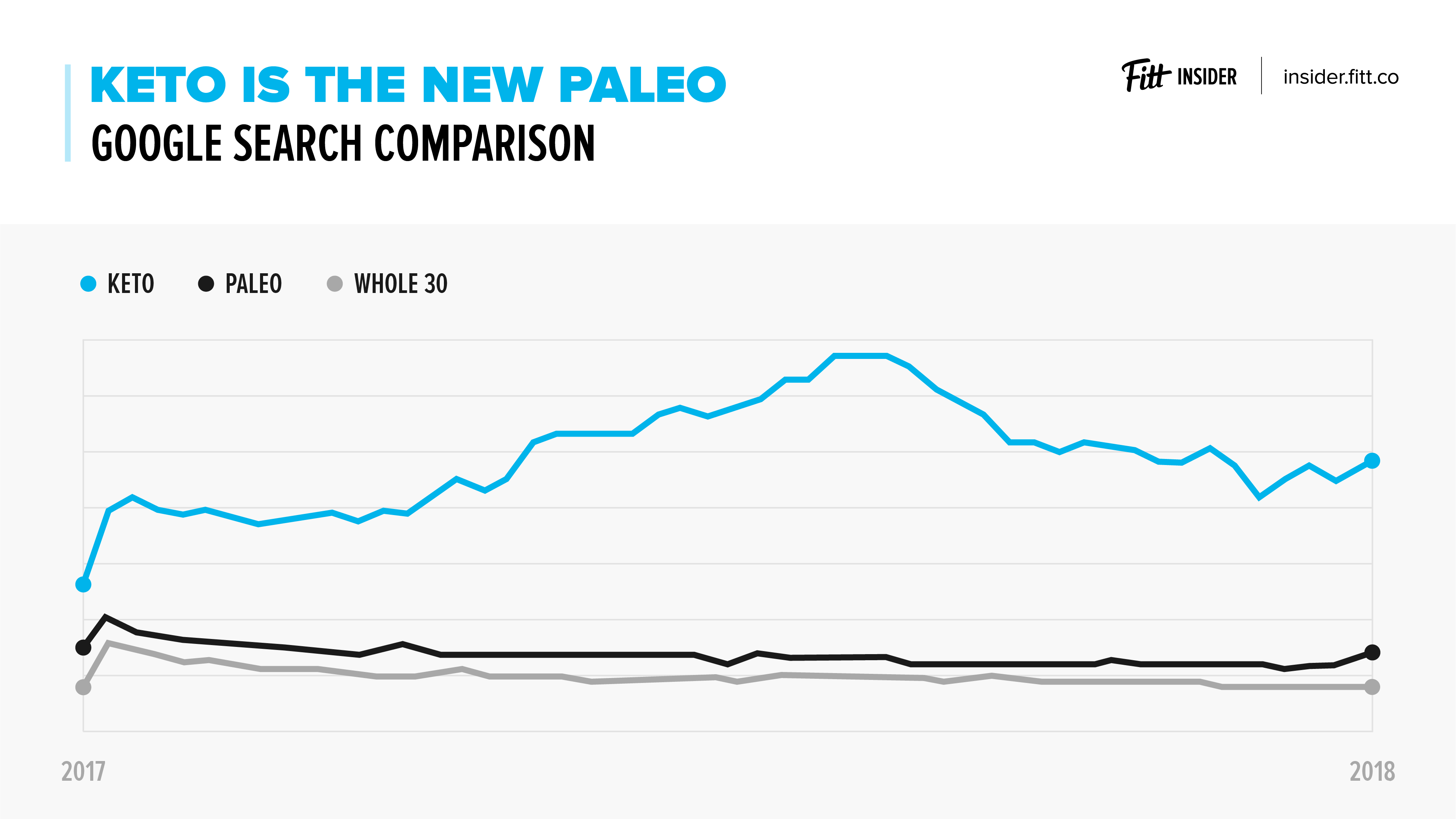

The Keto Gold Rush

With Chipotle announcing their keto-friendly menu and SlimFast hawking their take on a keto shake, there’s no denying the mainstream appeal of this fat-first diet.

- The market for medium-chain triglycerides or MCTs is expected to reach $2.5B by 2025.

- Sales of grass-fed butter rose 45% in 2018 as global butter sales expanded to $19.4B.

- Some estimates expect the global keto diet market to reach $366B by 2022.

But taking a step back, it’s worth exploring how this diet, initially conceived as a treatment for epilepsy, overtook paleo and Whole30 as Google’s most-searched diet term of 2018.

>> Read the entire Keto Gold Rush report

The New Wellness Consumer

Generation Z is doubling down on the wellness lifestyle — exercising more, eating well, and prioritizing mental health and sleep.

- 72% of Gen Zers say managing stress and mental health is their most important health and wellness concern.

- More than 80% have a sense of spirituality and believe in cosmic power.

- 87% of Gen Z reported exercising three or more times per week, with 43% working out at home, 65% using fitness apps, and 28% using wearable tech.

>> Read the Gen Z Wellness report

Mindfulness

Mainstream mindfulness: the business of mindfulness is fast becoming a pillar of the $4.5T wellness industry.

- The US meditation industry is now worth $1B, according to IBISWorld.

- By 2024, the alternative healthcare industry—including meditation, acupuncture, breathing exercises, yoga and Tai Chi, and chiropractic services—will be worth $19.9B.

- Meditation and mindfulness are the fastest-growing health trends in America, with nearly 40% of people reporting weekly meditation and breathwork sessions.

>> Read the Meditation & Mindfulness report

Sober Is The New Cool

From spiked kombucha and functional beer to alt-drinks and the rise of teetotalism, Big Alcohol is under siege from health-conscious consumers and upstart brands alike.

- 70% of millennials would rather brag about not consuming alcohol than being drunk.

- Between 2015 and 2018, US alcohol consumption declined three straight years, with beer consumption down five consecutive years.

- The global market for nonalcoholic wine and beer is estimated to reach $30B by 2025.

>> Read the Rise of Sober Culture report

Peak Wellness

New research from the Global Wellness Institute (GWI) valued the worldwide wellness industry at a record high of $4.5 trillion-with-a-“T”. From physical activity to anti-aging and personalized medicine to tourism, the report makes it clear: wellness is infiltrating every aspect of our lives.

But when everything is wellness, nothing is wellness. As this fact becomes more clear, the unbundling of wellness will see top-tier brands disassociate with the broader industry. Instead, they’ll evangelize their customers around a specific lifestyle, not a catch-all definition.

>> Read the Peak Wellness report

For more, subscribe to our weekly newsletter on the business of fitness and wellness.