Last month, we detailed the rise of the fitness creator. Today, we’re revisiting the topic with a focus on how fitness creators make money. Then, going a step further, we’ll explore emerging platforms and untapped opportunities at the intersection of fitness and technology.

How We Got Here

At the risk of being redundant, let’s recap what’s happening:

Like filmmakers on YouTube, writers on Substack, and independent podcasters everywhere, fitness professionals are waking up to the fact that they hold a disproportionate share of the value. Now, as consumer habits shift, and new digital tools emerge, the rise of the fitness creator could be more disruptive to the industry than Peloton. — Fitt Insider No. 81

In short, fitness professionals are unbundling from gyms and studios. Increasingly, fitness creators are cutting out the middleman by building digital, direct-to-consumer offerings.

The Creator Class

The term fitness creator is incredibly broad. For the sake of discussion, let’s establish some (overly simplified) parameters.

Online, it’s almost impossible to distinguish between a fitness influencer, celebrity trainer, fitness model, and fitness professionals. Yes, there’s often overlap. And generally speaking, they’re all fitness creators insofar they generate revenue from fitness-related content. Technically, though, only one group is “certified” to be expounding fitness advice.

The second point represents a larger threat to the traditional fitness sector. Online, anyone can sell a fitness, nutrition, or wellness program, no certification necessary. For fitness creators, producing compelling content, looking the part, and building an engaged audience are the keys to success. Formal credentials can be a point of differentiation, but it’s not a prerequisite.

The punchline? Credentialing is becoming quite the conundrum. So what becomes of personal training and group fitness? And what are the implications for the likes of ACE, NASM, and others? That’s a topic for another day.

Editor’s note: If the topic of fitness and wellness education interests you, we’re working on a concept aimed at this space. Want to hear more? Reply to this message or send us a note.

If You Build It

Like any online creator, building an audience is the barrier to entry. Whether it’s Twitch streamers, podcasters, TikTokers, or YouTubers, audience is everything. Beyond follower count alone, engagement rates are often the difference between a side hustle and full-time pursuit.

From David Dobrik to the D’Amelio sisters and Joe Rogan to Ninja, audience-first, creator-led businesses aren’t new. And let’s be clear: million-dollar paydays are the exception, not the rule. But now, anyone with an iPhone and internet access is free to try their hand at building an audience. If it goes well, you’re in business.

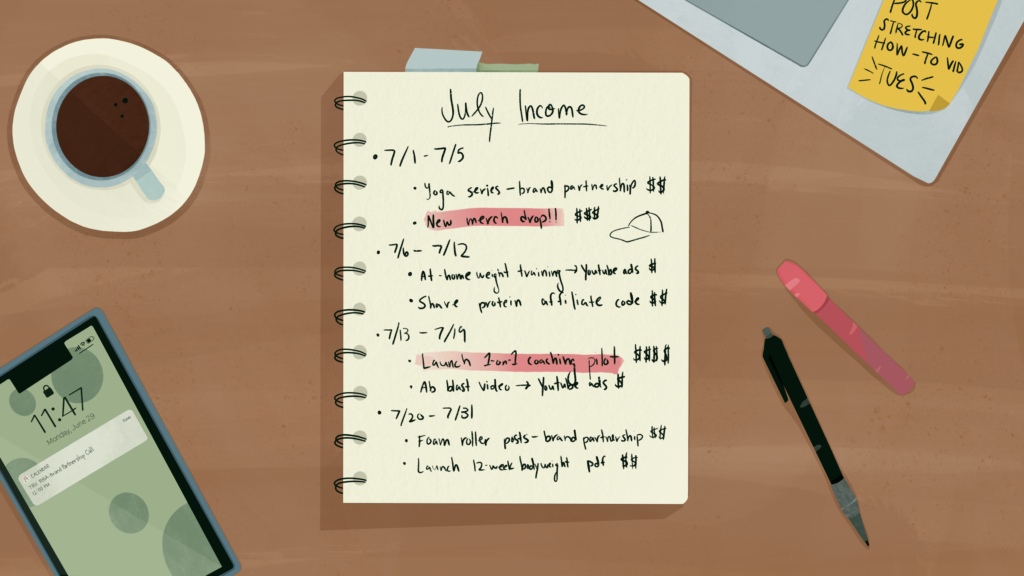

As it pertains to fitness creators, monetizing an audience typically involves one or more of the following:

- Brand deals. Aka influencer marketing, brands pay creators to promote a product or service in flat-rate or performance-based deals.

- Affiliates. Earning a commission for driving sales. The “Use Code: XX” on every fitness Instagram account is an affiliate code.

- Advertising. Fitness creators who utilize YouTube can earn advertising revenue after qualifying for the platform’s partner program.

- Information products. PDFs, ebooks, courses, and videos vary with respect to quality but can scale effectively.

- Online coaching. Individualized fitness, nutrition, and wellness programs, and ongoing support, like phone calls and revising the plan.

- Physical products. Using third-party providers to white-label supplements or sell merchandise.

- Standalone businesses. Kayla Itsines (BBG, SWEAT) and Joe Wicks (author, investor, entrepreneur) might be the epitome of fitness creator turned founder.

Create for Creators

There’s no denying this trend, but its impact on the fitness industry is still nascent. That’s because, to date, software solutions have catered to gyms and studios, not individual fitness professionals, let alone digitally-native fitness creators.

Although connected and on-demand fitness disrupted the status quo, they did little to empower fitness professionals — companies like Peloton or Future handpick the talent for a limited number of “trainer” roles. Unlocking value for fitness creators is the next wave of disruption.

Zooming out, the broader creator ecosystem has seen its fair share of innovation. From creator stacks like Adobe to community management tools, the passion economy is booming. Meanwhile, fitness creators have made do by hacking together solutions that weren’t meant for them.

Similarly, many of the platforms focused on fitness don’t go far enough in addressing the needs of creators. For now, the approach has seen companies like onPodio or Ompractice create a layer on top of Zoom, which ends up being clunky. Moxie is cleaner in that they have their own video platform, but it’s still one-dimensional.

Meanwhile, Playbook is taking a decidedly different approach. The company, which recently raised $3M in funding, is focused on arming fitness creators with the tools they need to build and monetize their audience. Ultimately, Playbook wins by helping the creators succeed.

For now, existing gym management software doesn’t cater to individual fitness creators who need a centralized platform to run their business. Looking ahead, there’s still so much room to innovate.

- Future connects trainers and clients via wearable tech and text messaging. Tailoring a similar platform to fitness creators, not consumers, is untapped.

- Fanjoy is a turnkey merchandise platform for online creators and influencers. Imagine a similar concept that helps fitness creators sell exercise equipment to their followers.

- Two Chairs, a mental health startup, focuses on matching patients with the right therapist and treatment plan for them. Apply that logic to fitness, nutrition, and wellness creators.

Takeaway: As the category continues to evolve, “creating for fitness creators” is an opportunity worth pursuing. Fair warning: industry incumbents should be wary of this trend.

[Editor’s note: Today’s topic was inspired, in part, by an article from Blake Robbins on how YouTubers monetize their audience.]

🤝 lululemon x Mirror

In a massive move with implications across retail, fitness, and technology, lululemon is acquiring Mirror for $500M in cash.

Context: Mirror is a connected fitness company that pairs an interactive screen (or “mirror”) with subscription-based exercise content.

- Founded in 2016, the company has previously raised more than $70M in funding, valuing the company at $300M. Of note, lululemon invested $1M into Mirror last year.

- Mirror founder Brynn Putnam said the company is on track to do $100M in revenue this year, with profitability in sight by 2021.

On paper, the deal makes a lot of sense. For starters, the acquisition fits with lululemon’s ambition to become an experiential brand that helps customers live a healthier lifestyle. The fact that Putnam is also the founder of Refine Method, a boutique fitness studio, and a former lululemon ambassador solidifies the alignment.

Looking closer, there are other obvious pros:

- Content: Nowadays, every company is a content company. lulu will continue using its global ambassador network to create content for the Mirror platform.

- Apparel: Will every Mirror instructor wear lulu? Will lulu drop exclusive apparel for Mirror users? Can you shop the look of your favorite instructor? Yes.

- Technology: Putnam has said Mirror might pursue other verticals, like fashion. If this partnership moves further into AR, it could help shoppers get the right fit or shop from home. Longer shot: connected yoga pants.

- Revenue: If profitability is within reach, lulu will benefit from diversifying its revenue — they already have the storefronts. It’s a good sign that Mirror and Putnam will continue to operate independently.

On the flipside, like most acquisitions, this isn’t a sure thing:

- Price: Mirror is on track to do $100M this year. But that number might be juiced by a COVID surge. Was the sale price 5x revenue or actually much more?

- Competition: There’s a long list of Mirror-like competitors. Beyond that, how much longer will a “mirror” be necessary if iPhone apps or standalone cameras can track movement?

- Core competency: At the end of the day, lululemon is a retailer. As Nike (FuelBand), Under Armour ($700M on connected fitness), and adidas ($240M for Runtastic) have learned, crossing the chasm into fitness or digital is no easy task.

Punchline: Ultimately, time will dictate the significance of this deal. But a few things are plain to see. First, this could be the lead domino, setting off an arms race for digital and connected fitness companies. Where do Nike, Apple, Peloton, and others fit in?

And two, brick-and-mortar fitness operators should be on high alert. After COVID, the gym won’t be the center of the fitness ecosystem. Now, retailers are competing for a piece of the pie. Further complicating matters, the industry’s top talent (instructors, technologist, execs) and funders will be chasing the next Peloton or Mirror, not another gym or studio. Much, much more to come…

💪 The Future of Personal Training

Circling back to the focus of our lead story, we teamed up with Courtside Ventures to produce this report on the Future of Personal Training.

In addition to discussing the role of in-person training, online offerings, and digital tools, we examine fitness education, compensation, new business models, and much more.

The big picture: As the industry continues to evolve, founders and investors will be well-served by putting fitness professionals at the center of the conversation about the industry’s future.

Read the report here.

📰 News & Notes

- The best Peloton ad yet.

- CrossFit has a new owner and CEO.

- Do CEOs prefer cardio or strength training?

- Venture capital doesn’t build the things we need most.

- Zwift is hosting a virtual Tour de France. [Reread: The Fornite of Fitness]

💰 Money Moves

- lululemon is acquiring Mirror, an interactive workout screen and digital content subscription, for $500M. More from Fitt Insider: The Connected Fitness Wars

- Calibrate, a metabolic healthcare startup, landed $5.1M in seed funding from Redesign Health and Forerunner Ventures.

- Tatch, a sleep diagnostic and monitoring patch, secured $4.25M in seed funding led by Spark Capital. More from Fitt Insider: Selling Sleep and our interview with Eight Sleep CEO Matteo Franceschetti

- Outdoor Voices landed new funding from NaHCO3. Ashley Merrill, the head of NaHCO3 and founder of sleepwear brand Lunya, will become the new CEO of Outdoor Voices. And Tyler Haney, the founder and former CEO, is back in an active role with the company.

- Black Wolf, a men’s skincare company, raised $1.5M in angel funding. More from Fitt Insider: The Next Wave of Men’s Wellness

- GNC Holdings, a nutritional supplements retailer, filed for Chapter 11 bankruptcy and will close 1,200 stores. More from Fitt Insider: The End of GNC (originally published in fall ’18.)

- SARVA, an India-based yoga platform, added new capital, bringing the total amount raised to more than $8M.

- Barry’s received a preferred equity investment from buyout firm LightBay Capital.

- Sun Genomics, a microbiome health company, closed an $8.65M Series A.

- Healthy.io, an Israel-based company offering at-home urinalysis, is purchasing Inui Health, its Silicon Valley competitor, for $9M.

- Airvet, a telehealth platform for pets, closed a $14M Series A round. More from Fitt Insider: The Big Business of Pet Wellness

- Restore Hyper Wellness + Cryotherapy secured an $8M investment from Level 5 Capital Partners. More from Fitt Insider: The High-Performance Lifestyle

- Snacks giant PepsiCo has acquired a minority stake in alt-milk and cereal company Rude Health. More from Fitt Insider: Healthy Cereal Aims to Remake Breakfast

- Oscar, a direct-to-consumer health insurance company, added $225M in new funding.

- Grove Collaborative acquired Sundaily, makers of gummy vitamins for healthy skin.

- The musician Pitbull acquired a stake in sports drink maker Halo Sport.

- The sale of Brait SE’s Virgin Active fitness chain will be delayed as much as 18 months following closures of gyms resulting from COVID-19.

- F5 Sports, maker of pitchLogic technology for baseball, secured $2.1M in seed funding.