Insider No. 65: The Impact of On-demand Fitness

On-demand options are shaking up the fitness industry. And now, we’re starting to see just how disruptive streaming content, connected equipment, and fitness apps can be.

Far from a fad, fitness has boomed along with the lucrative wellness economy. But on a finer level, a study of consumer purchasing habits in 2019 reveals a clear shift in spending.

- Gyms like Planet Fitness attracted 72% of total spending, boutique studios made up 22%, and on-demand options—from Beachbody to Peloton—accounted for just 6% of total fitness spending.

- While spending across gyms and studios grew about 5%, on-demand fitness spending jumped ~59%.

- Since 2017, on-demand fitness spending is up 128% while traditional gyms grew just 6%.

Going Deeper: To date, onlookers have leaned on anecdotes like “The Netflix of Fitness” to explain the evolution of the space. But, as the category matures, quantifying the impact of on-demand fitness is helping to make sense of the broader shift.

For starters, consumers aren’t just spending more on fitness apps; they’re hanging onto their digital subscription longer than a traditional gym membership.

Behind the scenes. The fitness industry is built on breakage — the idea that people sign up for a membership they’ll never use. And, considering the fact that gyms lose 30–50% of their members each year, attrition is a huge hurdle for operators and fitness-seekers alike.

So, it’s not surprising to learn that by fall 2019, traditional gyms and studios lost more than three-fourths of the customers who joined in January. Meanwhile, over the same period, on-demand fitness apps retained nearly half of the users who signed up to start the year.

Of note, these numbers don’t tell us who actually stuck to their workout habit, just who was still paying for it.

Selling Sweat

Speaking of spending, on-demand fitness is proving to be less expensive than other options.

While boutique fitness-goers spend about $136 per month and gym members spend $59, digital fitness users spend about $48 per month. Said differently, studio-goers spend almost double what on-demand subscribers pay.

But price is only one piece of the puzzle. If the experience and high-end amenities are central to the boutique fitness value proposition, access and convenience differentiate on-demand options.

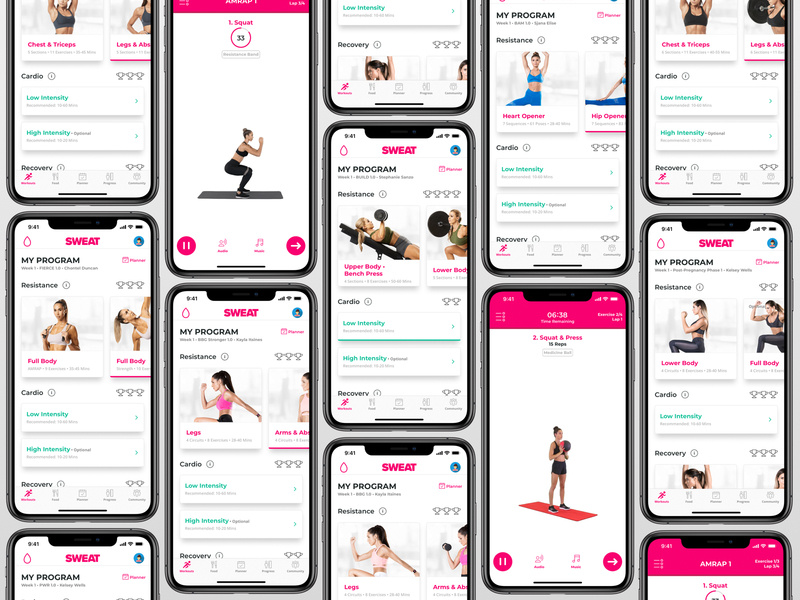

From Aaptiv to Fitbod and SWEAT to Freeletics, users willing to pay $10–20/month can work out wherever and whenever they’d like. Added perks like personalized coaching and nutrition resources sweeten the deal. Not to mention the fact that, unlike a traditional gym where you’re on your own, these apps are engineered for engagement and optimized for results.

Case Study: Peloton vs. SoulCycle

While earlier reports suggested that boycotts stemming from a pro-Trump fundraiser hurt SoulCycle’s ridership, new data points to Peloton as the real thorn in Soul’s side.

According to Earnest Research, SoulCycle experienced a 30% drop in US sales between the last week of December and the first weeks of January — it’s biggest year-over-year sales declines on record.

Meanwhile, as we learned in last week’s Q2 earnings call, Peloton reached 712K connected fitness subscribers, up 96% year-over-year. Now, the company expects to end the year with more than 900K connected fitness subscribers and revenue north of $1.5B.

Making matters worse for SoulCycle, more and more of its riders are taking Peloton for a spin. As of December, 9% of SoulCycle customers made a purchase with Peloton during the previous six months. On the flip side, just 2% of Peloton customers transacted with Soul during that same timeframe.

Punchline: far from definitive, this data does demonstrate just how receptive studio-goers can be to connected and on-demand options. As the list of digital offerings grows and category leaders like Peloton convert more defectors, it’s not hard to see how digital offerings are continuing to capture market share.

Looking ahead. Of course, chipping away at market share is different than the all-out collapse of sweating in real life. In reality, the evolution of the fitness landscape is creating more opportunity, not less. And going forward, that opportunity will prove to be more fragmented than ever before.

🚲 Beyond Bootcamp

Amid rumors that it’s up for sale, the boutique fitness operator previously known as Barry’s Bootcamp dropped “bootcamp” from its name and announced plans for an indoor cycling studio.

The news: Barry’s will open two cycling studios on Feb. 18 — one in New York City and one in Los Angeles, both near existing Barry’s locations.

Zooming out. According to Bloomberg, the company has already interviewed advisors to participate in a sale process.

- The deal could see Barry’s valued at more than $700M.

- Barry’s has 70 studios open or in development across the US and internationally.

- Barry’s is majority-owned by North Castle Partners, a private equity firm with investments in the fitness space including SLT, Brooklyn Boulders, Crunch Fitness, Equinox, and others.

Looking ahead. As Xponential Fitness and F45 Training prepare to go public, and with Orangetheory Fitness on a similar trajectory, Barry’s is leveraging the strength of its brand to diversify. With the Barry’s name swap and cycling studios in place, new concepts could build on their existing Release, a dynamic stretching class, and Lift, a weightlifting concept, to further bolster the company’s value.

🤔 Lose, lose?

Grab a coffee and pull up a seat. This 6,000-word deep dive into ClassPass’s impact on the boutique fitness scene is worth reading.

Over the years, ClassPass has reshuffled its business model and endured a down round while alienating studios and subscribers on both sides of its marketplace. Along the way, there have been plenty of questions about whether or not their model was sustainable.

- In theory. ClassPass users get discounts on fitness classes, studios get new customers, and the company takes a cut.

- In practice. Studios have seen their piece of the pie shrink, users are hooked on artificially low prices, and ClassPass has become a powerful middleman.

According to ClassPass: dissatisfied studios represent a small minority of its 30,000-plus partners. And CEO Fritz Lanman told VICE his company’s model is “as friendly as you can imagine.” But that’s of little consolation to operators who see ClassPass as devaluing boutique fitness and creating a race to the bottom.

Punchline. This newly-minted unicorn has to find a path to sustainability, profitability, and/or liquidity for its investors. How ClassPass gets there and whether or not it will come at the expense of studio owners (and the broader industry) is the real billion-dollar question.

📰 News & Notes

- Why consumer-driven healthcare will fail.

- There are a lot of lab-grown meat companies.

- Consumer DNA testing companies come crashing down.

- Reality check: By 2023, nearly 1 in 2 adults will be obese.

- Modern Fertility launches My Plan, a fertility planning tool.

- Former SoulCycle CEO Melanie Whelan joins Summit Partners.

- BOLO for RE:UNION Training, a new concept from F45 co-founder Luke Istomin.

💰 Money Moves

- Equinox secured new funding from private equity firm Silver Lake. Per Bloomberg, the investment will be used to build Equinox’s digital platform and add as many as 50 locations annually.

- Global private equity firm Advent International is rolling up studio management software, indicating their intent to compete in the space. In recent months, Advent has acquired Mariana Tek, zingfit, and TRIIB.

- Alpha Foods, maker of plant-based foods, raised $28M in Series A funding.

- BRAVO SIERRA, a “military-native performance wellness company”, secured $12M in funding.

- On-demand fitness app FitOn raised $7M in new funding.

- NURVV, a London, UK-based sports wearable biomechanics startup, raised $9M in Series A funding.

- PepsiCo-backed Yofix, an Israeli plant-based yogurt company, closed a $2.5M investment.

- Andreessen Horowitz raised $750M for its third bio fund, focused on products and companies at the intersection of tech, biotech, and healthcare.

- Personalized healthy meals platform KAIGO secured $3M in a seed funding round that included Mike Lee, founder of MyFitnessPal, and Micromanagement Ventures.

- Verde Farms, a provider of grass-fed beef, secured a $15M investment from private equity firm Manna Tree Partners.