Issue No. 158: Tracking Strava’s Rise

Illustration: Courtney Powell

Illustration: Courtney Powell

Founded in 2009, Strava has become the preeminent social network for athletes.

But the path has been anything but smooth. The company has endured privacy fiascos, overhauled management, and changed course on its way to a $1.5B valuation.

Riding the pandemic booms of running and cycling while reaching newfound profitability, Strava’s gearing up for its next move.

The Virtual Locker Room

The GPS-enabled platform allows athletes to relish in the “before, during, and after” sports, from planning routes and tracking progress to connecting post-workout.

A freemium social network, Strava is the preferred Proof-of-physical-activity platform. The app promises performance analytics, safety features, and wearable integration, where social feedback and competition drive engagement.

Initially focused on hardcore cyclists and runners, the app now attracts a range of passionate amateurs.

“We are focused on what we call our invested athlete—the person who’s decided sports and fitness are going to be an important part of their life. We want to support them in their journey, whether they’re attempting their first 5K or going for an Olympic gold medal.” – Mark Gainey, co-founder & executive chairman

Network effects. Strava leverages network effects to generate content and fuel growth. Accounting for >95% of the athlete base, free users power the engagement engine, creating posts, segments, and other interactions.

Repaving the trail. Last year, the company caught flack for paywalling key performance and competition features, but early signals suggest the move was successful:

- Since the May 2020 change, the user count has exploded from 55M to 90M+.

- Bloomberg reported that the company reached profitability five months after a May 2020 memo stated the contrary.

- In November 2020, Strava secured a $110M Series F led by TCV and Sequoia.

Plus, the paywalls came with a broader streamlining of the business model, simplifying subscription packages while removing sponsored ads. Strava’s hope? The remodeling creates a virtuous cycle: paid features enhance the user experience, leading to sustained revenue growth.

The monetization dilemma. Because Strava doesn’t sell personal data or serve ads, it can’t monetize a “free” product à la Facebook. But, that doesn’t mean the company has avoided controversy. Over a two-and-a-half-year stretch with former Instagram exec James Quarles as CEO, the company endured a series of missteps:

- In 2017, the platform attempted to build an influencer ecosystem through “Posts,” later testing poorly received ad-like integrations.

- In 2018, the app’s heatmaps potentially revealed military base locations in war zones, igniting a PR nightmare over privacy risks.

- In 2019, the original founders reclaimed the CEO and executive chairman seats to recapture Strava’s “athlete-first mindset”.

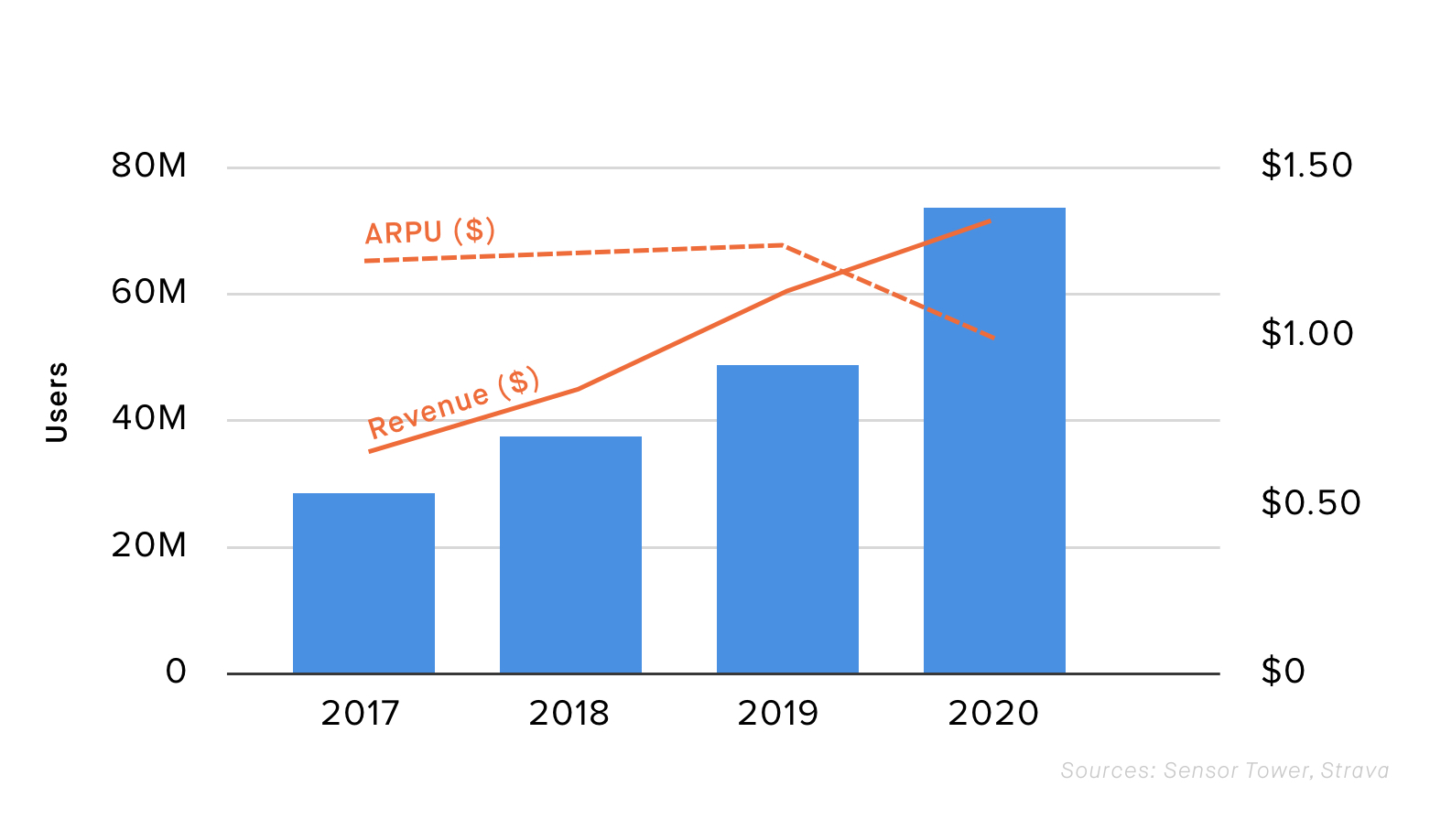

Forgoing privacy-be-damned growth tactics will likely prove to be beneficial, but it leaves Strava with fewer monetization pathways. Though revenue and users are trending up, Sensor Tower estimates average revenue per user slid to ~$1.00 in 2020 ― trailing the average fitness app benchmark of $4.30.

To drive sustainable monetization, Strava will have to deliver on experience. Fortunately, they don’t need a Hail Mary ― by some estimates a mere 0.5 percentage point increase in subscriptions would boost revenue.

Recent and upcoming strides. Doubling down on subscription-worthy upgrades, Strava continues to introduce new features:

- September 2021: 3D route planning and gear incorporation

- August 2021: Customizable privacy and safety upgrades for all users, plus personalized stat maps for subscribers

- May 2021: UX-focused redesign to facilitate activity tracking and social discovery

As for what’s next, speaking to Fitt Insider, Strava shared its intention to enhance core map, safety, and community features while emphasizing personalization:

“The tabs for ‘Maps’ and ‘Groups’ will continue to see new development… Additionally, the privacy and safety controls should also be seen as storytelling features ― customizing your map or muting your upload is just the start for how you can control the way you share your story with your community on Strava.”

From hard lessons learned, leadership is empowering users to own their experiences, whether through color-coded routes or precise privacy controls. In a space where athletes are notorious for tinkering with custom gear, handing users the reins may pay off big-time.

The Moat

Despite user critiques, Strava has distinct strengths that keep athletes coming back.

Global reach, local focus. Although Strava is a global platform, it maintains a local feel. Athletes often engage in word-of-mouth marketing within their own communities, saving Strava the effort of actively going to market in each country.

As a result, the brand has acquired an 80% international 90M+ user base across 195 countries. Mark Gainey explained how strong localization led to Strava’s global impact:

“We realized that our community was driving us internationally… We couldn’t control it. It wasn’t like we chose to go to the UK or to Brazil, which are two of our largest countries after the U.S. ― our athletes immediately took us there.”

Another word-of-mouth driver, Strava champions friendly competition and personal betterment, unlike other social platforms where engagement is often powered by outrage.

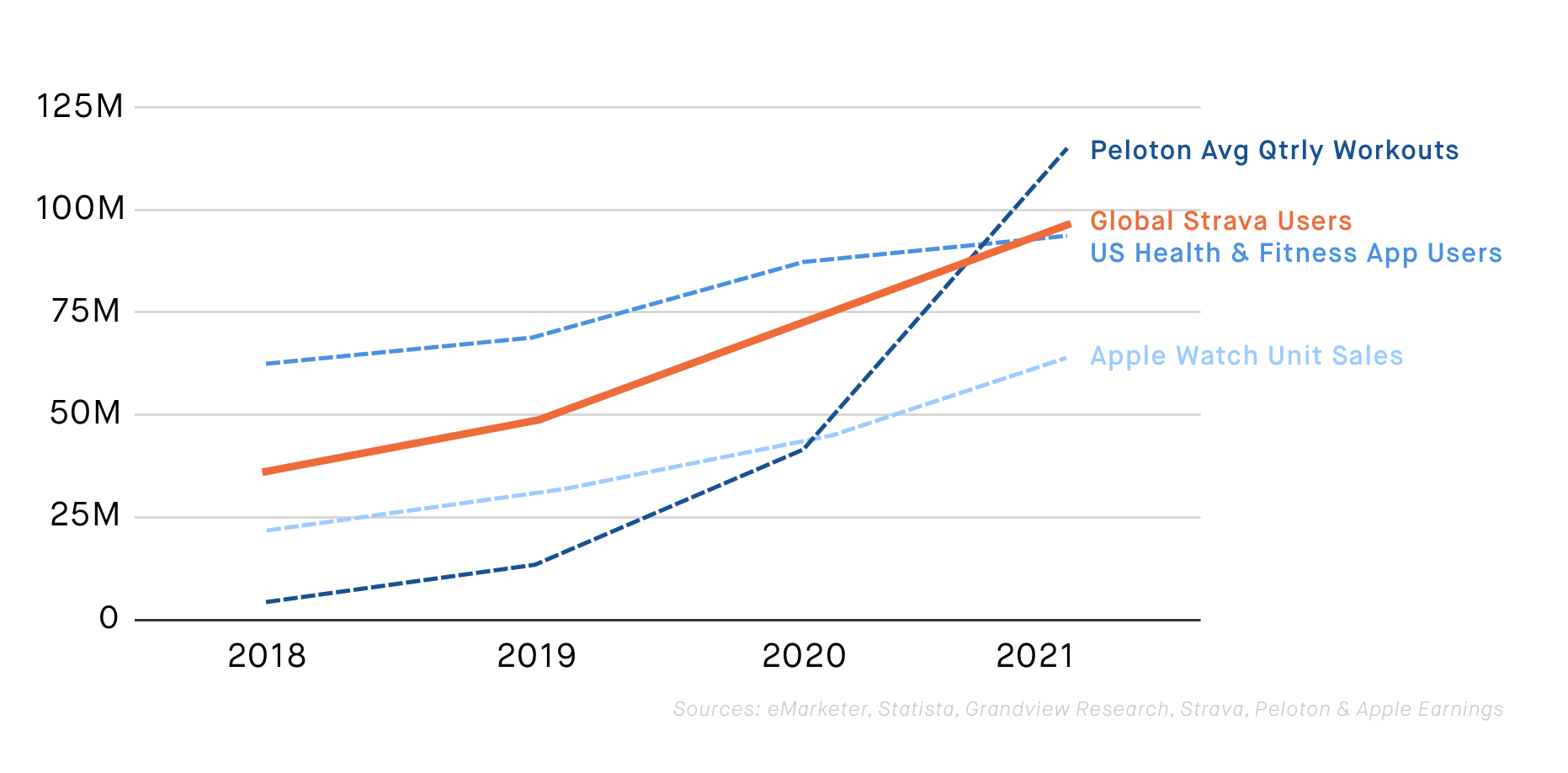

Connected fitness synergies. Strava taps data from 44K+ API partners and 400+ hardware devices including Oura, Peloton, and Zwift to track and share workouts. Nearly 50M Peloton activities have been uploaded, while a whopping 75% of Zwift users log their rides on the platform. These strategic partnerships, as Mark Gainey points out, have allowed Strava to draft on the connected fitness eruption.

“If you fast-forward to today, there’s not a major hardware manufacturer in the fitness wearable space that doesn’t integrate with Strava, whether that’s Apple Watch or Garmin or Suunto, or you name it. And we’ve found that’s been important.”

One caveat — Strava’s greatest growth came during the pandemic after scaling back free features, so its success appears tightly tethered to the broader market. So far, so good, but if the at-home fitness segment slows, Strava could decelerate with it.

Tailwinds. In addition to the pandemic driving exercise seekers outdoors, health and fitness optimization is powering Strava’s adoption. Striking while the iron is hot, acquiring and retaining users is key before they turn to old habits or new tech.

Tracking the Competition

In the era of fitness unbundling, Strava can’t spread itself too thin. While it focuses primarily on running and cycling, maintaining 30+ activities is no easy task. Branching out, they could cede ground to competitors, from niche upstarts to global ecosystems.

Device-agnostic. As the endurance tech category grows, players like Wahoo Fitness, FasCat Coaching, and TrainerRoad are adding new capabilities. But, social tech markets tend to have winner-take-most dynamics, and competitors would be hard-pressed to overtake Strava’s lead.

Meanwhile, apps like Under Armour’s MapMyRun and Nike’s Run and Training Clubs can benefit from existing ecosystems but are also limited by them ― these ancillary platforms often take a backseat to the core business.

Connected hardware. While hardware players like Apple, Fitbit, and Oura have the advantage of being the default fitness tracker on their respective devices, their networks are capped by device sales. Strava benefits greatly from hardware integrations, but strong feature development from these players could make a Strava subscription feel less relevant.

The Path Ahead

Strava has succeeded in winning over tens of millions of athletes, but, to date, the company has struggled with monetization.

In the best-case scenario, the company executes on new features to significantly improve subscription rates. In the worst, they fail to meet the needs or expectations of users, opening the door to more adept challengers.

Regardless, as health and fitness tech accelerates, Strava is well-positioned to draft on its momentum. But, as companies like Terra aim to unlock the next generation of health & fitness data, the competition over who can best leverage that data will heat up.

Ultimately, Strava’s massive global user base puts them in the pole position for what promises to be an ultra-marathon.

🏆 A High-Performance Platform

From pro athletes to corporate wellness and everyday fitness seekers, Exos aims to unlock human performance.

On the Fitt Insider Podcast: Exos CEO Sarah Robb O’Hagan joined us to discuss the company’s efforts to make elite performance more accessible through in-person and digital offerings.

We also cover: Exos programs that span work, sport, and life. And Sarah’s experience at companies like Nike, Gatorade, Equinox, and Flywheel Sports.

Listen to today’s episode here.

🚧 Breaking Down Barriers

Consumer views are shifting, tech is increasing access, and “vice” industries are booming. As the “Great Destigmatization” gains steam, it’s disrupting billion-dollar markets.

New views. Younger consumers are flipping the script on periods, skincare, and mental health. Embracing authenticity and opening up on social media, new attitudes are shaking up industries:

- Big Pharma has branded acne as a stigma, but startups like Starface and Club Psora are disrupting the $6B pimple and blemish market, zits and all.

- More than ever, younger generations are speaking out about mental health struggles, driving the digital mental health boom.

- Gen Zers don’t shy away from discussing their periods. Responding in kind, brands like Kotex, Thinx, and Aavia are refreshing menstruation marketing.

The telehealth effect. Digital health is making things a lot less awkward. The pandemic catalyzed this movement, widening the range of care we can access from the comfort of our home.

- Billion-dollar DTC men’s health brands hims and Ro help men (who tend to avoid the doctor) tackle touchier things like ED and hair loss.

- Bringing sensitive subjects into the open, brands like Evernow and Elektra Health help women navigate menopause.

- Addressing substance abuse and addiction, virtual rehab providers Workit Health ($118M) and Quit Genius ($64M) have raised millions.

The rise of vice. As consumers look for ways to cope with pandemic-driven stressors, vice industries are exploding. Though VC has long avoided investing in “bad industries,” firms like Vice Ventures are breaking the mold.

Squeamishness is old-school. Say hello to sex toys like Maude and Cake, and sexual therapy apps like Kama. Tying pleasure into wellness, even porn is getting a makeover — Dipsea, Ferly, and Quinn deliver erotica in podcast-sized bites.

And health isn’t just becoming explicit, it’s illicit. No longer just party drugs, psychedelics like ketamine, MDMA, and psilocybin are having a moment, poised to revolutionize mental health and addiction.

Punchline: Consumers are coming to understand that avoiding taboos often comes back to bite them — we’re only human, after all. That’s why Catharine Dockery, founder of Vice Ventures, wants more VCs to elevate companies that help promote harm reduction:

“If people just keep brushing it under the rug, then it’s not helping… deeming all vices [as] terrible without understanding what they are, where they come from, or why people use them, isn’t helping our society whatsoever.”

📰 News & Notes

- Who’s working on health and fitness x web3?

- Nike teams with Roblox on new virtual world.

- Equipment maker Life Fitness appoints new CEO.

- Hims & Hers to offer wellness products on Amazon.

- ChiliSleep parent co launches new SaaS sleep platform.

- RPM Training launches connected functional training system.

- DTC healthcare brand Thirty Madison opens brick-and-mortar clinic.

- Startup Q&A: Balanced CEO Katie Reed on digital fitness for older adults.

- Fitt Jobs: Explore 900+ curated openings from top health and fitness companies.

💰 Money Moves

- AllTrails, a digital trail guide and community, raised $150M in growth funding from Permira.

- Plant-based “meat” company Impossible Foods raised $500M in new funding, bringing its total amount raised to nearly $2B.

More from Fitt Insider: The Next Alt-Protein - Digital MSK clinic SWORD Health secured $163M in an oversubscribed Series D round led by Sapphire Ventures, valuing the company north of $2B.

More from Fitt Insider: The Business of Movement Health - Chobani, makers of Greek yogurt and oat milk, filed for IPO with a valuation expected to cross $10B.

- Salad chain sweetgreen raised $364M in its IPO, valuing the company at over $3B.

More from Fitt Insider: Sweetgreen’s Salad Empire - Wave, a mental health app for Gen Z users, closed $2M in a pre-seed funding round led by Hannah Grey, with participation from Tribe Capital, K50 Ventures, and others.

- Sports metaverse company SportsIcon landed $5.5M in a seed round.

- Nutrafol, a hair loss supplement company backed by Unilever, is exploring a sale in a deal expected to be worth ~$1B.

- UK-based GRNDHOUSE, a digital strength training platform, secured £1.5M ($2M) in a funding round.

- The Naked Market, an incubator and marketplace for better-for-you food brands, secured $27.5M in a Series A round led by Integrated Capital.

- ieso, a UK-based digital mental healthcare company, added $53M in a Series B financing round led by investment firm Morningside.

Today’s newsletter was brought to you by Anthony and Joe Vennare, Melody Song, Wesley Yen, and Ryan Deer.