Issue No. 149: Investor Insights, Sports Tech Edition

Illustration: Courtney Powell

Illustration: Courtney Powell

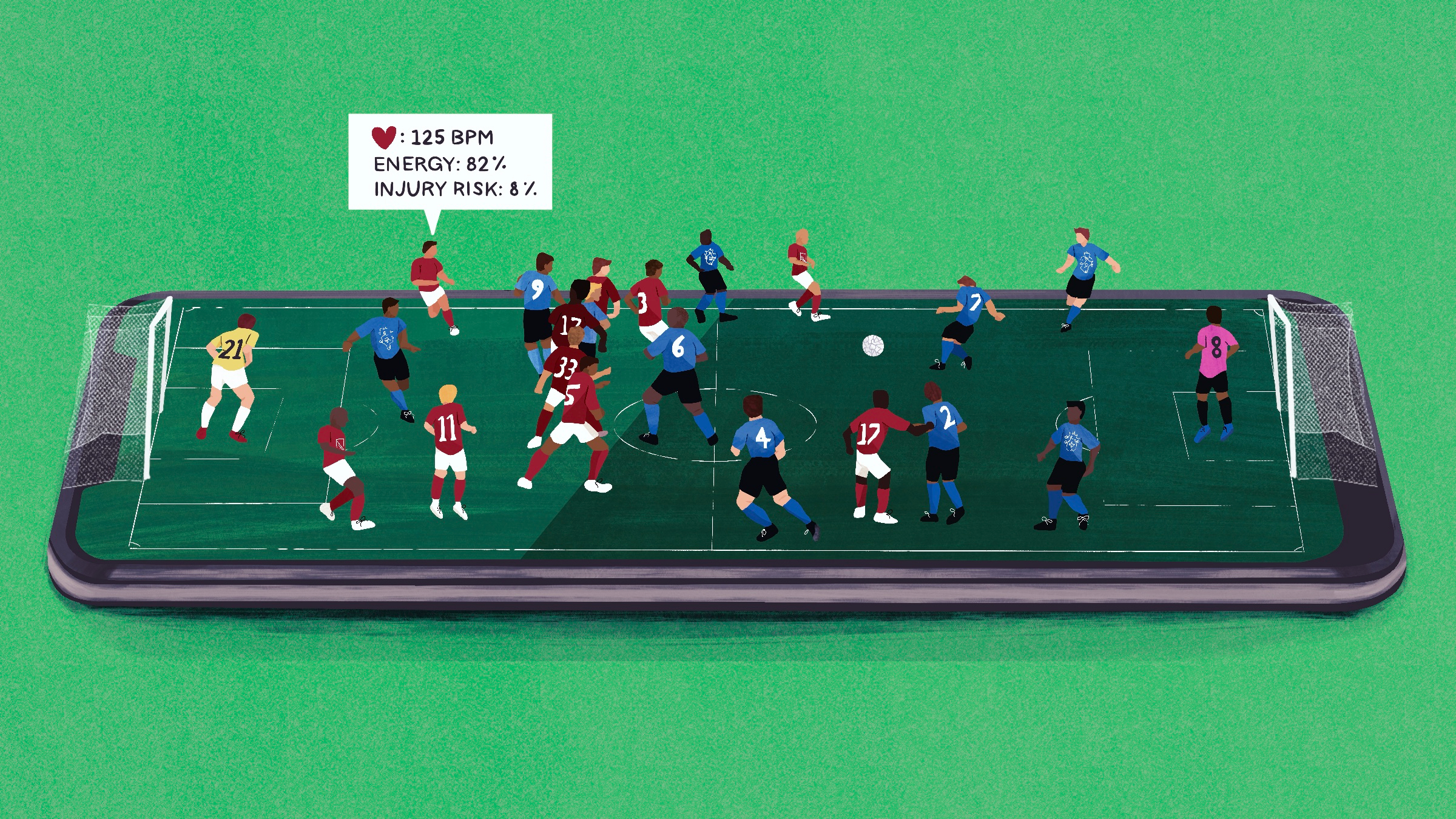

From human performance to media, betting, and NFTs, technology is transforming every aspect of sports.

Taking notice, a growing number of startups and investors, including venture capitalists, athletes, and the teams/leagues themselves, are pursuing the billion-dollar opportunity in sports technology.

As the sector evolves at a rapid pace, we discussed key focus areas, investment criteria, and future implications with top investors in the space.

Who you’ll hear from: Stadia Ventures, Courtside Ventures, KB Partners, Will Ventures, Techstars Sports Accelerator, EY Ventures Group, and NEXT VENTŪRES.

The Evolution of Sports [Tech]

Until recently, sports tech was thought to be a niche category.

According to Vasu Kulkarni, a partner at Courtside Ventures, “sports tech” has historically centered on products sold to teams and elite athletes. On their own, Kulkarni added, those markets didn’t generate large exits.

But now, widespread innovation is ushering in a new era of sport — an era that will be defined by technology.

In a report entitled 3rd Age of Sport, digital agency Mailman / Seven League detailed the disruption overtaking the sports world in three periods:

- First Age: Sports as a pastime

- Second Age: Sports as a business

- Third Age: Technology redefines sports

Like nearly every industry, from healthcare to education and financial services, the sporting world is in the midst of a digital revolution.

As a result, the traditional sports universe is experimenting with new business models, distribution channels, and marketing strategies to reach and engage fans.

For their part, amateur and professional athletes are leveraging new technologies to enhance their performance, personal brand, and bank accounts.

Meanwhile, flush with capital, ambitious founders are reimagining sports as we know them, pushing further into augmented/virtual reality, blockchain technology, and gaming.

Scouting Report

An expansive category, the term sports tech can be difficult to define.

In its analysis of the space, investment banking firm Drake Star Partners separates sports media from sports technology.

Sports media: media rights, sponsorships, merchandise, and ticket sales across pro sports.

Sports tech: fan experience, athletes as brands, OTT, data & analytics, gaming & betting, and smart stadiums.

Based on this framework, the firm expects the global sports tech market to grow at over three times the rate of the global sports market between 2019 and 2024.

- 2019: The sports tech market was valued at $11B, or 6.4% of the global sports market.

- 2024: Growing at 23.1% CAGR, sports tech reaches $31B, representing 13% of the overall market.

- 2030: The global sports tech market will become a $50B+ industry.

Elsewhere, in an effort to make sense of the sports tech industry, Scrum Ventures surveyed more than 100 investors, corporations, and sports industry professionals, compiling key findings in a state of the industry report.

Most impactful technologies: fan engagement, athlete performance, and stadium experience.

Most compelling investment areas: media & content platforms, esports, and data, analytics, & biometrics.

Another perspective, in exploring the future of sports tech, Deloitte identifies key stakeholders and technology trends across the industry.

Stakeholders: teams & athletes, leagues & clubs, fans, media, and brands.

Technology trends: data analytics, wearables & performance enhancement, media & broadcasting, fan engagement, sponsorship assets, stadiums of the future, and esports.

Investor Insights

Building on the themes identified in industry reports, we asked leading investors to share their insights on the opportunities taking shape across sports tech.

In terms of focus areas, at a high level, there’s general alignment among investors that overlaps with broader trends identified by Drake Star, Scrum, and Deloitte.

New-age memorabilia. Jordan Fliegel, managing director of Techstars Sports Accelerator, and Courtside’s Vasu Kulkarni both singled out collectibles, including NFTs and blockchain technology, as a point of emphasis.

Worth watching, Fliegel added, new legislation will continue to shape sports tech, especially as it relates to sports betting and athletes profiting off their name, image, and likeness (NIL).

Building on that point, EY Ventures Group managing partner Eloiza Tecson sees NIL as being part of a larger shift in athlete promotion, media, and sponsorships. Overall, Tecson said, increased funding and innovation will “extend the life cycle of both athletes and fans.”

Trickle-down tech. An interesting development, athletic performance is crossing over into consumer health and fitness.

With firms like NEXT VENTŪRES, KB Partners, and Stadia Ventures specifically looking to back human performance/optimization startups, they’re hoping to capitalize on innovation initially intended for elite athletes trickling down to everyday exercisers.

As Will Ventures managing partner Brian Reilly describes it, the demands of elite sports creates “the ideal proving ground for scalable, innovative tech beyond the field of play.”

At the same time, as consumers prioritize health and overall well-being, the term athlete is being applied broadly.

For instance, NEXT VENTŪRES founding partner Melanie Strong said the firm aims to help elite and everyday athletes perform better and live healthier lives. The key, Strong said, is identifying brands with “staying power and defensibility,” including “IP, research, a strong network, or other cornered resources.”

Combined with the pandemic’s impact on health and fitness, this shift has seen connected fitness companies (Tonal, Zwift, Hydrow) and wearable device makers (WHOOP, Oura) raise record levels of funding.

Always-on sports. Beyond performance, Brandon Janosky, managing partner of Stadia Ventures, sees sports paving the way for personalization and customized care in every facet of our lives. From game highlights and prop bets to integration across fitness, wearables, and nutrition, Janosky suggests, “everything will be tailored to our likes, interests, and tendencies.”

Echoing that sentiment, Lance Dietz of KB Partners expects to see more crossover of sports into other categories, adding: “sports is becoming more deeply part of our social fabric and touching nearly everything.”

Looking Ahead

While it’s difficult to pinpoint a singular definition of sports tech or predict where the sector is heading, there’s no denying that sports is a powerful platform for innovation.

As Courtside’s Vasu Kulkarni put it: “At their core, sports are about bringing people from all different walks of life together to witness the pinnacle of human performance.”

As more capital flows to the space, new technologies will push the limits of performance while strengthening the sense of community among fans.

🦠 The Magic of Microbes

From identifying the ideal diet to treating chronic conditions and extending lifespan, the answers to complex health questions could be hidden in our gut.

On the Fitt Insider Podcast: Ara Katz, co-founder & co-CEO of Seed Health, joined us to discuss the microbiome and the many ways it impacts well-being.

We also cover: Seed’s approach to building a platform around studying and commercializing probiotics. And we talk about the differences between wellness, healthcare, and consumer life science.

Listen to today’s episode here.

🏥 Retail Wellness

As consumers prioritize health and wellness, retailers are trying to capitalize on the trend. From wellness hubs to primary care clinics, the retail landscape is shifting.

The doctor will see you in aisle 3. Retailers are hoping you’ll stop by for groceries — and maybe a visit to the doctor’s office.

- Walmart has launched over a dozen primary care clinics offering in-store diagnostics and even dentistry services.

- Walgreens partnered with VillageMD last year to put primary care clinics in 500–700 drugstores over the next five years.

- CVS bought Aetna for $70B in 2018 and has rolled out hundreds of in-store “HealthHUBs” and virtual primary care programs.

Drugstore therapy. As the digital mental health market booms, retailers are honing in, offering therapy in store or online.

- CVS began employing licensed social workers at its pharmacies.

- Walgreens connects its customers to BetterHelp and Sanvello therapists.

- Rite Aid is piloting teletherapy in “virtual care rooms” at select store locations.

- Walmart acquired MeMD in May to expand its teletherapy and virtual care capabilities.

Beyond care, Walmart is reportedly working on a stealth health venture, while Dollar General just hired its first Chief Medical Officer and is pushing to “establish itself as a health destination.”

A trillion-dollar battle. Big-box and pharmacy retailers aren’t the first to make a move on healthcare. From Apple to Google to Amazon, Big Tech is racing to capture the $11.9T market.

Big-box retailers, however, are uniquely positioned to transform rural communities, who have been historically underserved by existing healthcare systems. 90% of Americans live within 15 miles of a Walmart and 75% within five miles of a Dollar General.

Their impact could be tremendous, claims Paul Schuhmacher of AArete Consulting:

“They [could be] one of the largest disruptive forces in health care by addressing… access to care in rural communities, price transparency, and even, to some extent, social determinants of health.”

Looking ahead: Many are skeptical of big-box companies taking over their health affairs, especially given past mismanagement of health benefits for their very own workers. COVID-19, however, practically rebranded pharmacies overnight; it may be just the catalyst retailers need to reinvent themselves.

👟 Running on Clouds

Last week, On Running made their public debut.

The footwear brand came hot out of the gates, opening ~50% above their initial asking price.

Launched in 2010, On is known for its outsole technology, aimed to make runners feel like they’re treading on clouds.

By the numbers:

The Swiss-based activewear company has been on a decade-long hot streak, exploding at an 85% 10-year CAGR to reach $463M in net revenue last year.

Can they keep this up on the public stage? Let’s explore their game plan…

Athlete advocacy. Capitalizing on a proven sportswear tactic, On has heavily leveraged its athlete endorsements, particularly from tennis superstar and investor Roger Federer.

Expanding cross-country. Growing aggressively in nearly all of its international markets, On saw North America sales balloon by a staggering 105% in the first half of 2021.

Chasing digital sales. A key driver of revenue, On is leaning into its profitable direct-to-consumer channel, which jumped 37% YoY in the first half of 2021.

Stewarding sustainability. A key trend in activewear, sustainability is now a top brand priority. A frontrunner in this space, On is launching a fully recyclable shoe via a circular subscription model.

Footwear is having a moment.

On is one of multiple footwear companies leading the IPO movement in a $440B global market. In the past few months, Allbirds and Authentic Brands (parent company of Eddie Bauer, Nine West, and more) have filed to go public.

Looking ahead: To date, On Running has only captured 8% of a notoriously crowded footwear market. Between giants like Nike and adidas, and specialty players like HOKA ONE ONE and Brooks, the upstart faces hurdles in all directions.

Of note, while the brand is diversifying into athleisure, apparel (outside of shoes) only makes up 4% of revenue. Moving forward, it may be in its best interests for On to stay on the footwear track and do what it knows best.

📰 News & Notes

- Connected clothing: the future of smart, tech-integrated fabrics.

- The economic case for curbing aging. [Reread: The End of Aging]

- Apple Fitness+ to launch group workouts, Pilates, and meditation.

- A personal note: COVID, cancer, and coming back stronger than ever.

- Expanding beyond home fitness, Peloton eyes the commercial sector.

- WHOOP’s message to competitors: “Don’t bother copying us, we will win.”

- Land your dream job: 900+ job openings at top health and fitness companies.

- Startup Q&A: Elektra Health co-founders Alessandra Henderson and Jannine Versi.

💰 Money Moves

- Connected rowing company Hydrow announced new celebrity investors, including Lizzo, Justin Timberlake, and Travis Kelce, bringing cumulative funding to $200M.

- Misfits Market, a sustainable DTC produce box service, closed $225M in a Series C-1 led by SoftBank Vision Fund 2, with participation from Accel.

- Digital mental health platform Spring Health raised $190M at a $2B valuation in a Series C led by Kinnevik and joined by Guardian Life, Able Partners, Tiger Global, and others.

More from Fitt Insider: Mental Healthcare Goes Digital - EGYM, a Munich, Germany-based fitness technology developer, secured $41M in a Series E round led by Mayfair Equity Partners.

- Digital musculoskeletal clinic Hinge Health acquired wrnch, creators of computer vision-aided motion tracking technology, for an undisclosed sum.

More from Fitt Insider: The Business of Movement Health - BetterUp, a digital life coaching platform, acquired two advanced software companies, Motive and Impraise, in a deal.

- Plant-based ramen maker immi raised $3.8M in a seed round led by Siddhi Capital, with participation from numerous other firms and individuals.

- Journey Clinical, a psychedelics company working with psychotherapists on ketamine-assisted treatment, landed $3M in seed funding.

More from Fitt Insider: Psychedelic Wellness - DTC fertility startup Bird & Be landed $1.8M in funding led by BAM Ventures. Note: Fitt Insider also participated in this round.

More from Fitt Insider: The Future of Fertility Tech - 9am.health, a digital diabetes clinic, raised $3.7M in seed funding from Define Ventures, Founders Fund, Speedinvest, and iSeed Ventures.

- Functional beverage company wildwonder, makers of a sparkling probiotic drink, closed $2.1M in seed funding.

- Mae, a digital health solution for Black expectant mothers, secured $1.3M in pre-seed funding led by SteelSky Ventures.

- VR athlete training software firm WIN Reality added $3.75M from LAGO Innovation Fund.

- MILLIONS.co, an e-commerce and social platform assisting pro and semi-pro athletes sell merchandise and video content, raised $10M in new funding.

- Skincare startup Veracity Selfcare, makers of a hormone-testing saliva kit that guides product choices, garnered $5M in seed funding led by Global Founders Capital.

Today’s newsletter was brought to you by Anthony and Joe Vennare, Melody Song, Wesley Yen, and Ryan Deer.