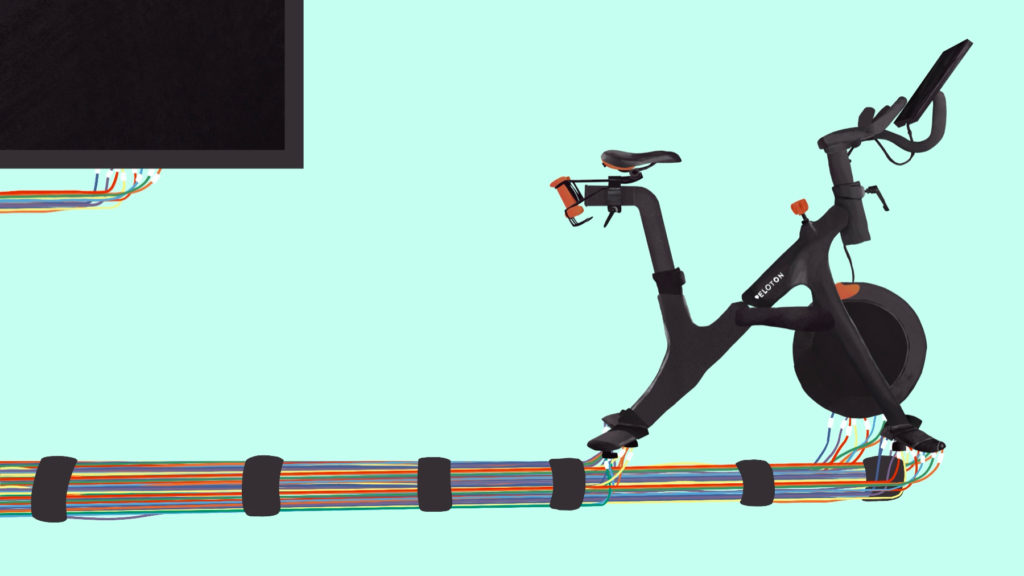

Elevating at-home workouts, efforts to bundle hardware, software, and content ignited the connected fitness wars.

But now, as gyms rebound, connected fitness could unbundle as equipment makers opt for open ecosystems over vertical integration.

Apple of Fitness

In 2015, Peloton co-founder John Foley said: “We’re not trying to be better than SoulCycle… We are better than SoulCycle.”

From the beginning, Foley’s formula combined top-tier instructors and a souped-up bike with the convenience of home exercise. A step further, likening boutique cycling to a religious experience, Foley sought to emulate the community of in-studio classes.

Executing this plan, Peloton created an end-to-end experience, manufacturing hardware, developing software, and producing content. Pointing to obvious similarities, Peloton’s approach was dubbed the “Apple of fitness.”

Initially, Foley echoed the analogy, lumping Peloton in with Apple, Tesla, and “other hardware and software platforms that are vertically integrated, direct to consumer, that are disrupting their respective categories.”

Before long, Foley ditched the comparison, explaining:

“I used to say we want to be the Apple of fitness. I’ve stopped saying that… We want to build the biggest consumer-products brand in the world. We’re going to make Apple look small-time.”

Broadening its vision, the brand’s 2019 IPO filing defined Peloton as a technology, media, software, product, experience, fitness, design, retail, apparel, and logistics company.

Flash-forward: In March of 2020, as COVID surged and gyms shuttered, Peloton’s rapid rise validated its strategy, helping companies running a similar playbook amass billions of dollars in venture funding.

Connected Wellness

Peloton sparked the connected fitness craze, but Technogym has built a vast wellness ecosystem.

Founded in 1983, the Cesena, Italy-based equipment maker is lesser known in the US. Around the world, though, Technogym has a presence in 85K health clubs and 400K homes, reaching 55M people.

While commercial sales comprise the bulk of its revenue, Technogym is strengthening its direct-to-consumer segment. Bolstered by COVID, home fitness sales grew 71% YoY in 2020. Of note, its commercial business rebounded last year, rising 20% as total earnings topped €611M ($676.9M).

Part of its “wellness on the go” strategy, Technogym created a business management software for gyms, including the ability to host original fitness content. Meanwhile, users can access the Technogym ecosystem on equipment in clubs or at home, and via its digital app anywhere.

Expanding its offering, the company’s smart bike now integrates with Zwift, Strava, ROUVY, and TrainingPeaks. In addition to producing content in-house, the company told Fitt Insider it will pursue an “open platform approach,” collaborating with fitness trackers, content providers, and third-party apps.

Pipes and Platforms

As demand slows, connected fitness startups are correcting course — and reevaluating their business models.

After its pandemic bubble burst, Peloton is regrouping under new CEO Barry McCarthy. Downplaying the role of equipment, McCarthy told the NYT, “The magic doesn’t happen in the sheet metal… The magic happens on the screen.”

Mulling a broader shift, McCarthy continued:

“Today, [Peloton is] a closed platform — but it could be an open platform and part of the creator economy. What other apps would you put on it? Could it be running an app store?”

While Peloton plots its next move, companies following its lead will likely rethink their connected fitness strategy. Surveying the landscape, Technogym’s open ecosystem represents another approach to consider.

Zooming out, these examples illustrate a prediction from our 2022 trends outlook. As competition intensifies, fitness brands are searching for distribution, giving rise to new partnerships:

- Equinox+ offers TB12, [solidcore], and Rumble workouts on its app.

- Barry’s and FORME announced an exclusive content and retail deal.

- Samsung invested in obé, streaming the startup’s workouts on its smart TVs.

Elsewhere, as Zwift readies its own connected equipment, CEO Eric Min hinted at the possibility of a Roblox-like future for his company:

“I would like to see more people innovating within our platform… the future of these virtual worlds is [building] an economy, [creating] things, and [owning] things indefinitely…”

Meanwhile, Meta’s Mark Zuckerberg believes we’ll all be working out in virtual reality before long. Doubling down, he acquired VR workout app Supernatural. But, the Quest headset hosts a number of exercise apps, representing yet another take on connected fitness.

And, as it turns out, Apple is the Apple of fitness. The company has continued to expand its digital workout subscription since its 2020 debut.

Punchline: Vertical integration was pivotal to Peloton’s rise, but it also hamstrung the brand.

As the company—and the smart equipment sector—evolves, the future of connected fitness could look less like Apple and more like Android.

Prioritizing core competencies and reaching more consumers over end-to-end integration, content and software developers will partner with hardware providers to create compelling fitness experiences.

💙 The Rise of Wellness Studios

From high performance to immune health and longevity, consumers are spending big on esoteric treatments — and wellness studios are cashing in.

On the Fitt Insider Podcast: Jim Donnelly, CEO of Restore Hyper Wellness, a provider of health and recovery-focused services, joins us to discuss the company’s approach to preventative wellness.

We also cover: a range of remedies from IV drips to cryotherapy and how the company’s $140M funding round will drive the opening of 100 new locations.

Listen to today’s episode here.

☀️ Sweat x Sunshine

The outdoor gym economy is on the way up.

For context: When the pandemic hit, most gyms were forced into outdoor setups. Now, even as restrictions are dropped, demand for open-air classes has remained.

The latest: Container gym company BeaverFit partnered with global equipment manufacturer Eleiko.

Targeting outdoor training, Eleiko will distribute BeaverFit products across the US, EU, UK, and Nordic countries.

Elsewhere, outdoor fitness is scaling up:

- After successful pandemic outdoor installations, boutique studios Barry’s and SoulCycle created permanent outdoor class formats.

- Outdoor bootcamp operator Camp Gladiator plans to expand to three more cities in 2022.

- TRX founder Randy Hetrick launched OutFit, a mobile unit of outposts and vans that delivers TRX training to local parks and neighborhoods.

- GYMGUYZ, a mobile personal training franchise, serves 150 locations and just entered corporate wellness.

Sweat and socialize. On a recent episode of the Fitt Insider Podcast, GORUCK CEO Jason McCarthy downplayed the buzzy fitness metaverse, championing outdoor, in-person exercise:

“You’re staring at your phone too much and you need to go [outside]. If someone invites you to go work out in a field, go work out in the damn field.”

Looking ahead: For many states, this is a seasonal opportunity. But as Americans continue to seek the outdoors while exercisers sorely miss in-person community, this segment is one to watch.

🧠 Mindful Movement

In 2022, 78% of Americans say mental/emotional well-being is the top reason for exercising. That’s ranked above physical well-being (76%).

Mind + body. As our collective mental health continues to suffer, pain & gain is no longer the mantra. Increasingly, consumers who want to restore and recharge are bolstering the $29B mindful movement sector.

Taking notice, gyms are adding classes that… do less.

- This year, Life Time hiked the availability of its Surrender class format by 50%; it’s an hour of gentle stretching to soft music in a dark room.

- Crunch Fitness is rebooting its chakra-focused breathwork and stretching class and also began adding rest and recovery areas to its gyms.

- 24 Hour Fitness increased its recovery classes by 33% since summer 2021 and partnered with iCRYO for rehab-in-gym installations.

A related development, Garmin reported the fastest-growing activities among users were Pilates (108.3%), breathwork (82.76%), and yoga (45.55%).

Leaning in, health and fitness brands are creating digital offerings with mental wellness in mind:

- Nike debuted Mind Sets, a movement series for the mind.

- Calm launched Daily Move, featuring yoga and stretching.

- Peloton & Apple Fitness+ offer meditation, linking mind and body.

Be on the lookout: Another spin on mindfulness, “mental muscle” has become yet another facet of health to optimize. From cognitive resilience to emotional health, mental fitness is bulking up.

📰 News & Notes

- Oura sold its one-millionth ring.

- sweetgreen unveils drive-thru concept sweetlane.

- CGM startup Levels switches to membership model.

- Fitt Jobs: connecting you to a health & fitness career.

- Athlete activation: Behind Strava’s Tour de France deal.

- Gary Vaynerchuk buys team in Major League Pickleball.

- InsideTracker’s biometrics platform integrates Apple Watch data.

- RIP Louie Simmons: powerlifting legend, Westside Barbell founder.

- Startup Q&A: Bird&Be co-founders on personalized prenatals (for men too).

💰 Money Moves

- COR, makers of at-home blood testing technology, raised $12M in Series A funding co-led by Khosla Ventures and Founders Fund.

More from Fitt Insider: Our conversation with COR founder Bob Messerschmidt - Youth sports technology platform Players Health secured $28M in a funding round co-led by Mastry Ventures and SiriusPoint.

- OK Capsule, a white-label personalized supplement startup, landed $9.5M in a funding round co-led by Mucker Capital and NEXT VENTŪRES.

More from Fitt Insider: The State of Supplements - Chinese fitness tech company Speediance, maker of a Tonal-like connected machine, raised ~$1.5M in Pre-A funding.

- Fisher Wallace, makers of an FDA-cleared wearable neurostimulation device for depression, anxiety, and insomnia, secured $2.5M in new funding.

More from Fitt Insider: Prescription Wearables - UK-based Muoverti, makers of a tilting stationary bike called TiltBike, added a “million-pound investment,” bringing total funding to £2.4M ($3.16M).

- Israeli neural tech startup brain.space, creators of a brainwave-reading EEG helmet, landed $8.5M in seed funding.

More from Fitt Insider: The Big Business of Brain Tech - Hylo, a UK-based athletic footwear startup, raised £2.5M ($3.28M) in a Series A round led by Eka Ventures.

- SoundMind, an audio-visual mental health app using soundscapes to treat anxiety, secured $800K in pre-seed funding.

More from Fitt Insider: The New Brain Game - Svexa (Silicon Valley Exercise Analytics), an exercise intelligence company, closed a $2.5M seed round led by Yamaha Motor Ventures.

- Professional Triathletes Organisation, a professional body for triathlon, received an undisclosed strategic investment from Eckuity and Sir Michael Moritz, partner at Sequoia Capital.

More from Fitt Insider: The Endurance Economy - SteelSky Ventures closed a $72M round for its inaugural fund focused on women’s health.

- Kids behavioral health platform Brightline landed $105M in a funding round led by KKR, valuing the company at $705M.

More from Fitt Insider: The Kids Aren’t Alright

Today’s newsletter was brought to you by Anthony and Joe Vennare, Ryan Deer, and Melody Song.