Reach the world’s active people.

Cancer screenings are falling short.

Call to Arms

This year, US cancer diagnoses will exceed 2M for the first time.

Widespread as ever, the disease will cost our country $245B by 2030.

More concerning, patients are skewing younger while risk increases in each generation, with no definitive answer as to why.

Performance Review

The public and private sectors agree: Current screening guidelines aren’t cutting it.

- Half of cancers aren’t caught until they’re advanced.

- Mass age-based screenings cost $40–80B per year, to little avail.

- Four screenable cancers—breast, prostate, colorectal, and cervical—are increasing.

And, most lethal cancers—pancreas, ovarian, liver, and brain—aren’t screened for at all.

A problem begging to be solved, catching cancer early means a higher chance of survival and 2–4x cheaper care.

Universal Scans

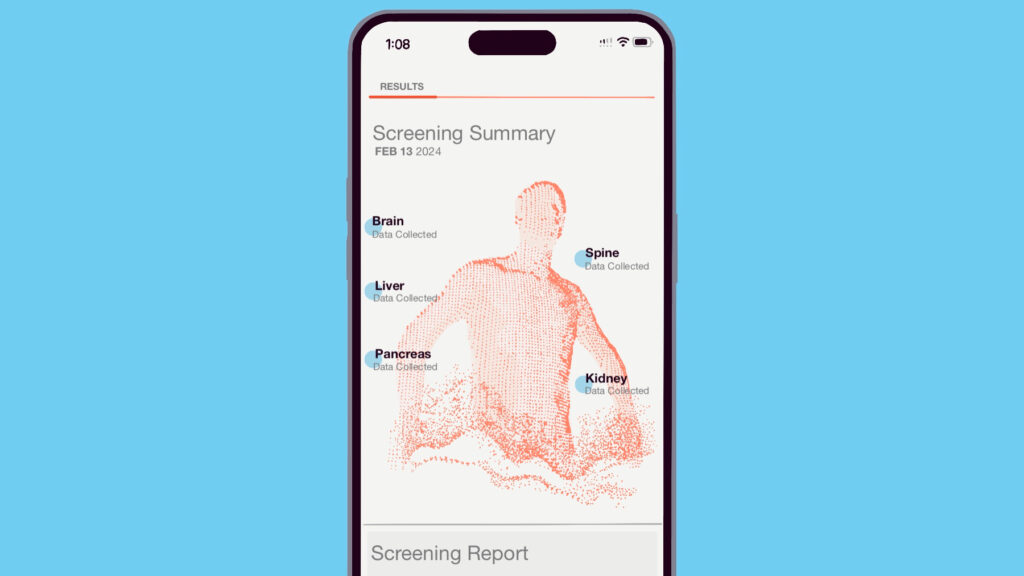

Democratizing early detection, startups are scaling new diagnostics.

- Full-body MRI company Ezra just added $21M; it’s targeting 50 locations by EOY.

- MRI competitor Prenuvo has raised $70M, opening nine clinics to date.

- Primary care unicorn Forward is planning cancer tests for its self-serve CarePods.

Skipping scans, Grail’s mail-order kits screen for 50+ cancers. Racing rival Harbinger Health, it hopes to be the first FDA-approved multi-cancer blood test (MCED).

Far from perfect, emerging tests are costly and not covered by insurance. Plus, medical professionals warn of false positives, overdiagnosis, and excessive treatment.

In response, startups say individuals should decide for themselves. Agreeing, 51% of people want to be screened even if it leads to unnecessary treatment — and 98% of false positive patients are still glad they tested.

Taking Control

Preventative diagnostics provide peace of mind, but lifestyle shifts will move the needle.

More than 40% of cancers are linked to modifiable risk factors like poor diet, obesity, inactivity, alcohol use, and smoking.

Support systems. Screenings aside, one in three Americans will develop cancer, and oncology care is frustratingly fragmented.

Guiding people post-diagnosis, Thyme Care collected $60M last August, and Jasper Health has raised $31.8M for digital wraparound care.

Not limited to cancer, Eureka Health secured $7M in 2023 for its peer-to-peer platform, dubbed the “Yelp” of chronic care.

New Money

Outshining Big Pharma, emerging biotech companies are behind two-thirds of cancer R&D.

Funding moonshots, 55% of investors are eyeing oncology startups — including Reed Jobs, who launched the $200M cancer-focused VC firm Yosemite.

Driving innovation, SHEPHERD Therapeutics studies the DNA/RNA of each patient’s cancer for personalized medicine, Faeth and L-Nutra merge metabolic health with traditional treatment, and UK-based immunotherapy developer Grey Wolf is backed by Pfizer.

Punchline: Precision cancer medicine and diagnostics are pending. But, if we don’t address social determinants of health—like race, income, education, environment, and insurance—they may never reach the people who need them most.

🎙 On the Podcast

Founder and CEO of D1 Training Will Bartholomew discusses nationwide expansion.

After an ACL injury cut his NFL career short, Will opened athletics-based training center D1 to help aspiring college athletes, pros, and the general public reach their fitness goals.

We also cover: landing pro athlete investors, deciding to franchise, and supporting youth sports.

Listen to today’s episode here.

🧬 Alter launches DNA-personalized fitness platform

Five years in development, Alter uses a cheek-swab DNA test to create wellness programs based on each users’ genetic response to workouts, dieting, sleep, and stress.

Powering its ecosystem, in-house coaches deliver consults via a 55lb smart screen and app, while sensors and an accompanying wearable create an always-on feedback loop.

Poor reflection. To date, at-home fitness mirrors have struggled to keep users engaged.

- lululemon shuttered MIRROR after paying $500M for the smart screen company.

- Spanish screenmaker VAHA sold to nutrition company Bioniq, and Chinese challenger Fiture ended new content creation and exited the US.

- After receiving NYSE delist warnings, FORME acquired vertical climbing brand CLMBR to boost its standing.

Downsizing, Tempo swapped its connected screen for smartphones, integrating wearable data, body scans, and camera-tracked workouts.

Takeaway: Combining digital fitness with personal diagnostics, Alter hopes its screens will become an everyday portal to health optimization.

Presented by Strava

🎯 Motivate your target audience

You can be an interruption on another platform, or be a source of motivation on Strava.

Upgrading health and wellness marketing, Strava’s Sponsored Challenges let brands engage a community of 120M+ active people.

Targeted by activity type, location, and more, Sponsored Challenges engage and delight consumers by motivating them to do their favorite thing — move.

Challenges aren’t just a way to raise awareness; they can drive direct sales too — with brands seeing up to 10x ROI from attributable revenue.

Learn how brands like Nike, Chipotle, adidas, and WHOOP use Challenges to drive sales and get their audiences moving.

💸 Odyssey Elixir adds $6M for mushroom energy

The adaptogenic energy drink maker fuses lion’s mane, cordyceps, and caffeine, offering a low-sugar Red Bull alternative.

Winning with Gen Z, Odyssey reaches its target demo at festivals, on college campuses, and in influencer ads. With 6K wholesale partners, from 7-Eleven to Wegmans, it’s transcending specialty grocers to tap the masses.

Secret ingredient. Mushroom-infused food and bev grew 19.5% from 2022–23 as demand for functional ingredients continued.

Here to stay, mushroom drinks are refining messaging and niching down.

- Four Sigmatic rebranded around mental wellness and entered Albertsons.

- MUD\WTR opened a coffee-free cafe + coworking space in LA.

- NA tonic maker hiyo sells itself as a social drink.

Tweaking the recipe, Beam rounded out its CBD offerings with a mushroom latte mix, and Pepsi launched “Rockstar Focus” with lion’s mane.

Punchline: As consumers seek drinks with added benefits, expect brands to push more adaptogenic products — while making the case for their mood-, cognition-, and immunity-boosting effects.

📰 News & Notes

- Tracksmith enters super shoe wars with Eliot Racer.

- Brooks notches $1.2B revenue, 20M units sold in 2023.

- Nike launches global wellness festival, kicking off in London.

- Tiger Woods debuts Sun Day Red apparel line following Nike split.

- Keto Kind, Superfrau win Nestlé Health Science startup competition.

- Samsung Galaxy Watch gains FDA approval for sleep apnea feature.

- Tonal teams with LOVB on training room installations, volleyball content.

- Athleta unveils high-performance apparel line. [Re-read: Changing the Game]

- SAUNA HOUSE accelerates franchise biz in the Carolinas, targets Charleston.

- Got news? Reach industry leaders by publishing a press release to Fitt Insider.

- HYROX enters Canada, plots fitness racing event in Toronto. [Re-read: HYROX’s Rise]

- Featured role: 10 SQUARED by Peter Attia is hiring a Strength & Mobility Specialist. Join our free talent network to be considered for open roles.

💰 Money Moves

- Full-body MRI company Ezra added $21M in a funding round co-led by Healthier Capital and FirstMark Capital.

More from Fitt Insider: Issue No. 239: Inside Out - Apothékary, maker of east-meets-west herbal remedies, closed an equity round comprising $5M in equity and $3M in debt.

On the Podcast: Apothékary founder & CEO Shizu Okusa - Food and beverage company bia acquired keto-friendly functional nutrition brand Bulletproof for an undisclosed amount.

- Functional beverage brand Odyssey raised $6M for its mushroom energy drinks.

- Water filter company BRITA SE acquired sustainable self-cleaning water bottle brand LARQ.

- Probiotic soda brand culture POP secured $21M in new funding.

- French bouldering gym Climbing District secured a €10M Series A extension from Pléiade Venture and 123 Investment Managers.

- Gluten-free snack company Creations Foods acquired low-carb snack maker HighKey for an undisclosed amount.

- Walker Brothers, maker of traditional and hard kombucha, raised $3.68M in a funding round.

- Mental healthcare company Headlight raised $18M in a new funding round led by Matrix and EPIC Ventures.

- London-based luxury ski brand Perfect Moment closed its IPO, raising $8M in gross proceeds.

- Powdered electrolyte beverage maker HALO Hydration landed $2.38M in a round.

- Supplement brand Doctor’s Best acquired Activ Nutritional and its Viactiv vitamin brand from clinical nutrition company Guardion Health Sciences for $17.2M.

- Unlearn, an AI biotech startup using digital twins to improve clinical trials, raised $50M in a Series C round led by Altimeter Capital.

- Upcycled fruit snack maker RIND Snacks acquired granola brand Small Batch Organics.

- BioAge closed a $170M oversubscribed Series D round led by Sofinnova Investments to develop therapeutics for metabolic disorders like obesity.

Today’s newsletter was brought to you by Anthony Vennare, Joe Vennare, Ryan Deer, and Jasmina Breen.