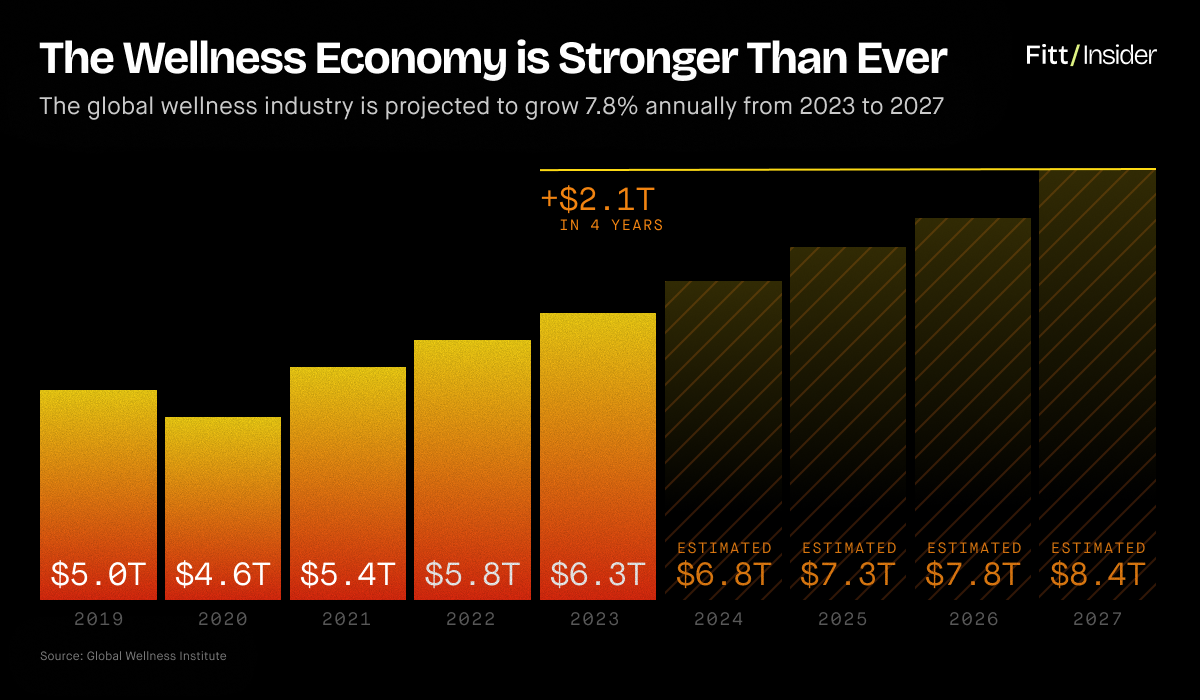

The wellness industry has been evolving for years, but momentum is stronger than ever.

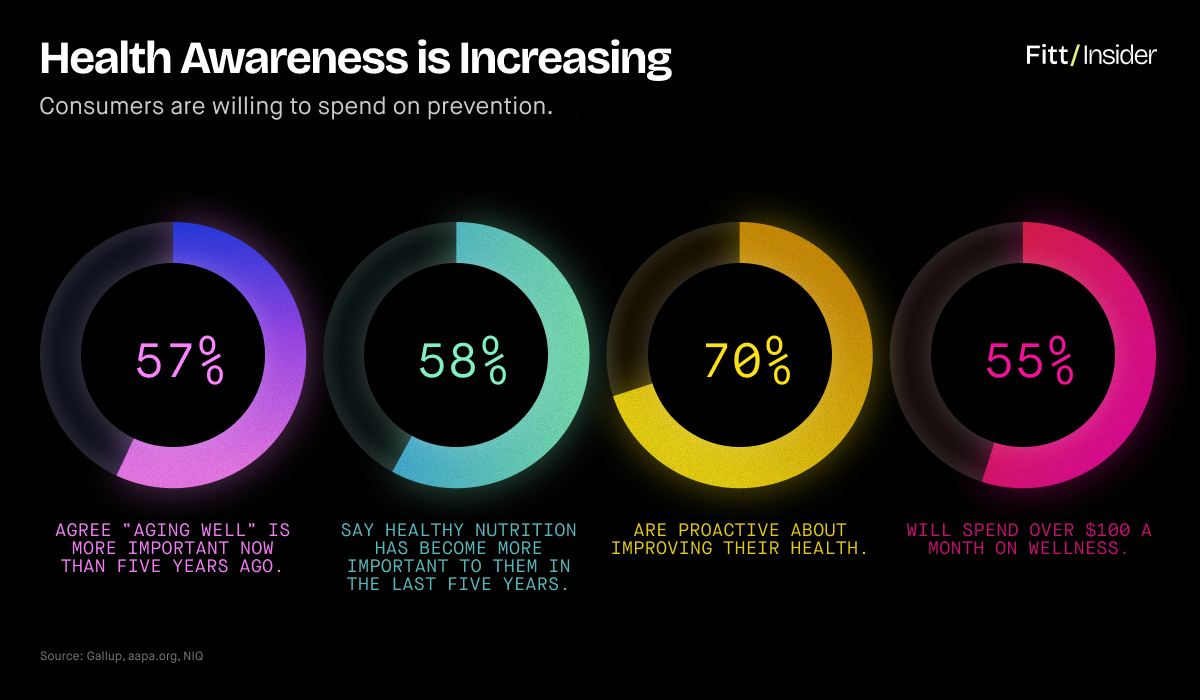

Hyperaware of healthcare’s shortcomings, people are more willing to pay for out-of-pocket services. As a result, wellness spending has shifted from aspirational to foundational.

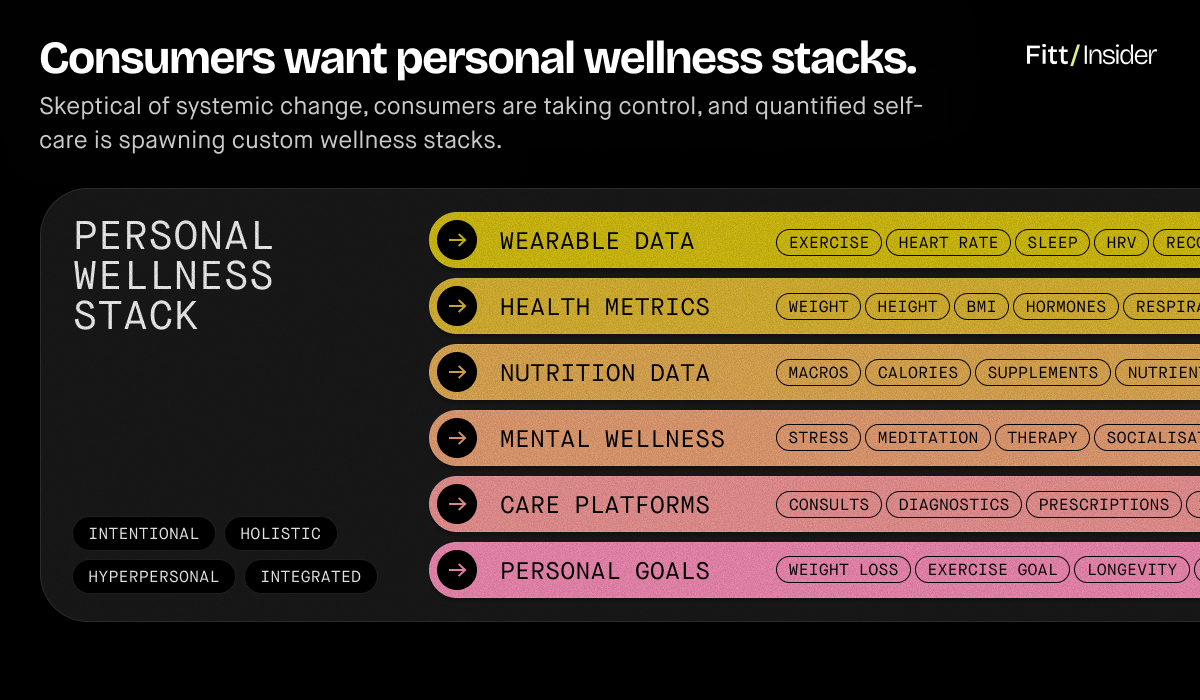

Skeptical of systemic change, consumers are taking control, and quantified self-care is spawning custom wellness stacks.

Prioritized by 84% of consumers, Americans collectively budget $1.1T for wellness, with 78% saying they’ll continue spending the same or more.

Heat Check

Tracing the trends, today we’re breaking down H1’s biggest moves and what they mean.

Next week, we’ll dig deeper into consumer mindsets, brand playbooks, and strategic frameworks influencing the industry’s future.

Fitness

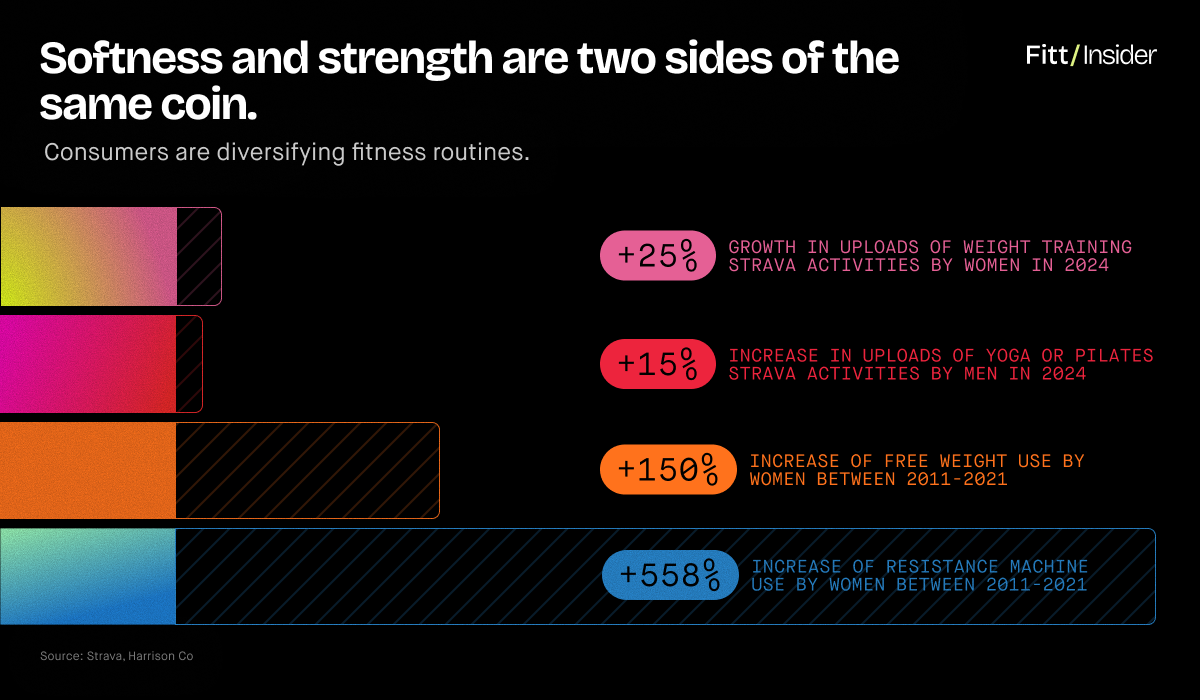

Softness and strength are two sides of the same coin.

Dissolving false dichotomies, women are embracing strength training, men are picking up Pilates, and gyms are bundling full-stack services in-house. Everything Gyms are the new expectation, with social experiences as a selling point.

Diversifying, Equinox launched a run club, Nike debuted strength studios, and Technogym unveiled a reformer. Measuring up, WHOOP teamed with [solidcore] to better track time under tension, while Oura is quantifying CorePower and The Sculpt Society classes.

A model for HVLPs, EōS and Crunch were each acquired for ~$1.5B after redesigning clubs for both strength and self-care. Looking for leverage, F45 regrouped around holistic wellness, and Peloton turned focus from cardio to lifting.

Unlocking new revenue streams, Life Time leaned into sports and diagnostics, while HYROX unveiled gym buildouts, coaching, equipment, and merch. At a crossroads, CrossFit is struggling to sell its 100% intense mentality.

Activewear

Labels are tapping unexpected ambassadors to widen reach.

lululemon linked with F1 pro Lewis Hamilton and 78-year-old fitfluencer Joan MacDonald, Vuori signed college QB Arch Manning and the entire Gerber family, On released a new Zendaya edit, and Alo’s racking street cred through athletes Jimmy Butler and Joe Burrow.

In the biggest apparel-related news of H1, Nike partnered with Kim Kardashian’s SKIMS on a joint venture, plus debuted a Doechii-narrated, female-focused Super Bowl spot.

Celebs don’t guarantee sales, but they do shape consumer brand perception. Still, authentic values alignment is key to keeping partnerships from feeling like audience pandering.

Healthcare

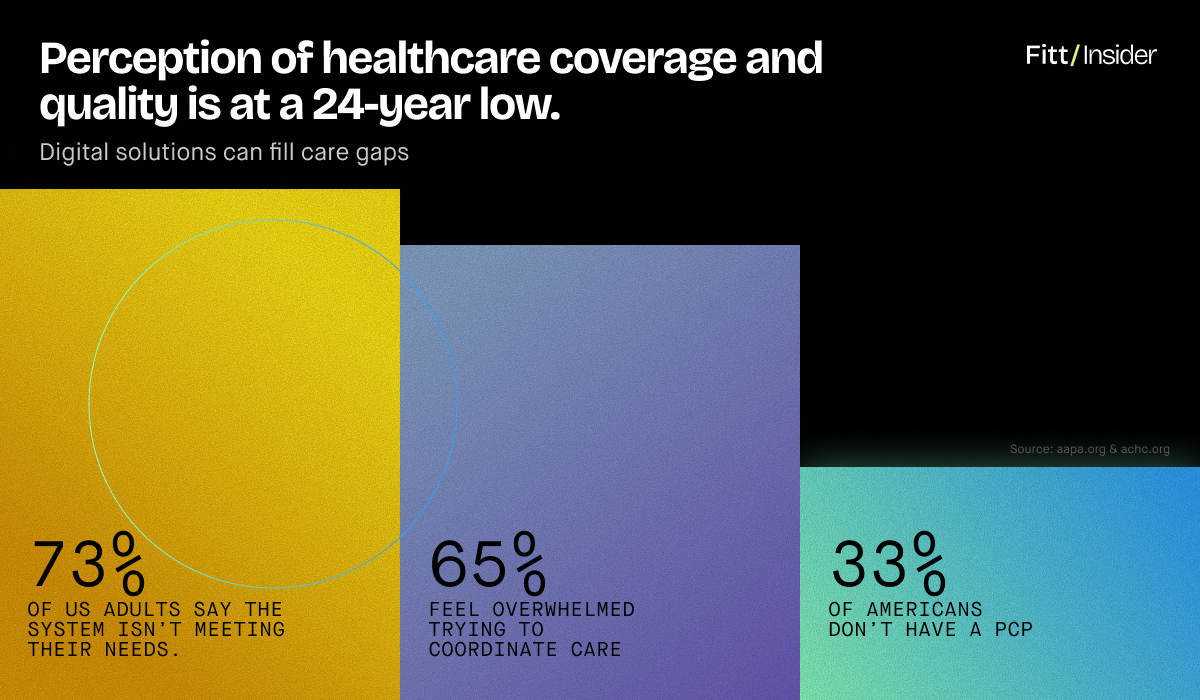

Digital solutions are shifting the point of [primary] care.

Rethinking the ROI of doctor’s visits, a third of Americans don’t have a PCP, but digital providers are fighting to keep them engaged. General checkups could become obsolete as data goes DTC.

Trailblazers, Teal Health launched a DIY pap smear alternative, and Hims & Hers acquired an at-home diagnostics provider. Enabling clinical interoperability, Junction scored $18M. Elsewhere, former PillPack founders launched digital care storefront General Medicine.

Chronic care company Omada Health and MSK-focused Hinge Health filed for IPOs, breaking a digital health dry spell and signaling faith in AI-enabled virtual approaches. After proving its remote PT model works, Sword is expanding into mental health.

Making IRL visits worth it, Commons Clinic raised $26M for its integrated multi-specialty care system. Meanwhile, the quest to create a unified Personal Health OS—making data continuous, seamless, and actionable—is underway.

Wearables

Wearables are winning consumers while reshaping healthcare.

Trialing next-gen primary care, Oura partnered with Lumeris and Maven Clinic, plus started selling Dexcom CGMs. WHOOP repositioned, dropping two new devices while refining its mission statement to reach non-athletes. Still to come, Apple’s AI doctor.

Targeting new metrics, Epicore Biosystem raised $32M for hydration sensing, Level Zero Health secured $6.9M for hormone tracking, and Aktiia scored $42M for blood pressure tech.

Longevity

Longevity clinics are scaling up but remain fringe.

Funding for longevity startups has grown by triple digits, but consumer sentiment is mixed.

Priced for the 1%, Biograph, Fountain Life, and Humanaut Health are expanding in-person clinics. Still, to go mainstream, longevity will need a rebrand and buy-in beyond biohackers.

Trying to make the category relevant to “regular” people, Midi launched an AgeWell program, Myo is taking its future-proofing MSK care to NYC, and Eternal debuted “offensive” healthcare.

Vertically integrating, preventative testing startup Function Health absorbed Ezra’s whole-body MRI tech. Also promising full-body scans, Prenuvo and Neko Health each closed a Series B.

Signaling the field’s larger potential, biotech startup NewLimit raised $130M to reverse aging, and Sam Altman-backed Retro Biosciences is working with OpenAI toward the same mission.

Nutrition

Food-as-medicine is on MAHA’s agenda.

A fringe concept just a few years ago, food-as-medicine is now a mainstream movement.

Discovering nutrition science for the first time, consumers are obsessing over ingredients, leading some to develop excessive fear or become fad diet apologists. Food matters, but TBD if 24/7 tracking and heightened paranoia simplify health or simply overcomplicate eating.

Protein, creatine, fiber, colostrum, and tallow are trending, and a chasm is forming between “all-natural” vs. optimally engineered products. Embodying opposite sides of the spectrum, David secured $75M for its highly processed bars with perfect macros, while Talo Organic scored funding for additive- and seed oil-free dining.

Better-for-you CPG is benefitting from GLP-1s, leading to Pepsi’s $2B poppi purchase, Hershey’s $750M deal with LesserEvil, and Chobani’s Daily Harvest acquisition.

Bringing RD’s in-network, Nourish, Berry Street, and Fay closed fresh rounds. Riding tailwinds, Yuka’s product analysis app is becoming a go-to for health-conscious shoppers. Meanwhile, Marc Lore’s Wonder app sees a future where food decisions are entirely outsourced to AI.

CNS

Interest in central nervous system regulation is fueling innovation.

Sitting at the intersection of mental and physical wellness, neurotech is the next frontier.

Endorsed by NBA’er Damontas Sabonis, Lithuania’s Pulsetto raised €2M for its vagus nerve stimulator. On the same page, competitor Spark Biomedical secured $15M.

Democratizing insights, Muse debuted an EEG x fNIRS brain training device, MYndspan is making MEG brain scans available to all, and Lifeforce launched a Brain Protection Program.

Salvia BioElectronics bagged $60M for migraine-specific neuromodulation, while Grey Matter Neurosciences added $14M for its transcranial ultrasound headset to treat Alzheimer’s.

Tackling sleep, Somnee grabbed $10M in a seed extension for its neurostim headband, and UK-based Samphire Neuroscience secured $5M to ease period pain.

Analog

Helping people unplug is an opportunity in mental health.

Aware screens are an issue, people are struggling to disconnect, creating demand for wellness fourth spaces and low-tech tools.

Trying new tactics, Opera launched a “mindful” web browser, and Ginko raised $1.5M for its parent-focused screentime responsibility platform. Steppin, Receipts, and WeWard pitch move-to-earn models, with the latter landing funding from Venus Williams in February.

Offering alternative activities, Therme Group is scaling accessible wellness resorts, and Ballers scored $20M for its sports-centric social wellness concept. Recovery-oriented, Alchemy Springs and FlowHaus add to a growing list of communal bathhouses.

Putting money into play, national youth league operator Unrivaled Sports raised $120M, while Rocket Youth secured $100M to support local after-school businesses.

Ambient

Environment is moving from invisible force to modifiable factor.

New platforms are bringing microplastics, forever chemicals, and other subtle poisons to light. While purifiers and filters are nothing new, their impact can now be measured and managed.

Lightwork and Goodhome launched home health assessments, Ultrahuman’s rolling out always-on ambient sensors, and MoldCo pairs specialized tests with treatment plans.

As wellness design and real estate matures, more consumers will rethink basic living standards. From biophilic design to smart monitoring systems, brands are starting to carve out the space.

Gut Check

Celebrating the wellness industry’s $6.3T rise without confronting its shortcomings is misguided. Despite record spending, well-being is stuck.

- Objectively, US life expectancy has hovered around 78 since 2007.

- Subjectively, people are lonely, overstimulated, and lacking purpose.

- Americans live longer than less developed nations, but spend the most years sick.

Stifled by bureaucracy, Western medicine is great at keeping people alive but not helping them thrive. Pairing traditional care with personalized lifestyle practices can close the gap, but polarizing rhetoric is making wellness feel like a zero-sum game rather than a win for all.

Self-centeredness has its place in every health journey, yet collective well-being rests on people reaching the second mountain — where meaning, purpose, and community take precedence.

America is splintering into over-optimizers vs. struggling-to-survivers, at the expense of everyone’s happiness. Getting back to its roots, wellness must meet basic psychological and physiological needs before selling consumers the next shiny object.

Besides, the more baseline healthy people, the more potential buyers of optimization products.