Xponential Fitness is hitting reset.

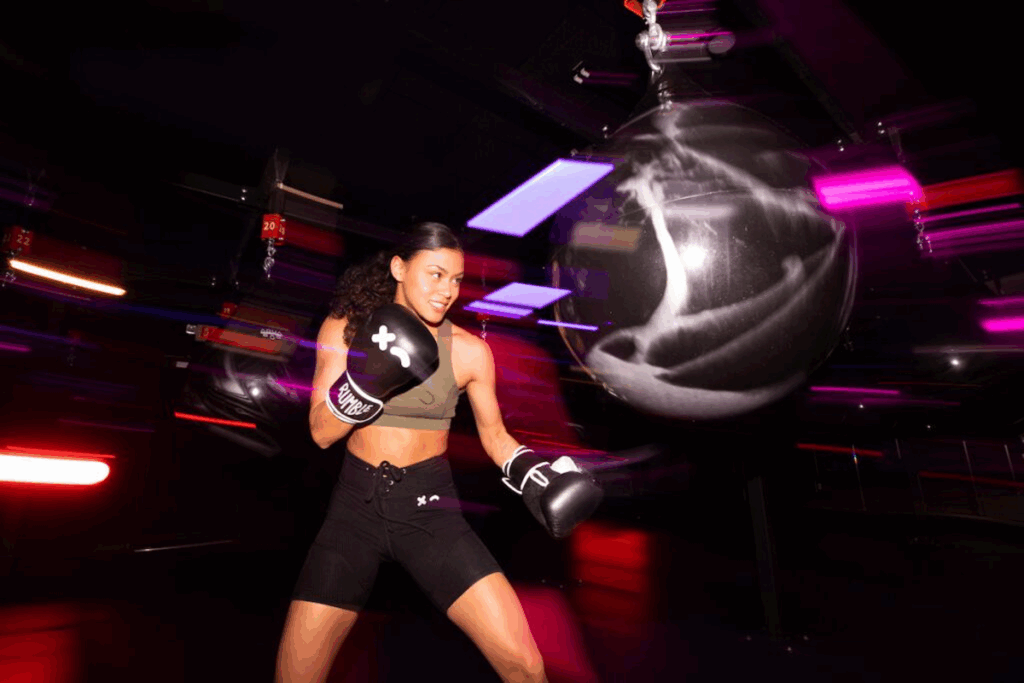

What’s happening: The boutique fitness operator sold indoor cycling concept CycleBar and boxing studio Rumble to Extraordinary Brands, which also acquired Row House from XPOF last May.

High/low. While boutique studios account for 23M US gym memberships, growth has been uneven. At Xponential, Pilates, stretching, and barre make up 85% of sales, with Club Pilates alone driving 57%.

With 1.2K locations, Club Pilates is 8x larger than its closest Pilates challenger. Riding momentum, new studios are ramping up revenue 10 months faster than they did in ’21.

Next step. Facing headwinds, XPOF vowed to do more with less, divesting from five brands in two years. This year, it plans to reduce studio openings by 30%, focusing on high-performing modalities and more selective franchisee vetting.

Supercut. Once a race to diversify, franchise supergroups are adjusting to a new era.

Betting on Pilates, strength, and longevity concepts, Xponential founder Anthony Geisler launched Sequel Brands, while F45 reorganized under holistic parent FIT House of Brands.

Looking ahead: As gyms integrate boutique concepts and wellness amenities, Xponential and other franchisors must confront a boutique fitness identity crisis.