Inspired by the concept of virtual competition in 2014, Zwift co-founder Eric Min set out to improve the indoor cycling experience.

Fast-forward to the present day, leveraging entertainment and gaming, Zwift has earned a valuation north of $1B.

More than just a game, Zwift acts as a gateway to virtual training and multiplayer competition that, as Min believes, could become an Olympic sport.

As the company plots its next move, today, we’ll look at how far Zwift can climb.

Cycling Meets Mario Kart

What it is: A fitness company born out of gaming, Zwift is reimagining exercise, starting with indoor cycling and running:

“We don’t talk about training [or suffering] all that much. What we want to do is entertain you ― and the outcome is fitness.” – Eric Min, co-founder & CEO

Gamifying fitness. Making exercise more engaging and racing more accessible, Zwift users can join live competitions on a virtual track without the hassles and costs of traditional events.

In addition to in-race performance boosts (“PowerUps”), players can earn digital currency (“Drops”) to spend on custom bike equipment, clothing, and more. But, unlike other games, players can’t simply purchase in-game currency ― the harder you go, the more you earn.

Training. Despite its emphasis on racing, only 25% of Zwifters participate in group events, with 75% preferring solo workouts. Rather than provide instructed classes, Zwift simulates the outdoor cycling experience without hazardous road or weather conditions, all while providing real-time performance analytics.

Flexibility. Vertically integrated platforms like Peloton follow in Apple’s footsteps by bundling content and hardware, compelling users to buy its equipment. Zwift, on the other hand, integrates with almost any racing bike, smart trainer, and Wi-Fi-enabled screen.

Simply software. Zwift’s software focus (until recently) and $15 monthly price aid adoption and margins while streamlining the company’s focus toward game development. But, this approach also demands deeper customer education to acquire and onboard users without a plug-and-play hardware setup.

In their lane. Unlike Peloton, which targets gym-goers and casual exercisers, Zwift zeroed in on cycling enthusiasts, a cohort willing to spend on gear and training accessories. To date, cycling has comprised as much as 98% of activity on the platform, but Zwift has expressed interest in new modalities, including rowing.

Digital bike gang. Driving retention through community, Zwift’s virtual rides and global user base help distinguish it from competitors. Enhancing network effects, Zwift encourages in-game sub-communities, and users propel the brand forward by creating blogs, race videos, and podcasts dedicated to the platform.

Strategic Bets

Changing the game. Beyond fitness, Zwift could transform sports. In addition to running its own esports league and organizing the 2021 Olympic Virtual Series, the brand hopes Zwift racing will become an Olympic sport by 2028.

Making competition accessible. This Nike-esque approach of investing in athletes and virtual competition is paying off. Case in point: Roughly 117K riders participated in Zwift’s Virtual Tour de France 2020 versus about 200 cyclists in the real-life Tour de France.

In a podcast interview with Fitt Insider, Min elaborated on the power of increasing access to competition:

“[There is a huge pool of] people who can be super competitive at the highest level while having a job and a family. These aren’t professional athletes ― they’re moms with three kids. We’re creating opportunities for people like that.”

Winning with women. In June, Zwift inked a four-year deal with Tour de France operator ASO to sponsor the in-person Tour de France Femmes event. The company also designed its Zwift Academy program to fast-track young female cyclists to the World Tour, and the developers leveled in-game gender performance differences so women can compete on equal footing.

Strava synergy. Strava and Zwift have a symbiotic relationship. While Strava’s 95M users typically ride outdoors, this partnership helps it capture indoor activity while Zwift gains engagement from dedicated Strava athletes. A step further, Strava integrated Zwift roads into its platform so users can become “Local Legends” on virtual segments.

Hardware aspirations. While a sole focus on software has been beneficial, it leaves money on the table from its most engaged users. After initially prioritizing integrations with hardware makers like Wahoo Fitness, Elite, and Tacx, the fitness gaming brand restructured to emphasize hardware development in March 2020.

The company recently confirmed their competitively priced smart bike and connected trainer. Citing people connected to Zwift’s hardware efforts, cycling blog DC Rainmaker reported that the company hopes to officially launch its smart hardware in July 2022.

The [Virtual] Path Ahead

Zwift will face a number of obstacles in its attempt to break away from the pack.

Hardware hurdles. A huge opportunity, Zwift leadership has lamented hardware’s monumental challenges. Manufacturing has taken significantly longer than expected, exposing the brand to supply chain issues in a turbulent environment. Min, however, holds conviction in staying the course:

“It’s causing delays for everyone, including us. But it doesn’t change our strategy. We believe that we have to be manufacturing hardware in order to grow our business.”

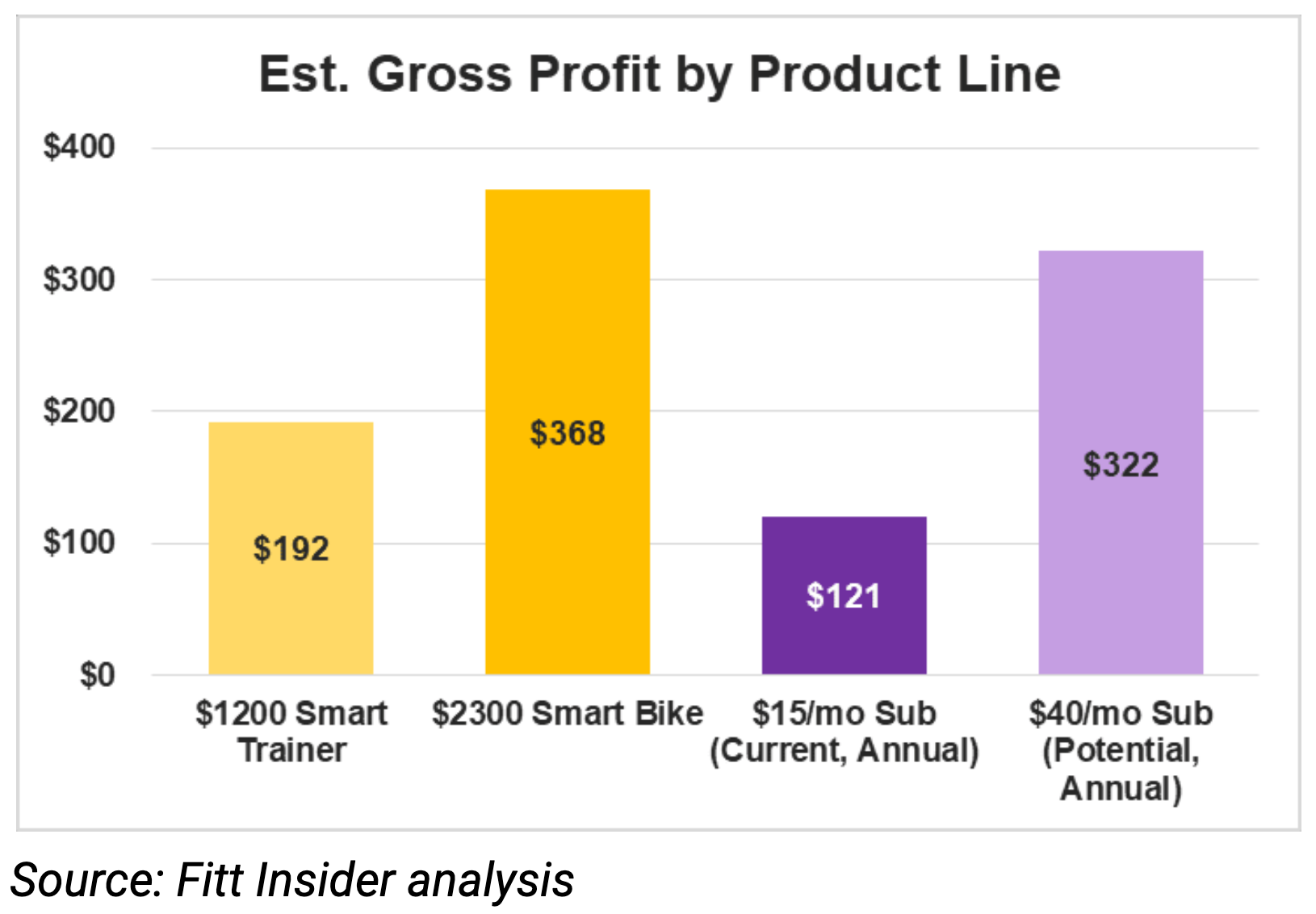

Profit potential. A key consideration: How will hardware impact the core business? For reference, Peloton expects its connected hardware gross margin to level out to 16% on the year, while its subscription gross margin is 67%.

Applying these numbers to reported Zwift pricing implies respective gross profits of $368 and $192 for the bike and trainer, eclipsing the current subscription’s $121/year.

Far from guaranteed, succeeding in hardware would boost the bottom line and drive retention while validating the brand’s lofty ambitions.

Will at-home win out? Zwift says it’s not competing with outdoor cycling but rather with inactivity ― a notion supported by simultaneous booms during the pandemic. Still, the company notes higher usage during the winter and lower in warmer weather. Ultimately, the brand believes convenience and gameplay make it a viable year-round option.

The Roblox of fitness? Zwift could grant developers access to create their own virtual realms and accessories. While the complexity may make this a far-off notion, Min’s comments back the approach’s feasibility:

“I would like to see more people innovating within our platform… the future of these virtual worlds is [building] an economy, [creating] things, and [owning] things indefinitely…”

In addition to encouraging creation and sponsorship, the CEO’s above quote even hints at tokenomics, NFT ownership, and metaverse real estate within the game. These web3 staples may just become table stakes in the future of gaming.

IPO. Zwift has repeatedly hinted at an IPO, but Peloton and MIRROR have both reported lower-than-expected growth given reopening, supply chain issues, and high customer acquisition costs, while iFIT delayed its public offering altogether. Though a public capital injection could certainly aid its hardware transition, these are harsh conditions for an IPO.

Market & Competition

Over the past year and a half, bikes have continuously been on backorder as the global cycling industry has gone hyperbolic on its way to an expected $92.5B by 2028. Even with demand outstripping supply, there are plenty of ways to get in the saddle.

Training specialists. TrainerRoad, Wattbike, and Wahoo Fitness focus on analytics-based training geared towards performance. In this realm, Zwift has one key advantage: entertainment. The brand maintains that fun 3D worlds remain its priority, and it will have to deliver on that to keep riders engaged.

Instructed cycling. While the Pelotons of the world aren’t direct Zwift competitors, their lanes are converging. Peloton plans to launch a fitness game called Lanebreak, and Zwift eventually plans to reach casual cyclists. If Zwift pursues instruction, it may have to find an approach aligned with its training- and racing-focused memberbase.

Gamified fitness. In Issue No. 131, Fitness 3.0, we wrote “the future of fitness looks like a game.” Proving that, more and more companies are prioritizing play:

- Zwift look-alikes. RGT Cycling has amassed a loyal following after launching just two years ago.

- Game maximalists. Capti and Playpulse are gamifying cycling while game-based rowers like Ergatta and Aviron gain steam.

- Burn-to-earn. An emerging web3 trend, Genopets, Calo Metaverse, and OliveX allow players to earn crypto tokens and NFTs by exercising.

Zooming Out

Facing a volatile and saturated market, Zwift will need to balance its software-building clout with its hardware aspirations. On the innovation front, the company will have to become increasingly creative in building out the fitness metaverse of its dreams, managing community issues like digital doping, and making its Olympic dreams a reality.

Still, with its authentic staying power and multi-pronged strategy of sport, worldbuilding, and community investment, Zwift is well-positioned to build the metaverse of fitness.

🦾 Connected Clothing

Beyond wrist-worn trackers, as the next generation of health and fitness wearables takes shape, smart apparel makers are scaling up.

On the Fitt Insider Podcast: Adam Crofts, founder and CEO of Prevayl, joined us to discuss the company’s SmartWear clothing, which combines performance apparel and wearable technology.

We also cover: Prevayl’s recent $10M funding round. And Adam shares his vision for the evolution of athleisure.

Listen to today’s episode here.

⛪️ The Church of Wellness

Spiritually undernourished and seeking connection, a growing wave of soul-searchers are in pursuit of meaning.

The Great Secularization. A decades-long trend, there has been a steady shift away from organized faith. As of last December, 29% of US adults say they have no religious affiliation, a 6% increase since 2016.

At the same time, the pandemic has exacerbated our isolation — over 60% of young adults report feeling “serious loneliness,” and trust in social institutions is at an all-time low.

Now, prioritizing holistic well-being, younger generations are unbundling spirituality from the cathedral, looking for the divine without the devout.

Spiritual concierge. Across the country, high-end apartments are offering spiritual concierges as an amenity. Available via email or phone, they can help residents book everything from yoga retreats to sound baths to shaman-led ceremonies.

Put me in coach. Promising a sense of purpose, a growing number of life coaches and spiritual directors are providing a path forward for the directionless. The personal growth coaching market is now worth over a billion dollars, and startups are cashing in. Coaching marketplace platform Guidely just raised $4M.

Look to the stars. A source of meaning, many have turned to the cosmos, adopting astrology as a guide. Discussing horoscopes provides connection and a chance to self-reflect, and investors have funneled funds to apps like Co–Star and Sanctuary. The former has been downloaded by a quarter of all young women aged 18–25 in the US.

Virtual reverend. Religion isn’t completely out of the picture. Faith-based apps have seen nearly 30x growth in VC funding since 2016, topping $175M last year.

- Catholic prayer app Hallow raised a $40M Series B last November, including backing from Peter Thiel, Drive Capital, and more.

- Christian meditation app Glorify landed a $40M Series A in December in a raise led by a16z.

But… where some see nouveau spirituality, others see dollar signs by commoditizing these belief networks. And many have noted that the movement’s most loyal disciples are higher-class individuals, ones who can already afford the pricey ceremonies, retreats, and coaches.

Punchline: Grappling with loneliness, anxiety, and a lack of meaning, younger generations are seeking solace, embracing spirituality as a cornerstone of well-being. Whether this can be achieved digitally remains to be seen.

🤑 Athletic Greens Cashes In

Nutritional supplement maker Athletic Greens raised $115M in new funding, valuing the company at $1.2B. Before taking its first outside investment last summer, the company was bootstrapped to a $150M run rate. In 2021, revenue grew 200% as customer growth topped 100%. With the nutritional supplement industry projected to reach $188B by 2025, AG recently installed CPG veteran Kat Cole as president and chief operating officer to accelerate its “wellness rocket ship.”

🛖 Wellness Tourism Rebounds

In 2019, the wellness tourism market—encompassing destination yoga retreats, spiritual journeys, thermal springs, and more—was valued at $720.4B. In 2020, that number was nearly slashed in half, falling to $436B. This year, GWI projects the market to hit $817B before soaring to $1.3T in three years’ time. The surge can likely be attributed to trends of remote work, increased disposable income, and emphasis on mental well-being, including emergent psychedelic experiences.

📉 Peloton’s Wild Ride

Last week, word of a potential restructuring, including job cuts, raised red flags at Peloton. Making matters worse, CNBC reported that the equipment maker was halting production of its bikes and treadmills amid weak demand. Then, an activist investor called for CEO John Foley’s firing and the company to be sold. But, according to Axios, Foley is staying put and there won’t be a sale. If that’s the case, the connected fitness company must now retool in pursuit of sustainable growth, with its shares hovering around its 2019 IPO price.

📰 News & Notes

- CLMBR hits Amazon.

- 25% of US adults are physically inactive, says CDC.

- Fitt Jobs: 900+ openings at top health & fitness companies.

- Jeff Bezos-backed Altos Labs launches with $3B to reverse aging.

- Hyperice teams with IRONMAN triathlon as official recovery partner.

- Startup Q&A: RPM Training Co.’s Shane Rogers on tech x functional training.

- FDA gives Peter Thiel’s ATAI Life Sciences the nod for ketamine depression therapy.

- UK’s TRIB3 partners with OliveX to launch metaverse gym in The Sandbox’s virtual world.

💰 Money Moves

- STEPN, a web3 running app that rewards physical activity with digital tokens, raised $5M in a seed round co-led by Sequoia Capital and Folius Ventures.

- Powdered supplement drink maker Athletic Greens landed $115M in a funding round led by Alpha Wave Ventures, valuing the company at $1.2B.

- Earable, makers of a sleep- and focus-enhancing wearable, secured $6.6M from Founders Fund and Smilegate Investment.

More from Fitt Insider: Selling Sleep - Health monitoring startup Casana, makers of a toilet seat that measures vitals, closed $30M in Series B funding led by Morningside.

More from Fitt Insider: Get Ready for Smart Toilets - Eleusis, a life sciences company exploring psilocybin-based mental health treatments, will go public via SPAC merger with Silver Spike Acquisition Corp. II, seeking a valuation of $446M.

More from Fitt Insider: Psychedelic Drug Makers Scale Up - Bicycle component manufacturer SRAM acquired cycling computer maker Hammerhead for an undisclosed sum.

More from Fitt Insider: The Endurance Economy - Gympass, a corporate well-being platform, acquired Spanish and Romanian counterparts Andjoy and 7Card.

- Mantra Health, a digital mental health clinic for young adults, raised $22M in a Series A round led by VMG Partners.

More from Fitt Insider: Kids Face a Mental Health Crisis - Workforce mental health platform Lyra Health secured $235M at a $5.85B valuation in a funding round led by Dragoneer. It also acquired global employee assistance platform ICAS World.

More from Fitt Insider: Mental Healthcare Goes Digital - Big Health, creator of digital therapeutics Sleepio and Daylight, pulled in $75M in Series C funding led by SoftBank Vision Fund II.

- Hard kombucha brand Flying Embers secured $20M in a Series C round led by global distiller Beam Suntory, with participation from PowerPlant Ventures and others.

- Moon Juice, an LA-based wellness product retailer, landed $5.1M in new funding.

- Grass-fed jerky company Chomps raised $80M in a funding round led by Stride Consumer Partners, valuing the company near $300M.

More from Fitt Insider: Snacking on Plant-based Jerky - Global investment company KKR acquired Dutch e-bike and bicycle maker Accell Group for $1.77B.

More from Fitt Insider: E-bikes and the End of Cars - Seawall Capital-owned Kent Outdoors acquired inflatable paddleboard brand BOTE and bicycle maker Kona Bikes.

Today’s newsletter was brought to you by Anthony and Joe Vennare, Melody Song, Wesley Yen, and Ryan Deer.