Issue No. 136: Apple’s Plan to Reimagine Healthcare

Courtney Powell

Courtney Powell

Apple chief executive Tim Cook has his sights set on transforming health for all mankind.

For now, the company’s plan to reimagine healthcare remains a work in progress.

Codename: Casper

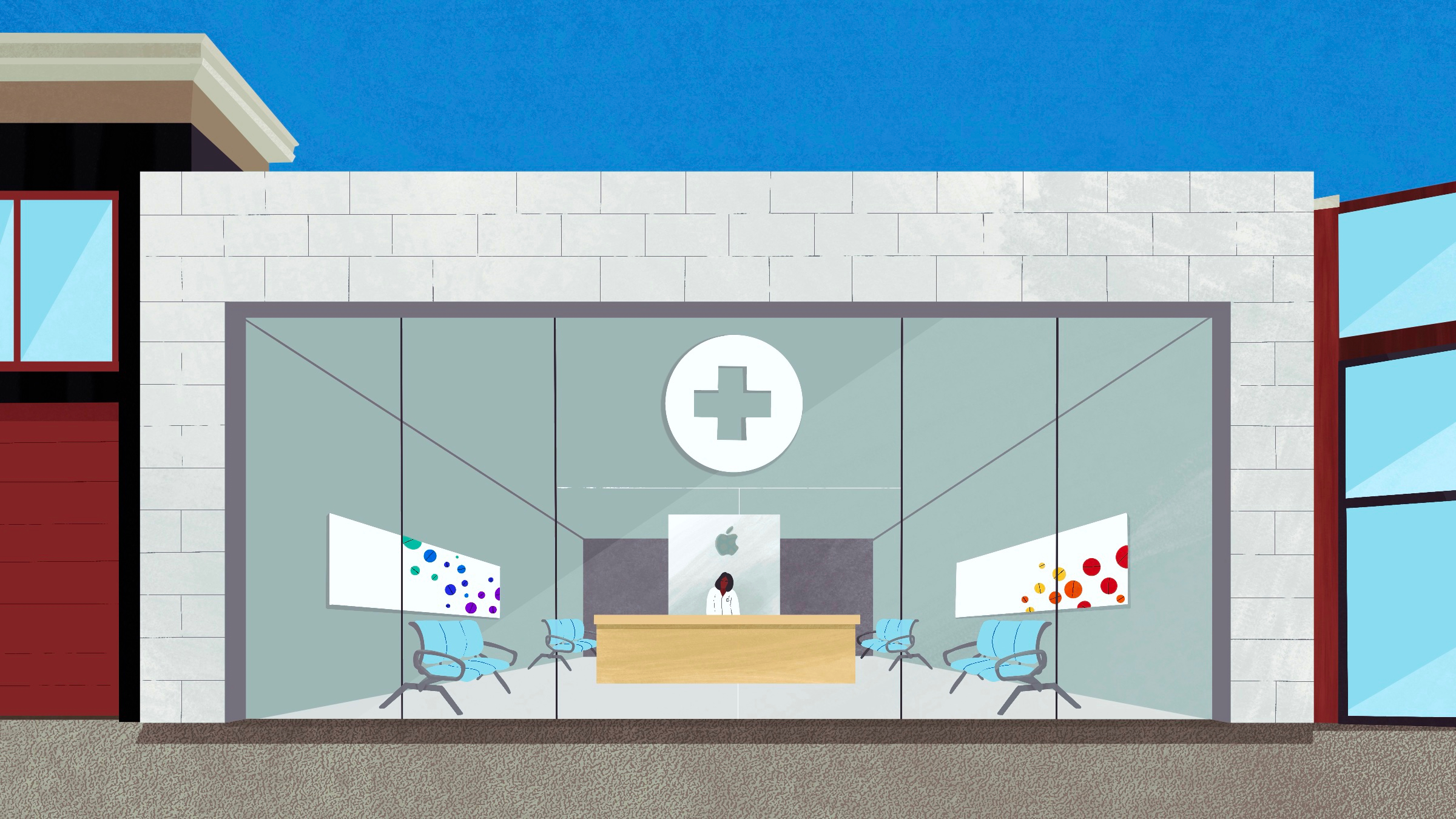

Picture an Apple Store. But, instead of a regular retail location, it’s a souped-up doctor’s office.

Inside, sensors know when a visitor arrives. The patient’s Apple Watch data automatically syncs with the doctor’s iPad. And any follow-up information, including real-time messaging, is available via an iPhone app.

In an effort to make this vision a reality, Apple has been quietly piloting a primary care service — complete with its own doctors and clinics.

According to the WSJ, the healthcare initiative, codename Casper, saw the tech giant hire clinicians, engineers, and product designers in hopes of creating a subscription-based personalized health program.

Combining remote monitoring and telehealth services (powered by an Apple Watch) with in-person visits, the tech giant aims to create a new healthcare paradigm.

After validating the concept, Apple envisioned licensing its model to health systems and, possibly, countries.

The catch? So far, Casper has struggled to move past a preliminary stage.

Think Big

A nature lover and fitness nut, Apple CEO Tim Cook has never been shy about his desire to revolutionize well-being.

Making his ambitions known on multiple occasions, Cook has said:

“I really believe that if you zoom out to the future and then look back and ask, ‘What has Apple’s greatest contribution been?’ it will be in the health and wellness area.”

Speaking to Outside, Cook—an exercise devotee—said he’s “off-grid” when working out, adding: “I am religious about doing that regardless of what’s going on at the time.”

Of course, consumer health isn’t Cook’s pet project. It’s Apple’s wedge into the trillion-dollar healthcare market.

- This year, US healthcare spending will top $4T, jumping to $6.9T by 2028.

- Analysts estimate Apple could earn $15B from health services in 2021, with the potential to reach $300B by 2027.

Pursuing this opportunity, Apple COO Jeff Williams, who oversees the health team, encouraged employees to think big. As the WSJ put it, Williams said:

“Apple should disrupt what he called the ‘363’ and ‘break fix’ model of care in the U.S., where patients may not see their doctors 363 days a year and only visit when something goes wrong.”

Although work continues, the WSJ said Apple’s attempts to disrupt healthcare have “largely stalled,” leading the company to refocus its health unit on selling devices like the Apple Watch.

The Future of Health

Although Apple hasn’t succeeded in solving the primary care formula, they have made great strides in the health arena.

Like other segments of its business, Apple has three focus areas within health: hardware (mainly the Apple Watch), software (including the Health App, CareKit, and ResearchKit), and services (like Fitness+, a digital workout subscription).

Earlier this year, ahead of debuting the Watch Series 6, Apple declared the future of health is on your wrist. Initially labeled a flop, Apple Watch is the global smartwatch leader — capturing a third of the market.

As Cook sees it, beyond activity tracking, the device empowers the “individual to manage their health.” Soon, Apple could become an interface between doctor and patient. In fact, the company’s newly announced “Sharing” feature enables access for a doctor or loved one.

Bulking up its health offerings, future Apple Watch models are expected to include body temperature and non-invasive blood glucose sensors.

Another upgrade, with the addition of motion sensors, AirPods are set to become Apple’s newest fitness tracking wearable. Paired with patents the company holds related to exercise guidance and pose-detecting earbuds, Fitness+ could get much more personalized.

Asked about the potential for health-focused AirPods, Apple VP of technology Kevin Lynch said: “We already do sensor fusion across some devices today, and I think there’s all kinds of potential here.”

Full Circle

When discussing Apple’s foray into fitness, Tim Cook explained:

“In a way, we’ve been in this business of coaching… If you go into a retail store, the thing you’re most likely to be looking for is help—to create something, to learn something. Fitness+ is taking that personal touch into the wellness space.”

Expanding on that idea, whether it’s wearables, telehealth services, or primary care, Apple is intent on extending that personal touch into healthcare.

A massive undertaking, along the way, Apple will run up against stiff competition from Big Tech foes like Amazon, retailers like Walmart, and a growing list of digital health startups pursuing the same personalized approach.

🏆 MasterClass for Sports

What do you get when you combine EdTech and sports performance?

On the Fitt Insider podcast. The Skills founder and CEO Omer Atesmen joined us to share his plan for building the definitive education platform in the sports and wellness space.

We cover: How the company partnered with athletes like Michael Phelps, Maria Sharapova, and Megan Rapinoe. The challenges and opportunities in scaling content. And the success of mindset and leadership courses.

Listen to this episode here.

💼 Peloton Enters Corporate Wellness

Connected fitness frontrunner Peloton is partnering with employers to provide exclusive offers on its digital content and popular equipment.

In addition to employer-subsidized perks, corporate partners gain access to enterprise features for encouraging engagement and measuring usage. Peloton will also work with employers to outfit onsite fitness spaces.

According to Peloton president William Lynch, the program could become one of its biggest growth channels.

B2B fitness. On its new corporate website, Peloton checks all the boxes employers want to see, emphasizing worker engagement, productivity, and community-building.

So far, Peloton has piloted the initiative with Accenture Interactive, Samsung, Nasdaq, and SAP, among others.

Well-timed for the return of offices, companies could incentivize employees with Peloton’s new program — attracting new hires, luring existing workers to HQ, or bolstering remote work benefits.

The big picture: As we detailed in Issue No. 120, WFH Wellness, employee well-being programs are being reimagined for the future of work.

- In 2019, 88% of US employers with 200+ workers offered a wellness program.

- The US employee wellness industry was worth $8B in 2019.

- Globally, this number is expected to top $94B by 2026.

With user acquisition and revenue growth as the goal, partnering with employers is big business for health and fitness brands like Peloton. The caveat: corporate wellness programs rarely move the needle on healthcare costs or behavior change.

Next up? Peloton is poised to enter the wearables market. According to Bloomberg, the company is developing a heart rate tracking armband to measure workout intensity.

🧠 A $50K Fitbit For Your Brain

Neural tech company Kernel has developed a $50K brain-tracking helmet. Years in the making, orders will soon be fulfilled.

What it is: Kernel aims to make non-invasive brain recording technology widely accessible. To that end, the company developed two sensor-packed helmets, known as Flux and Flow, capable of analyzing the brain in real time.

- Flux detects magnetic fields generated by collective neural activity (magnetic flux).

- Flow detects cortical hemodynamics, representative of neural activity (blood flow).

Why it’s interesting: From steps to sleep and heart rate to blood glucose, we use countless gadgets to quantify our health. Decoding the brain, Kernel hopes to add its mind-reading helmet to the list.

Kernel founder and CEO Bryan Johnson said, by 2030, the cost of his company’s tech will compare to that of a smartphone, making it possible for every American household to own a brain-sensing helmet.

Prior to Kernel, Johnson founded payments platform Braintree. In 2013, he sold the company to PayPal for $800M. In 2015, Johnson started Kernel. Early on, some 200+ investors passed, leading him to invest $50M of his own money. Last year, General Catalyst led a $53M funding round.

From aging to mental health and high performance, Johnson views Kernel as a great unlock, adding: “To make progress on all the fronts that we need to as a society, we have to bring the brain online.”

The big picture: A trend we detailed in Issue No. 123, Connected Mindfulness, the brain + body connection is poised for a high-tech breakthrough.

- Brain health disorders account for $3T of lost productivity every year.

- The global brain-computer interface market could reach $3.7B by 2027.

- The global neurotechnology market is expected to cross $19B by 2026.

As Kernel scales its non-invasive helmet technology, the idea of implanted brain-computer interfaces, à la Elon Musk’s Neuralink, doesn’t seem all that far-fetched.

📰 News & Notes

- Madhappy x Vans.

- Venrock’s 2021 healthcare report.

- Boutique fitness brand F45 Training is going public.

- Recovery tech company Hyperice inks esports deal.

- Gym visits rebound, approaching pre-pandemic levels.

- Glucose monitoring a “waste of time” for nondiabetics?

- Better-for-you restaurant chain Sweetgreen files for IPO.

- Roundup: Cool health and fitness jobs from our network.

- Facebook’s Zuckerberg: Peloton-like VR fitness is coming.

💰 Money Moves

- MyYogaTeacher, an on-demand yoga platform, raised $3M in seed funding.

More from Fitt Insider: Arming the Rebels - Beachbody made a minority investment in Feed Media Group, the company behind Feed.fm, a B2B music licensing service.

More from Fitt Insider: Music as a Moat - Peter Thiel-backed psychedelic startup Atai Life Sciences made its stock market debut.

More from Fitt Insider: The ’Shroom Boom - Stork Club, a maternity care platform, raised $30M in Series A funding led by General Catalyst.

- Kindra, a wellness brand for menopause essentials, closed a $4.5M funding round.

More from Fitt Insider: Femtech 2.0 - Connected coaching startup asensei added $2.2M in seed funding led by KB Partners.

More from Fitt Insider: Software Eats Fitness - Form Health, a medically supervised weight loss program, landed $12M in Series A funding led by M13.

- Motif FoodWorks, a plant-based food tech company, raised $226M in Series B funding.

More from Fitt Insider: Meat vs. “Meat” - DUOS, a personal assistance platform for older adults, raised $6M in seed funding from Redesign Health and Forerunner Ventures.

More from Fitt Insider: The Senior Care Crisis - French startup Mediflash, a freelance marketplace for healthcare professionals, closed a $2M funding round led by firstminute Capital.

- UK-based Hertility Health, a women’s hormonal and reproductive health startup, announced a €4.8M ($5.7M) seed investment.

- Animal-free dairy startup Change Foods secured a $2.1M seed investment.

More from Fitt Insider: The Quest for Cow-Free Milk - Brightline, a mental health platform for children, raised a $72M Series B round led by GV (formerly Google Ventures).

- RIND, makers of functional and sustainable whole fruit snacks, closed a $6.1M Series A round led by Valor Siren Ventures.

- Mental health startup Ksana Health has received $2M in seed funding led by re:Mind Capital.