Affecting every aspect of well-being, metabolic health determines the body’s ability to digest food and process energy. And metabolic health in the US is… not good.

With far-reaching implications from chronic conditions to healthcare spending, startups and Big Tech alike are moving in.

Can technology curb the metabolic health crisis? Let’s take a look.

Red Flags

While the focus on metabolic health is fairly recent, there’s no denying its impact.

- Over 128M Americans have prediabetes or diabetes.

- 88% of Americans display some level of metabolic dysfunction; up to 37% suffer from full-blown “metabolic syndrome.”

- 90% of $4T annual healthcare costs in the US are tied to largely preventable chronic conditions — several linked to metabolic dysfunction.

Unwell. Accessing biomarkers is key to diagnosing clinical metabolic syndrome. Those afflicted possess three of the five co-contributing traits: high triglycerides, low HDL cholesterol, elevated fasting blood sugar, increased blood pressure, and/or a large waist.

An accumulation of these conditions leads to increased risk of heart disease, diabetes, and stroke. A heavy burden, the US has recorded over 100K diabetes deaths for two years straight.

Choose Wisely

A host of lifestyle choices—including diet, exercise, sleep, and stress—impact metabolic function.

While healthy habits support optimal performance, creating and maintaining a flawless routine is more complicated than it seems.

Overconsumption. Cheap and widely accessible, nearly 60% of total calories consumed by Americans come from ultra-processed foods like soft drinks, cereals, and packaged snacks. Meanwhile, the average American eats nearly 10x more sugar per day than 100 years prior.

Underactivity. COVID-19 highlighted another pandemic ― inactivity. Today, one in five US adults are completely inactive. Worse, nearly 50% are projected to be obese by 2030. Experts believe sedentary behavior will plague us for years to come, especially with younger generations moving almost an hour less per week than boomers.

Burnout. Despite a flood of mindfulness and mental health apps, chronic stress is at an all-time high. Cortisol―the stress hormone―is responsible for regulating the metabolism, with high levels leading to increased risk for cardiometabolic disease.

Poor sleep. While the demands of an increasingly complex world lead to burnout, many consistently fail to prioritize shut-eye. Insufficient and low-quality sleep has been found to disrupt metabolic health.

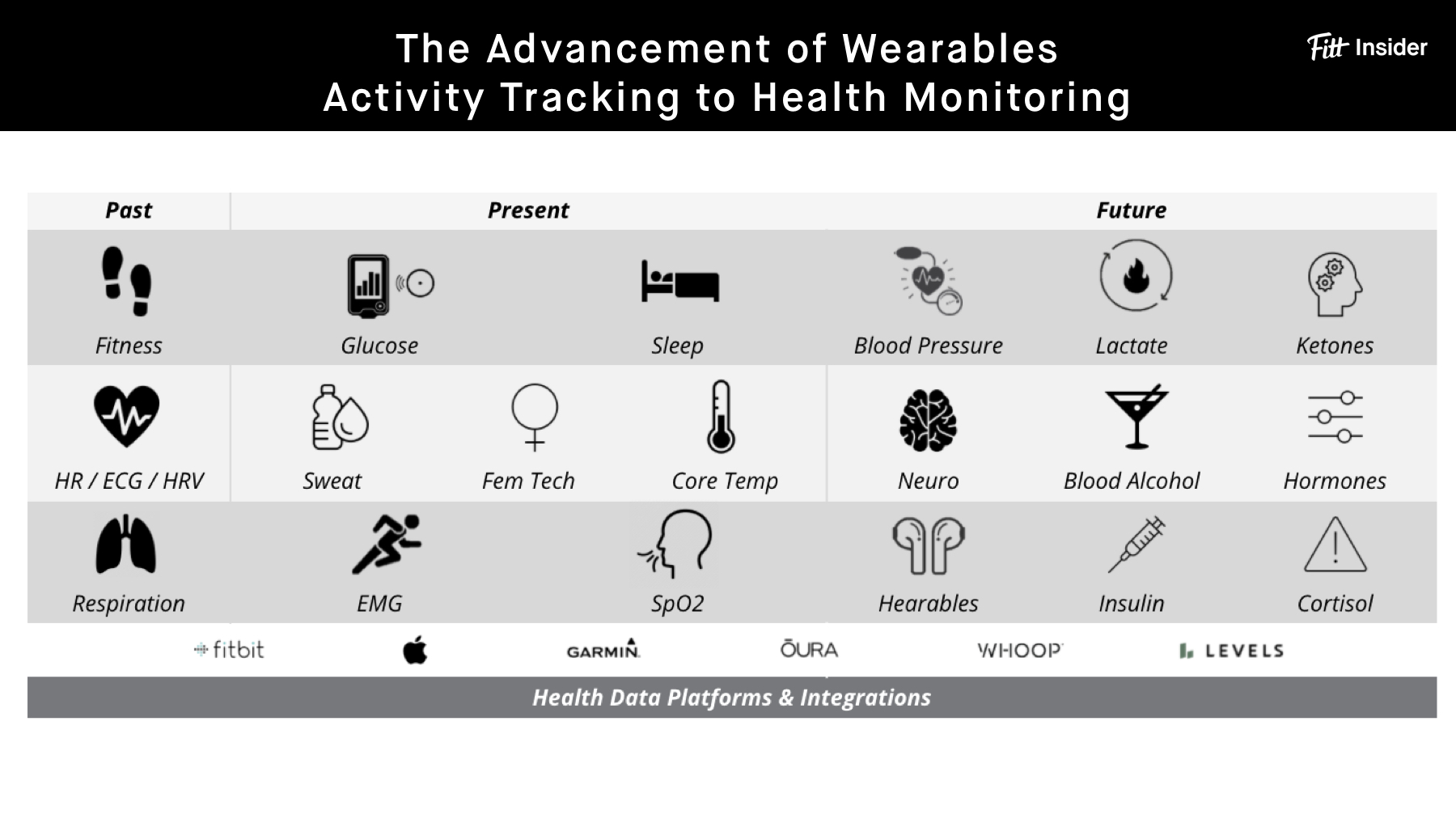

And more… We’re barely beginning to comprehend the intricacies of metabolism and how to holistically approach it. Including the big four above, there are at least 40 inputs that impact blood sugar (and therefore metabolism), including hydration, alcohol use, and temperature.

All in on CGMs

From keto dieting and intermittent fasting to high-intensity workouts, fitness and nutrition regimens are zeroing in on metabolic health. But, while these protocols help keep the body functioning smoothly, glucose monitoring aims to decode the body’s functions in the first place.

Offering real-time insights on blood sugar levels, continuous glucose monitoring (CGM) sheds light on how lifestyle choices like diet, exercise, and sleep uniquely affect your body.

Increasingly, CGM is gaining traction in the fight against metabolic syndrome.

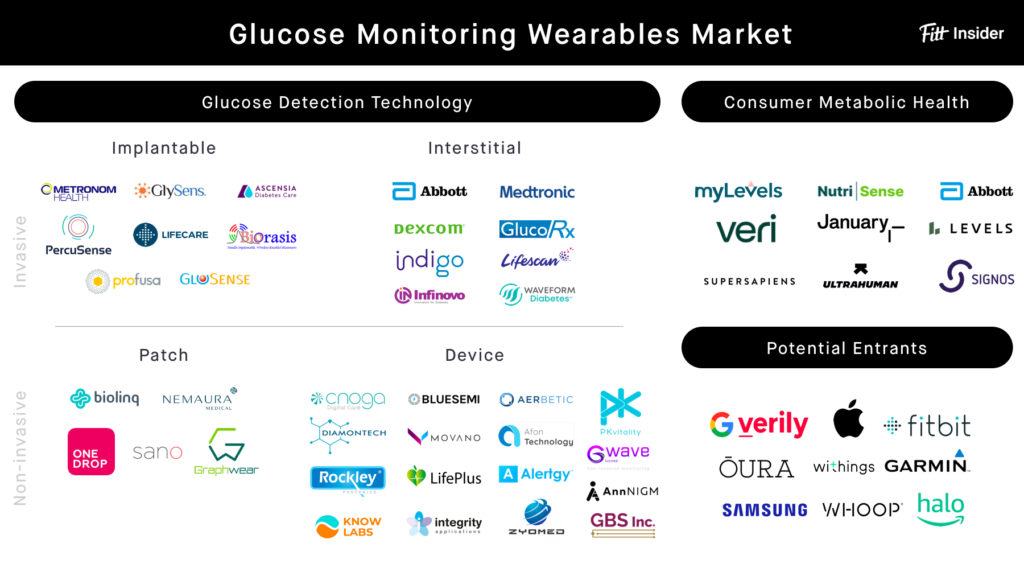

The biohacker boom. As glucose tracking takes hold, the category is growing more crowded. Here, we’ll be focusing on the consumer metabolic health segment ― exploring the companies that use CGMs for optimizing wellness over those primarily offering clinical diabetes treatment.

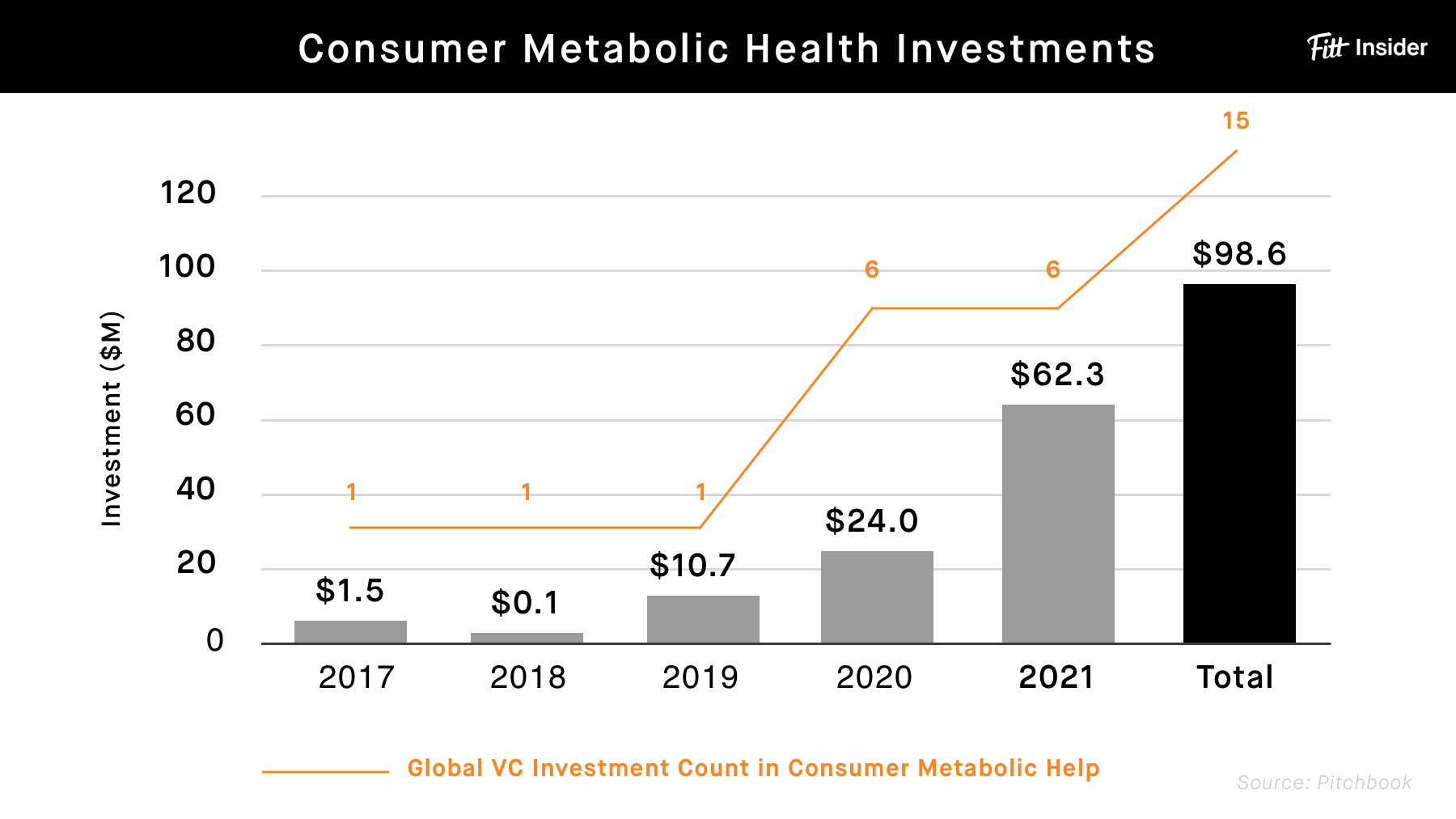

Cashing in. Investors have wasted no time backing wellness-focused CGM, ramping up bets in the space over the past five years to $62M in 2021, per Pitchbook.

Varying Approaches

Metabolic health startups are leaning on familiar models to navigate uncharted territory.

Members only. a16z-backed Levels, which raised $38M at a $300M valuation in April 2022, recently adopted a membership model likened to Costco. The company will charge an annual fee ($198/year), then offer a la carte products and services like CGMs and blood testing at or near cost — notably, CGM costs fall from $399/mo. to about $199/mo.

The Quantified Athlete. Sports performance company Supersapiens secured $13.5M in funding in April 2021. Taking a page out of the athlete-as-investor playbook, Supersapiens is initially honing in on high-performers before broadening its customer base.

Predictive power. Leveraging artificial intelligence, January AI raised $8.8M in early 2021 to support its proprietary “food atlas” algorithm, which predicts glycemic responses to 16M+ foods before users even eat them. The company also expanded beyond consumers to offer enterprise services and assist in clinical trials.

Next-gen nutrition. Meanwhile, NutriSense, Veri, myLevels, and Signos cater to the $200B diet and weight loss market. They all use CGM to help users make informed nutrition decisions while avoiding glucose spikes.

Elsewhere, BioCoach recently landed $4M in funding at a $100M valuation to scale its platform, pairing glucose and ketone readings with a coach-approved eating plan.

Beyond patches. Eliminating the need for filaments and needles, some companies are developing noninvasive solutions, including: photothermal tech by Berlin-based DiaMonTech, needle-free dermal sensors from Biolinq, and saliva tests developed by researchers at Australia’s University of Newcastle.

Market Opportunities

While the glucose monitoring space is relatively new, CGMs aren’t the only solution.

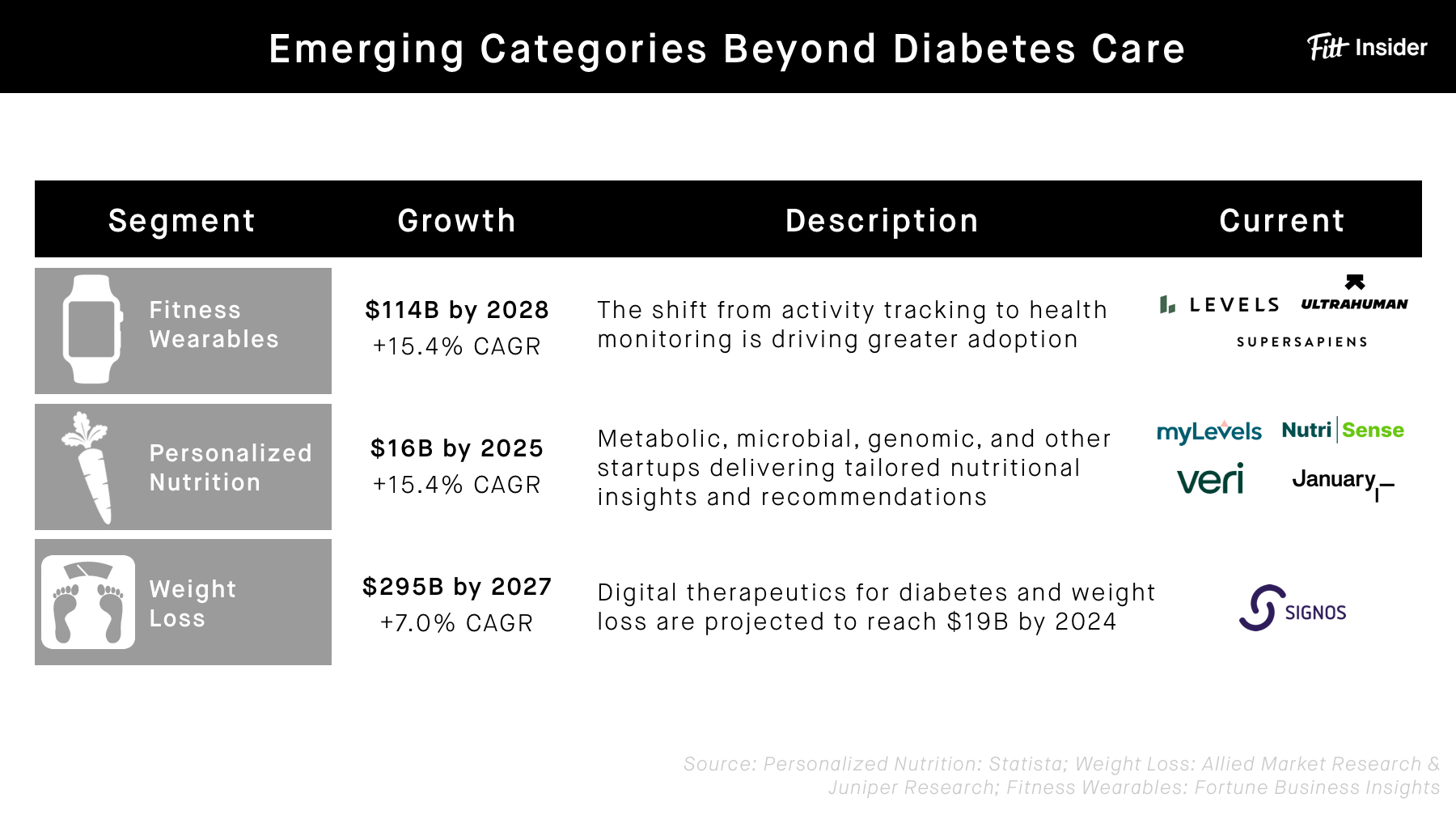

Consumer metabolic health startups are innovating across fitness wearables, diet tech, and digital weight loss, where non-CGM approaches are gaining traction in the fight against metabolic syndrome:

- Wearables. Wearable makers like WHOOP and Oura have championed individualized health decisions by providing digestible, proactive insights on sleep and recovery management. However, Apple, Amazon, Samsung, and Google/Fitbit are all eyeing the $42B diabetic care market.

- Personalized nutrition. Rejecting the one-size-fits-all approach, companies like ZOE, Seed Health, and Wellory are giving rise to the $64B personalized nutrition category.

- Weight loss. Noom, Found, and Calibrate have all raised hundreds of millions to advance their digital weight loss platforms while prescription weight loss drugs gain credibility.

New frontiers. Metabolic health has great potential within consumer and clinical segments like femtech (see Wild.AI), corporate wellness, and primary care as well. Increased accessibility and convenience are a must here, especially for rising markets.

Challenges Ahead

Hardware headaches. Amid looming competition from Big Tech, metabolic health startups must contend with a critical weakness in their pipeline — wellness-focused CGM platforms run on hardware from incumbent manufacturers Abbott and Dexcom.

Dexcom and Abbott dominate the hardware space. After having its “best year ever” in 2021, Dexcom launched a venture fund and made its first investment in Signos’s $13M Series A.

Enabling real-time integration for consumers, Dexcom’s new API connects its FDA-approved hardware to fitness tracking software. It launched its first partnership with Garmin in October 2021. And, showing no signs of slowing down, the manufacturer is rolling out its G7 system—a smaller, more accurate device—this year in hopes to double revenue by 2025.

Meanwhile, Abbott is seeking FDA approval for its sport-focused Libre Sense Biosensor to enter the US market via Supersapiens.

And, announcing its new category of biowearables at CES 2022, Abbott will enter the general health and wellness biowearables with a collection called Lingo, capable of tracking glucose, ketones, alcohol levels, and lactate.

Buyer beware. Many experts question whether health apps and wearables actually help; CGMs are no exception.

While the tech is certainly groundbreaking, Dr. Robert Eckel, for one, deemed it a “waste of money” for those without diabetes. Proponents, like Dr. Peter Attia, argue that we can’t determine if somebody has normal glucose responses without first tracking them.

Another issue, the industry has yet to establish definitive standards for healthy, nondiabetic individuals.

Focusing on the positives, with wider uptake, increased demand, and more funding, manufacturers hope to make better and cheaper products for everyone, diabetic or not.

Inaccessible and invasive. Most CGMs use sensor wires, or filaments, that pierce the skin to continuously assess blood sugar levels — which could be unappealing to the everyday wellness seeker. Not to mention, as the filament-model patch needs to be replaced every 14 days, most will run you thousands of dollars per year. As is, they’re currently sought after by dedicated biohackers and diabetics.

Bad habits. The hope is that increasingly accurate, affordable, and less-invasive devices eventually drive adoption and behavioral change. However, data alone won’t inspire the world to heed age-old warnings. Most people know that exercise and proper nutrition are healthier than inactivity and processed snacks — and yet, the problems persist.

Looking Ahead

Revisiting the initial question, when discussing metabolic health, is CGM—or, more broadly, tech-enabled intervention—solving the most pressing problems for the largest number of people?

If preventing metabolic syndrome is the goal, then consistent exercise, proper diet, and stress management will do much more for the average person than a glucose monitor. Besides, even if everyone eventually adopts the tech, there’s no guarantee they adopt healthier habits.

That being said, CGMs mirror broader trends in digital health: personalized data, real-time feedback, and customized recommendations. Whether or not they make sense for non-diabetes patients, next-gen health wearables will unlock powerful health insights, including glucose, ketones, cortisol, hydration, and more.

Thanks to Charlie Thomsen and Ryan Deer for contributing to this report.

Illustration: Courtney Powell

Illustration: Courtney Powell