Issue No. 161: WHOOP’s High-Performance Platform

Illustration: Courtney Powell

Illustration: Courtney Powell

In a world that glorifies the grind, WHOOP champions rest and recovery. Measuring strain rather than steps, the wearable tech company is driving a paradigm shift.

Worth upwards of $3.6B, WHOOP touts itself as the most valuable human performance brand in the world. But, for now, they’re still David to Goliaths like Apple, Google, and Amazon.

From smart clothes to virtual communities and even healthcare, we’re taking stock of WHOOP’s rise and the roadmap ahead.

The Personalized Digital Health Coach

Like its users, WHOOP is competitive. Pulling no punches, the phrase “Don’t bother copying us, we will win” is etched into each circuit board of its latest device. So, what’s at stake?

Hyper hardware. Sleek and screen-free, their device is optimized for 24/7 health metrics, taking 100 measurements per second. WHOOP boasts sleep tracking tech, and its 4.0 model features an ultra-efficient silicon anode battery.

Simple software. Unlike old-school fitness trackers that drown users in data, WHOOP synthesizes measurements into three main attributes: Strain, Recovery, and Sleep.

Data > intuition. With a 360-degree view, the app shifts focus from reactive or feeling-based inputs to proactive and data-driven insights. Or, as WHOOP co-founder and CEO Will Ahmed sees it:

“Feelings are largely overrated… There are secrets your body is trying to tell you that WHOOP is now able to measure… the data is better at predicting your level of performance than your own intuition.”

Strapped. After four months of usage, members report a host of benefits, including a lower resting heart rate, increased heart rate variability, improved sleep, and 60% fewer injuries.

Business Model

Subscription hardware. After initially struggling to sell a $500 band, WHOOP moved to a subscription model in 2018. For a monthly price of $18–30, users get the wearable device and analytics without an upfront hardware cost, resulting in several key unlocks:

- Aligned incentives. It forces the company to continually deliver consumer value to ensure profitability through retention.

- Lowered barrier to entry. Subscription shifted near-term costs to the company rather than consumers for potential long-term gains.

- Renewable hardware. WHOOP sends new straps to members with six-month commitments, rewarding loyal users with new tech.

- Investment positioning. The business model wooed venture capitalists who were wary of hardware companies following notable wearable failures.

Strong engagement and retention numbers prompted the move, with >50% of members using WHOOP daily, even 18+ months after purchasing the band. Though this transition required an overhaul of its business model, it appears to have paid off.

Trend-setting. Watching WHOOP, other companies have adopted subscription, though not to the extent of replacing device sales:

- Fitbit launched Fitbit Premium in 2019 and recently incorporated a WHOOP-like Daily Readiness Score.

- Oura recently paywalled detailed insights and features behind a $5.99/month subscription.

- Amazon’s [eerily similar] $100 Halo wearable is accompanied by a $3.99/month subscription.

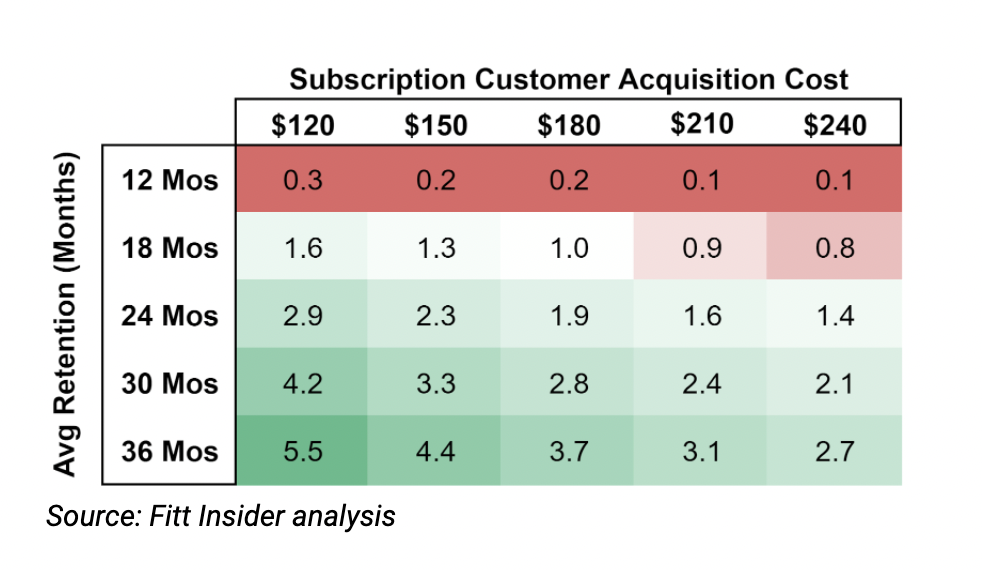

Unit Economics. Taking a closer look at WHOOP’s subscription model and recurring revenue, we approximated customer lifetime value (LTV) and customer acquisition cost (CAC).

For context, the LTV to CAC ratio is essentially the gross profit delivered by each customer (LTV) divided by the cost of acquiring said customer (CAC). A ratio above one indicates growth, while a score below one spells trouble ― though, common wisdom indicates a 3:1 LTV to CAC ratio is ideal.

Assuming average monthly sales of $26.16 (incorporating lifts from WHOOP Pro) and 44% gross margin on the original $500 price (estimated average between Apple and Fitbit), any customer commitment below 24 months risks damaging the bottom line.

Currently, hardware makers are reporting supply chain and manufacturing issues, and WHOOP is no exception ― its delivery time as of this writing is 11+ weeks.

With digital marketing costs rising, WHOOP’s margins could suffer, creating even more pressure to diversify revenue and deliver lasting value.

Strategic Bets

HRV (Healthy revenue variability). WHOOP is adding revenue streams beyond the core subscription business, including a $12/month Pro membership granting early access to features and discounts.

Anytime, any-wear. Entering smart clothing, newly-launched WHOOP Body opens the door to a fast-growing industry. Leading with style and versatility, the brand is taking “the first step in making wearable technology completely invisible.”

A pulse on enterprise. Focusing on workplace wellness, WHOOP started internally by paying its own employees to sleep more. The company is also eyeing B2B wellness à la Peloton, recently partnering with Tory Burch.

Eyeing healthcare. In September 2021, WHOOP announced a partnership with Datavant, a healthcare data company. As high-performance health takes hold, wearing a WHOOP (or similar device) could replace trips to the doctor’s office.

Heavy hitters. Securing key partnerships, WHOOP is the official wearable of the PGA, NFL, CrossFit, and WTA. An innovative branding opportunity, the Ryder Cup broadcast featured a live golfer heart rate tracker.

Beyond athletics, the US Army is using the device to track and improve performance under extreme military conditions.

Sick recovery score, bro. Building community, WHOOP released a Strava-esque “Team Chat” feature where users form groups and share stats. The program has seen early success with over 85K teams created. A proven strategy, leveraging network effects can accelerate engagement and lower acquisition costs.

Betting on women. The company recently announced its Women’s Performance Collective, investing in efforts (like menstrual cycle coaching) to unlock female performance. As women’s sports continue to take off, the company is positioning itself for synergistic growth.

PUSHing toward coaching. This fall, WHOOP acquired PUSH, a wearable tech company focused on velocity-based performance data. Already popular with athletes, strength coaches, and military operators, the acquisition could spur an entry into coaching and athlete management software.

Can it WHOOP the Competition?

A top-heavy market, Apple, Samsung, and Xiaomi dominate wearables. But, increased competition creates opportunities for WHOOP and others — with each player taking a slightly different approach.

- Apple aims to revolutionize healthcare, leveraging its emerging wellness flywheel of hardware, software, health data, and fitness services.

- Shoring up its wellness ecosystem, Google acquired Fitbit for $2.1B, partnered with Samsung on Wear OS, and invests in health-related startups.

- Combined with its medical record software and online pharmacy PillPack, Amazon’s WHOOP-esque Halo likely factors into a “Prime Health” ecosystem.

- Oura offers similar capabilities via a sleek, ultralight ring. The company touts partnerships with the NBA, UFC, and NASCAR.

Slaying giants. The wrist wars are heating up. Adopting a kingkiller mentality, WHOOP is taking on the tech oligopoly.

As Facebook prepares to join the FAANG smartwatch party, high profile privacy controversies could benefit WHOOP, with CEO Will Ahmed noting:

“Ultimately I welcome Amazon to the market and expect every big tech company to want to play in it… But… many companies will make YOU the product… We exist to improve your life, not invade it.”

So, What’s the Big WHOOP?

The new era of wearables wants to transform how we live, train, and recover.

But, there are legitimate concerns over whether or not wearables actually improve our well-being. Further, while device makers promise increased access, a recent study suggests health trackers mostly benefit the rich.

Still, as the quantified athlete redefines fitness data while analytics-driven healthcare systems emerge, we’ve only scratched the surface of what’s possible.

So far, WHOOP has executed on providing long-term value for members, where aligned incentives in a subscription model give them an edge. But considering who they’re up against, there’s little margin for error.

Time will tell whether this David can defeat the tech Goliaths, but the battle over our wrists is just getting started.

👀 Pilates Goes High-Tech

Smart bikes kicked off the connected fitness boom. Now, Pilates wants in on the action.

On the Fitt Insider Podcast: Frame Fitness co-founder and CEO Melissa Bentivoglio joined us to discuss the company’s connected Pilates reformer.

We also cover: the company’s $5M funding round that included 24 Hour Fitness founder Mark Mastrov. Plus, we discuss Frame’s approach to content, community, and design.

Listen to today’s episode here.

🤑 Trillion with a T

Emerging from a pandemic crash, the global wellness market is expected to grow at 9.9% annually, reaching $7 trillion by 2025.

Top line. A new Global Wellness Institute (GWI) report reveals the state of the industry.

- 2017: $4.3 trillion

- 2019: $4.9 trillion

- 2020: $4.4 trillion

Ups and downs. Before the pandemic, wellness was soaring. But, COVID-19 had a disruptive impact on the industry — with many of the developments aligning with our analysis of trends, M&A, and investment.

Living well. Maintaining the top growth of any sector both pre- and mid-pandemic, wellness real estate grew 22.1% in 2020.

Peace of mind. The mental healthcare and wellness segment surged 7.2%, spurred by burnout and investments into digital solutions.

Gaining ground. Boosted by telehealth, personalized and preventative medicine rose 4.5%. Likewise, from nutrition to weight management, the healthy eating, nutrition, & weight loss category was up 3.6%.

Growth ahead. More than money, the pandemic has changed how consumers view wellness. Over the next five years, the sectors tied to an overall healthy lifestyle shift, both mentally and physically, are set to cash in.

🔎 Reflecting on Connected Fitness

In its latest earnings report, lululemon’s activewear sales exceeded analyst estimates. But, MIRROR, the company’s connected fitness brand, is weighing it down.

On the bright side. lululemon’s net revenue increased 30% YoY to $1.5B. With its women’s business up 25%, the retailer grew menswear and international sales—two strategic priorities— 44% and 40%, respectively.

A strong showing, lululemon boosted its full-year forecast, with the brand set to surpass $6B in annual revenue.

A red flag. While lululemon’s apparel outperformed, its home workout device suffered a setback.

- 2020: lulu paid $500M to acquire MIRROR, which earned $170M in revenue that year.

- 2021: Heading into this year, MIRROR’s revenue target was set at $250–275M.

- Now: Cutting MIRROR’s 2021 sales figure in half, lululemon now expects the equipment maker to bring in $125M to $130M.

As CEO Calvin McDonald put it: “2021 has been a challenging year for digital fitness… We have seen increasing pressures on customer acquisition costs that are impacting the entire industry.”

Home workout hangover. Bolstered by the pandemic, connected fitness boomed. But, as gyms reopen and competition across the category grows, consumers and brands are trying to find their footing. For lululemon, the synergies made the MIRROR acquisition too good to pass up. Now, they’re likely wondering if the deal was too good to be true.

📰 News & Notes

- TRX partners with ZARA on new apparel line.

- Strava appoints Spotify VP Gustav Gyllenhammar to its board.

- CLMBR integrates Alexa voice commands, Halo Band live stats.

- Music as a moat: Tonal adds Amazon Music for in-workout tunes.

- Fitt Jobs: Explore 900+ openings at top health & fitness companies.

- Coinbase CEO Brian Armstrong launches company to extend human healthspan.

💰 Money Moves

- Mental health startup Cerebral raised $300M in a Series C round led by SoftBank Vision Fund 2, valuing the company at $4.8B.

- Nike acquired RTFKT, a startup offering hybrid NFT/physical shoe collectibles for an undisclosed sum.

- Restore Hyper Wellness raised $140M for its health and recovery centers, which offer IV drips, infrared saunas, and cryotherapy. General Atlantic led the round.

- ONYX Interactive, makers of a connected Pilates reformer, added new funding ahead of its January launch.

- Fresha, a business management platform for beauty and wellness, added $52M to its Series C funding round, reaching $152M at a $640M valuation.

- Canadian frozen food manufacturer McCain Foods acquired a minority stake in Strong Roots, maker of plant-based frozen food, for $55M.

- Therify, a therapist-matching app for marginalized populations, secured $1.3M in a seed round led by SoftBank’s SB Opportunity Fund, Y Combinator, Looking Glass Capital, and others.

- Plant-based ice cream maker NadaMoo! closed $10M in a Series C round co-led by District Ventures Capital and InvestEco.

- Tava Health, a corporate mental health platform matching employees to therapists, landed $10M in a Series A.

- Healthtech startup Mightier, creators of a video game supporting the emotional health of children, added $17M in Series B funding led by DigiTx Partners.

Today’s newsletter was brought to you by Anthony and Joe Vennare, Melody Song, Wesley Yen, and Ryan Deer.